January Auto Market Off to a Disappointing Start, Sparking Anxiety: Can New Subsidy Policy Save the Day?

![]() 01/20 2025

01/20 2025

![]() 601

601

Introduction

Amidst a disappointing start to the auto market, the country has swiftly unveiled a fresh round of market rescue measures.

In 2024, China's auto market undeniably flourished, with annual production and sales surpassing 30 million units, setting a new historical high. Moreover, new energy vehicle sales surpassed 10 million units for the first time, and auto exports reached 5.859 million units, retaining the title of global export champion. These robust figures undeniably underscore the market's vitality.

However, despite industry optimism for the new year, the domestic auto market failed to usher in a promising start, encountering an unexpected downturn instead.

Particularly in the thriving new energy vehicle segment, sales plummeted sharply in the first week of the new year, with market performance falling well below expectations. Only a handful of automakers held firm, while most reported a decline in sales. Even popular brands like Tesla and Li Auto faced similar challenges.

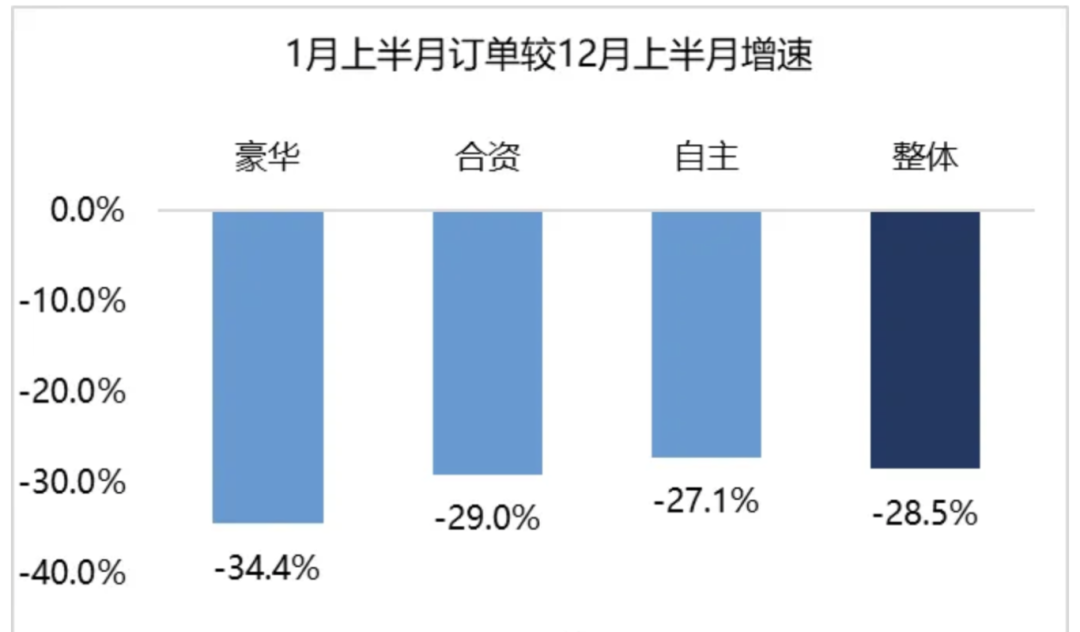

Based on various brands' performance, the market predicts that retail sales of new energy vehicles in January will be approximately 720,000 units, a sharp drop of 44.7% compared to 1.302 million units in December 2024. With new energy vehicles, which have a substantial sales base, experiencing such a decline, the outlook for the overall auto market in January becomes uncertain, sparking anxiety about the market's performance in the first quarter and even the entire year.

While it's reasonable to speculate about annual sales based on weekly or even monthly performance, it's not entirely accurate. January, coinciding with the Spring Festival holiday, sees a reduced effective production and sales period for automobiles. Most consumers' pre-holiday car purchase needs were already partially met in December. Coupled with the window period for scrapping and replacement incentives, the passenger vehicle market in January experiences a predictable seasonal decline.

Nevertheless, amidst this disappointing start, the country has already rolled out a new round of market rescue plans. That's right, a fresh wave of policy subsidies is here!

Higher Amounts, Lower Thresholds

Recently, the "Notice on Doing Well in Promoting the Trade-in of Old Vehicles for New Ones in 2025" (hereinafter referred to as the "Notice"), jointly issued by eight departments including the Ministry of Commerce, revealed that this year, building on last year's policy, not only will some vehicles meeting National IV emission standards be included in the scrapping and replacement subsidy scope, but specific standards for replacement and upgrade subsidies will also be clarified.

Specifically, the "Notice" proposes that individual consumers who scrap gasoline passenger vehicles registered before June 30, 2012, diesel and other fuel passenger vehicles registered before June 30, 2014, or new energy passenger vehicles registered before December 31, 2018, and purchase new energy passenger vehicles listed in the Ministry of Industry and Information Technology's "Catalog of New Energy Vehicle Models Eligible for Vehicle Purchase Tax Exemption" or fuel passenger vehicles with a displacement of 2.0 liters or less will receive a one-time fixed subsidy.

For scrapping the aforementioned eligible old vehicles and purchasing new energy passenger vehicles, a subsidy of 20,000 yuan will be provided; for scrapping the eligible fuel passenger vehicles and purchasing fuel passenger vehicles with a displacement of 2.0 liters or less, a subsidy of 15,000 yuan will be offered.

The "Notice" indicates that the new policy includes eligible "National IV" emission standard fuel passenger vehicles within the scope of old vehicles eligible for scrapping and replacement subsidies, and uniformly standardizes the maximum subsidy limit for national auto replacement and upgrading. Notably, this is the first time individual consumers' scrapping of vehicle models has been expanded to include "National IV" models.

This new subsidy policy further broadens the subsidy scope compared to last year's scrapping and replacement policy, potentially driving a resurgence in auto consumption.

Last April, to rescue the market, relevant departments introduced subsidy measures for scrapping and replacing automobiles, subsequently raising the scrapping subsidy standard in August 2024. For individual consumers scrapping and purchasing eligible passenger vehicles, the subsidy standard was increased to 20,000 yuan for new energy vehicles and 15,000 yuan for fuel passenger vehicles with a displacement of 2.0 liters or less.

From policy formulation to preferential effort adjustments, after implementing these two policies, domestic auto sales achieved continuous high growth since September 2024, gradually peaking before subsidy expiration.

Data shows that from September to December 2024, passenger vehicle retail sales increased by 4.5%, 11.3%, 16.6%, and 14.8% year-on-year, respectively. Industry insiders noted, "Driven by the old-for-new vehicle trade-in policy, passenger vehicle sales performed well in 2024, especially in the fourth quarter, when market sales far exceeded expectations."

The subsidy policy provided a significant boost.

According to Ministry of Commerce statistics, in 2024, over 2.9 million vehicles were scrapped and replaced, and over 3.7 million vehicles were replaced and upgraded, effectively driving auto sales of over 920 billion yuan. Notably, since the implementation of the "two new" policies in 2024, the proportion of new energy vehicles purchased in old-for-new vehicle trade-ins exceeded 60%.

Compared to last year's policy, this year's "Notice" includes some National IV emission standard vehicle models within the scrapping and replacement subsidy scope, and simultaneously reduces the age limit for new energy passenger vehicles eligible for scrapping and replacement subsidies by another 8 months.

According to Circulation Association calculations, there are currently about 12 million passenger vehicles meeting National III emission standards and below that are eligible for scrapping and replacement policy subsidies. With this year's relaxed criteria, over 10 million additional eligible National IV emission standard passenger vehicles and over 1 million additional new energy passenger vehicles will be included, presenting a significant opportunity for the new policy to stimulate the auto market in the new year.

No Need to Worry, the Auto Market Will Rebound

"The 'Notice' continues last year's policy's subsidy funding standards, allowing more old vehicles to enjoy scrapping and replacement subsidies."

The relevant Circulation Association official said it is predicted that over 23 million passenger vehicles will be eligible to apply for scrapping subsidies this year, a significant expansion compared to last year's application scope. The new policy will also encourage more consumers to participate in scrapping and replacement, further promoting auto consumption growth.

Moreover, the "Notice" further clarifies the policy cross-year convergence issue that concerns consumers.

The "Notice" states that individual consumers who only partially obtained the four types of certificates from July 25 to December 31 last year and obtain all four types of certificates by February 28 this year can be included in this year's auto scrapping and replacement policy support scope and counted as the number of subsidies enjoyed this year.

"The Ministry of Commerce and other departments actively ensure policy convergence, stabilize market expectations, avoid policy disruption, and ensure a smooth transition."

The Circulation Association noted that the Ministry of Commerce promptly issued the "Notice," clarifying the implementation standards and funding arrangements for this year's policy transition period to ensure policy convergence and effective implementation.

Apart from expanding the scrapping and replacement subsidy scope, the "Notice" also improves auto replacement and upgrade subsidy standards.

These include providing one-time subsidy support this year to individual consumers transferring the registration of passenger vehicles under their names and purchasing new passenger vehicles. The subsidy for purchasing new energy passenger vehicles does not exceed 15,000 yuan, and the subsidy for purchasing fuel passenger vehicles does not exceed 13,000 yuan. Additionally, each individual consumer can enjoy a maximum of one auto replacement and upgrade subsidy within one calendar year, meaning only one subsidy can be claimed for either scrapping and replacing an old vehicle or replacing and upgrading to a new vehicle.

Furthermore, the "Notice" states that local departments should accelerate the formulation of auto replacement and upgrade implementation plans, reasonably determine subsidy standards and implementation methods, and refer to auto scrapping and replacement requirements to ensure a smooth and orderly cross-year transition.

The "Notice" clarifies the upper limit of the replacement and upgrade subsidy standard and sets requirements for old vehicle holding times, effectively addressing last year's competitive behavior where some regions disorderly increased subsidy upper limits. Under regulatory compliance, local regions are allowed to reasonably formulate detailed auto replacement and upgrade subsidy implementation rules according to this notice, stimulating market vitality and benefiting more consumers.

Last year, passenger vehicle retail sales reached 22.894 million units, an increase of 5.5% year-on-year. Simultaneously, the amount of scrapped car recycling reached 7.872 million units, an increase of 70.7% year-on-year. Calculations show that last year's subsidy fund usage exceeded 90 billion yuan, driving an increase in new car sales of about 2.4 million units and an increase in tax revenue of over 53 billion yuan.

Based on this, industry insiders said that the national scrapping and replacement policy and local replacement and upgrade policies to promote auto consumption have achieved better-than-expected results, especially in the fourth quarter of last year, when passenger vehicle retail sales growth reached 14%. This year's policy further expands the scrapping and replacement subsidy scope, which will further unleash auto consumption demand.

With the introduction of this year's new subsidy policy, it will further tap into the auto market's potential. The auto market is expected to continue showing a stable and positive development trend this year, with auto production and sales continuing to grow. Some are optimistically predicting that with the new policy's promotion, auto sales in 2025 will reach 32.9 million units, an increase of 4.7% year-on-year.

On one hand, the new subsidy policy opens up new growth markets, providing potential growth points for the auto market's 2025 performance. Additionally, as mentioned earlier, multiple factors contributed to the auto market's "black start" in the new year's first week, besides the small sample size. These include the reduced effective production and sales time during the Spring Festival month, the partial release of consumers' pre-holiday car purchase demand in December, and the window period for scrapping and replacement guidance. In the long run, these factors are not cause for concern.

With the new subsidy policy's effect, more new products will enter the market. Coupled with the recovery of subsidies and consumer demand from more regions and automakers, the auto market will rebound soon.