Applying Marxist Dialectical Thinking to Reasonably Assess 'Battery Swapping' and 'Ultra-Fast Charging'

![]() 03/19 2025

03/19 2025

![]() 729

729

Both battery swapping and ultra-fast charging are pivotal components of the new energy vehicle industry, and they should not be viewed as mutually exclusive contradictions.

On March 17, BYD hosted a super e-platform technology conference, where their newly unveiled "megawatt flash charging technology" garnered significant attention.

The fully liquid-cooled megawatt flash charging terminal system, equipped with the world's first liquid-cooled ultra-fast charging device, boasts a maximum single-gun output power of 1360kW, enabling an energy replenishment of 800 kilometers in just 5 minutes (under CLTC conditions) and compatibility with all BYD models and third-party brands.

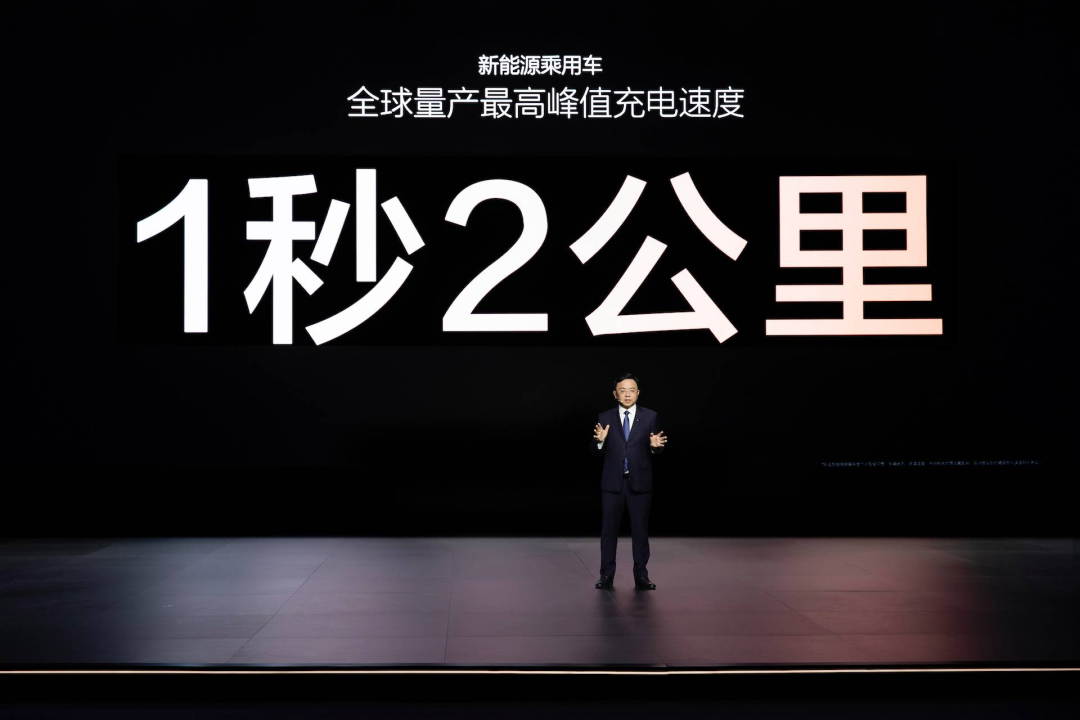

BYD also introduced the "flash charging battery," which establishes ultra-high-speed ion channels from the battery's cathode to anode, reducing internal resistance by 50%. This innovation achieves a charging current of 1000A and a charging rate of 10C, enabling a charging power of 1 megawatt (1000kW) with a peak charging speed of 2 kilometers per second—the fastest in mass production. A 5-minute flash charge can provide a driving range of 400 kilometers.

Regarding the national ultra-fast charging network, BYD plans to establish over 4,000 "megawatt flash charging stations" from 2025 to 2027, covering highway service areas, urban cores, and county markets, aiming for a coverage rate exceeding 80% with "one ultra-fast charging station per kilometer."

BYD Chairman and CEO Wang Chuanfu stated at the conference, "To thoroughly address users' charging anxiety, our goal is to make the charging time for electric vehicles as short as the refueling time for fuel vehicles, achieving 'same-speed oil and electricity' in charging speed."

This marks another convergence between fuel and electric vehicles, following 'same rights for oil and electricity.' However, observant netizens pointed out that if this technology becomes widespread, it may further compress the survival space of the battery swapping market.

Just a day later, two prominent domestic battery swapping firms announced a strategic cooperation, seen as a response to the external debate on the technological path between battery swapping and ultra-fast charging.

On March 18, NIO and CATL officially signed a strategic agreement, aiming for comprehensive cooperation in battery swapping networks, capital investment, and technical standards. CATL will invest up to RMB 2.5 billion in NIO Energy to jointly build a "globally-scaled, most technologically advanced passenger vehicle battery swapping service network."

The core of this cooperation lies in the joint construction of a battery swapping network based on the 'dual-network parallel' model. According to the agreement, CATL's chocolate battery swapping technology will be open to NIO's third brand, Firefly, and future models of this brand will be compatible with CATL's battery swapping standards, allowing users to replace batteries at either NIO or CATL battery swapping stations.

This signifies NIO's first break from its closed battery swapping system, extending its user ecosystem from high-end to mid-to-low-end markets. Meanwhile, CATL accelerates the penetration of its chocolate battery swapping ecosystem in the passenger vehicle sector through partnerships with leading automakers.

From an outsider's perspective, a competition between ultra-fast charging and battery swapping has commenced.

Opposition and Unity

Despite Li Bin's repeated emphasis that NIO's energy replenishment system is 'chargeable,' 'swappable,' and 'upgradable,' many still associate NIO with battery swapping, viewing it as a transition while ultra-fast charging as the ultimate future solution. This perception pits battery swapping against ultra-fast charging.

In reality, battery swapping and ultra-fast charging are not contradictory; neither are fuel and electric vehicles.

Despite the surge in electrification seemingly revolutionizing fuel vehicles, fuel vehicles still contribute half of national passenger vehicle sales.

For those with insufficient cognition, consider capital's choice.

On March 18, NIO's Hong Kong stock price surged over 17% at its peak, ultimately closing up 8.95% at HK$41.4. Despite BYD's rapid advancements on the other side, even surpassing 'Ning Wang' for the first time in seven years to reach a market value of RMB 1.6 trillion, capital views the two not as a life-or-death competition but as complementary technologies.

The difference in charging methods between battery swapping and ultra-fast charging lies solely in their applicability to different user groups, without fundamental contradictions or conflicts.

This aligns with the basic law of opposition and unity in Marxist dialectical thinking. The contradiction between the two lies in their different charging modes, but essentially, they both contribute to the establishment of the energy replenishment system amidst the new energy vehicle development wave.

In objective terms, factors such as heavy assets and high costs hinder the expansion of battery swapping stations, affecting automakers' business operations—an issue NIO is actively addressing.

Last August, NIO launched the Power-Up Partner Program, sharing its charging and battery swapping facility construction and operation experience accumulated since 2018 with social capital. This program opens cooperation with charging and battery swapping stations to the public, offering three cooperation modes—'charging station franchise,' 'fixed income from charging and battery swapping stations,' and 'guaranteed income + revenue sharing from charging and battery swapping stations'—to cater to different partners' needs and preferences, jointly building and sharing profits, and paving the way for social capital to enter the charging and battery swapping infrastructure construction.

Moreover, NIO's Power-Up Partner Program effectively reduces the cost of building charging and battery swapping stations, lightening the original heavy asset and high-cost model.

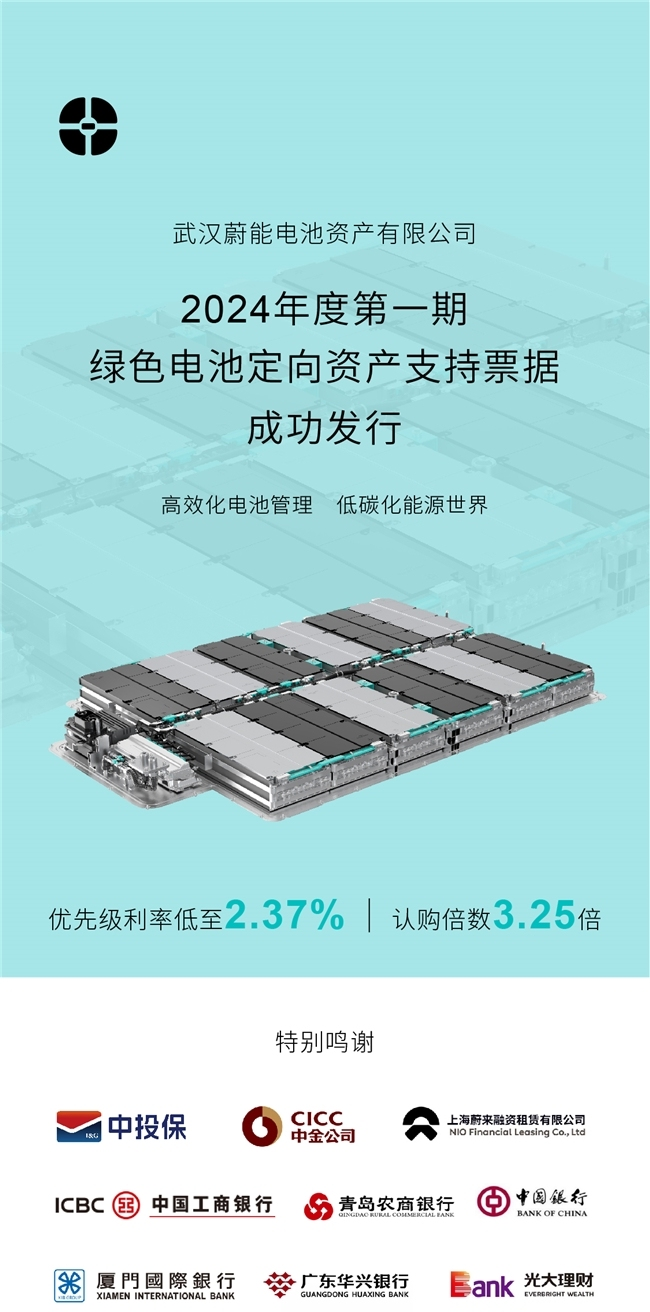

Through BaaS, NIO sells battery pack assets to WeiNeng (NIO holds a 19.8% stake), transferring part of the cost of battery packs at battery swapping stations to WeiNeng.

NIO raises funds from banks through asset securitization. In 2022, it issued a phase of ABN with a total scale of RMB 400 million and an interest rate of only 3.12%. The subsequent ABN had a larger issue size of RMB 635 million.

In layman's terms, WeiNeng can be seen as a battery bank, borrowing from banks and engaging in asset securitization, optimizing costs and improving operational funding support through reasonable leverage.

Returning to ultra-fast charging, this technology also has its limitations, such as higher requirements for supporting cables and cooling equipment due to excessive charging voltages, with safety a major concern. To achieve ultra-fast charging, automakers must develop products based on new platforms,不利于成本控制.

The seemingly 'same-speed oil and electricity' ultra-fast charging actually has shortcomings in layout, with most charging stations having more slow chargers than fast ones.

At the State Grid port, taking the detail of power application as an example, the upper limit of a single transformer capacity that 'does not allow the use of box transformers and requires the construction of a distribution room' varies by region, such as 630kVA, 1250kVA, and 1600kVA.

Simply put, taking the 360kW ultra-fast charging pile as an example, 630kVA can only accommodate 2 ultra-fast chargers, 1250kVA can barely accommodate 3, and 1600kVA can only accommodate less than 4.

In terms of cost, battery swapping stations are no different from ultra-fast charging stations.

Qualitative Change Induces Quantitative Change

On March 17, the CCTV program 'Focus Interview' again focused on power battery recycling. Relevant data shows that by 2030, China's power battery retirement volume will reach 3.5 million tons.

However, as of the end of 2023, the standardized recycling rate of new energy vehicle power batteries in China was less than 25%, with most waste batteries flowing to non-compliant enterprises operating in the 'gray zone.' These 'workshop'-style non-compliant enterprises lack production qualifications and technical accumulation, operate extensively, and pose significant safety and environmental risks.

BC has previously elaborated on the current chaos in power battery recycling in the article 'Documentary on Secret Visit to Power Battery Recycling - The Disappearing 'Lithium''.

Returning to battery swapping and ultra-fast charging, most discussions still center on energy replenishment, but battery swapping stations offer another significant benefit: standardized battery management.

In NIO and CATL's strategic cooperation, the two parties will jointly promote the formulation and promotion of national standards for battery swapping technology, facilitate cross-brand and cross-model battery compatibility, and jointly build a full lifecycle closed loop of 'battery research and development - battery swapping service - battery asset management - cascade utilization - material recycling' to support the high-quality and sustainable development of the entire new energy vehicle industry chain.

In practice, policies on battery recycling from a top-level design perspective have been continuously updated and improved alongside new energy vehicle development. However, due to varying battery standards among automakers, recycling is challenging, and the original recycling policy dominated by automakers and some whitelist enterprises cannot be implemented.

This is also an objective law of development. After all, in market behavior, unity implies monopoly, and monopoly precedes unity.

To some extent, the cooperation between NIO and CATL has significantly advanced battery standards consistency. On December 18, 2024, at the CATL Chocolate Ecosystem Battery Swapping Conference, CATL announced the launch of two standardized chocolate battery swapping blocks, named the 20-number and 25-number battery swapping blocks.

Industry insiders speculate that in the future market, several automakers may form groups to establish standards, potentially unifying the entire market into 2-3 standards.

As more automakers join the same system, battery recycling difficulties will be easily resolved, reflecting the practical result of qualitative change induced by quantitative change.

Furthermore, battery swapping stations are natural energy storage stations that can participate in grid peak shaving and valley filling, and in grid regulation through virtual power plant construction.

In other words, battery swapping stations have high energy storage value and significant commercial potential in energy internet scenarios such as vehicle-grid interaction and virtual power plants.

With automobiles leading the way, the economic potential of energy storage peak-valley arbitrage is gradually being explored, aiming for integrated photovoltaic energy storage and charging (swapping) in the future, reducing station electricity costs and dependence on the distribution network.

Just a week ago, on March 11, China's largest prefecture-level city-level battery swapping virtual power plant was completed and put into operation in Jiangsu. With a series of instructions issued, this NIO battery swapping station in Kunshan High-tech Zone began supplying power to the State Grid in reverse.

Thanks to the application of a new power load management system, after large-scale grid access, new energy vehicle battery swapping stations can form a battery swapping virtual power plant.

Staff introduced that each electric vehicle battery swapping station in the city is essentially a large energy storage device, akin to commonly used mobile phone power banks. When battery swapping stations are not in use or have idle electrical energy, they become potential adjustable resources.

From this perspective, the significance of battery swapping stations extends far beyond mere energy replenishment. They are redefining energy distribution and directly impacting the entire chain of energy production, storage, and consumption.

Whether battery swapping or ultra-fast charging, both are crucial components of the new energy vehicle industry and should not be viewed as contradictory.

If NIO is merely considered an automobile company, given its current sales performance, there are indeed voices in public opinion that are not overtly pessimistic. However, adopting a different lens, viewing it as an energy company, offers a more profound understanding of NIO's potential future.

Note: Some images are sourced from the internet. In the event of any infringement, kindly contact us for prompt removal.