"Price War + Intelligent Driving Race": Navigating Dual Pressures, How Can Tesla Sustain Its Trillion-Dollar Market Value?

![]() 02/05 2025

02/05 2025

![]() 579

579

On January 30, Tesla unveiled its Q4 and full-year 2024 financial reports. Given that 2025 is already underway, our focus will primarily be on the comprehensive analysis of 2024 and the outlook for 2025. Let's dive in.

01 Deliveries and Profits

In 2024, Tesla manufactured approximately 1.773 million electric vehicles globally and delivered approximately 1.789 million vehicles. In comparison, 2023 saw Tesla produce roughly 1.85 million vehicles and deliver around 1.81 million. Tesla did not meet the compound growth rate predicted by Musk in 2024, and there was even a slight decline. Several factors contribute to this sales dip: 1. Heightened industry competition. A few years ago, few automakers could rival Tesla in technology and products, but the landscape has changed dramatically. Increasingly powerful domestic automakers like BYD and Xpeng are capturing market share through cost-effective advantages and rapid technological advancements, thereby squeezing Tesla's sales. 2. Market saturation. With the widespread popularity of Model 3 and Model Y, these segments have become fiercely competitive, with many automakers vying for a slice of the pie. For instance, in September 2024, domestic automakers launched a series of new products, such as the Zeekr 7X, IM LS6, Lantu Zhiyin, and AITO 07, all targeting Model Y. This segment is now extremely crowded and internally competitive.

From Tesla's perspective: 1. Product lifecycle challenges. The Model 3/Y have been on the market for several years with limited design and technological updates. They undergo significant upgrades every five to six years, in stark contrast to the domestic trend of annual model changes. The gap in products and configurations is narrowing. 2. Product gap. While Tesla currently has S3XY and Cybertruck, it mainly relies on Model Y. There are also production ramp-up issues with Cybertruck, and Model 2 has not been launched on time, leading to a gap in the product matrix and affecting sales. However, Tesla asserts that its automotive business will resume growth this year. Regarding profits, Tesla's net profit in 2024 was $7.09 billion, a 53% decrease, effectively halving. This is due to Tesla's adoption of measures such as interest-free loans and price reductions to boost sales and stimulate demand, which impacted profits. In 2024, Tesla's gross margin was 17.9%, down from 18.2% in 2023, representing a significant decline. Many are concerned about the drop in Tesla's single-vehicle profit margin and overall profits. However, these concerns are unwarranted. For Tesla, short-term declines in sales and profits are merely temporary setbacks that cannot undermine its foundation.

Amidst the global price war, it is understandable for product prices to be adjusted downwards to cope with increased competition, and this is not a major issue. Notably, despite the gross margin dropping from 30% to 18%, Tesla's cost control has already yielded results, with the cost per vehicle falling below $35,000. Moreover, compared to the vast majority of automakers selling cars at a loss, Tesla has achieved a balance between cost and efficiency while still turning a profit, which is unparalleled. Additionally, Tesla has substantial funds available for investment, particularly in new technologies represented by AI, further enhancing its capabilities. Statistics reveal that in 2024, Tesla's total annual R&D investment set a new record of approximately RMB 32.9 billion (USD 4.54 billion), compared to USD 3.969 billion in 2023. To date, Tesla's cumulative investment in AI, including infrastructure, is approximately USD 5 billion.

Manufacturing, AI, and robotics will be Tesla's investment priorities in recent years. The decline in Tesla's sales also signals that the electric vehicle industry is transitioning from "wild growth" to a "knockout stage," where technology, cost control, and ecosystem integration capabilities will be crucial for survival.

02 Progress in Intelligent Driving

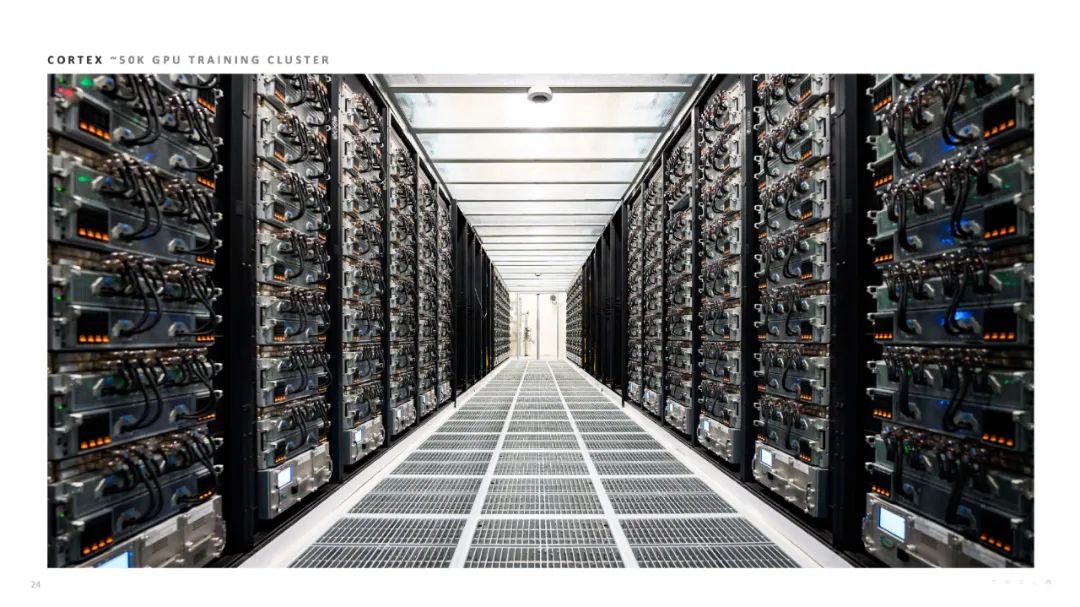

Currently, the spotlight is on Tesla's FSD progress. As an industry leader, Tesla pioneered end-to-end technology globally and enabled true point-to-point intelligent driving on FSD V13 (i.e., starting autonomous driving from a parked state and performing reverse and parking maneuvers). Tesla continues to advance down the path of pure vision and incremental development, still guiding the technical development of various automakers and intelligent driving companies. In the fourth quarter of 2024, Tesla deployed approximately 50,000 H100 training cluster Cortex at its Texas Gigafactory. This larger computing power cluster helped Tesla take the lead in intelligent driving. According to Tesla's data, in the fourth quarter of 2024, Tesla vehicles using Autopilot technology traveled 5.94 million miles between incidents, setting a new best record for the quarter, compared to the US average of 0.7 million miles.

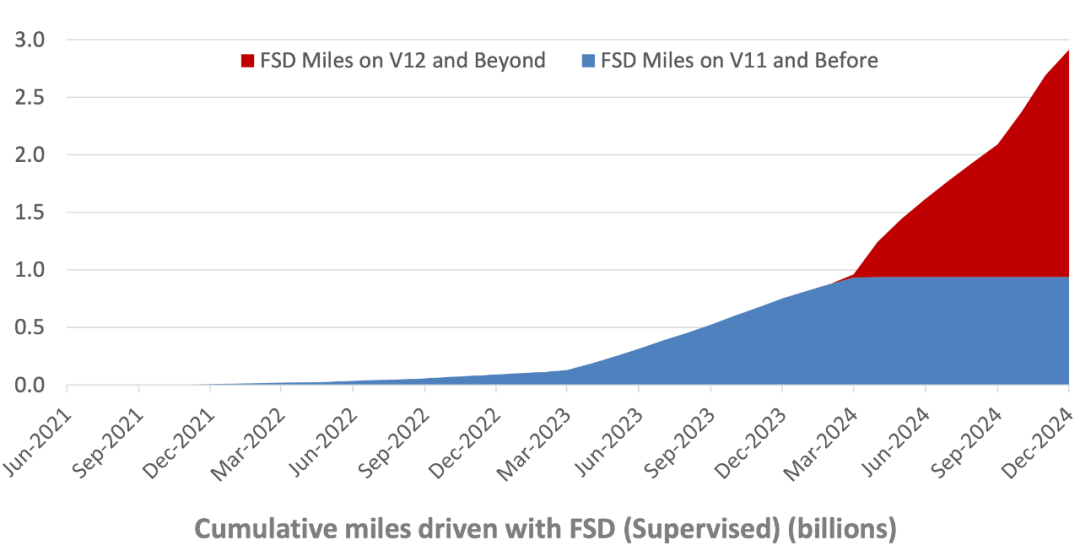

As of January 2025, the cumulative mileage of the Smart Summon feature (driver-supervised version) exceeded 4.8 billion kilometers (3 billion miles). The growth rate of this road test data is truly astonishing, and currently, no domestic company can match this performance. Computing power + data is the elixir for Tesla's intelligent driving breakthroughs. Now, the main concern is undoubtedly the introduction of FSD in China. Previously, Tesla has already introduced the Smart Summon feature (ASS), which shares the same technology as FSD. It is certain that FSD will enter China this year, competing with various domestic automakers and intelligent driving companies. Judging from the current progress of intelligent driving in China, in 2025, leading intelligent driving companies will shift from end-to-end + VLM to end-to-end + VLA in terms of technology. In terms of implementation, they will gradually achieve true point-to-point intelligent driving, connecting scenarios such as parks and ETC, while L3 will also become a key focus for various automakers this year.

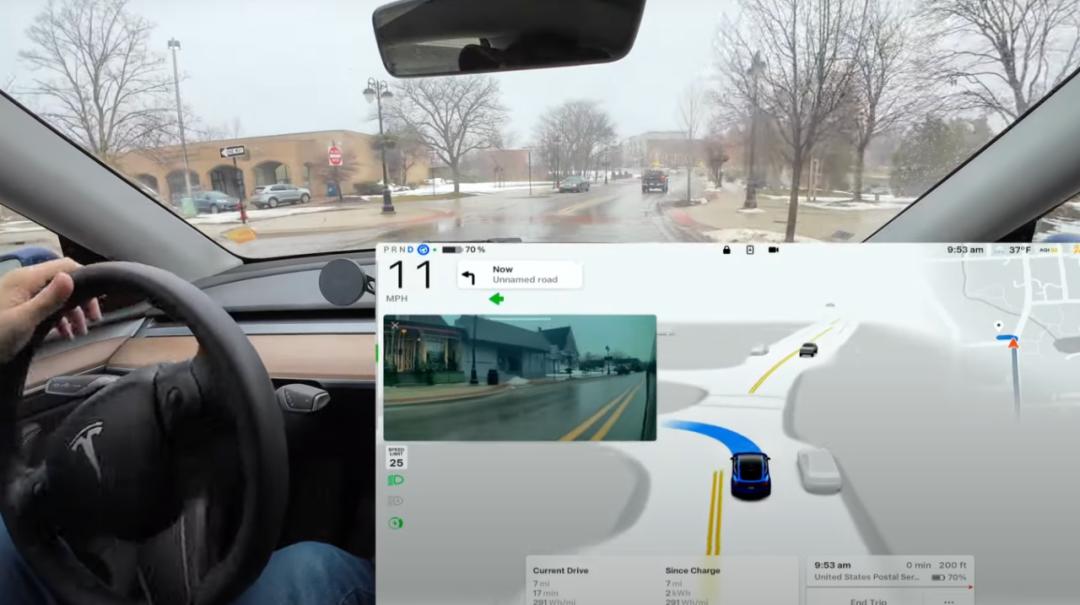

(Image from the internet) In terms of technology, Tesla's current intelligent driving hardware is AI 4, with a computing power of up to 720 TOPS. It is expected that in the second half of this year, Tesla will launch AI 5, with energy consumption increasing to 4-5 times the current level and computing power reaching 10 times the current level. If this is true, it means that the computing power of AI 5 will soar to an impressive 7200 TOPS. With a computing power exceeding that of any existing intelligent driving chip, AI 5 will aim for L4 and L5 autonomous driving capabilities. Tesla's autonomous driving tests are already underway. At the Fremont factory in California, thousands of Tesla vehicles autonomously drive without a driver every day. These vehicles do not follow fixed routes but dynamically plan paths based on delivery needs. For example, they autonomously drive from the end of the production line to designated parking spaces to await delivery. This will soon be applied to the Texas factory as well. The Austin factory will also launch a paid autonomous driving service in June. Now that V13 has been released, V14 is already on the horizon. V14 is highly likely to be unsupervised FSD. It is truly exciting to see how far Tesla's FSD will advance in 2025.

03 The Most Important Year in History

In January 2025, Tesla launched the refreshed Model Y, which appears to have significant upgrades in most aspects perceived by users (comfort, ride, energy consumption, range, etc.). According to reports, the refreshed Model Y secured 70,000 orders within 5 days, highlighting Tesla's formidable brand influence. Judging from past sales composition, Model Y has become Tesla's biggest sales contributor. However, over-reliance on a single star product is currently Tesla's biggest challenge.

To address this issue, Tesla needs to diversify its product offerings. Tesla's answer is Model 2. As a star product priced at USD 25,000, this car has generated a buzz. It will introduce Tesla to a larger product segment and could potentially contribute significantly more sales and revenue than Model Y. According to Tesla, this car will be launched in the first half of 2025. In summary, whether Tesla can achieve sales growth in 2025 largely depends on whether it can launch a hit model in the USD 20,000 price range, whether its autonomous driving technology can create a competitive advantage, and the resilience of its global supply chain amidst volatile situations. Additionally, in the field of robotics, Tesla's humanoid robot has made new progress. In 2025, it will initiate a pilot production plan to deliver thousands of humanoid robots.

Musk stated that, in the long run, the potential market size for Optimus could exceed USD 10 trillion. By then, even if the training computing power cost is USD 500 billion, it will still be worthwhile. It's hard not to admire Musk's foresight. He has been laying the groundwork for robots since an early stage. Now, looking back, numerous embodied intelligence startups have emerged in China, and an increasing number of automakers are also beginning to venture into the robotics sector. "Through autonomous vehicles and humanoid robots, we have seen the path for Tesla to become the most valuable company in the world (with a market value exceeding the combined total of the top five companies globally)." In Musk's view, 2024 was a year of preparation, and 2025, with continuous progress, will be the most important year in Tesla's history, while 2026 to 2028 will be a period of explosive growth. In short, Tesla's 2025 promises continuous advancements in new technologies and products, making it highly anticipated. End.