"Battery Swap" Duo Join Forces

![]() 03/20 2025

03/20 2025

![]() 511

511

The quest for fast charging is catalyzing a "breakout" in battery swapping.

Author | Li Dapeng | Produced by Electric Union

The strategic union of battery swap pioneers is reshaping industry norms.

On March 17 evening, Contemporary Amperex Technology Co. Limited (CATL) and NIO inked a strategic cooperation agreement in Ningde, Fujian Province. They announced plans to jointly construct the "world's largest battery swap network" and push for standardization of battery swap technology. Additionally, the two parties will deepen capital and business ties, with CATL making a strategic investment of up to RMB 2.5 billion in NIO Power.

This "technology + capital" synergy enables deep industrial integration for both companies, fundamentally altering the competitive landscape of China's and even the global new energy vehicle refueling ecosystem.

01

Complementary Approaches

What benefits does the battery swap collaboration between CATL and NIO offer each party? Insights can be gleaned from their respective battery swap models and deployment strategies.

The alliance of these two battery swap giants essentially fuses two differentiated models. It shifts from "going solo" to "dual network parallel operation".

First, let's consider NIO. Its model is a user-centric "chargeable, swappable, and upgradable" system. It focuses on user needs, reducing car purchase costs via "vehicle-battery separation" and alleviating range anxiety through battery upgrades. Its "three-minute full-charge travel" experience has set an industry benchmark.

As a pioneer in battery swapping, NIO has established 3,172 battery swap stations across over 700 cities nationwide, providing over 68.71 million battery swap services.

However, in the past, NIO's battery swap network was primarily self-operated, facing high operating costs and brand-specific limitations, impeding rapid market penetration. NIO Chairman Li Bin once candidly remarked, "Isn't it troublesome if we're the only ones doing it?"

It's evident that as a "lone hero" in battery swapping, Li Bin is concerned about the future widespread adoption of the electric vehicle battery swap model.

Next, let's turn to CATL, which emphasizes the technology-driven "Chocolate Battery Swap Block" solution. As a global leader in the power battery field, CATL's "Chocolate Battery Swap Block" adopts a modular design with a single battery capacity of 26.5kWh, supporting flexible combinations to fit various vehicle models, and prioritizing battery lifecycle management.

Previously, CATL aimed to build 1,000 battery swap stations by 2025, with a medium-term target of 30,000. Unlike NIO, CATL's battery swap deployment emphasizes technology output and standardization, aiming to dismantle industry barriers through an open ecosystem.

The crux of their collaboration lies in "dual network parallel operation" and technical standard unification.

NIO's existing battery swap network will interconnect with CATL's Chocolate Battery Swap Network. NIO's Firefly brand, targeting the low-end market, will be the first to adopt CATL's battery swap standard. Meanwhile, CATL will gain battery swap network operational experience through its investment in NIO Power.

This model not only averts direct market conflicts but also achieves a preliminary standardization of battery swap through technology interoperability. For instance, CATL's long-life battery technology can extend battery life in swap scenarios to 15 years, maintaining a health level above 85%. Conversely, NIO's experience in high-speed battery swap network deployment provides a reference for CATL's large-scale expansion.

For NIO, its premium model differentiators are preserved, while service coverage expands through technology compatibility. Li Bin candidly stated, "Cooperation is not just a capital handshake but a two-way empowerment of technical standards and service systems."

Therefore, the transition from "going solo" to "dual network parallel operation" for both parties is not merely a model complementarity in battery swapping but also significantly realizes NIO's premium market deepening and CATL's standardization ambitions.

This is indeed a grand chess move.

02

Strategic Mutual Benefit

From the development strategies of both companies, this battery swap collaboration is immensely valuable. Behind the RMB 2.5 billion investment lies the reconstruction of industrial chain logic.

For NIO, this cooperation represents a dual breakthrough in "blood transfusion" and "hematopoiesis".

As is well-known, NIO has long been hampered by high battery swap network construction costs (approximately RMB 3 million per station). NIO aims to achieve full battery swap station coverage in 2,300 county-level administrative regions nationwide by the end of 2025. This goal necessitates an average annual increase of over 1,000 stations, imposing significant capital pressure.

CATL's strategic investment of RMB 2.5 billion in NIO Power directly alleviates the latter's financial strain in expanding its battery swap network.

The deeper value lies in CATL's standardized technology reducing NIO's Firefly sub-brand R&D costs. By sharing the Chocolate Battery Swap standard, Firefly can swiftly enter the affordable market, avoid redundant battery system development, and concentrate resources on vehicle design and user service.

From CATL's perspective, "cooperation" swiftly secures the right to set battery swap standards.

Although CATL possesses core battery technology, it has relatively limited experience in battery swap operations. By partnering with NIO, which boasts the largest battery swap network, it can rapidly accumulate user data, optimize technical solutions, and accelerate commercialization through NIO's established network.

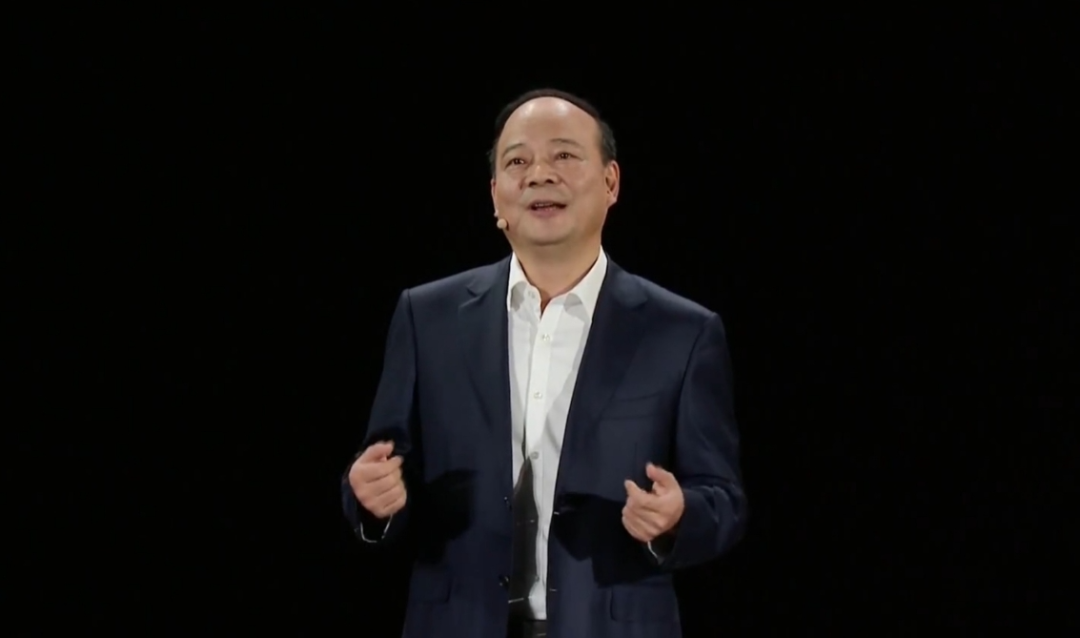

CATL Chairman Zeng Yuqun emphasized, "This cooperation marks a milestone in collaborative innovation across the entire industrial chain. We will leverage Chocolate Battery Swap technology as a fulcrum to build a smart energy network catering to multi-level needs."

Of course, besides being a strategic win-win for these two major players, this "cooperation" is pivotal in promoting standard unification and closing the battery swap industry chain loop. The battery swap industry's most pressing pain point lies in fragmented standards. Their collaboration will jointly drive the formulation of national battery swap standards, foster cross-brand and cross-model battery compatibility, and shatter the "everyone fighting their own battles" status quo.

Moreover, both parties propose establishing a full lifecycle closed loop of "battery R&D - battery swap service - asset management - cascading utilization - material recycling," reducing comprehensive battery use costs by approximately 30% and minimizing resource waste.

Additionally, the collaboration between these two leading enterprises has a potent market demonstration effect. Estimates suggest that if the proportion of battery swap models rises to 30%, the global battery swap market size will exceed RMB 1 trillion by 2030.

03

Industry Implications

From strategic mutual benefit to industrial upgrading and the inclusive value of the battery swap model, this may be the more ambitious goal of their collaboration.

It's undeniable that the vigorous promotion of the battery swap model can significantly accelerate the popularization of new energy vehicles.

Firstly, "battery swap" addresses refueling anxiety and broadens the user base. About 50% of electric vehicle users in China cannot install private charging piles. The battery swap model markedly reduces users' dependence on charging piles through the "swap and go" experience.

According to NIO data, over 50% of its users' power comes from battery swaps. For every 10% increase in battery swap station density, regional sales increase by an average of 7%. Following this collaboration, more low-end users can enjoy the convenience of battery swap through the Firefly brand, further expanding the market base.

Secondly, it lowers the car purchase threshold and activates the used car market. The "vehicle-battery separation" model reduces car purchase costs by about 30%, and the battery-as-a-service (BaaS) program enables users to flexibly upgrade battery capacity based on their needs. CATL's standardized battery pack design also enhances used car residual value – as the fastest depreciating component, battery replaceability significantly alleviates users' concerns about battery degradation.

Despite the promising prospects of this collaboration, the battery swap model still faces multiple challenges. For instance, there's resistance to technical standard unification. Even if CATL and NIO reach an agreement, it remains uncertain whether other automakers (like Tesla and BYD) will follow suit.

If NIO and CATL's standards become industry benchmarks, they may drastically lower automaker entry barriers, thereby transitioning battery swap from a "niche choice" to a "mainstream refueling method".

Cost control is another critical issue. The construction cost of a single NIO battery swap station is approximately RMB 3 million. While CATL's third-generation unmanned station has been reduced to the million-yuan level (excluding batteries), it requires 100 battery swaps per day to break even. Their collaboration can improve station utilization through network sharing. For example, NIO users may be compatible with CATL stations in the future, and vice versa, thereby spreading out operating costs.

Of course, this collaboration is far from a simple business complementarity or a straightforward capital union. It's a strategic layout by both companies for dominance in the new energy vehicle industry, deeply bundling technical standards, ecological resources, and market paths.

With CATL's support, NIO can solidify its pioneering edge in the battery swap field and withstand competition from Tesla's supercharging network and Xiaopeng's 800V high-voltage platform. For CATL, this is a crucial step in its transformation from a "battery supplier" to an "energy service provider," mastering battery lifecycle data through the battery swap network, which can feedback into battery R&D and expand into the energy storage market.

As Zeng Yuqun stated, "Letting every battery create greater value throughout its lifecycle is the ultimate goal of the energy revolution."

If both parties can truly dismantle brand barriers and promote standardization, the battery swap industry will witness a qualitative transformation from "warlord chaos" to "unification." The success or failure of this experiment will not only determine the fate of these two companies but also the ultimate direction of the new energy vehicle refueling revolution.

The "vertical and horizontal integration" in the battery swap field is accelerating the advent of the battery swap era.