2025: The Dawn of Huawei as Standard Automotive Equipment

![]() 01/20 2025

01/20 2025

![]() 493

493

The past year has witnessed Huawei's ascension in China's automotive landscape. The HarmonyOS Smart Drive series has surpassed 440,000 new vehicle deliveries, ranking first among new forces with over 300,000 sales. Simultaneously, Huawei's three cooperation models in the automotive sector continue to expand their horizons.

Before the Lunar New Year, Huawei's collaborations with multiple automakers achieved significant breakthroughs, including GAC, SAIC, FAW-Volkswagen Audi, and VOYAH. Last week, we exclusively reported that SAIC welcomed Huawei, initiating a restructuring of its large passenger vehicle sector.

In addition to these companies, a recent source revealed to Lucar that a prominent Chinese automaker, despite having its own intelligent driving R&D, will prioritize solutions from Huawei and Momenta this year.

Let's venture a bold prediction: what if Huawei becomes standard equipment in cars? This vision is increasingly becoming a reality.

Huawei on the Verge of Becoming Standard Automotive Equipment

In early 2025, senior executives from FAW-Volkswagen Audi disclosed during an interview that all new products launched that year, based on the PPC fuel platform and PPE high-end electric platform, will collaborate with Huawei on intelligent driving or smart cabins. Audi's 2025 new product plan includes unveiled models like the Q6L e-tron, A5L, new Audi Q5L, and all-new Audi A6L e-tron.

Huawei's intelligent driving solution is already integrated into new SAIC-Audi vehicles. In a recent interview, SAIC Volkswagen executives revealed that the Audi A5L Sportback will partner with Huawei in intelligent driving, adding, "Wait until everyone tests it to see if it rivals the top new forces in intelligence."

Beyond technical cooperation, the "Huawei Solution" has become a marketing boon for automakers. Take the all-new VOYAH Dreamer, the "first MPV equipped with Huawei's intelligent driving," as an example. Its monthly sales exceeded 10,000 units in December 2024. Recently, the all-new VOYAH Dreamer, equipped with Huawei's Kunlun Intelligent Driving ADS 3.0, released its December travel report, revealing that 86% of users have subscribed to the high-level intelligent driving package.

At the start of this year, GAC and SAIC, two automotive giants, made strides in their partnerships with Huawei.

GAC officially announced the investment in establishing the GH project company as a platform for in-depth collaboration with Huawei. Additionally, Feng Xingya, general manager of GAC Group, shared more details. GAC and Huawei have commenced joint office work, with their first jointly developed model positioned as a luxury smart new energy vehicle priced around 300,000 yuan.

SAIC's collaboration with Huawei also made key progress. Lucar recently exclusively reported that SAIC's independent large passenger vehicle sector was undergoing organizational restructuring to prepare for Huawei's introduction. Furthermore, over 40 Huawei staff have been stationed at SAIC, planning to introduce Huawei's comprehensive solutions on the R7.

Notably, Huawei's partnership with GAC is internally defined as a "brand-new model," while SAIC and Huawei are also exploring a novel cooperation model. Media reports suggest that the specific models and details of Huawei's cooperation with GAC and SAIC will differ. This "brand-new model" with GAC will be a pivotal project for Huawei to promote in 2025.

This signifies that Huawei has almost secured all automotive groups, poised to become standard equipment. Many domestic automaker executives share a similar prognosis: intelligent driving will be standard in new cars by 2025. Denza Auto has already stated, "For upcoming new cars, don't sell any that don't have L2.5+ intelligent driving."

A recent source revealed to Lucar that a domestic automaker will focus on the mid-to-high-end market in 2025, prioritizing solutions from Huawei and Momenta for high-level intelligent driving.

The Real Contender Isn't Bosch

Does Huawei's rise pose a threat to traditional Tier 1 giants? In early 2024, senior executives from Bosch China told the media that Huawei dominates all its cooperation models, unlike Bosch. They also noted, "Even in the intelligent race, Bosch's advantages are incomparable to Huawei." One point is that Bosch offers standardized hardware, while Huawei focuses on software. As the Bosch executive mentioned, Huawei is also a Bosch customer, relying on its hardware.

As mentioned in our recent exclusive report on SAIC and Huawei, the models initially planned for their collaboration, besides the refreshed R7, also include a large SUV and an MPV. An insider from SAIC Group commented, "SAIC doesn't lack technical reserves; what it lacks is product definition." In its partnership with Huawei, SAIC emphasizes Huawei's deep involvement in product definition.

In fact, besides SAIC, more traditional automakers are redefining their next-generation products with Huawei's assistance.

Admittedly, automakers don't need to rely on Huawei for product definition. However, the success of the HarmonyOS Smart Drive model underscores Huawei's prowess in this domain, an advantage not shared by other Tier 1s. "We sometimes joke that Huawei's entry into the automotive business has taken away consulting firms' jobs," commented an insider from an automaker. Before establishing a new model, there's typically market research, marketing strategy research, and analysis. "This solution is usually costly, starting at at least one million yuan."

Yu Chengdong publicly stated in June 2024 that all Huawei vehicles currently priced below 300,000 yuan are unprofitable. "We don't have the capacity to make cars priced below 200,000 yuan." With increased scale effects, by 2025, consumers will enjoy higher configurations at the same price or the same configurations at a lower price. This implies that high-level intelligent driving will become prevalent in new cars priced between 150,000 and 200,000 yuan.

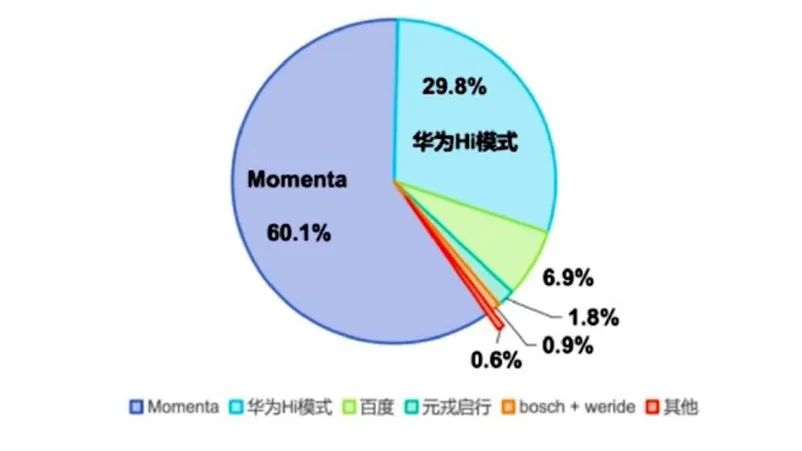

ZoZo Auto Research's latest 2024 Urban NOA Industry Research Report shows that currently, four third-party suppliers in China have achieved mass production of end-to-end large models on vehicles: HUAWEI Inside, Momenta, Apollo, and Yuanrong Qixing. Among them, Momenta's fixed-point customers cover nearly 70% of the top ten global automakers by sales, with a market share of 60.1%, surpassing HUAWEI Inside, which ranks second. Together, they occupy nearly 80% of the domestic high-level intelligent driving market share. In layman's terms, for mid-to-high-end models priced above 200,000 yuan, Huawei and Momenta are the two most mainstream solutions.

Moreover, suppliers like Qizhou Zhixing and Yuanrong Qixing, including Momenta, have in-depth collaborations with NVIDIA, which provides a suite of products and services ranging from chips, toolchains to solutions.

The trend is unmistakable. Intelligent driving has entered a winner-takes-all era, especially for high-level intelligent driving, where there's no room for a third player. Automakers whose self-research progress falls short can either choose NVIDIA's Orin solution or Huawei's solution.

In 2024, NVIDIA's solution penetration rate in high-level intelligent driving exceeded Huawei's. NVIDIA's camp includes mainstream automakers like NIO, Li Auto, XPeng, Geely, and Great Wall, and almost every automaker's self-research route cannot bypass the NVIDIA solution. Besides brands like "AITO," AVATR, and Denza in Huawei's camp, it's anticipated that more new cars jointly launched with GAC and SAIC, along with expansions with models from enterprises like BYD and VOYAH, will be introduced in 2025. As more HUAWEI Inside new cars hit the market, the competition between the two in the high-level intelligent driving market will intensify.