UK Leads in Reshaping the European EV Market Landscape

![]() 01/08 2025

01/08 2025

![]() 467

467

Compiled by Yang Yuke

Edited by Li Guozheng

Produced by Boning Studio (gbngzs)

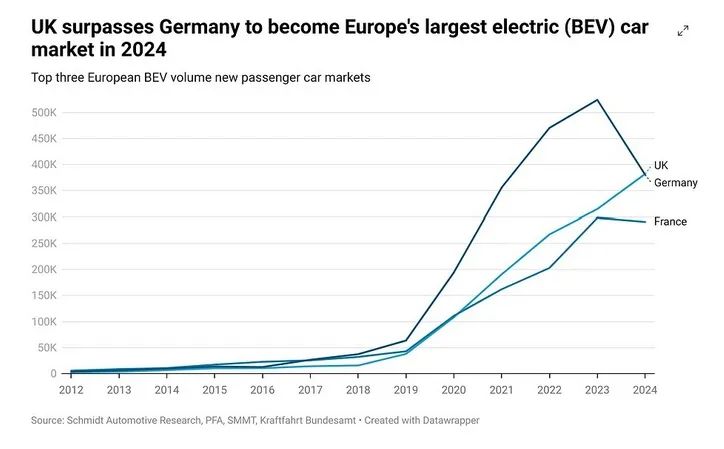

In 2024, the UK surpassed Germany to become Europe's largest electric vehicle (EV) market, with Germany losing its long-held crown.

On January 6, 2025, Germany's Kraftfahrt-Bundesamt (KBA) released data revealing that pure EV registrations fell by more than a quarter in 2024, totaling 380,609 units. In contrast, according to the Society of Motor Manufacturers and Traders (SMMT) in the UK, EV registrations surged 21% to 382,000 units, outpacing Germany by 1,361 units.

The UK has seen a sharp rise in EV adoption rates in recent months. SMMT data shows that in 2024, pure EVs accounted for 19.6% of the total new passenger car market, meaning one in every five new cars sold in the UK was an EV. 2024 marked a milestone for the UK's EV market, as strong consumer demand and supportive policies for zero-emission vehicles propelled it to the forefront of the EV revolution.

Conversely, EV sales in Germany have plummeted, primarily due to the cancellation of purchase incentives. Government incentives for businesses ended in September 2023, and incentives for private cars expired at the end of December that year, leading to a decline in EV demand. The UK's impressive EV growth is partly attributed to the Zero-Emission Vehicle (ZEV) mandate, which requires car manufacturers to ensure a certain proportion of their new car sales are zero-emission vehicles.

The 2024 target was 22%, rising to 28% in 2025. Non-compliance with the mandate results in fines of up to £15,000 ($18,800) per vehicle sold. However, in 2024, the overall share of EVs in the UK (19.6%) was still below the 22% target. In Germany, EVs accounted for 13.5% of registrations. The UK's annual EV sales surpassing Germany is not just a numerical achievement; it also serves as a roadmap for other European countries to prepare for stricter regulations.

This shift reflects changing consumer preferences, an effective regulatory framework, and the automotive industry's resilience. It underscores the importance of proactive policies like the ZEV mandate in driving the transition to zero-emission vehicles. As Europe moves towards stricter regulations, the UK's performance serves as both an incentive and a benchmark.

Starting in 2025, the EU market, including Norway and Iceland, will face stricter CO2 emission targets, requiring an average fleet reduction of 15% compared to 2021 levels. This translates to a challenging but achievable target of 93.6 grams of CO2 per kilometer for fleet emissions. The UK's rise as Europe's largest pure EV market signifies its commitment to a green future, despite challenges in infrastructure development and affordability.

With Germany preparing for a comeback and other EU markets gearing up for regulatory reforms, Europe will present a dynamic and competitive landscape in the coming years. Analysts at Schmidt Automotive Research believe the slight decline in German EV registrations may be temporary, expecting a recovery by the end of 2025. This is due to a wave of 3-year lease drivers returning to the market and manufacturers launching more EV models to meet stricter emission targets.

UK Leads

SMMT data shows that EV registrations in the UK have increased for the fifth consecutive month as of December 2024, with nearly one-fifth of all registered cars being EVs throughout the year—a record proportion.

Registrations of pure gasoline and diesel cars in the UK fell by 4.4% and 13.6% year-on-year, respectively, as more buyers opted for pure EVs or hybrids. Consequently, the average emissions of new cars decreased by 6.2% year-on-year to 102.1 grams of CO2 equivalent per kilometer.

As anticipated, demand for EVs and hybrids has been dominated by fleet purchases. A quarter of the cars bought by businesses and fleets were pure EVs, attributed by SMMT to "more attractive tax incentives for non-private buyers".

Dan Ceasar, CEO of EVUK, said, "We've been told that consumers don't want EVs, but these regular record data tell a different story." Vicky Read, CEO of ChargeUK, added, "We expect these record numbers to continue into 2025. The fifth consecutive month and another year of growth in EVs demonstrate that demand is strong and growing, and the future belongs to EVs." Read also noted, "This year has been a year of growth for the EV charging industry, with over 73,000 public chargers now in place, with thousands more being installed each month to support these vehicles."

In January 2024, the UK government unveiled its roadmap to achieving a zero-emission vehicle transition by 2035, requiring car manufacturers to annually increase the share of zero-emission vehicles in their total sales. By 2024, zero-emission models accounted for 22% of total sales, with this figure rising to 28%, 33%, 38%, 52%, 66%, and 80% from 2025 to 2030, respectively.

UK car manufacturers have urged the government to reconsider the target of achieving 100% zero-emission vehicle sales by 2035, arguing that demand does not match expectations. Last month, the UK government announced it would consult on the ZEV mandate.

In recent weeks, this mandate has garnered media attention, with car manufacturers like Nissan arguing that they cannot achieve the 2025 target. Manufacturers that fail to meet the target can purchase credits from competitors who exceed their targets.

In response to the SMMT data, a spokesperson for the UK Department for Transport said, "Due to the flexibility of the ZEV directive, we are confident that the 22% target will be met, and no car manufacturer will need to pay a fine."

Examining the list of the UK's best-selling EVs provides insight into market leaders and struggling players. The Tesla Model Y topped the list, with 32,862 units sold in a year, which is not surprising.

In terms of growth, BYD led the pack with sales of 8,788 units, a staggering 659% increase from 2023. Chery Omoda also had a strong debut, with a policy to launch as many cars as possible. It has an extensive dealer network and registered 3,629 cars in its first year.

Ben Nelmes, CEO of New AutoMotive, believes that "the UK's transition to EVs is gaining momentum," with nearly one-third of cars sold in December 2024 being EVs.

He said, "EV sales soared like a rocket in 2024, with December data far exceeding targets for 2024 and 2025. This trend will continue as more affordable EVs enter the market, reducing driver costs while helping to achieve net-zero emissions."

However, the SMMT is less optimistic. It calculates that car manufacturers spent £1.8 billion on purchasing credits to avoid fines over the past year. To meet targets, companies spent £4.5 billion on price reductions, equivalent to nearly £12,000 per EV.

Matthias Schmidt, an automotive analyst who compiled the above data, said that the ZEV mandate forces car manufacturers to supply directly to the UK.

He explained, "(This) is related to the EU market's brake on pure EVs in 2024, while the UK actually took action a year earlier and implemented stricter legislation than the EU in 2024, forcing car manufacturers to increase the number of EVs delivered in the UK."

The SMMT warned that discount levels across the industry are "unsustainable," and the true level of driver demand for EVs is lower than the government's target.

Car manufacturers argue that this target puts jobs and investment at risk, with the Stellantis group explicitly blaming EV quotas for the decision to close its Luton plant.

Mike Hawes, CEO of the SMMT, revealed that several car manufacturers have privately told him they may have to purchase credits from competitors—another way to avoid fines. He said manufacturers are being forced to make significant price reductions to increase EV sales, a situation that is "unsustainable." Hawes added, "The ZEV mandate does not directly affect the market, does not force demand, and does not create a market by itself, but it affects the supply side."

Germany Suffers a Waterloo

Germany's once thriving EV market has suffered a significant setback.

Sales plummeted by a staggering 27.4% last year (2024). Official data shows that only 380,609 EVs were registered in Europe's largest car market in 2024, marking a "lost year" for EVs in Germany.

After years of steady growth, the EV boom in Germany came to an abrupt halt in 2023, with government subsidies disappearing and potential buyers stranded. Analysts say the sudden end of subsidies created significant uncertainty. High prices, limited range, and an inadequate charging network in Germany have left many buyers at the starting line.

Constantin Gall, an analyst at EY, analyzed that the support program was abruptly terminated in 2023 due to the government budget crisis, leading to "significant uncertainty among potential buyers."

The decline in EV sales has contributed to the overall decline of the German automotive market. Since the pandemic, the German automotive market has struggled to recover. About 2.8 million new cars were sold in 2024, a 1% decrease from the previous year.

Weak demand for new cars in Germany, combined with high production costs and increasing competition from China, has exacerbated challenges facing the German automotive industry.

The Volkswagen Group, Europe's largest car manufacturer, announced an agreement with labor unions at the end of 2024 to cut production capacity by about 730,000 vehicles in Germany and eliminate 35,000 jobs. Volkswagen Group said significant layoffs were necessary to put the core Volkswagen brand on a sustainable footing and fund the company's struggling electrification strategy.

The entire German economy seems to be stagnating.

Gall said, "2024 was a bad year for the automotive industry, and there are fears that 2025 will not be any better."

In Germany, the decline in EV sales has led to battery-powered cars losing market share compared to traditional internal combustion engine and hybrid vehicles. In 2024, EVs accounted for 13.5% of total sales, down from 18.4% the previous year.

Gall said that starting the EV market requires a "strong push." A new support program could "significantly boost" EV sales, but the outlook is uncertain as Germany will hold elections on February 23 this year.

The government led by German Chancellor Olaf Scholz canceled the previous subsidy program. During the campaign, he called for the development of a new subsidy program at the European level.

Opposition politicians have also called for more aid to the struggling automotive industry while criticizing Europe's plan to phase out internal combustion engines.

In 2025, the German automotive industry faces a critical juncture. Industry expert Stefan Bratzel from the Center of Automotive Management called these issues a "multiple crisis for Germany."

Bratzel told Deutsche Welle that the German automotive industry "is still learning new skills to transition to EVs, software-based vehicles, and autonomous driving." The automotive industry has entered a "new competitive environment" with challenges "not limited to Tesla and new Chinese manufacturers."

A spokesperson for the German Association of the Automotive Industry (VDA) partially blamed policymakers. He believes that the sudden termination of EV subsidies by the Scholz government in December 2023, combined with insufficient charging infrastructure in Germany, "suppressed sales figures and led to an overall deterioration of the situation." Ferdinand Dudenhöffer, from the think tank Center of Automotive Management, shared this view, criticizing politicians for sending contradictory signals: "One moment they want EVs, and the next moment they are promoting internal combustion engines, which confuses people."

As of 2021, the number of drivers switching from EVs to gasoline and diesel cars in Germany accounted for 14%, and the number of new EV buyers has decreased. In the third quarter of 2024, only 3.9% of private car owners chose EVs. Previously, in the fourth quarters of 2022 and 2023, the proportions of switches from internal combustion engines to EVs were 6.9% and 6.6%, respectively. Therefore, the decline in EV sales may not be solely due to the cancellation of subsidies; the development of charging infrastructure has also been insufficient.

In recent years, it has become evident that the future of automobiles lies beyond traditional internal combustion engines, whether fueled by fossil fuels or synthetic fuels. The automotive industry is inexorably trending towards electric vehicles.

Frank Schwope, a professor of automotive economics at Germany's University of Applied Sciences, asserts that "some manufacturers have committed serious management errors." He criticizes executives for ignoring the issues, hoping that "everything will resolve itself."

Brazo points out a critical deficiency: While German automakers excel in producing traditional cars, they lag behind in electric vehicle (EV) production. This is because EVs rely heavily on automotive software and electronic components, rather than mechanical parts.

He laments, "The erosion of old models and knowledge is undeniably tragic."

Dirk Dohse of the Kiel Institute for the World Economy (IfW) believes that German developers and engineers "remain among the global elite," but they "lack flexibility, particularly in management, and struggle to attract new customer segments, such as tech-savvy young people in Asia."

Dohse contends that China clearly outpaces Germany not only in EV technology but also in market dominance. "The Chinese EV market is the largest and most dynamic in the world, signaling that China will continue to lead the sector," he explains.

Frank Schwope maintains that German automakers can still find hope in developing the most advanced batteries, which are crucial for both current and future EVs.

"EV batteries are far from mature, and significant advancements are possible. By 2030, we might witness a shift to solid-state batteries, which could revolutionize the industry," he predicts.

Brazo believes that 2025 will be a pivotal year for the German automotive industry, not only due to regulatory improvements but also because of the innovative and bold actions taken by management.

However, Dohse is more pessimistic, believing that the situation may worsen before it improves. He foresees 2025 as a challenging year for the German automotive industry, emphasizing the importance of setting the right course for the future during this critical period.

(This article is a compilation of reports from Automotive News, EV Booster, The Telegraph, Euro Weekly, The Street Times, FT, Edie, CAR Magazine, The Guardian, and DW, with some images sourced from the internet)