Only a Few Auto Dealers See a Path Forward

![]() 01/10 2025

01/10 2025

![]() 669

669

Introduction

Introduction

Perhaps, only when the flag of price wars is lowered, can dealers truly find redemption.

As the year 2024 draws to a close, the curtain slowly falls, revealing a China's auto market rife with intense competitions. The battles rage on like relentless tides, with each moment filled with unpredictability and challenges.

OEMs, as the command centers of this fierce battle, are busily deploying troops and strategies. They are well-versed in market dynamics, throwing one trump card after another at their opponents, striving to seize the upper hand in the cutthroat market competition. On the front lines, dealers, like valiant warriors, continue to charge forward without hesitation.

However, the market's cruelty is lamentable. According to Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, it is estimated that throughout 2024, a total of 4,000 4S stores will be eliminated in this silent war, becoming casualties of market competition.

For the surviving dealers, there is little time to celebrate their victories, as the smoke of battle has yet to dissipate, and crises still lurk everywhere. To survive at a minimum level, they must re-enter the battlefield and continue to fight for their existence. The fate of these frontline soldiers is often beyond their control. Perhaps, only when this battle under the banner of price wars gradually determines a victor over time, or when both sides shake hands and make peace, can dealers truly usher in a moment of redemption.

2024: The Darkest Hour for Dealers

RMB 138 billion is the amount of overall retail losses suffered by China's new car market in the first eight months of 2024. Unfortunately, most of these losses have been transferred to dealers.

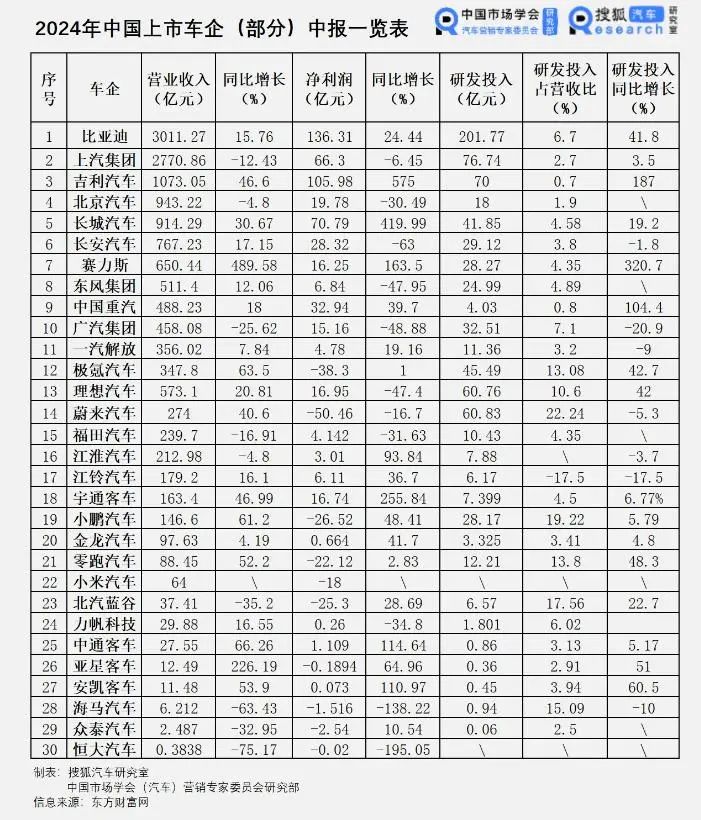

According to the mid-year financial report summary of listed automakers in China (partial) in 2024, out of the 30 listed automakers in China in the first half of 2024, only new forces like Zeekr, NIO, Xpeng, Leapmotor, Xiaomi, and BAIC BluePark, as well as automakers like Haima, Zhongtai, Evergrande, and Yaxing Coach, did not achieve profitability. Statistically, the combined net profit of these 30 listed automakers in the first half of the year reached RMB 37.7 billion.

While suppliers are also facing tough times, driven by the explosive growth in auto sales and the strong pull of the new energy transition, more than 70% of the over 200 auto parts companies listed on the A-share market in the first half of 2024 achieved profit growth.

While some rejoice, others sorrow. Most of the market losses are borne by dealers with tears. The "2024 First Half Year National Auto Dealer Survival Status Survey Report" shows that the number of domestic auto dealers continued to expand in the first half of this year, with a loss ratio as high as 50.8%, an increase of 7.3% year-on-year, and a profit ratio of only 35.4%.

Among them, losses from new car sales are particularly severe. The above report reveals that in the profit structure of dealers, the gross profit contribution of new cars has reached -26.5%, and the loss surface is still expanding. Additionally, the total gross profit per store has decreased significantly compared to 2023, especially for the new car business, with an average loss of RMB 1.78 million per store.

Undoubtedly, the new car business has become a major drag on dealers. Once, dealers who followed OEMs could easily make money; now, dealers forced into price wars are facing not just the issue of profitability, but rather the life-or-death test of whether they can withstand losses and ensure the normal flow of funds.

In early 2024, Guangdong Yong'ao experienced a cash flow crisis and imploded, followed by Guanghui Auto being forced to delist in the middle of the year. Subsequently, top 100 dealer Baolide collapsed, all 19 4S stores under the Zhongtong Group were closed, BMW China terminated its authorization for 9 4S stores under the G.A. Group, and multiple 4S stores including Tianjin Tianbao, Beijing Xingdebao, and Fuzhou Zhongbao experienced cash flow crises, making survival difficult...

Price inversion caused by price wars is merely the superficial reason pushing dealers into the abyss. The underlying logic behind the rapid deterioration of dealers' survival conditions is still the pressure passed on to dealers by OEMs in pursuit of scale benefits under the disconnection between production and sales. Dealers, acting as a buffer zone and temporary warehouse for automakers, are extremely lacking in discourse power and can only act at the whim of OEMs.

Multiple auto dealer protest incidents that erupted in 2024 were all complaints about the unequal status between dealers and automakers.

Furthermore, whether it is the direct sales model or the direct sales + agency model, the set of rules that dealers once familiar with has already shown signs of being rewritten. In the new game, the position left for traditional dealers is obviously much narrower.

Change Begins from Within

Facing an increasingly brutal market landscape, either sticking to outdated rules or sitting idle will only lead to elimination.

Although they don't have many cards in hand, if used properly, they can tighten some losses and even step over the threshold of profitability.

On the one hand, since July 2024, the penetration rate of new energy vehicles in the domestic auto market has remained above 50%, and new energy automakers have achieved explosive growth with unabated momentum. Under such circumstances, opening arms and actively embracing new energy is a wise move. However, it should also be noted that the sales and after-sales systems for new energy are different from those of the fuel era. Before embracing them, dealers should also familiarize themselves with the new approach and act within their capabilities.

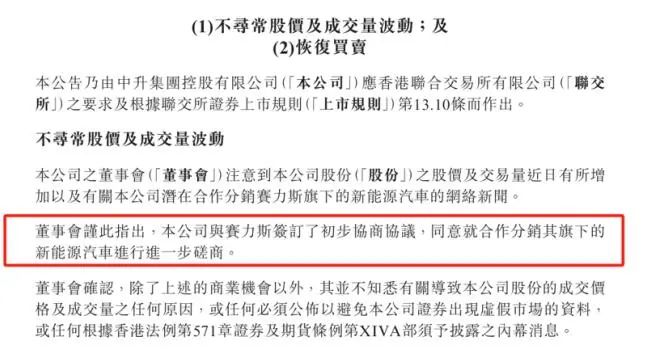

Previously, Zhongsheng Holdings, a leading domestic auto dealer, saw its net profit halved due to severe "price inversion" in the first half of the year. International rating agencies Moody's and Fitch successively adjusted their rating outlooks from "stable" to "negative". In November 2024, Zhongsheng Group actively embraced new energy and reached a strategic cooperation with Thalys. Before the official announcement, JPMorgan Chase upgraded Zhongsheng Group Holdings Limited's rating to neutral. On the day of the announcement, Zhongsheng Holdings' share price surged by more than 20%. An analysis report from Bank of America Securities also pointed out that each AITO store is expected to bring Zhongsheng Group up to RMB 20 million in net profit.

On the other hand, after-sales, insurance, and other businesses have become the main sources of profit for dealers. Data from the China Automobile Dealers Association shows that in the first half of 2024, after-sales services and financial insurance businesses accounted for 69.7% and 36.9% of dealers' overall profit structure, respectively.

Additionally, benefiting from the trade-in policy, China's used car market is becoming increasingly large, driving an increase in dealers' revenue.

If dealers can grasp these three businesses and use their profits to cover new car losses and other costs, their days will be much easier.

In terms of after-sales and insurance, although automakers are deepening their layout, and chain stores such as Tmall, Tuhu, and JD.com are coming on strong, independent after-sales can still find opportunities in businesses such as car washing, beauty, three-film services, and light modifications, as well as in third- to fifth-tier cities. The trend of after-sales transitioning to specialization and refinement is becoming increasingly apparent. As for the used car business, dealers face fewer restrictions, have pricing power, and have more room for development.

All of the above are just conventional means for auto dealers to save themselves in the fierce market competition. However, facing the ever-changing market environment and an unknown future, dealers have to consider a deeper question: What kind of situation will they eventually evolve into?

The future auto market will be a market full of variables and challenges. The rise of new energy vehicles, the rapid development of intelligent technology, and the constantly changing consumer demands will all put higher requirements on dealers' business models and service philosophies.

Perhaps, in the future, dealers will no longer be just intermediaries for car sales, but will become comprehensive service providers offering all-round auto services.

But now, standing at this crossroads full of variables, no one knows where the real path forward lies. Continuing to endure means having to bear the heavy pressure of the market, facing increasingly fierce competition, and shrinking profit margins; while exiting the stage means giving up years of hard work and abandoning the dream of growing together with the auto industry.

For dealers, this is undoubtedly a difficult choice.

The Key to Breaking the Deadlock Lies in External Forces

As mentioned earlier, the fundamental reason why dealers are struggling to survive is the disconnection between production and sales, with OEMs producing according to plans rather than market sales. In this context, dealers lacking discourse power have to digest oversaturated products by themselves.

Monthly statistics from the China Passenger Car Association show that in the first eight months of this year, the cumulative number of vehicles sold by manufacturers to dealers was 2.47 million more than the number sold by dealers to consumers, about 320,000 higher than the same period last year, significantly higher than the sluggish years of 2018 and 2019.

When and how these 2.47 million vehicles will be digested are no longer within the consideration of automakers, but have become private matters for dealers. The accompanying risks of inventory backlog and cash flow disruption have also shifted to the shoulders of dealers.

At the same time, the backlog of orders and tight cash flows also force dealers to sell their products at "inverted" prices. Ultimately, dealers exchange corporate sales rewards for volume sales at a loss, subsidizing some losses or achieving profitability.

The one who tied the bell should untie it. To reduce the sacrifices of frontline soldiers, the simplest approach is for those in power to shake hands and make peace, or more radically, to overthrow the battlefield directly.

The so-called shaking hands and making peace means stopping price wars or redirecting them towards value wars that can achieve a win-win situation for all parties.

However, the only way to truly stop price wars is probably time. Under the brutal law of survival of the fittest, the pace of eliminating backward enterprises is unlikely to stop. Not to mention that automakers' price wars are in full swing, and it is unlikely for them to stop now.

The so-called overthrowing the battlefield is to completely overthrow the existing strange phenomenon of disconnection between production and sales, enhance dealers' discourse power, and have automakers and dealers join hands to lead the auto market into a market economy.

However, given the current situation, this also seems far-fetched. The auto market elimination tournament is in full swing, and sales are not only linked to the profit benchmark but will also directly affect the future survival of automakers in terms of market share. In this critical moment when they may not even be able to save themselves, it is sheer fantasy to expect automakers and dealers to sit down on equal footing, give up the bottom-line guarantee of sales, and pull dealers up. This is also the fundamental reason why some direct-sales automakers open up agency channels.

Although this is the case, dealers are not sentenced to death. During the darkest moment of 2024, the timely rain of car purchase subsidies did give nervous dealers a breather. Stepping into 2025, subsidies are continuing.

Besides policies, automakers can also lend a hand to alleviate dealers' difficulties.

In the short term, the relationship between automakers and dealers has become quite delicate, like walking on a narrow steel wire. Any slight movement may break this fragile balance. Automakers are facing enormous pressure from market changes and need to constantly adjust strategies to adapt to new consumption trends and technological innovations. As a bridge between automakers and consumers, dealers' roles and positions are becoming increasingly important yet awkward.

Against this backdrop, how to find a win-win cooperation model between automakers and dealers has become a major challenge facing them. Perhaps the only way is to stabilize those high-quality and powerful dealer channels, making them a solid backbone for automakers in the market. These high-quality dealers not only have strong sales capabilities but can also provide high-quality after-sales services, enhancing consumers' trust and loyalty to the brand.

At the same time, for those weak and poorly managed dealer stores, automakers may adopt a strategy of persuasion to withdraw. Due to various reasons such as poor management, shortage of funds, and inaccurate market positioning, these stores have already struggled to survive in the fierce market competition. Continuing to barely maintain them may not only negatively impact the brand image of automakers but may also plunge dealers themselves into deeper difficulties.

By stabilizing high-quality dealer channels and encouraging weaker stores to exit, automakers can allocate resources more efficiently and enhance market performance. Dealers, in turn, can establish their positioning and development path in a clearer market landscape. This arrangement promises a mutually beneficial scenario for both automakers and dealers, enabling them to collaborate in overcoming market challenges and fostering shared growth and prosperity.

The principle of natural selection, where only the strongest survive, may be harsh but it reflects the realities of the market.