"American Canoo" Completely Shuts Down, Selling Only 22 Vehicles in a Year Amidst Continuous Scandals of Fraud and Label Sticking

![]() 01/20 2025

01/20 2025

![]() 597

597

Stock Price Plunges by 10%

Author | Liu Yajie

Editor | Qin Zhangyong

The wind of new carmaker bankruptcies has now reached the United States.

Electric vehicle startup Canoo has recently announced that it will file for Chapter 7 bankruptcy protection and immediately cease all operations.

Canoo stated that it has supplied renowned institutions such as NASA, the US Department of Defense, and the US Postal Service, and has also signed agreements with companies like Walmart. However, it consistently failed to secure financial support from the US Department of Energy's Loan Programs Office.

According to the bankruptcy filing, its assets are valued at $126 million, while its liabilities exceed $164 million.

Canoo primarily focuses on electric delivery vans and pickup trucks for cargo transportation. It was once a darling of the capital market, with a peak market value of $2.1 billion, equivalent to RMB 15.4 billion.

However, within eight years of its establishment, the situation has drastically changed. After announcing bankruptcy, its market value has significantly shrunk, leaving only RMB 140 million in total market value.

01 Only 22 Vehicles Sold in a Year

Similar to the plight of marginal new carmakers in China, Canoo's current situation is mainly due to a lack of funds, but there are also deeper, self-inflicted reasons.

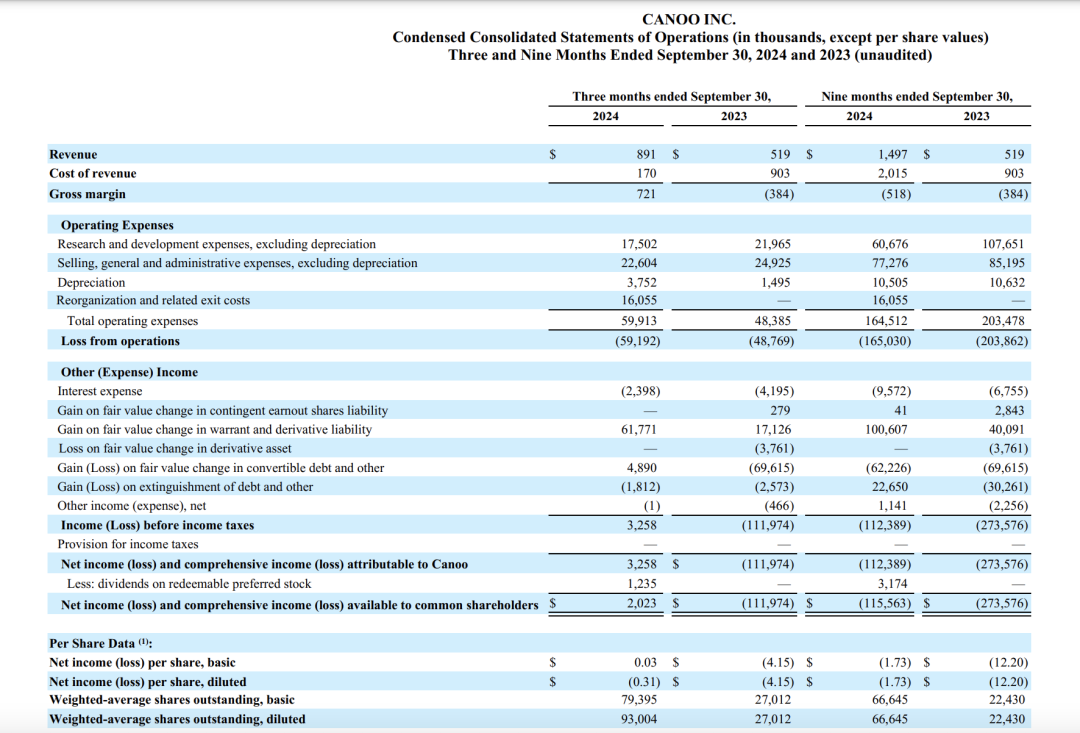

This new carmaker generated revenue for the first time in its sixth year of operation, during the third quarter of 2023. In the third quarter of 2024, Canoo released its first profitable financial report, reporting a net profit of $3.258 million (approximately RMB 23.841 million).

However, the cumulative loss for the first three quarters of last year was still $112 million (approximately RMB 820 million). As of September 30, 2024, Canoo's cash and cash equivalents amounted to $1.53 million, indicating a tight capital chain. The cash reserve at the end of that quarter was only $16 million.

The rate of capital consumption has been astonishing. According to financial information disclosed by Canoo in November last year, its bank account balance was only $700,000, reflecting a severe shortfall that gradually crippled the company's operations.

Moreover, due to the inability to pay accounts payable in a timely manner, Canoo is also facing multiple lawsuits from suppliers.

In the face of a capital shortage, layoffs have become the most effective measure for self-rescue.

In December last year, Canoo announced on its official website that it would suspend production at its factories. The announcement stated that Canoo had laid off a total of 82 employees, including salaried and hourly workers, while the remaining employees were placed on "mandatory unpaid leave," a status that would last at least until the end of 2024. Additionally, due to capital shortages, Canoo will temporarily halt operations and close its assembly plant in Oklahoma.

At a time when business operations were poor and rumors were rampant, Canoo was also exposed for its CEO's annual expenditures on private jets, which were double the company's 2023 revenue. With already limited funds, the CEO's lavish spending further exacerbated the situation, reminiscent of the saying, "The rich feast on wine and meat, while the poor freeze to death on the roadside."

Earlier, Canoo was also embroiled in a fraud scandal. In November 2023, Canoo announced that it had delivered the first batch of "Made in Oklahoma" electric vehicles to the state government.

However, former Canoo employees claimed that no vehicles were actually produced at the factory. The vehicles that Canoo claimed to have delivered were all handmade at AFV in Justin, Texas, and "90% of the vehicles only had their body stickers changed." As of now, the official has not made any response.

It is worth mentioning that although the company has not been established for a long time, there has been frequent leadership turnover.

In April 2021, Canoo's then-CEO Ulrich Kranz left to join Apple to help expand its automotive business, with Executive Chairman Tony Aquila taking over as the new CEO.

With the departure of the founder, there was an internal upheaval at Canoo. From the end of 2021 to the beginning of 2022, there was a wave of small-scale resignations, with more than 50 people leaving the company. After that, Canoo executives continued to leave.

By September 2024, with the departure of Senior Director of Automotive Engineering Christoph Kuttner, Chief Designer Mike de Jung, Vehicle Project Leader Nicolas Leblanc, and seven other co-founders, all had left Canoo.

Given these scandals, at the critical juncture of bankruptcy, Canoo failed to obtain financial support from the US Department of Energy's Loan Programs Office, and overseas capital showed little interest in investing in it.

Although the appearance of Canoo EV is unique, sales have been unsatisfactory. Financial reports show that the company sold only 22 vehicles in 2023, earning a total of $886,000.

02 How to Squander a Good Hand

As a new player, Canoo's early conditions were not bad.

Founded in 2017, Canoo was co-founded by two former Faraday Future executives, Stefan Krause and Ulrich Kranz.

Both have roots in BMW. Krause was once the CFO of BMW, while Kranz was the project director of the BMW i3 series, known as the "father of the BMW i series."

Initially, the name of this new carmaker was Evelozcity. With the addition of more people, the number of co-founders increased to nine, and the company was later renamed Canoo.

The resumes of the seven later co-founders were also impressive, mostly consisting of executives from BMW, Uber, and Ford.

With a strong founding team, Canoo attracted many investors, including current CEO Tony Aquila, who was previously an investor in Canoo.

The initial capital for Canoo's establishment was provided by a Chinese investor, Li Botan, and Taiwan-based tech company TPK, which supplies touchscreen technology to Apple.

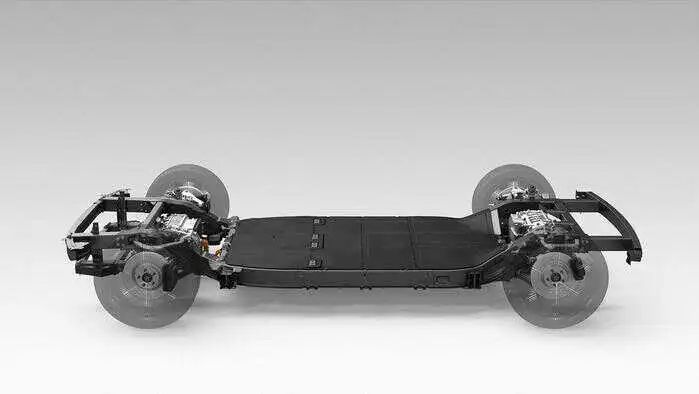

Canoo's initial goal was to manufacture cute egg-shaped electric delivery vans and pickup trucks. It also proposed using a skateboard chassis structure for vehicle manufacturing, which could satisfy various vehicle types with a single chassis.

Because the chassis is an integrated architecture that eliminates mechanical connections, more space can be retained in the cabin. With the skateboard chassis, Canoo became a star startup overnight.

In 2019, the Canoo EV was unveiled, featuring a skateboard architecture. The unique design of this new vehicle attracted much attention. It is worth mentioning that Apple at that time expressed interest in acquiring it.

According to foreign media reports, to advance its pure electric vehicle project, Apple was interested in acquiring the startup Canoo in the first half of 2020, but the plan did not progress as scheduled.

In addition, Ulrich Kranz joined Apple's "Titan" project and became the second-in-command of the project for a time. However, soon after, Kranz was sued by the US Securities and Exchange Commission (SEC), which alleged that he had misreported his salary and provided unreasonable revenue forecasts while in charge of Canoo.

Getting back to the topic, although Canoo was not acquired by Apple, it enjoyed a period of prosperity. In December 2020, three-year-old Canoo went public through a SPAC (Special Purpose Acquisition Company), reaching a peak market value of $2.1 billion, equivalent to RMB 15.4 billion. However, soon after, Canoo was investigated by the US Securities and Exchange Commission.

Later, in March 2021, Canoo reached a cooperation agreement with South Korean automaker Hyundai Motor Company to jointly develop an electric vehicle platform, but the project eventually came to nothing.

To date, Canoo has launched four series of models: its first electric MPV, launched in 2019, a pickup truck, a sedan, and a delivery van LDV.

At that time, Canoo's business model primarily focused on providing electric vehicles to commercial operators, with the slogan of "entering the last-mile delivery market."

In 2022, Walmart announced that it would purchase 4,500 Canoo LDVs for delivering online orders, which remains Canoo's largest order to date.

The US Postal Service and NASA are also customers of Canoo. NASA purchased three manned transport vehicles to transport astronauts to the launch pad for the Artemis lunar mission. The US Postal Service purchased six right-hand drive LDVs for use on mail delivery routes and invested $40 billion to improve its transportation and distribution network.

Although these customers are impressive and can serve as endorsements for Canoo, the number of products they require is clearly insufficient to support the normal operation of a company.

Moreover, to cope with these customers, Canoo was also embroiled in scandals of fraud, undoubtedly damaging its already limited popularity among the general public.

Previously, Canoo also planned to enter the Chinese market. Given the participation of Chinese capital, it was not impossible to achieve large-scale mass production in China. However, it now appears that there may be no such opportunity.