Can BYD's 'Same Speed as Oil Cars' Revolutionize EV Charging Anxiety?

![]() 03/19 2025

03/19 2025

![]() 680

680

On March 17, 2024, BYD (01211.HK) unveiled its groundbreaking new pure electric 'Super e-Platform' in Shenzhen, showcasing 'Megawatt Flash Charging' and 'Same Speed as Oil Cars' as its primary selling points. The platform boasts a peak charging rate of '2 kilometers per minute,' enabling a range of 400-407 kilometers in just 5 minutes, effectively matching the refueling efficiency of gasoline vehicles in 5-8 minutes. This innovative system will be integrated into BYD's new flagship models, Han L and Tang L, which are now available for pre-order.

Since 2025, BYD has embarked on a journey of comprehensive scientific advancements, from 'Smart Driving for All' at the beginning of the year, to the 'Lingjiu' drone system, and now the 'Super e-Platform.' Its market impact has shown relentless momentum, with this latest focus on addressing the persistent pain point of EV charging – a challenge often seen as the last bastion of gasoline vehicles. If this technology is fully realized, it could revolutionize not just the EV industry but also impact gasoline vehicle enterprises.

What sets the Super e-Platform apart from existing EV enterprises? And what market impact will its launch have? This article delves into these questions.

01

Technological Breakthrough: Overcoming Technical Barriers with a Holistic Approach

The heart of BYD's Super e-Platform lies in its all-domain kilovolt high-voltage architecture, the world's first mass-produced 1000V high-voltage system for passenger vehicles. This system integrates batteries, motors, power supplies, and air conditioning components throughout the vehicle. According to the launch event, BYD models equipped with the Super e-Platform support 1000V voltage and 1000A current, achieving a charging power of 1 megawatt and a charging rate of 10C, making it the fastest charging efficiency in mass production globally.

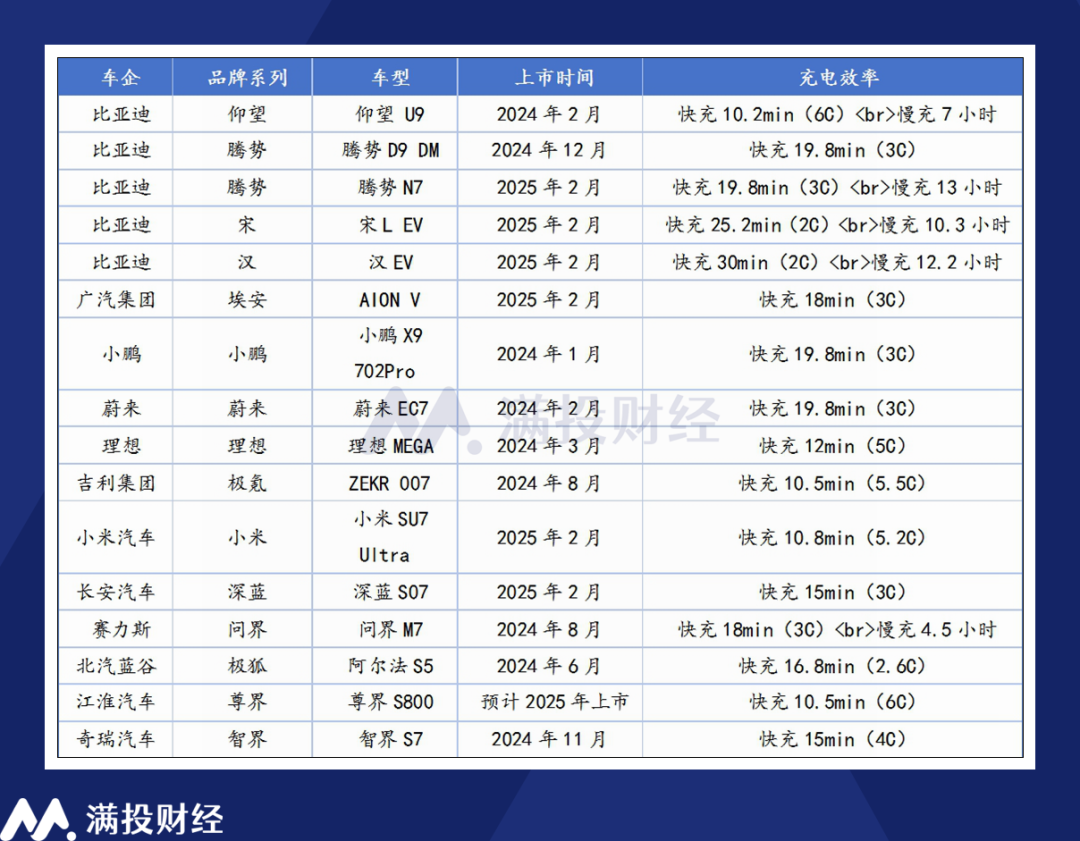

In the context of fast charging technologies, Xpeng Motors (09868.HK) previously released the G6 and G9 with standard 5C supercharged AI batteries at its 2025 Spring Conference. Li Auto (02015.HK)'s Li Auto MEGA also boasts a charging efficiency of over 520kW through its 5C battery. However, BYD's Super e-Platform doubles this efficiency numerically.

Leaving aside top-tier EV models, research reports from China Merchants Securities indicate that the mainstream charging rate for newly launched vehicles has reached 2C, with high-end models moving towards 5-6C and mid-to-low-end models advancing towards 3-4C. Hybrid models are also surpassing 2C. As consumer demand for faster charging continues to rise, supercharging technology is rapidly evolving. Yet, BYD's advancements in this field surpass general market expectations.

Data Source: Tongchedi, China Merchants Securities Research Report

Achieving EV charging in 10 minutes is an ideal scenario, especially with adequate charging infrastructure. BYD plans to establish over 4,000 'Megawatt Flash Charging Stations' nationwide to support its Super e-Platform. Additionally, BYD will employ 'dual-gun charging' technology to be compatible with public fast charging piles, enhancing the adaptability of its fast charging technology.

To ensure safe Megawatt Flash Charging, BYD has optimized automotive cells and battery pack modules. Furthermore, to match ultra-high-power charging, BYD has independently developed and mass-produced a new generation of automotive-grade silicon carbide power chips. The seamless coordination of charging piles, batteries, and motors has enabled this technological leapfrogging.

Overall, BYD's launch event further solidifies its leadership in electrification. The fusion of intelligence and performance presents a formidable challenge to traditional gasoline vehicles. Given the comprehensive design of supporting technologies, it may be challenging for other EV enterprises to replicate BYD's success through isolated technological breakthroughs, creating a technological barrier for BYD against its competitors.

02

Market Impact: Revolutionizing EV Range, but Gradual Adoption is Key

Since 2024, pure electric vehicles priced above 200,000 yuan in China have generally featured 800V high-voltage fast charging. As the market expands, consumer concerns about charging efficiency have become a critical aspect of EV technology iteration. New models demand increasingly higher charging efficiency, intensifying competition in this area.

While domestic automakers strive to avoid 'price wars,' the race for intelligence and fast charging has escalated competition to new heights. From a competitive strategy perspective, BYD's transition from 'cost-effectiveness' to 'technological barrier construction' is evident. Its plan to build over 4,000 Megawatt Flash Charging stations diverges from the traditional reliance on public charging piles, aligning more closely with NIO's battery swap station model.

However, achieving 'Same Speed as Oil Cars' is not straightforward. While technological advancements pressure competitors, other automakers still have time to catch up. BYD's 'Megawatt Flash Charging' is contingent on supporting charging infrastructure, and constructing 4,000 self-developed flash charging stations will take time. Moreover, the power demand of a single Megawatt Flash Charging station operating at full capacity may strain local power grids, especially in smaller cities. Though BYD has designed a storage and charging solution, implementation will take time.

Numerous automakers, including NIO, Xpeng, and Li Auto, are also investing in supercharging infrastructure, with quantities ranging from 1,000 to 2,000 stations. However, their density is not yet widespread. Many users find it difficult to replicate laboratory charging performance in real-world scenarios, and BYD may face similar challenges.

Moreover, highway scenarios, where EVs most need fast charging, require accelerated charging infrastructure development. As of November 2024, China had built 33,000 charging piles and 49,000 charging parking spaces in highway service areas, still insufficient for the growing number of EVs. In urban areas, sufficient battery range and slow charging suffice for most use cases.

In the author's view, while BYD's flash charging technology is impressive, its perceptibility among consumers may not match that of 'Smart Driving for All' earlier this year. EV range anxiety has specific application scenarios where fast charging alone may not fully alleviate consumer concerns.

03

Conclusion

The launch of BYD's Super e-Platform represents not just a technological leap in EV range but also a redefinition of the EV 'charging experience.' As charging speeds rival those of gasoline vehicles, the last bastion of gasoline vehicles is eroding. However, fully transitioning from technology to an integrated ecosystem requires industry-wide collaboration, policy support, and shifts in user habits, a process that cannot be rushed.

Technological innovations always garner market recognition. Since January, BYD's Hong Kong and A-share market capitalizations have risen, with the Hong Kong stock gaining 53% and the A-share up 38% year-to-date. Post-announcement, the company's share price showed an upward trend but leveled off in the following days.

With BYD's technological advancements, its market position may evolve. By leveraging technological barriers to create a closed-loop ecosystem and building a 1000V standard supercharging network, BYD is gradually setting itself apart in the industry. Whether this isolation is beneficial remains to be seen. However, as long as BYD continues to lead in technology, its dominant position in auto sales will remain unshaken.