MiniMax: Navigating Without a Plan B

![]() 04/11 2025

04/11 2025

![]() 628

628

Written by | Hao Xin

Edited by | Wu Xianzhi

DeepSeek looms over the AI Six Little Tigers like an inescapable specter, casting a shadow of inevitable fate.

Defense and staying afloat have become paramount, and players have made their choices after carefully weighing their options.

Kimi voluntarily retreated from the investment fray, ceding the stage to larger companies and focusing on foundational technology research. Stepwise Stars relentlessly pursues the release of multimodal large models and strengthens its industrial collaborations. Baichuan resorted to drastic measures to survive, abandoning finance to preserve healthcare and halting the training of general large models. Zhipu, while reinforcing its Agent label, has also marched in formation and clung to the G-end, becoming a hot commodity sought after by both north and south.

Among them, MiniMax stands out as particularly unique, not engaging in the same race as the others from the outset. In terms of general large models, MiniMax adheres to the concept of "integration of production and model," meaning all base models must serve products. In the To C race, Kimi's main battlefield is domestic, whereas MiniMax's strategic focus is on overseas markets. While other players grappled with user retention, growth, and commercialization, media reported that MiniMax had already earned an annual revenue of $70 million through its overseas star product "Talkie".

"Better models can lead to better applications, but better applications and more users do not necessarily lead to better models."

Although Yan Junjie's reflection on technology investment preceded the rise of DeepSeek, MiniMax still faces numerous uncertainties: the overseas market environment is fraught with variables, and domestic competition with large companies is fierce; the B-end business lacks early development, and catching up will not happen overnight.

Since the beginning of this year, except for Zhipu, the funding progress of the AI Little Tigers seems to have stalled. Can the shift from models, products to commercialization help MiniMax stand out?

From Integration to Separation of Production and Model

MiniMax's model is fundamentally an alternative existence.

According to the official introduction, the MiniMax-01 series model breaks the limitations of the traditional Transformer architecture and realizes the linear attention mechanism on a large scale for the first time. To illustrate, the traditional Transformer is akin to a "clumsy method," similar to reading word by word and then taking notes. Linear attention, on the other hand, is a "smart method," akin to first discussing within a group and then summarizing to form a final conclusion.

In essence, MiniMax's "underlying innovation" lies in modifying the foundational architecture of large models. The bus has been transformed into a light rail, significantly improving efficiency and reducing costs.

For a long time, MiniMax heavily promoted the concept of "integration of production and model," emphasizing that models should serve applications. Specifically, each MiniMax model corresponds to an AI application product, such as the text model corresponding to MiniMax Assistant, the video model corresponding to Conch AI, and Xingye and Talkie being more like a culmination of technology.

The technology-to-product implementation logic made MiniMax's multimodal route apparent in the early stages. Some professionals believe that MiniMax has surpassed other players in finding scenarios, with single-point technologies such as text-to-image, text-to-video, and speech all playing a crucial role in C-end applications, naturally leading to good commercial returns.

"Although MiniMax's total revenue cannot compete with Zhipu, which focuses on the To B direction, it wins in quality, and positive feedback from users will bring stable growth," said the aforementioned professional.

According to Yan Junjie, the change occurred in March or April of last year. At that time, he re-examined the relationship between users and technology and concluded that "the improvement of intelligence does not rely so much on many users".

Yan Junjie said in a conversation with LatePost: "We are very clear that we are a technology-driven company. It's not just a slogan; essentially, it's about who decides when there is a conflict," implying that technology overrides everything.

Based on this, the idea of integration of production and model was abandoned. Technology and products need to be separated; technology needs to continuously improve its upper limits, while products need to consider how to better meet user needs.

To some extent, Yan Junjie rejects the current AI application logic of investing in marketing to exchange for growth. According to Photon Planet's understanding, MiniMax has also focused on promoting Talkie and Conch AI overseas. According to DataEye data, from November to December last year, Xingye once topped the daily list of AI App buy-side material rankings, with the amount of material increasing several times compared to previous periods.

After DeepSeek, MiniMax released and open-sourced the MiniMax-01 series model, which includes two models: the basic language large model MiniMax-Text-01 and the visual multimodal large model MiniMax-VL-01. Additionally, it is betting on long context and Agent in terms of technical direction.

Conch AI: A New Hope

In terms of products, MiniMax has taken two actions. The first is to implement a focus strategy and unify the brand image for external output. The most well-known "Conch" was reserved for the video generation business, and the original AI assistant "Conch AI" was renamed MiniMax.

Another new trend is also related to AI video. It is rumored that MiniMax will acquire Luying Technology, a Shenzhen-based AI video generation startup, and both parties have already finalized the acquisition intention. It is reported that the core product of this startup is YoYo, an AI video generation platform for anime. MiniMax's acquisition may be to further expand its user base, extending from film and television creators and AI creators to the anime community.

Various signs indicate that following Xingye and Talkie, Conch AI video products have become a new trump card for MiniMax.

The reason may be related to the removal at the end of last year. According to Diandian data, on December 14, 2024, Talkie was removed from the App Store in the US market, and on November 30, Talkie had already been removed from the App Store in the Japanese market.

As of press time, when we searched for "Talkie" in the US App Store, we only found "Talkie Lab" and did not find the actual application. However, according to App Annie, a statistical tool for the App Store, the Talkie app is still generating new downloads and payments.

Currently, MiniMax's main revenue comes from advertising and subscription fees for Talkie and Xingye, its two main products. App Annie data shows that from April 1, 2023, to the end of March 2025, Talkie's total App Store revenue was $3.218 million (approximately RMB 23.519 million); from September 2023 to the end of March 2025, Xingye's (only available in China) total revenue was $244,000 (approximately RMB 178,000).

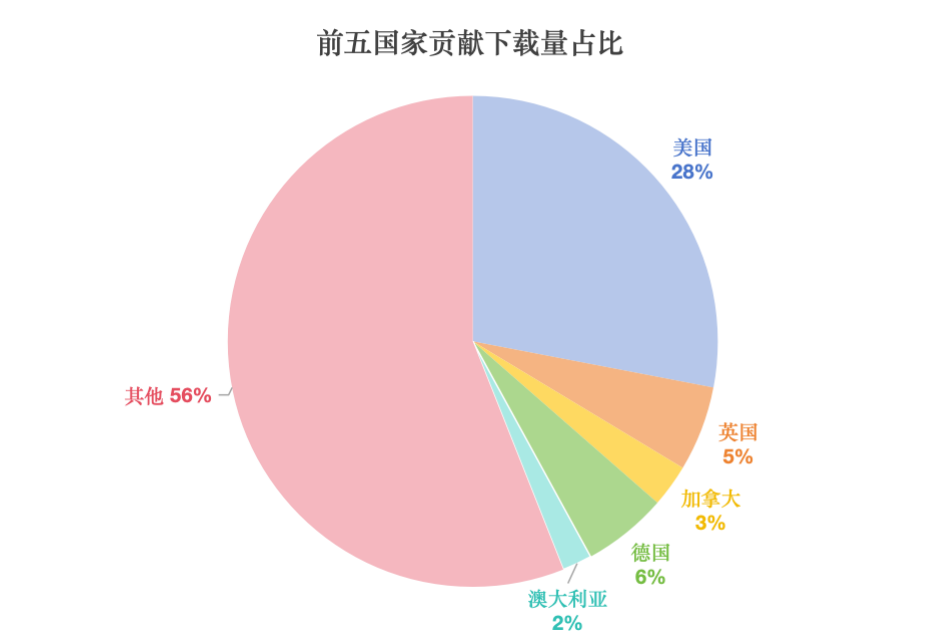

Coupled with advertising revenue, Talkie's importance to MiniMax is self-evident. By compiling data, Photon Planet found that the top five countries for Talkie downloads on the App Store are the United States (28%), Germany (6%), the United Kingdom (5%), Canada (3%), and Australia (2%).

Photon Planet chart, data source: App Annie

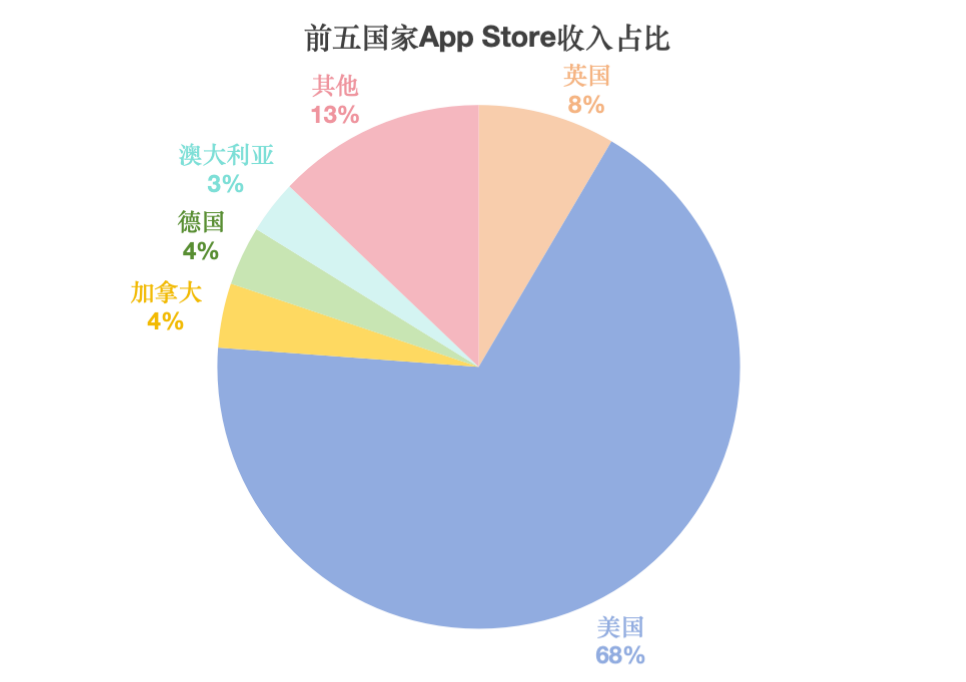

Generally, we believe that countries with a larger proportion of download contributions should naturally generate a similar proportion of revenue. Explaining it with the above chart means that the other regions, which account for 56%, should generate a similar proportion of revenue. But the fact is the opposite; the United States, which only generates 28% of app downloads, ends up contributing 68% of the revenue. The data shows that the more developed countries and regions have a stronger willingness to pay. This explains why MiniMax attaches such importance to the US market and frantically invested in marketing after being removed.

Photon Planet chart, data source: App Annie

AI companionship products and Chinese companies going overseas have been labeled, exacerbating the risk level of Talkie. It is either forced off the shelves by public opinion or becomes a victim of the game between China and the United States.

To prevent potential risks, MiniMax is betting on Conch AI video, which is less risky and tied to productivity.

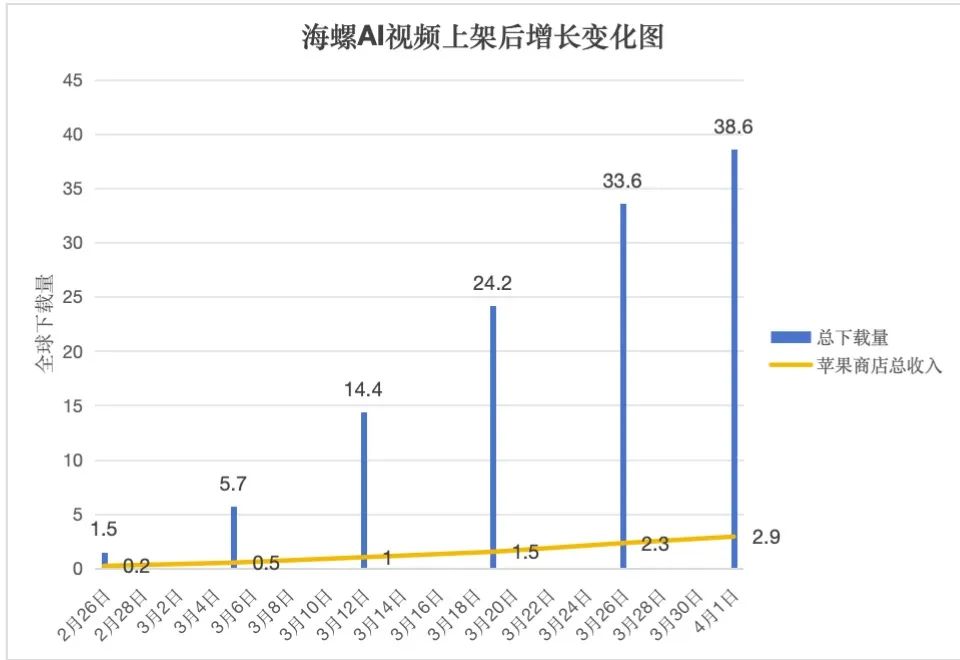

Currently, the market feedback for Conch AI video is positive, and its growth momentum is rapid. App Annie shows that Conch AI was gradually listed on the global App Store on February 19 of this year. As of April 1, just 42 days later, its total global downloads reached 386,000, and its total App Store revenue was $29,000, showing considerable potential.

Photon Planet chart, data source: App Annie

Tackling the Tough Bone of To B?

So far, MiniMax has formed a product matrix of Talkie, Xingye, and Conch AI, and there is still an opportunity to achieve steady growth in revenue from globalization and C-end AI applications. Against this background, the shortcomings of its B-end business have become increasingly apparent.

During this tumultuous period, MiniMax's To B business is undergoing dual tests of people and business.

According to Intelligent Emergence, Wei Wei, co-founder and vice president of MiniMax, has left the company. He was previously responsible for the commercialization of the To B business and held important positions at Tencent Cloud and Baidu Intelligent Cloud.

Relevant sources told us that MiniMax's enterprise business basically operates in a natural traffic mode. They only serve customers who come to inquire and do not actively maintain a large To B sales team, mainly transacting through the sale of APIs.

Another client who contacted MiniMax's enterprise business once pointed out euphemistically in our conversation that MiniMax, which is obsessed with technology, exudes the aura of an engineering man and sometimes seems to lack a bit of "emotional intelligence".

Before DeepSeek, industry clients recognized MiniMax's voice large model capability. Among them, AI toy manufacturer Haivivi BubblePal, Yuwen Qidian audiobooks, and Gaotu Education are its clients, with main application scenarios including AI dialogue, AI teaching, and AI storytelling.

After DeepSeek, MiniMax turned its attention to agents and intelligent hardware, announcing the establishment of the "MiniMax Intelligent Hardware Industrial Innovation Alliance" with multiple intelligent hardware companies in smart homes, wearable devices, and smart cockpits.

It is evident from the above that MiniMax's style in the B-end business tends towards light delivery, with the advantages of a short cycle and low risk, but this indirectly stifles its potential to deeply root itself in the B-end field. Large B-end models have always been a tough nut to crack; each sub-industry is like a complex tree with more difficulties the deeper you dig. Relying on university resources, Zhipu not only engages in information technology application innovation but also provides a full set of solutions, targeting high-value customers, and barely squeezed into the ranks of cloud vendors.

Not only MiniMax, but many AI enterprises are locking in their ecological positions by forming alliances. However, such alliances are precarious, often presenting a relationship of mutual support. Partner companies use and leave, and are happy to endorse multiple times as long as their interests are not violated. Ultimately, the depth of cooperation between the two parties determines the effectiveness of rooting in the industry.

Enterprise B-end business is often not as straightforward as technology, filled with games and trade-offs. MiniMax, which wants to tackle the tough bone of To B, needs a bit of determination and time to settle.