Li Xiang's Milestone Punch Reshapes the Face of New Energy Automakers

![]() 03/21 2025

03/21 2025

![]() 627

627

Introduction

Introduction

What do 8 million kilometers of test mileage signify?

"The automotive industry is fiercely competitive, yet it must serve the industry and benefit users! Li i8's cumulative test mileage has surpassed 8 million kilometers and continues to grow. We aspire for Li i8 to become the champion of test mileage."

Recently, Li Xiang, CEO of Li Auto, tweeted this while promoting Li i8, the company's inaugural pure electric SUV. Most comments beneath this tweet came from onlookers, raising numerous questions. However, if indeed 8 million kilometers of testing have been accomplished, it will positively impact everyone in the automotive supply chain.

Particularly for automakers and consumers' perspectives on "car manufacturing." Many consumers perceive new energy automakers as belonging to the realm of internet and technology, and their new energy products are driven by the mindset of electronic consumer goods, making it challenging to compare them with the mechanical attributes valued by traditional automakers, such as chassis, handling, and hardware.

Li Xiang's statement this time appears to convey two messages. Firstly, new energy automakers may have "hit a ceiling" and can only compete in test mileage. Secondly, they are shifting from software investment to hardware capability investment. However, this also reflects the numerous deficiencies still present in the current products of new energy automakers.

01 The Struggle of New Energy Products

Li Auto aims for Li i8 to become the "king" of test mileage, a measure that implies a relentless pursuit of product quality and reliability. A substantial test mileage means the vehicle can be thoroughly verified in various complex road conditions and extreme environments, enabling potential issues to be discovered and resolved promptly, thereby enhancing product quality and safety, and allowing users to drive with confidence.

Historically, some new energy automakers have relied heavily on conceptual marketing, attracting consumers' attention through flashy features and promotions. In stark contrast, automakers like Huawei and Xpeng are now investing heavily in the chassis development of new energy products.

This also suggests that new energy automakers' conceptual marketing may have peaked and is now transitioning to the genuine "car manufacturing skills" previously honed by traditional automakers. For the entire new energy vehicle industry, this transformation is positive and necessary. Whether it's a gasoline or electric vehicle, it is essentially an industrial product and must possess exceptional mechanical qualities.

With the vigorous growth of new energy vehicles, an issue that cannot be overlooked is gradually emerging. Especially for new energy automakers, they have a profound understanding: poor chassis performance, which has become a common problem for many new energy vehicle products.

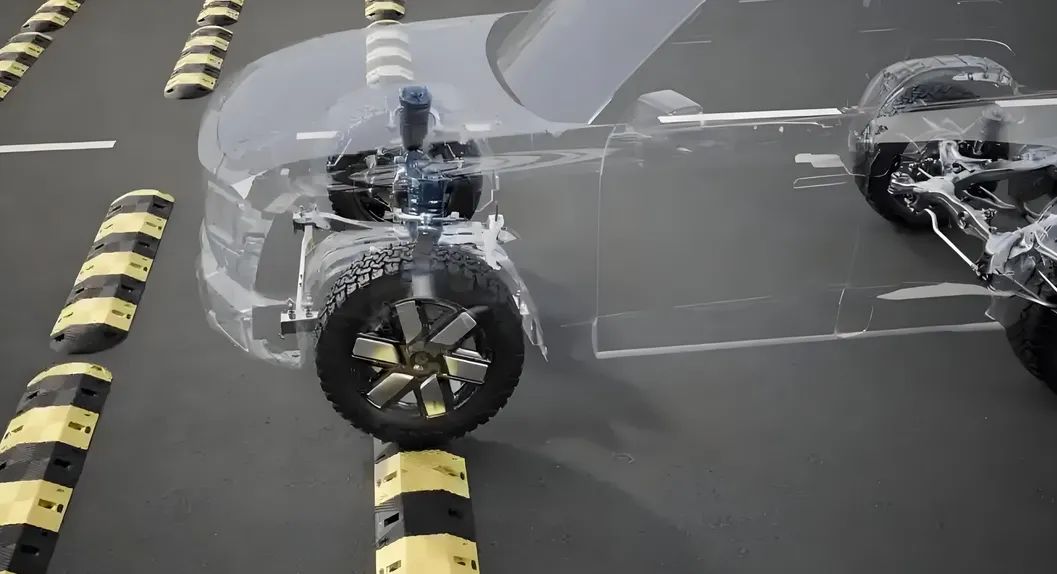

As battery technology continues to innovate, battery weight increases, making new energy vehicle models generally heavier. Concurrently, many new energy automakers lack the ability to tune chassis and suspension. These two factors intertwine, leading to severe shortcomings exposed during the driving of many new energy vehicles.

When the vehicle traverses sloped roads, the body experiences significant up-and-down shaking, and this uncomfortable "flying slope" effect has been confirmed in numerous media tests, with unacceptable results.

This issue of inadequate chassis performance has seriously affected consumers' driving experience. Imagine driving a new energy vehicle and experiencing severe body shaking while traversing a ramp. This not only makes the driver feel anxious but also casts doubt on the vehicle's handling and stability. In the long run, this will undoubtedly erode consumers' trust and willingness to purchase new energy vehicles.

To compensate for this shortcoming, some high-end new energy products have begun to rely on "technology and hard work." For instance, technologies like CDC continuous damping control systems and air suspensions are employed to attempt to forcibly stabilize the body posture. Although the application of these advanced technologies has alleviated the problem of poor chassis performance to a certain extent, it also highlights the lack of basic chassis tuning ability among new energy automakers.

Fortunately, some automakers have recognized the gravity of the issue and are actively taking action. He Xiaopeng, CEO of Xpeng Motors, stated that Xpeng spent over 200 million yuan to meticulously redesign the chassis of the 2025 G6 and enhance the experience through a series of refined tunings. Coincidentally, many other companies have undertaken similar chassis upgrades.

As one of a car's core components, chassis performance is directly related to the vehicle's handling, comfort, and safety. It is evident from these companies' initiatives that new energy automakers still have significant room for improvement in their products' mechanical qualities. As the industry collectively addresses chassis technology, the real competition has just begun.

And this breakthrough, starting with mileage testing and chassis technology, reflects the structural contradictions within the new energy vehicle industry. When intelligence becomes the overt battlefield, the covert war of mechanical qualities is even more fierce. What new energy automakers need to address is not just the chassis tuning course but also the complete closed loop of the entire vehicle engineering system.

02 Everyone is "Truly" Making Cars

Chassis and handling performance have always been the relentless pursuit of Chinese automotive brands. In the evolution of the automotive industry, these two indicators serve as crucial yardsticks for measuring automotive quality, not only becoming the benchmark for an automaker's excellence but also profoundly influencing consumers' driving experience and brand recognition.

However, the current state of the automotive market is not optimistic. Many products launched by new energy automakers fall short in chassis performance. During driving, the chassis feels loose, the suspension tuning lacks resilience, and the body rolls significantly when cornering, giving the driver a lack of confidence.

Surprisingly, many new energy products from traditional automakers may not necessarily provide satisfactory answers in terms of chassis and handling. In the era of fuel vehicles, while these traditional automakers accumulated certain car manufacturing experience, they did not truly master the core areas of chassis and handling technology.

For a long time, they relied to some extent on foreign technology for reference to improve their products' performance. However, when the automotive industry abruptly transitioned to the electric vehicle era, the landscape changed dramatically. In the realm of new energy vehicles, China has emerged as a leader, foreign brands no longer hold absolute technological advantages, and domestic automakers have lost ready-made technologies to refer to.

This means that traditional automakers can only rely on their own strength to explore chassis and handling tuning from scratch in the new energy sector. This is a challenging path requiring substantial investments in research and development funds, manpower, and time. Yet, it is also the only way for Chinese automotive brands to achieve overtaking and enhance their core competitiveness.

Therefore, we should no longer dismiss those traditional automakers investing in the new energy field. Taking Lantu Auto as an example, since its inception, it has firmly emphasized its hardware qualities. Amidst the endless stream of new concepts in the new energy vehicle market, Lantu Auto has not followed the trend of excessive packaging and marketing gimmicks but has focused on vehicle hardware research and development.

However, along the way, Lantu Auto has also faced criticism. But when we see automakers like Li Auto and Xpeng, once renowned for their novel thinking and approaches, now also investing heavily in hardware technologies such as chassis development for new energy products, we can appreciate the soundness of Lantu Auto's approach.

Of course, if automakers like Li Auto, Huawei, and Xpeng can successfully take the lead and inspire other new energy automakers to follow suit, it will present a magnificent picture of industrial transformation: test data supplants parameter stacking, engineering verification overshadows conceptual packaging, and user trust transcends marketing jargon.

If test mileage, chassis technology, etc., become the new battlegrounds for new energy competition, industrial competition has already formed a "positive cycle." By then, the new energy vehicle industry will undergo a fundamental transformation from marketing-driven to technology-driven, a profound industrial revolution that reshapes the entire industry's ecosystem.

It not only redefines users' cognitive standards for vehicle reliability, making them more confident in products that have undergone rigorous testing and verification, but it will also compel the entire industrial chain to accumulate technology. From component suppliers to vehicle manufacturers, greater emphasis will be placed on technology research and development and quality control, fostering a benignly interactive industrial ecology.

When industrial competition reverts to the essence of car manufacturing, and when users pay for real value rather than marketing gimmicks, China's new energy vehicles can truly achieve a leap from big to strong.

Managing Editor: Shi Jie, Editor: He Zengrong