Thailand: A Stable and Profitable Destination

![]() 01/20 2025

01/20 2025

![]() 500

500

The recent incident involving actor Wang Xing being scammed in a Myanmar telecom fraud park has ignited heated discussions in both domestic mainstream and self-media outlets, with the mere mention of Thailand eliciting fear among the public. Traveling to Thailand has temporarily become a subject of controversy and reckless speculation.

Many self-media platforms rely heavily on traffic, so whether they have visited Thailand or conducted thorough investigations and rational analyses is often secondary. What matters most is jumping on the bandwagon and attracting eyeballs through criticism. Meanwhile, mainstream media is also eager to create a narrative of domestic prosperity versus foreign turmoil, especially during the festive season when comparisons bring a sense of satisfaction.

However, there is no need for undue concern. Recently, the editor of Journey to the West visited Singapore, Malaysia, and Thailand. Apart from a slight depreciation of the RMB and a corresponding decrease in purchasing power, these countries remain largely unchanged, with the people's aspirations for a better life as strong as ever.

Thailand, in particular, is a solid upper-middle-income country with the second-highest GDP in ASEAN. It has a clear vision for developing its economy and opening its doors to the world. Beyond the automotive industry, which serves as a pillar, Thailand also ranks third in ASEAN in terms of digital competitiveness.

Thailand is the largest producer and exporter of automobiles in Southeast Asia, with the automotive industry accounting for about 10% of the country's GDP and employing roughly 10% of the workforce. In 2023, Thailand produced 1.85 million vehicles, with 780,000 sold domestically and 1.07 million exported. The total value of automobile and parts exports from Thailand in 2023 reached $27.7 billion.

01

2024 Thai Auto Market Analysis

In 2024, the Thai auto market is expected to sell 570,000 vehicles. Among the top 10 best-selling brands, Japanese brands continue to dominate, while luxury cars are led by Mercedes-Benz and BMW.

Japanese brands have cultivated the Thai market for years, particularly in the field of internal combustion engine vehicles, where they enjoy a firm position. For Chinese brands to penetrate and compete in this market, they must engage more closely with local consumers and launch models tailored to the local market.

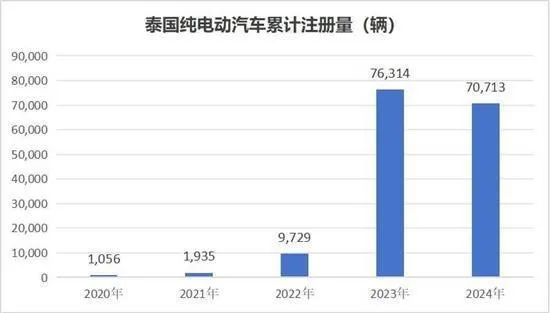

In 2024, the total number of pure electric vehicle registrations was 70,173, a year-on-year decrease of 8.1%, with a market penetration rate of 14.0%. Among the top 10 best-selling brands, Chinese brands occupied seven spots, with BYD leading the pack, accounting for more than one-third of the market share.

After the commissioning of BYD's factory in July, the company successfully became the sales champion of pure electric vehicles in Thailand for 2024.

02

Chinese Automakers Expanding in Thailand, Radiating Southeast Asia

Chinese automakers investing and building factories in Thailand are also contributing to the transformation and upgrading of the country's automotive industry.

In March 2023, BYD officially broke ground on its factory in Rayong, Thailand, with an annual production capacity of about 150,000 vehicles. The products are primarily intended for the Thai domestic market, with consideration for neighboring ASEAN countries and some European markets.

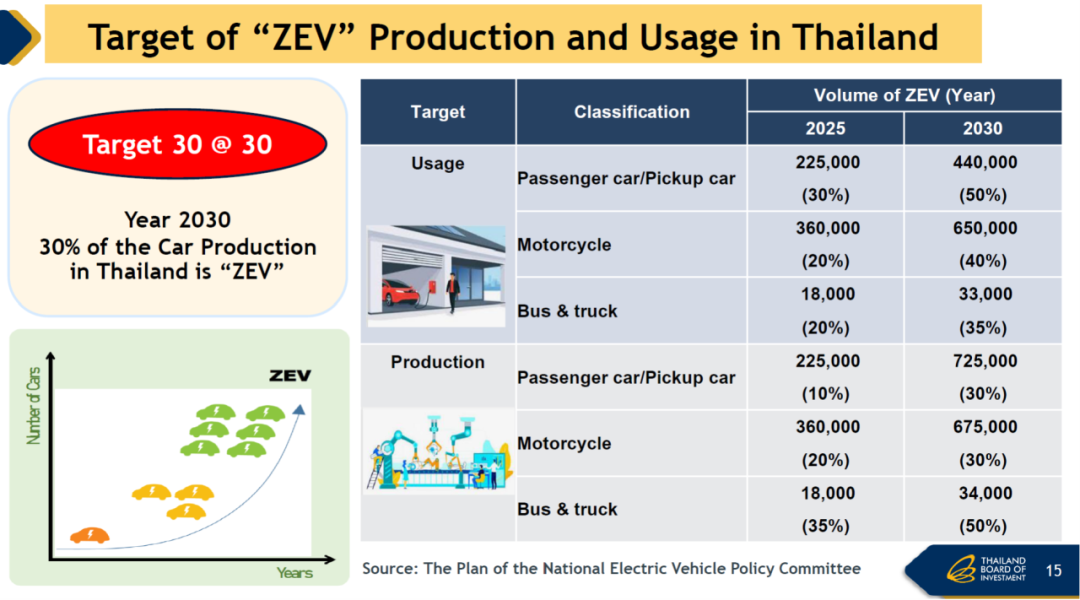

As Thailand's fourth-largest pillar industry, the automotive sector accounts for 11% of its GDP and employs over 750,000 workers. To reduce greenhouse gas emissions, promote green transformation, and sustainable development, the Thai government has set clear development goals and vigorously promoted the development of new energy vehicles. According to the government's plan, by 2030, new energy vehicles will account for 30% of Thailand's auto sales.

Thailand aims to sell 225,000 electric vehicles by 2025 and 725,000 by 2030, representing 30% of its auto production.

The roadmap comprises three phases of development plans:

- Phase 1 (2021-2022): The government promotes electric motorcycles and supports their infrastructure development nationwide.

- Phase 2 (2023-2025): The electric vehicle industry will produce 225,000 electric cars/pickups, 360,000 motorcycles, and 18,000 buses/trucks, including battery production.

- Phase 3 (2026-2030): Efforts will be made to achieve the goal of producing 725,000 electric cars/pickups and 675,000 electric motorcycles by 2030, with electric vehicles accounting for 30% of total auto production. This also includes domestic battery production.

According to the NEVPC roadmap, Thailand hopes to increase electric vehicle production by 100,000 to 300,000 units annually by 2025, rising to 400,000 to 750,000 units by 2026.

In November 2020, Chinese automaker Great Wall Motors completed the acquisition of the Rayong factory in Thailand, becoming the first Chinese auto brand to enter the country with full ownership. On January 12, 2023, Great Wall Motors' electric vehicle brand Ora Good Cat officially rolled off the production line at the Rayong New Energy Vehicle Manufacturing Base, marking the first locally produced mass-produced pure electric vehicle in Thailand.

Thailand's EV incentive program covers electric four-wheelers, boats, and motorcycles. For electric vehicles, PHEV projects worth at least 5 billion baht (about $163.783 million) are eligible for a three-year corporate tax exemption; BEV projects (of the same value) will be eligible for an eight-year corporate tax exemption, which also extends to R&D expenditures for BEV projects.

For PHEV and BEV projects worth less than 5 billion baht (about $163.783 million), the tax exemption period is limited to three years. However, BEV projects meeting certain requirements may apply for an extension, including producing at least 10,000 vehicles within three years; producing additional auto parts; investing in R&D; or commencing projects in 2022.

Projects for electric motorcycles, electric tricycles, electric buses, and electric trucks are eligible for a three-year corporate income tax (CIT) exemption, which may also be extended under certain conditions.

03

BYD's Strategic Moves

It is worth noting that BYD's Thailand factory is the company's first overseas passenger vehicle production base, with a planned investment of 3.6 billion yuan.

On July 4, 2024, BYD achieved two significant milestones:

- The completion of its factory in Rayong, Thailand. From the start of construction to completion and production, it took only 16 months, encompassing the "four major processes" of vehicle production—stamping, welding, painting, and assembly—as well as related parts production.

- The official launch of BYD's 8 millionth new energy vehicle, which rolled off the production line on the opening day of the newly completed super factory and was delivered to the owner on the spot. It was acquired by Princess Tipananada, CEO of the Thai Royal Mother's Foundation, making it a "royal car" in Thailand.

In Southeast Asia, high upfront costs remain a significant barrier to the widespread adoption of electric vehicles.

Expanding overseas markets, of course, cannot rely solely on a few tricks. On January 15, BYD announced a partnership with Singapore-based mobility company Grab to provide 50,000 BYD electric vehicles to Grab's driver partners across Southeast Asia, including markets such as Singapore, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam.

Current mainstream car rental models in Chiang Mai, Thailand (January 2025) include multiple models such as the Denza D9, ATTO 3 (also known as the Yuan PLUS), Seal, and BYD M6, increasing opportunities for Grab users to enjoy green travel.

According to reports, BYD will offer competitive discounts to Grab's fleet partners and cooperating drivers, including extended electric vehicle battery warranty services.

Conclusion

In ASEAN, Thailand ranks second after Singapore in various economic aspects. However, due to its strategic location at the Malacca Strait, Singapore is highly contested territory with extremely valuable land. As a "stable" investment destination for China's manufacturing industry, Thailand has surpassed Singapore to become the top choice in ASEAN.

Thailand operates under a constitutional monarchy, with the most recent dynasty spanning ten kings from the 18th century to the present, ensuring continuity. Despite party politics and even coups, successive Thai kings have been able to unite the people. While there are occasional political upheavals, Thailand experiences no major social disturbances, unlike many other Southeast Asian countries, including neighboring Myanmar.

As a Buddhist country, the Thai people embody a peaceful and harmonious national character, making it unlikely for extremist religious organizations or extreme xenophobia to take root, as seen in some fundamentalist theocratic systems.

Most importantly, Thailand is not only one of the countries with the best relations with China but also one where Chinese people are best integrated and hold the highest status in local society globally. This is crucial for Chinese companies to avoid geopolitical risks overseas.