Save Tesla, Musk needs to refocus

![]() 03/20 2025

03/20 2025

![]() 887

887

Introduction: Currently, a group of Chinese new energy vehicle manufacturers are performing quite strongly. It will not be easy for Tesla to return to high-speed growth on the sales side unless it can once again introduce new products that are absolutely leading in the industry. To launch such new products, Musk must make choices among his current diverse businesses to refocus.

Author: Li Ping / Producer: Lishi Business Review

In the history of global business, there are numerous examples of highly talented entrepreneurs failing due to diversification.

Currently, Musk is the entrepreneur involved in the widest range of businesses. He not only controls a number of commercial companies such as Tesla, SpaceX, Twitter, X.AI, Starlink, SolarCity, Neuralink, and The Boring Company, but also deeply participates in politics, serving as the U.S. Secretary of Government Efficiency, responsible for streamlining and reforming the country's massive bureaucracy.

Musk's courage is admirable, but the energy of any genius is limited. When he engages in too many unrelated things, he is bound to neglect one thing while attending to another. Currently, Musk is encountering such a dilemma. On the one hand, he has offended many vested interests due to his drastic reforms of the U.S. bureaucracy, leading to fierce retaliation from these people and even the risk of assassination; on the other hand, Tesla, the most important company controlled by Musk, is also facing an important crisis. Due to the strong competition from Chinese new energy vehicle companies, Tesla's sales are encountering huge challenges.

The poor sales performance has also led to a large number of investors abandoning Tesla in the capital market. Since February 2025, Tesla's share price has fallen by 50%. As of now, its market value has fallen to less than $800 billion. At the same time, its largest global competitor, China's leading new energy vehicle company BYD, has seen its share price increase significantly during the same period, with a market value stably exceeding RMB 1 trillion.

1

Disappointing Q4 Report

According to the latest financial report, in the fourth quarter of 2024, Tesla generated revenue of $25.707 billion, a year-on-year increase of 2%, significantly lower than analysts' expectations of $27.21 billion; net profit was approximately $2.32 billion, a year-on-year decrease of 71% (the fourth quarter of 2023 included a one-time non-cash tax benefit of $5.9 billion), and adjusted net profit was $2.566 billion, also lower than analysts' expectations of $2.68 billion.

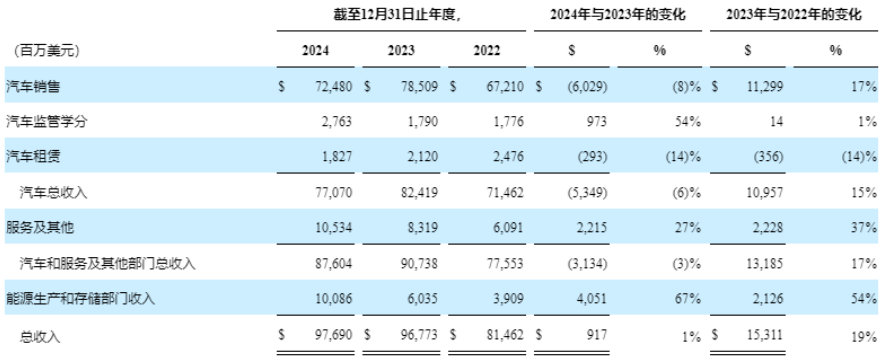

In terms of business segments, Tesla's automotive business generated revenue of $19.8 billion, a year-on-year decrease of 8%, which also included some revenue from carbon credits ($692 million); the energy storage business generated revenue of $3.06 billion, a year-on-year increase of 113%; and the services segment, including the Supercharger charging network, vehicle maintenance, insurance, and other businesses, generated revenue of $2.848 billion, a year-on-year increase of 31%.

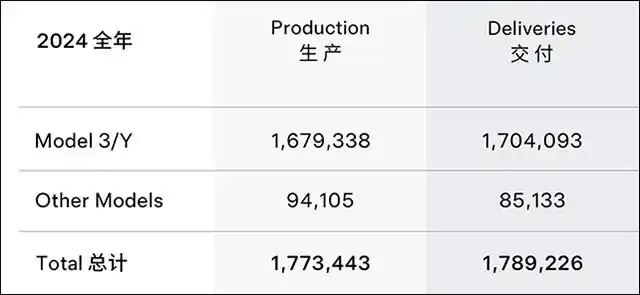

Against the backdrop of weak demand and intensified industry competition, Tesla's new car sales have been significantly pressured in the global market. Data shows that for the full year of 2024, Tesla delivered a total of 1.789 million new vehicles, a year-on-year decrease of 1.1% compared to 2023 (1.8086 million vehicles), marking the first decline in Tesla's new car sales in a decade. Among them, in the fourth quarter of 2024, Tesla delivered 495,600 new vehicles, a year-on-year increase of 2%, but still below market estimates of 512,300 vehicles.

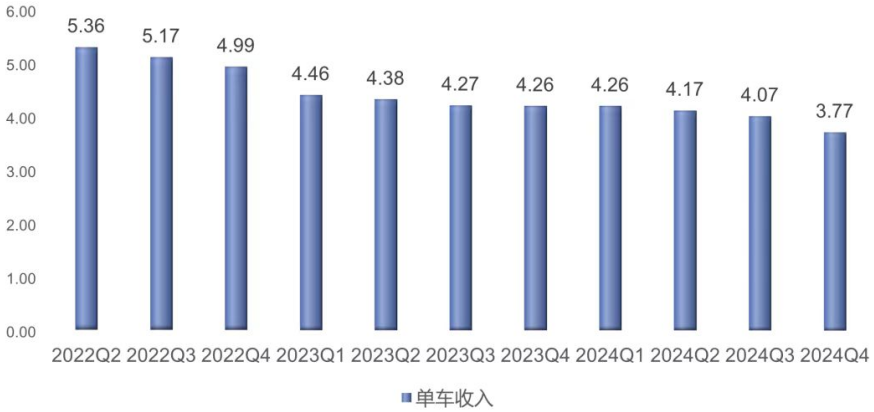

In addition, due to factors such as inventory clearance, discounts on older Model Y vehicles, and an increase in the proportion of sales of lower-priced models, Tesla's automotive gross margin hit a new historic low. Data shows that in the fourth quarter of 2024, Tesla's automotive sales gross margin was 16.6%, down 3.5 percentage points from the previous quarter, and the automotive business gross margin after deducting regulatory credits was only 13.6%. Affected by the sharp decline in automotive business gross margin, Tesla's fourth-quarter consolidated gross margin was only 16.3%, significantly lower than Bloomberg's expectation of 18.9%.

The poor performance in the fourth quarter directly affected Tesla's full-year performance. Data shows that for the full year of 2024, Tesla generated revenue of $97.69 billion, a year-on-year increase of 1%, a significant decline from the same period last year (19%), with an operating profit of $7.076 billion, a year-on-year decrease of 20%, and Non-GAAP net profit of $8.419 billion, a year-on-year decrease of 23%.

In terms of business segments, Tesla's revenue from vehicles was $77.07 billion, a year-on-year decrease of 6%; revenue from energy storage was $10.086 billion, a year-on-year increase of 67%; and revenue from services was $10.534 billion, a year-on-year increase of 27%. It is not difficult to see that Tesla's energy storage and service segments still maintained relatively fast growth in full-year revenue, but the decline in sales revenue from the core automotive business ultimately led to its full-year 2024 performance falling short of market expectations.

As usual, Musk himself downplayed the electric vehicle business, which accounts for nearly 80% of revenue, during the Q4 2024 earnings call, with his remarks focusing mainly on autonomous driving, artificial intelligence, and robotics. In Musk's view, only autonomous vehicles and humanoid robots are the correct path for Tesla to become the "most valuable company in the world," possibly even several times the combined value of the current top five companies.

Interestingly, despite Tesla's fourth-quarter performance falling almost entirely below analysts' expectations, the company's share price still recorded a 1.08% increase on the day after the earnings release (January 31), with intraday gains exceeding 4% at one point. In this regard, Dan Levy, a senior analyst at Barclays, believes that Tesla is gradually becoming "bitcoinized," stating, "When Tesla provides you with superior narrative capabilities, who cares about valuation?"

However, after entering February 2025, Tesla's share price turned downward, with cumulative declines exceeding 50%. Clearly, when new car sales experience a year-on-year decline not seen in a decade, no amount of "pie in the sky" talk about AI and humanoid robots can sustain its lofty share price.

2

First Decline in Car Sales in a Decade

As the world's most popular electric vehicle brand, Tesla's competitiveness and influence in the global market were once unmatched. However, with the strong rise of Chinese new energy vehicle brands such as BYD and the accelerated electrification transformation of established automakers such as Volkswagen, Tesla is facing increasing external competitive pressure, and its first-mover advantage is being severely challenged.

However, faced with strong competitors and the continuous launch of competing models, Tesla has been unusually slow in product iteration. In fact, since the launch of the Model Y in 2020, Tesla has not introduced a new mainstream model until the launch of the revised Model Y in January 2025.

Due to aging models and higher average selling prices, Tesla's new car sales have shown signs of decline since 2023. For the full year of 2023, Tesla delivered 1.8086 million vehicles globally, barely meeting its annual target of 1.8 million vehicles. In 2024, Tesla encountered a series of issues, including an arson attack at its Berlin factory, shipping rerouting, and large-scale layoffs globally. In Q1-Q2 2024, Tesla delivered 386,000 and 444,000 new vehicles, respectively, down 8.53% and 4.8% year-on-year.

After encountering its worst half-year financial report ever, Tesla began a series of promotional activities in the second half of 2024 to stimulate new car sales. In the U.S. market, Tesla offered a three-month free Supercharger and FSD (Full Self-Driving Capability) incentive for consumers who took delivery of their vehicles by the end of 2024.

In the Chinese market, Tesla offered an immediate discount of RMB 10,000 and a 5-year interest-free policy for the Model Y. In the European market, Tesla offered incentives such as free access to Supercharger services for one year for buyers of the Model Y.

However, the launch of these price reductions and preferential benefits did not fundamentally reverse the declining trend in Tesla's new car sales. In the U.S. domestic market, Tesla encountered strong competition from emerging electric vehicle brands such as Rivian and Lucid, with sales declining 5.1% year-on-year for the full year of 2024, including a 12% decline in California sales. In the European market, Tesla also faced strong competition from local brands such as Volkswagen, with sales declining more than 10% year-on-year in 2024, including a decline of more than 40% in the German market.

Compared to the sluggish European and American markets, Tesla's sales in the Chinese market still maintained positive growth. For the full year of 2024, Tesla's sales in the Chinese market reached 657,000 vehicles, a year-on-year increase of 8.8%, with the Chinese market accounting for up to 37% of Tesla's global sales, exceeding the 35% of the U.S. domestic market. Additionally, in terms of production, Tesla's Shanghai Gigafactory delivered more than 916,000 vehicles in 2024, accounting for half of Tesla's global deliveries. Obviously, without the counter-trend growth in the Chinese market, Tesla's sales pressure in 2024 would have been even more severe.

However, it should be noted that while Tesla's sales in the Chinese market achieved year-on-year positive growth, the growth rate lagged far behind the industry average. Data shows that for the full year of 2024, sales of new energy vehicles in China reached 12.866 million, a year-on-year increase of 35.5%, with sales of pure electric vehicles increasing by 22.6% year-on-year. As Tesla's sales growth rate lags significantly behind the increase in the domestic pure electric retail market during the same period, Tesla's market share of pure electric vehicle models in China has dropped to 5.4%, down 2.4 percentage points from 2023. In 2021, this proportion was as high as 16.6%.

It is not difficult to see that from the perspective of the three major automotive markets in the U.S., Europe, and China, Tesla's new car sales are not optimistic. In addition, due to the continuous promotion of promotional activities, Tesla's revenue per vehicle has continued to decline. In the fourth quarter of 2024, Tesla's revenue per vehicle fell to $37,700, a significant drop of $3,000 from the third quarter, which is also a major reason why the company's new car gross margin fell short of expectations.

3

Where is the Next Growth Engine?

Faced with the continued weakness in new car sales, Tesla stated during the earnings call that it will launch a more price-competitive model in 2025, which will use parts from existing platforms and some technology from the next-generation platform, with an expected starting price of around $30,000. This should be the long-rumored Model Q (Model 2).

In fact, as early as 2022, Tesla claimed it would launch a model positioned lower than the Model 3/Y, with a price of approximately RMB 150,000 in the Chinese market. However, the launch and delivery timing of this rumored new model has been repeatedly "delayed." Now, with competitors such as Aion RT and Xpeng MONA M03 pushing the price of A-segment pure electric sedans down to the RMB 100,000 level, Model Q may struggle to become a phenomenon-level product like the Model 3 or Model Y.

Some analysts believe that even Musk himself seems to lack confidence in Tesla's new car sales in 2025. During the Q3 2024 earnings call, Musk indicated that Tesla's sales guidance for 2025 would increase by 20%-30% year-on-year. However, during this earnings call, Musk only mentioned that Tesla's sales would return to positive growth in 2025.

Amidst significant uncertainty regarding new car sales, Musk focused on the promising prospects of his autonomous driving (FSD), Robotaxi, and Optimus (humanoid robot) businesses during the earnings call. In terms of humanoid robots, Tesla expects to produce 10,000 robots in 2025 and begin deliveries in the second half of next year, primarily for tasks in Tesla factories. It is expected that starting in the second half of 2026, the company will begin delivering Optimus to companies outside of Tesla.

In Musk's view, humanoid robots have 1,000 times more use cases than cars. It is expected that by 2028-2030, Optimus could generate over $1 trillion in annual revenue for Tesla, more than 10 times Tesla's total revenue in 2024. However, before Optimus can truly be mass-produced and implemented, Musk's trillion-dollar revenue outlook still needs further observation.

In terms of autonomous driving, Musk confirmed that Tesla will launch a paid ride-hailing service without drivers in Austin, Texas, this June, and is also actively promoting its Smart Summon system (driver-supervised version) into the European and Chinese markets. Additionally, Musk boldly predicts that Tesla's Robotaxi Fleet will expand to multiple cities in the U.S. by the end of 2025.

However, judging from the current subscription situation of FSD, Tesla's autonomous driving service revenue scale should not be too optimistic. As of now, there are approximately 1.8 million Tesla vehicles in North America, with 850,000 active FSD users and only 550,000 paid users. In the Chinese market, the FSD option rate for Tesla is even less than 2%. With the launch of BYD's full-standard and free intelligent driving policy, the future prospects of Tesla's FSD in the Chinese market will only be more embarrassing.

Compared to conceptual topics such as robots and self-driving cars, Tesla's energy storage business has seen significantly better implementation. For the full year of 2024, Tesla's energy storage business revenue exceeded the $10 billion mark for the first time, a year-on-year increase of 67%, which is significantly higher than the company's overall revenue growth rate. Additionally, in terms of gross margin, Tesla's energy storage business gross margin reached 26.2% in 2024, an increase of 7.3 percentage points from the same period last year, making the energy storage business an important force driving Tesla's revenue and profit growth.

Array

Array

Array