Volkswagen's German Factories Up for Grabs: Chinese Automakers as Likely Buyers

![]() 01/20 2025

01/20 2025

![]() 562

562

Introduction | Lead

The recent strike triggered by Volkswagen's plans to shut down two of its German factories has subsided, but rumors of a potential sale of these facilities have emerged. Who is the mysterious buyer?

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | Heyan

Total words: 2968

Reading time: 4 minutes

Volkswagen is currently exploring options for its Dresden and Osnabrück factories in Germany, with a potential sale to Chinese automakers on the table. This could be a mutually beneficial solution for both Volkswagen and the factory workers.

△Volkswagen plans to sell factories initially slated for closure to Chinese automakers

Asset Sale: The Best Option

Volkswagen's primary objective right now is to downsize the company.

Volkswagen recently announced its 2024 sales figures, revealing a total of 9.027 million new vehicles sold, a 2.3% year-on-year decrease. Regionally, sales in Western Europe, Volkswagen's home market, fell by 0.4% to 3.259 million; in the North American market, sales increased by 6.4% to 1.057 million; and in China, sales declined by 9.5% to 2.928 million.

△Decline in Volkswagen sales in China

In the Chinese market, Volkswagen, like other multinational automakers, faces stiff competition from local brands. While Volkswagen still sells nearly 3 million vehicles in China, the profits generated are a fraction of what they used to be. This is evident in Volkswagen's financial report: In the third quarter of last year, while global revenue remained at 78.48 billion euros, down only 0.5% year-on-year, net profit plummeted from 4.34 billion euros in the same period the previous year to 1.57 billion euros, a decrease of 63.8%; operating profit also fell by 42% year-on-year to 2.86 billion euros; and the operating profit margin slipped from 6.2% to 3.6%, reaching a recent low.

In the short term, Volkswagen and other multinational automakers are unlikely to see a significant improvement in the domestic market. A turnaround could only be expected when Volkswagen's new generation of more competitive products is launched and the price war among Chinese local automakers subsides. Until then, Volkswagen needs to downsize, reduce unnecessary operating costs, and focus more resources on developing new models and core technologies. This is why Volkswagen previously planned a series of cost-cutting measures, including factory closures, layoffs, and executive salary reductions. However, due to strong opposition from labor unions and the German government, Volkswagen withdrew its proposal to close the factories. With weak demand in the European market and an uncertain overall economic outlook for Europe, keeping factory capacity idle while bearing high salary costs goes against Volkswagen's original intention of cost reduction. Under these circumstances, selling the two factories to Chinese automakers becomes Volkswagen's best option to revitalize assets, recoup some funds (estimated at 100-300 million euros per factory), and shed its burden.

△Autonomous brands have shaken the position of joint venture brands in the domestic market

From the German government's perspective, if Volkswagen can sell the factories to Chinese automakers, it would be a win-win situation. The German government could require Chinese manufacturers to agree not to lay off employees at the acquired Volkswagen factories and to guarantee certain employee benefits through post-acquisition agreements. It could also demand that Chinese automakers increase investment in the acquired German factories, potentially resolving more employment issues. Moreover, Chinese electric vehicles and the entire new energy vehicle technology are ahead of Europe. Regardless of which Chinese automaker successfully acquires Volkswagen's factories in Germany, the models they introduce later will be formidable competitors in the entire EU market. For Germany, this presents a new economic growth point to lead the local economy towards rapid development.

Which Chinese Automaker Will Make a Move?

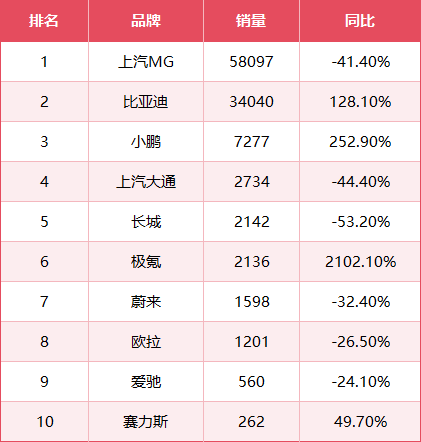

With the EU imposing additional tariffs on Chinese automakers starting in 2024, sales of most Chinese brands have declined significantly, except for BYD, Xpeng, Zeekr, and Thalys. However, the volumes of Zeekr and Thalys exported to the European market throughout the year are negligible. Therefore, only BYD and Xpeng have truly achieved growth. Recently, the United States has also enacted regulations further restricting the sale of Chinese cars in the U.S. market, prompting Chinese automakers to accelerate their European market layout, where purchasing power is relatively strong.

△Sales statistics of autonomous brands in 14 European countries in 2024

To maintain previous sales scales in Europe, local production to circumvent tariff constraints has become the only viable solution.

Judging from the current development trend, SAIC and Chery are the most likely automakers to acquire Volkswagen's factories.

The EU has always been a crucial part of SAIC's overseas sales, and the MG brand is highly recognized in Europe. If not for EU suppression, MG would have already established a firm foothold in the EU market with its high cost-effectiveness. Now that Volkswagen is willing to sell the factories, and SAIC and Volkswagen already have a joint venture in China, they are familiar with each other's working methods and habits. Therefore, SAIC acquiring Volkswagen's factories in Germany will face relatively fewer obstacles in terms of initial communication, integration, and corporate culture in the later stages. However, for SAIC, the painful experience of acquiring South Korea's SsangYong is still fresh in memory. Avoiding a repeat of the SsangYong situation is the first step for SAIC to operate factories overseas.

△The EU's new tariff policy has dealt a heavy blow to the MG4, which was popular in the European market

As for Chery Automobile, it has also fully benefited from globalization, with its overseas sales consistently accounting for a significant proportion of the group's total sales. By the end of 2024, Chery's first model at its factory in Spain had rolled off the production line. If Chery can make a concerted effort to acquire another German factory, its entire European strategy will be further bolstered. For Chery, whether it introduces electric vehicles, hybrids, or even fuel vehicles, its high cost-effectiveness will significantly impact local European automakers and Japanese and Korean brands produced locally in Europe.

Additionally, among domestic emerging automakers, Zero Run Automobile, which is showing strong upward momentum, does not rule out the possibility of acquiring a Volkswagen factory in Germany and then seeking to expand its presence in Europe and even the global market. However, Zero Run has already reached a cooperation intention with Stellantis and established Zero Run International. There are also reports that models such as the Zero Run T03 will be produced at Stellantis' factory in Poland in the future. But for Zero Run Automobile, if there is an opportunity to independently operate in Europe, the earnings will undoubtedly be more substantial. As for Stellantis, it can help Zero Run expand into markets that are less familiar to Chinese companies, such as ASEAN, South America, the Middle East, and even Africa.

Opportunities and Challenges of Overseas Acquisitions

For Chinese automakers, acquiring Volkswagen's factories in Germany is undoubtedly a milestone event, with significance comparable to when Japanese automakers, represented by Toyota, entered the U.S. market on a large scale.

However, acquiring the factories is merely the first step. Familiarizing oneself with local German laws and regulations, learning to deal with powerful German labor unions, managing employees better, and controlling factory operating costs are all significant challenges for Chinese automakers. Especially the familiar 996 work schedule in China is not only completely unfeasible in Germany but may even violate local labor laws. Not to mention the long annual leave, summer vacations, and extended paid sick leave in Europe, which are expected to make domestic automakers very uncomfortable in the initial stage. Taking Tesla's superfactory in Berlin, Germany, as an example, its performance to date is still far behind Tesla's superfactory in Shanghai, which is enough to show that setting up a factory in Germany is not an easy feat.

△The efficiency of Tesla's factory in Berlin is far inferior to its superfactory in Shanghai

Moreover, this time, domestic automakers are acquiring only Volkswagen's factories in Germany, primarily for local production. Subsequently, domestic automakers need to introduce new models and technologies to overseas factories. This is entirely different from the previous situation where Geely acquired the entire Volvo Cars. After acquiring Volvo, Geely quickly carried out in-depth cooperation with Volvo, helping Geely achieve a leap in its vehicle manufacturing system capabilities, resulting in Geely's current vehicle manufacturing quality that is on par with joint venture brands. Currently, once Chinese automakers acquire these two factories, while introducing models and technologies to Germany, they also need to build an entire local parts supply chain. The question arises whether to export directly from China to Germany, find new local parts suppliers, encourage domestic parts manufacturers to set up factories in Europe, etc. This requires careful calculation to find the most suitable and economical solution.

△This time, Chinese automakers' desire to acquire Volkswagen's factories in Germany is completely different from Geely's acquisition of Volvo at that time

Commentary

Globally, it is estimated that only Chinese automakers have the capability and willingness to take over Volkswagen's factories in Germany. From Volkswagen's perspective, selling its factories in Germany to Chinese automakers could yield the greatest benefits: not only can it revitalize assets and recover a sum of cash, but it can also shed the heavy burden of thousands of workers. However, for Chinese automakers, while entering the global market is imperative, they must make sound plans and set aside sufficient funds for operating an automotive factory in Germany in the early stages. Otherwise, once cash flow issues arise, domestic automakers, which are already not very profitable, may be dragged down by overseas factories.