Domestic Battle for Intelligent Driving: Unrelated to Tesla FSD

![]() 03/19 2025

03/19 2025

![]() 606

606

Author|Xiaoman

Disclaimer|The featured image is sourced from the internet. This is an original article by Jingzhe Research Institute. For reprints, please leave a message to apply for authorization.

On March 17, Tesla China announced that it would temporarily offer a free trial of its FSD (Full Self-Driving) intelligent assistant driving function for one month. This announcement immediately sparked widespread discussion on social media.

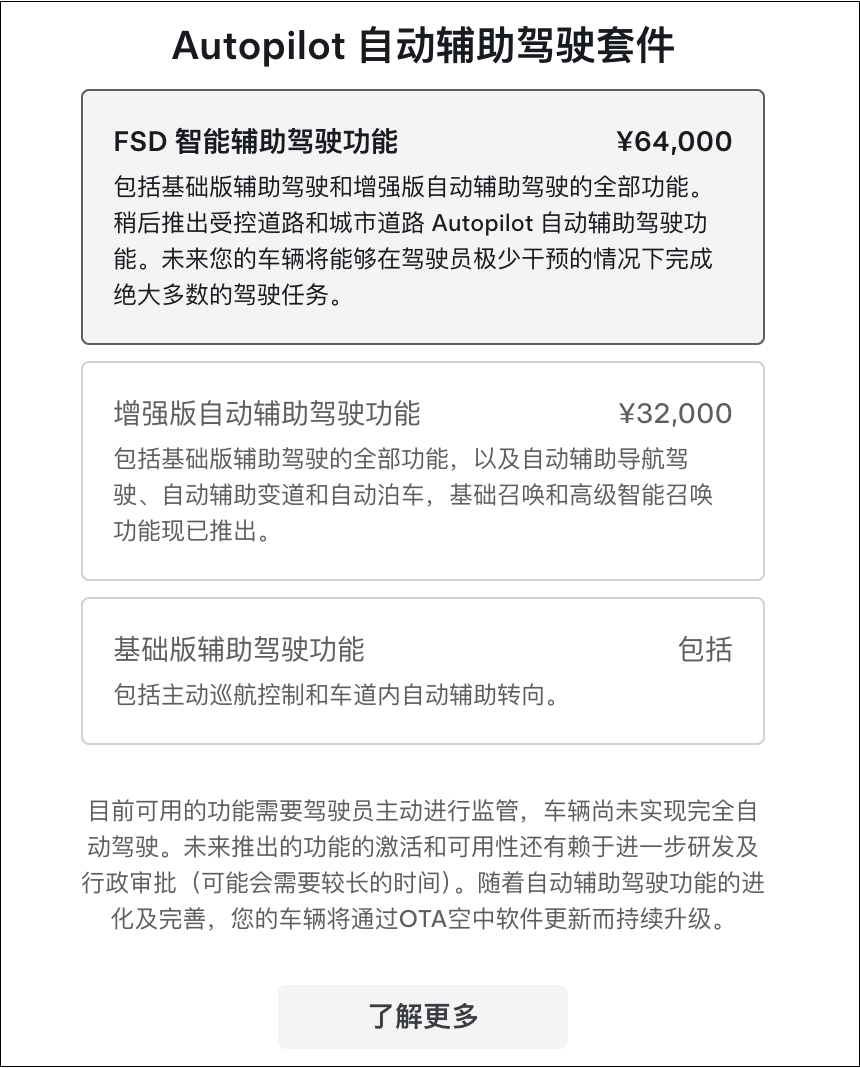

Chinese Tesla owners who had previously purchased FSD were particularly vocal in their reactions. Many had paid a substantial sum of 64,000 yuan for the FSD service package but were unable to use it due to hardware support and software iteration issues. Some even considered trading in their cars, but the official depreciation valuation for FSD services was reportedly 0 yuan.

Industry reactions to Tesla's move were mixed. Some believed that Tesla would continue to play the role of a catalyst, pushing domestic new energy vehicle manufacturers to offer advanced intelligent driving systems. Others saw it as a desperate move by Tesla in the face of increasing competition, given that its FSD's visual technology had yet to adapt to the complex road conditions in Chinese cities, and the free trial gimmick's impact on sales was questionable.

Consequently, Tesla's FSD entering China also raised a question: In the automotive industry in 2025, will intelligent driving, which is being vigorously pursued by many, become a decisive factor influencing consumer decisions? And how should we view the prospects of this function?

Tesla FSD Faces Obstacles on Both Ends in China

Earlier this year, during Tesla's Q4 2024 earnings call, Musk spent considerable time discussing the progress of FSD, particularly in the face of the company's first sales decline in a decade. Musk admitted that Tesla had encountered setbacks in promoting FSD in China, mainly due to data regulatory restrictions. On one hand, Tesla's local training data in the Chinese market is not allowed to be transmitted overseas; on the other hand, the US government does not permit Tesla to conduct FSD training in China.

*Image source: Tesla's official Weibo

Without local training data, Tesla has had to rely on public videos of Chinese streets (including various short videos) to extract road signs and traffic rules. This data is then used to establish a simulation system (SIM) for training FSD to handle China's complex traffic rules.

Musk acknowledged that relying solely on this simulation training made Tesla's FSD less applicable in China compared to the United States. For instance, the model trained based on video data struggles to understand bus lane rules in Chinese traffic regulations.

However, just a month after expressing these concerns, Tesla suddenly pushed an OTA update containing the "FSD intelligent assistant driving function" to Chinese car owners on February 25, with software version 2024.45.32.12. Simultaneously, Tesla renamed its entire intelligent driving system as the "Autopilot Suite" on its official website.

*Image source: Tesla's official website

Accessing this FSD function, however, comes with a threshold.

According to a response from the technology media "GeekPark" after calling Tesla China's 400 customer hotline, the "FSD intelligent assistant driving function" will be prioritized for models equipped with Tesla's latest AI4.0 hardware. Car owners need to subscribe to Tesla's FSD function to use the corresponding service. Most older models purchased by car owners on the market are equipped with earlier hardware systems and are therefore not among the first batch of FSD-eligible cars.

When Jingzhe Research Institute called Tesla China's 400 customer hotline on March 19, Tesla's official customer service staff confirmed that the FSD intelligent assistant driving function was currently only being pushed to some domestic models compatible with 4.0 hardware. The timing for other vehicles equipped with AI4.0 hardware to receive the update was uncertain, and there was currently no public push logic or list. Regarding whether models with earlier hardware versions could experience the FSD function, the staff clearly stated that FSD currently does not cover models with 3.0 hardware, and it was uncertain whether it would be supported in the future.

Despite the usage threshold, Tesla announced on March 17 that it would open this function for free for one month to all car owners with AI4.0 hardware models. This move may not be interpreted as a signal that Tesla's FSD has officially entered the Chinese market but rather as an "internal test plan" aimed at optimizing intelligent assistant functions and promoting FSD product iterations by combining Chinese road data and user daily usage habits through targeted small-scale open access. Tesla's FSD's true "trump card" may still be forthcoming.

From the Battle of Intelligent Driving Routes to a "New Competition"

If the current competitive landscape of intelligent driving technology among major global automakers is summarized, it can be described as a group of heroes facing off against Lv Bu, where "Lv Bu" represents Tesla's FSD.

Simply put, Tesla's FSD stands out for its complete abandonment of LiDAR and adoption of an 8-camera pure vision solution with extremely low costs for data collection. This is combined with self-developed neural networks and massive computing power for continuous training, building an entire intelligent driving system. The key to this system lies in the vast amount of real road data continuously provided by Tesla's over 6 million car owners worldwide.

According to the research report "Tesla FSD Development and Its Impact" released by Chebai Think Tank, Tesla has formed a phased lead over its competitors in terms of computing power, data, tools, and algorithms.

For example, the report shows that as of 2023, Tesla's cloud computing power reached 35 EFLOPS (hereinafter referred to as E), surpassing Huawei's BU (3.3E), NIO (1.4E), Li Auto (1.2E), Geely (0.81E), Great Wall (0.67E), XPeng (0.6E), and other domestic new energy vehicle brands. Tesla's computing power is even more than three times the combined computing power of the other six brands.

*Image source: NIO's official Weibo

With the huge amount of 6 million real vehicle data, Tesla's FSD has indeed achieved a certain level of replacing human drivers in some areas. From the perspective of Liu Yilin, former Senior Director of Autonomous Driving Products at XPeng, Tesla's FSD is accurate and "as stable as an old dog" in terms of dynamic and static perception capabilities and complex scenario handling abilities.

This aligns with the perception of many Tesla car owners – in some high-difficulty maneuvers that human drivers find challenging, such as narrow road meetings under viaducts and emergency avoidance scenarios, Tesla's assistance is quite stable, resembling an "experienced driver with ten years of driving experience".

FSD performs better in optimal road conditions but appears inadequate in poor road conditions and complex traffic rules. Since the FSD update was pushed by Tesla at the end of February, many of the first Chinese car owners to try it have collectively complained on social media about issues such as lane changes across solid lines and running red lights during autonomous driving.

Specifically, when merging into solid lane lines on ordinary roads and entering the main road from ramps, Tesla's FSD cannot recognize road diversion lines or bus lanes. Additionally, for relatively rare ground traffic lights in reality, as well as overhead traffic lights that distinguish between left-turn and straight signals, Tesla's FSD also struggles with recognition.

Considering that Musk has admitted that Tesla's FSD only uses publicly available videos of Chinese roads and signs for simulation training, in the eyes of the first batch of Chinese car owners who have experienced Tesla's FSD, it is more like an "experienced American driver with ten years of driving experience" who is not acclimatized to China.

Compared to Tesla's FSD, domestic new energy vehicle manufacturers represented by Huawei's BU and XPeng generally adopt intelligent driving solutions that integrate LiDAR and visual cameras, aiming to be more robust in dealing with complex road conditions.

Meanwhile, based on the advantage of local data, after DeepSeek emerged, various automakers have accessed large models for data training, which has the potential to narrow the gap with Tesla's self-built neural network model capabilities to a certain extent. The competition among new energy automakers focusing on intelligent driving has shifted from a simple "route battle" to a time race oriented towards functional localization and adapting to the actual needs of car owners.

New Energy 2025: Will It Be Decided by "Intelligent Driving"?

Due to the dual decline in share price and sales, Tesla's aggressive promotion of FSD entering China in 2025 is also seen as a strong signal that 2025 will become the "first year of intelligent driving." However, considering the initial experience of Chinese car owners with Tesla's FSD and the increasingly competitive environment in the domestic new energy vehicle market, one cannot help but ask: In the future, will intelligent driving really become a key factor influencing consumer decisions?

A recent research report released by CITIC Securities stated that the overall size of the intelligent driving industry is expected to grow from 70.59 billion yuan in 2024 to 105.6 billion yuan in 2025, a year-on-year increase of 49.6%. Simultaneously, the intelligent driving industry chain will also usher in the second peak after the market boom from 2021 to 2022, namely, the "equalization of intelligent driving" driven by autonomous automakers after the maturation and cost reduction of mid-to-high-level intelligent driving solutions.

The popularity of intelligent driving can also be seen from the data recently released by leading new energy manufacturers.

BYD sold 322,800 vehicles in February 2025, an increase of 163.95% year-on-year. Its newly released "Tian Shen Zhi Yan" high-level intelligent driving system covers models priced between 70,000 and 200,000 yuan, breaking the high-price barrier and directly boosting sales in the low-to-mid-end market.

XPeng sold 30,500 vehicles in February 2025, exceeding 30,000 for four consecutive months, with 15,000 deliveries of its main model, the MONAM03 (intelligent driving version), in a single month. This proves that the extension of intelligent driving functions to the 150,000-yuan market can effectively boost demand.

Huawei Hongmeng Zhixing sold 35,000 vehicles in January this year, with 12,500 deliveries of the Wenjie M9 (high-level intelligent driving version), making the intelligent driving system a core selling point for models priced above 300,000 yuan.

Behind these sales figures lies a prevailing view in the current market – due to a substantial increase in supply, vehicles with intelligent driving functions are expected to be chosen by more consumers in 2025. This is likely to profoundly change consumer perceptions, making intelligent driving functions a "must-have" option for future car purchases.

However, from another perspective, when intelligent assistant driving becomes an industry standard, how should competition among new energy vehicle manufacturers unfold? The first factor is scene coverage and the degree of functional completeness.

*Image source: XPeng's official Weibo

The ranking of intelligent driving vehicles (autonomous driving classification ≤L2) that have been launched, compiled by the First Electric Platform in 2024, roughly divides the current intelligent driving capabilities of automakers into three tiers. Huawei Hongmeng Zhixing, XPeng, NIO, Li Auto, and others lead the first tier, which has relatively obvious competitive advantages in terms of measured intelligent driving capabilities and coverage.

The second tier includes automakers such as Xiaomi, Wuling Baojun, Aion Haoplatin, and BYD Denza. These companies have fewer intelligent driving open areas but already possess full-scene intelligent driving capabilities of "High-speed NOA + Urban NOA". The third tier includes other automakers whose driving functions temporarily stay at the "High-speed NOA" level.

Although consumers do not use High-speed NOA and Urban NOA with the same frequency in daily life, "having it or not" is more likely to influence consumers' final decisions when purchasing a car than "whether it can be used or not." From High-speed NOA to Urban NOA, and then to full-scene intelligent driving, continuously enriching the application scenarios of intelligent driving systems and improving product functions and experiences have become key competitive points for new energy automakers in 2025.

The second factor is price, or rather, the pricing model. Currently, there are three pricing models for intelligent driving functions of domestic new energy vehicles: subscription, buyout, and standard configuration (no additional charge).

*Comparison of intelligent driving function pricing models of some automotive brands (created by Jingzhe Research Institute)

The disparity in pricing models for intelligent driving functions among different manufacturers stems from diverse business strategies. Some automakers integrate the cost of developing these features into the overall vehicle price, while others, concerned about raising product prices and losing market competitiveness, offer the choice to the user. For many consumers, the need to assess the value of optional features adds complexity to the purchasing decision, thereby increasing decision-making costs.

Consequently, as intelligent driving becomes an "industry standard," new energy automakers must grapple with the challenge of maintaining a price advantage while incorporating the costs of intelligent driving functions. This presents a significant hurdle that demands focused attention.

In essence, whether Tesla's FSD entry into China directly impacts the domestic new energy vehicle market or not, a fierce competition centered on intelligent driving is already underway. However, the ultimate outcome of this competition will hinge not only on technology but also on user experience and the cost-benefit ratio of intelligent driving features. Undoubtedly, the new energy vehicle industry is hurtling towards a crucial phase of full-fledged competition.