Xiaomi Auto Nears Profitability Despite Initial Losses, Delivering Robust Financial Results

![]() 03/21 2025

03/21 2025

![]() 682

682

With a well-established supply chain, Xiaomi Auto continues to break records in the automotive industry.

After Xiaomi Group released its annual financial report on March 18, the phrase "Xiaomi Auto loses an average of RMB 45,000 per vehicle" trended on Weibo.

Since Xiaomi Auto's launch, many have believed that Lei Jun is selling cars at a loss. The starting price of RMB 215,900 led to speculations that Xiaomi Auto's pricing strategy is aimed at gaining market share. This notion was further reinforced by the launch of the Xiaomi SU7 Ultra at the end of February, priced at RMB 529,900, RMB 300,000 lower than its pre-sale price.

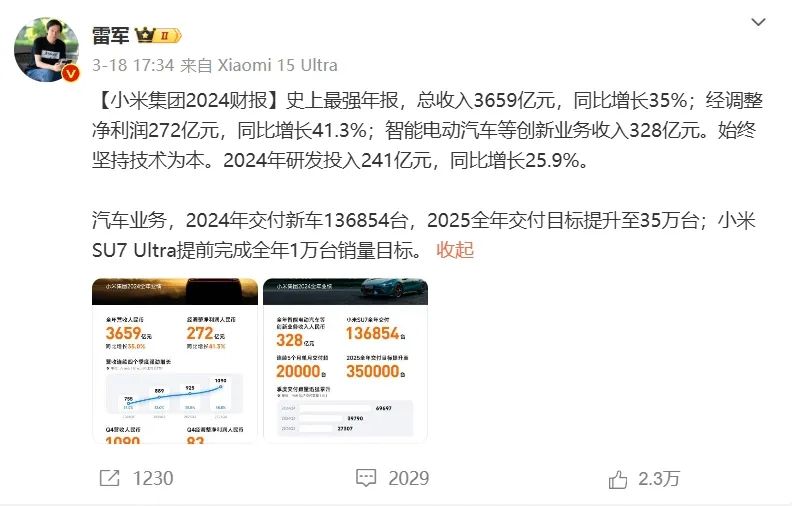

Contrary to online speculation, Lei Jun, facing Xiaomi Group's financial report, deemed it the company's strongest financial performance to date.

How strong? Let's consider a few key figures: annual revenue of RMB 365.9 billion, a 35% year-on-year increase, and a net profit of RMB 27.2 billion, a 41.3% year-on-year increase.

Although Xiaomi is still some way from its goal of earning RMB 100 million per day, the 40% growth rate propelled Xiaomi's share price to a new high. On March 19, Xiaomi Group's share price hit an all-time high of HKD 59.45.

This raises the question: Is Xiaomi Auto actually making money?

Losses Are About to End

According to the financial report, Xiaomi Group classifies its automotive business as an innovative venture, alongside smart electric vehicles, with annual revenue of RMB 32.8 billion and cumulative losses of RMB 6.2 billion.

It's clear that Xiaomi's automotive business is still incurring losses. However, Xiaomi Auto is nearing profitability.

From the concurrent fourth-quarter financial report, Xiaomi's quarterly loss in the automotive business dropped to RMB 700 million, accounting for only about 10% of the annual loss.

More impressively, Xiaomi Auto's gross margin in the fourth quarter grew to 20.4%, significantly higher than the full-year gross margin of 18.5% and the second-quarter gross margin of 15.4%.

For comparison, Li Auto's recent financial report shows a gross margin of 20.3%, but its average selling price (ASP) for the year is RMB 288,700 per vehicle, much higher than Xiaomi Auto's ASP of RMB 234,400 per vehicle. NIO, another profitable new energy vehicle maker, has a gross margin of only 8.4%. Xiaomi Auto's profit margin has already reached industry profitability levels, surpassing even Li Auto, a decade-old competitor.

Quarterly financial reports reveal that Xiaomi Auto's losses in its automotive business were RMB 2.2 billion, RMB 1.8 billion, RMB 1.5 billion, and RMB 700 million, respectively, showcasing a clear downward trend.

Revenue, on the other hand, has surged, with the fourth quarter contributing RMB 17.4 billion, accounting for over half of the annual revenue. Xiaomi Auto earned the equivalent of the previous six months' revenue in just three months of the fourth quarter, backed by a steady increase in deliveries.

Unlike other brands, Xiaomi Auto's monthly delivery data has always been vague, with sales figures ranging from 10,000+ to 20,000+. Xiaomi only releases specific data at the end of the year, announcing cumulative deliveries of 136,854 vehicles in 2024.

Sales in the fourth quarter also saw a significant increase, with monthly deliveries exceeding 20,000 vehicles and total quarterly deliveries nearing 70,000, accounting for half of the annual sales volume.

In November last year, Xiaomi Auto rolled out its 100,000th vehicle, setting a new record for the fastest delivery of domestic new energy vehicles in just 230 days. On March 18, the day Xiaomi released its financial report, Xiaomi Auto delivered its 200,000th vehicle in only 119 days, marking a substantial increase in production capacity.

This indicates that Xiaomi SU7 has moved beyond the initial investment stage and entered a growth period where sales share costs. As sales increase, there is still room for Xiaomi SU7's gross margin to rise.

The entire first factory is currently highly profitable, with each Xiaomi Auto produced generating earnings.

According to its financial report, it is plausible that Xiaomi Auto will turn a profit and achieve earnings in the first quarter of fiscal year 2025.

With the financial report's release, Xiaomi Auto's annual sales target has also been increased from 300,000 to 350,000 vehicles. On average, Xiaomi needs to deliver over 30,000 vehicles per month from March to achieve this target.

With Xiaomi YU7 not yet on the market and relying solely on the SU7 model, achieving monthly deliveries of 30,000 vehicles is currently not an issue for Xiaomi. According to third-party statistics, Xiaomi Auto currently has 19,000 new weekly orders, with a delivery cycle of over 30 weeks. This means Xiaomi has at least 200,000 orders on hand, sufficient to support the launch of YU7 in the second half of the year.

The Secret to Rapid Profitability

For new energy vehicle makers, achieving profitability through new energy vehicles is challenging. Currently, only Li Auto and NIO have achieved profitability, with NIO only achieving quarterly profitability. Whether it can smoothly transition to annual profitability in 2025 remains to be seen.

In contrast, other brands, whether established new energy vehicle makers like NIO and Xpeng with over a decade of experience or brands backed by large enterprises like Zeekr, SL03, and Voyah, are still struggling to achieve profitability.

The primary factor behind this is sales volume. Without the support of economies of scale, the better the product, the more difficult it is to achieve profitability. The greater the initial investment, the more sales are needed to spread out costs. Especially amidst price wars, profit margins are limited, and only more sales can mitigate costs.

Li Auto's financial report highlights the impact of price wars on vehicle profitability. In 2024, Li Auto's revenue was RMB 144.5 billion, a 16.6% year-on-year increase, while its net profit was RMB 8.032 billion, a 31.9% year-on-year decrease. The profit per vehicle halved from RMB 31,200 to RMB 16,000.

This demonstrates the profound impact of price wars. In 2024, Li Auto reduced the prices of its entire lineup by RMB 30,000, significantly impacting profitability. The successful launch and sales of L6 rescued Li Auto.

Economies of scale also mitigated the losses caused by price reductions. Li Auto's models have high parts commonality, and with only one new model, L6, R&D investment expenses remained almost the same as the previous year, around RMB 10 billion.

This can be seen as a disguised volume-for-price strategy, where the magnitude of price reductions outweighed the impact of the resulting sales growth. Despite delivering 500,000 new vehicles in 2024, Li Auto still failed to maintain profitability.

Besides economies of scale, another significant advantage of Xiaomi Auto is its production cycle. While production capacity restricts Xiaomi's sales growth, it also balances Xiaomi's funds.

With the robust sales of SU7, rapidly investing to increase production capacity is crucial. However, the key is to strike a balance between investment and benefits. Expanding capacity by 200,000 or more vehicles at once is not a problem for Xiaomi Auto.

Xiaomi Auto's second-phase factory has recently been reported to have doubled in size compared to the previous phase. As a key project in Beijing, the Xiaomi Auto factory has progressed rapidly from land acquisition to construction.

However, Xiaomi needs to manage the scale of production capacity, as blind investment will only lead to more losses in the short term.

Xiaomi SU7's current delivery cycle is over 30 weeks, with the slowest standard version nearing 40 weeks. This is favorable for Xiaomi's capital turnover, as relying solely on deposits can maintain the turnover of production funds.

This may be one of the reasons why Xiaomi Auto's prices are higher and delivery cycles shorter. The deposit for SU7 Ultra is RMB 20,000, with a delivery cycle of around 15 weeks.

Of course, the most crucial factor is that Xiaomi Group's supply chain management is unparalleled by other new energy vehicle makers. Since its inception in making smartphones, Xiaomi has been able to obtain more favorable prices than its competitors and has maintained this advantage to this day. Lei Jun announced in 2018 that Xiaomi's hardware business's comprehensive after-tax net profit rate would not exceed 5%.

Such a commitment can only be achieved through strict control of the supply chain. Many new energy vehicle brands struggle to achieve profitability due to supply chain issues, as evidenced by internal rectifications at Xpeng Auto and internal audits at NIO, highlighting the importance of a transparent internal supply chain system.

Additionally, Xiaomi has another advantage that other automakers lack: the sharing of software development costs. As Xiaomi evolved from digital electronics, it has a strong foundation in software development. The intelligent cockpit of Xiaomi's vehicles is highly compatible with its mobile phone systems, reducing R&D costs.

Moreover, R&D expenses can be shared with other products. For instance, in terms of AI investment, Xiaomi invested approximately RMB 7-8 billion in 2024. With the sharing of costs between its mobile phone and AIoT businesses, the proportion allocated to its automotive business is significantly reduced.

It can be said that Xiaomi Auto's success relies on its robust industrial chain advantage. With a mature new energy vehicle supply chain system, Xiaomi can obtain competitive prices from multiple supply chain enterprises, making it more competitive compared to early auto manufacturing brands.

Furthermore, Xiaomi has never pursued full in-house research and development. Integrating supply chain advantages has always been Xiaomi's strength.

Of course, the most significant factor is Xiaomi Auto's success in sales volume. No other brand could replicate Xiaomi Auto's success. A waiting period of over 30 weeks would be detrimental for other automakers but is just right for Xiaomi Auto.

With these advantages, Xiaomi has a strong chance of surpassing other new energy vehicle makers and becoming the third domestically profitable new energy vehicle brand. It can be said that Lei Jun, who has staked his reputation on this final venture into auto manufacturing, has indeed won the bet.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.