The First Year of AI Agent Explosion: Xpeng Motors Pursues Profitability with Three Growth Strategies

![]() 03/20 2025

03/20 2025

![]() 674

674

Sales of two popular models, the MONA M03 and P7+, surged, allowing Xpeng Motors to survive the fierce competition among new carmakers.

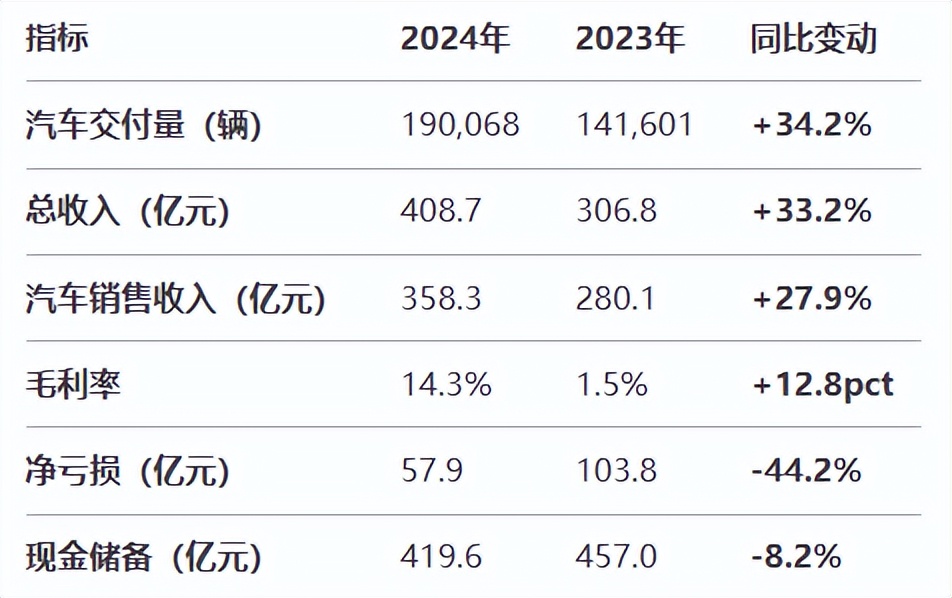

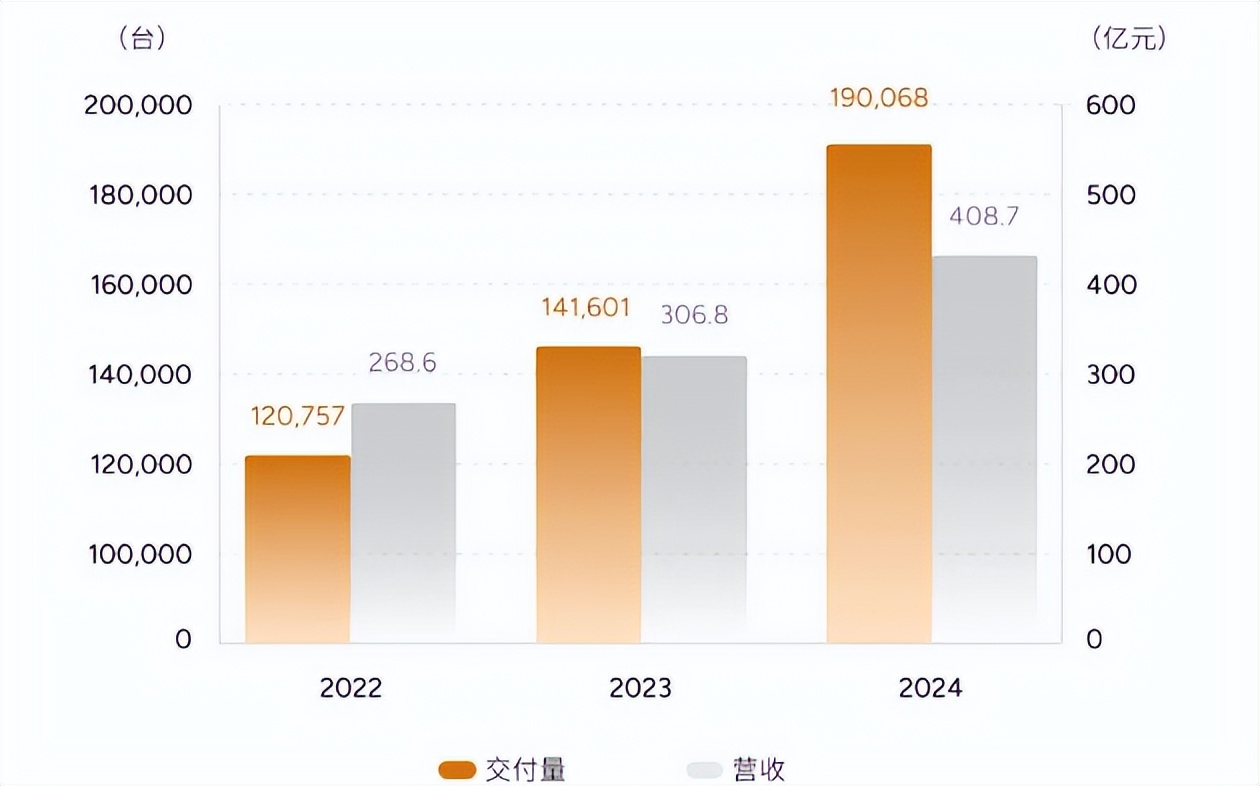

On March 18, Xpeng Motors released its fourth-quarter and full-year 2024 financial report. The report revealed that with annual deliveries increasing by 34% year-on-year to 190,100 units, Xpeng Motors' revenue grew by 33.2% year-on-year to 40.87 billion yuan, while net losses narrowed by 44% year-on-year to 5.79 billion yuan.

Sales have surged, but reducing losses remains a work in progress. Can Xpeng Motors achieve profitability in 2025 and emerge as a winner in the automotive elimination race in the coming years?

Revenue exceeds 40 billion yuan, and popular models shine through the shadow of price wars

China's new energy vehicle industry is undergoing a period of deep integration marked by technological revolution and market restructuring.

The industry price war that began in February 2024 has persisted for over a year, with "configuration upgrades + price reductions" becoming a standard strategy for automakers to compete for market share. According to Li Shufu, chairman of Geely Holding Group, the industry will continue to battle "until only a few competitive automakers remain".

Navigating price wars while striving for profitability is no easy feat.

Nevertheless, Xpeng Motors has delivered a commendable performance. In 2024, both revenue and delivery volumes maintained growth of over 30%, proving that the company's market competitiveness has improved under price pressure.

Xpeng Motors' revenue growth was fueled by its popular models. By quarter, the company delivered 21,821 units in Q1, 30,207 units in Q2, 46,533 units in Q3, and 91,007 units in Q4. The significant increase in Q4 deliveries was mainly due to the robust sales performance of the MONA M03 and P7+ during the peak season.

In addition to revenue growth, Xpeng Motors is gradually inching closer to profitability. The company's gross margin rose to 14.3% in 2024, and its net losses for the year narrowed significantly. This improvement is attributed to structural cost reductions for new vehicles and increased revenue from high-margin services.

On the one hand, the company's automotive gross margin has improved for six consecutive quarters. In 2024, the automotive gross margin was 8.3%, a notable improvement from -1.6% in 2023. It hovered around single digits in the first three quarters but reached 10% for the first time in Q4, indicating that the reforms implemented by the new president, Wang Fengying, have optimized the cost structure of new vehicles.

On the other hand, the collaboration with Volkswagen Group has brought "technology export" revenue to Xpeng Motors. In 2024, Xpeng Motors' service and other revenue amounted to 5.04 billion yuan, an increase of 89% year-on-year.

The surge in new vehicle sales, coupled with deepened cooperation with Volkswagen, has positioned Xpeng Motors on a path of healthy growth amidst the industry's price wars.

Behind this lies factors such as technology cost reduction and innovative collaboration. Xpeng Motors' ability to internalize technology dividends through vertical integration also reflects a key turning point in industrial transformation. The focus of market competition has shifted from mere price competition to a comprehensive strength contest encompassing "technology reserves + cost control + ecosystem construction".

Against this backdrop, Xpeng Motors is further investing in an intelligent technology ecosystem. During the financial report conference call, He Xiaopeng, chairman and CEO of Xpeng Motors, expressed his belief that AI will accelerate the realization of L3 and L4 autonomous driving in the automotive industry. He aims to transform Xpeng Motors into a global AI automotive company and looks forward to competing with world-class AI driving companies in both the Chinese and global markets, promoting the rapid penetration of AI driving.

This is also the direction for Xpeng Motors to emerge from the industry consolidation period and become one of the "remaining competitive automakers".

Behind carmaking and sales, Xpeng Motors' three "survival strategies"

"For automotive companies, the period of survival is far from over, and we will continue to strive."

He Xiaopeng's speech at this year's Xpeng Motors Spring Conference highlighted the company's current development status. The market is still concerned about whether the company's rapid growth in delivery volumes is sustainable, whether the automotive gross margin can stabilize above double digits, and whether the company can cross the profitability threshold.

In Xpeng Motors' current strategy, three growth strategies determine the company's answers:

The first strategy: AI cars, focusing on "intelligence + cost-effectiveness".

After clearly repositioning itself as "a global AI automotive company" at the end of last year, Xpeng Motors' development main line has comprehensively shifted to "AI + cars".

For Xpeng Motors, the rationale behind promoting AI cars is to trade price for scale, which in turn supports technology iteration, ultimately achieving a virtuous cycle of technology cost reduction.

The Xpeng P7+ brings the latest pure vision solution to below 200,000 yuan, and the Xpeng MONA M03 offers high-level intelligent driving at the 150,000 yuan level, both exemplifying this point. Similarly, when the price of the new Xpeng G9 model dropped from 469,900 yuan at its initial launch to 278,800 yuan in March 2025, He Xiaopeng was optimistic rather than concerned.

Image source: Xpeng Motors

With BYD's flagship model promoting "equal rights in intelligent driving" in February this year, the correctness of Xpeng Motors' strategy of bringing intelligent driving to a lower price point was further validated.

The period from 2024 to 2027 will be the most competitive for China's automotive industry. A new round of intelligent driving price wars, which are also popularization wars, will further optimize the market structure, and only "technology cost reduction" enterprises will survive.

During the financial report conference call, He Xiaopeng expressed his confidence in 2025, stating that with improved operational capabilities, technology cost reductions, and greater scale effects, Xpeng Motors expects to achieve profitability in the fourth quarter of 2025. The company's total sales target for 2025 is over 380,000 units.

From a market perspective, during the off-season from January to February this year, Xpeng Motors completed 60,803 deliveries, an increase of 375% year-on-year, indicating that it is on track to hit its sales targets and form a virtuous cycle.

The second strategy: Accelerating global expansion driven by AI.

In 2025, the globalization strategy is also a key development focus for Xpeng Motors.

Amidst domestic high competition, automakers "exporting to earn foreign exchange" is inevitable and a guarantee for sales growth. In the first quarter, Xpeng Motors expanded into five new markets in Europe, including the United Kingdom, Poland, Switzerland, the Czech Republic, and Slovakia. Simultaneously, it explored the Southeast Asian market by entering Indonesia and announced plans to start localized production of G6 and X9 models in the second half of the year, achieving a strategic upgrade from product exports to capacity landing.

Next, Xpeng Motors should build a synergistic closed loop of "AI intelligent driving + global market". Its full-stack self-developed intelligent driving technology forms a differentiated competitive barrier, and the expansion of overseas sales scale not only provides data fuel for AI algorithm iteration but also dilutes R&D costs through economies of scale.

Only through technology export and market feedback can Xpeng Motors advance to become a global AI automotive enterprise.

The third strategy: Evolving towards swarm intelligence and constructing an intelligent technology ecosystem.

With the advent of the first year of AI agent explosion in 2025, the industry has shifted from competing on scale to competing on ecosystems. "AI cars + humanoid robots + flying cars" have become the "three pillars" of Xpeng Motors' intelligent technology ecosystem.

Among them, the humanoid robot, which has garnered significant attention from the capital market this year, is undoubtedly the most notable. According to Goldman Sachs' predictions, global shipments of humanoid robots will reach 1.4 million units by 2035, with the market size increasing from $6 billion to $38 billion.

Since last year, He Xiaopeng has mentioned the latest progress of humanoid robots on multiple important occasions. Clearly, in addition to AI cars and globalization, Xpeng Motors also aims to tell a story of embodied intelligence.

In fact, automakers such as Tesla, BYD, Xpeng Motors, Xiaomi Automobile, and Li Auto are all venturing into the embodied intelligence race. This is because automakers possess inherent advantages in both software and hardware technologies for building robots, and entering this market is an inevitable choice for automakers seeking growth.

Of course, compared to smart cars, AI robots present a more challenging level of difficulty. For cars, intelligent driving can be an auxiliary feature, but for humanoid robots to truly commercialize, they must possess L3 capabilities, meaning that hands, feet, mouth, eyes, and the brain must be fully integrated. According to the person in charge of Xpeng Motors' humanoid robot, its humanoid robot IRON aims to achieve large-scale mass production by 2026.

In summary, Xpeng Motors is facing the global market and striving to tell a story of "swarm intelligence". From the perspective of the evolution cycle of intelligent technology, Xpeng Motors has completed the stage from 0 to 1 but is still a startup striving towards the stage from 1 to 2. The speed of breakthroughs in hard technology and ecosystem construction will determine whether it can win the industry elimination race.

Source: Hong Kong Stocks Research Institute