China's New Tech Surge: Toyota Warns of Time Running Out

![]() 05/13 2025

05/13 2025

![]() 759

759

Compiled by Yang Yuke, Edited by Li Guozheng, Produced by Bangning Studio (gbngzs)

Toyota Motor, the world's largest automaker and a symbol of reliability, is currently facing an operational crisis.

Just a year ago, Koji Sato, Toyota's new CEO, was basking in the glory of record profits, sales, revenue, and production in fiscal year 2024.

However, a year later, the fiscal year 2025 results and fiscal year 2026 forecasts announced by Sato on May 8 paint a much dimmer picture compared to last year's highs.

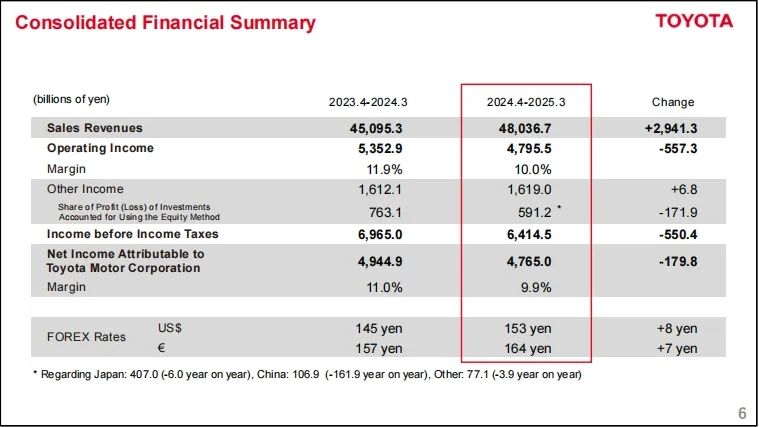

In fiscal year 2025 (April 1, 2024, to March 31, 2025), sales amounted to approximately 9.362 million vehicles, a decrease of about 81,000 vehicles from the previous fiscal year. Sales revenue stood at $314 billion. Operating profit fell from $36.9 billion to $31.3 billion, and net profit decreased from $34.1 billion to $31.1 billion.

More notably, Toyota's outlook for the coming year is bleak. The company expects its operating profit to decline by about one-fifth in fiscal year 2026, ending March 31, 2026. Toyota attributes this to adverse factors such as the strengthening yen and the impact of tariff policies implemented by former U.S. President Donald Trump.

Toyota predicts that tariffs alone, calculated for just two months (April and May), will cost the company $1.3 billion.

Toyota's pessimistic forecast highlights how swiftly the fortunes of this once unshakeable automotive giant have reversed against the backdrop of uncertainties like U.S. tariffs.

On April 1, 2023, Sato succeeded Akio Toyoda as CEO of Toyota Motor. He has generally adopted a wait-and-see attitude towards U.S. tariffs.

Apart from tariffs, the strengthening yen will also negatively impact Toyota's future profits.

For a long time, an extremely weak yen has been a boon for Toyota and other Japanese automakers.

Last year, the yen fell to its lowest level against the U.S. dollar since 1990. This not only helped Japanese exporters make their products cheaper overseas but also increased the value of sales denominated in dollars when repatriated to Japan and converted into yen.

However, since January this year, the yen has strengthened significantly against the U.S. dollar due to trade tensions, concerns about a possible recession in the United States, and expectations of interest rate cuts in the United States.

SBI's Endo Reckons believes that if the yen continues to appreciate against the dollar in the current fiscal year, Toyota's operating profit will decrease by about $3.33 billion.

Led by Tesla, Chinese automakers have disruptively reshaped the automotive industry. Toyota has been slow to respond to the electric vehicle revolution and has made numerous missteps. From recalling the BZ4X to delaying plans to launch a dedicated electric vehicle platform, it shows that Toyota is struggling to keep pace with the rapidly evolving electric vehicle market.

However, is Toyota's sudden downturn the end of an era for the company or just a one-off mishap in its long history in the automotive industry? Can it stage a comeback under the new leadership?

Will the tariff issue persist forever?

Toyota claims that tariffs will cause its profit to decline by 21% in fiscal year 2026 and erase $1.3 billion in profit in just two months.

Moreover, the impact after these two months is "very difficult to predict," Sato said at a briefing on May 8. "The current environment surrounding the automotive industry, including trade relations, is in a state of extreme turmoil."

Toyota's fiscal year 2026 forecast, labeled as "tentative," includes the impact of U.S. tariffs for April and May.

"Negotiations are currently underway, and government officials are working hard, so the details of the tariffs are still changing," Chief Financial Officer Yoichi Miyazaki said at a briefing. "So for now, it's difficult to predict the future," he added.

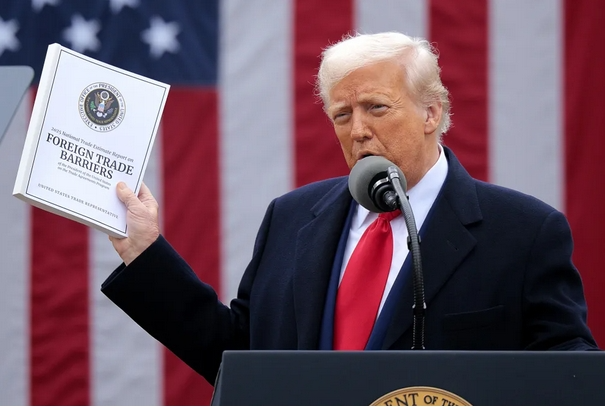

The uncertainty in Toyota's forecast underscores how the impact of Trump's tariffs is upending the automotive industry, making it impossible for many global companies to estimate their future prospects. The United States imposed a 25% tariff on cars imported into the United States from the beginning of last month, which was expanded to auto parts in early May.

Toyota exports 500,000 cars from Japan to the United States each year. Sato said, "In the short term, we are adjusting shipment volumes... In the medium to long term, we will pursue local development of products suitable for local customers." But he added that from the perspective of protecting the supply chain and earning foreign exchange through exports, the company aims to maintain annual production of 3 million vehicles in Japan.

In 2024, Toyota sold 10.8 million vehicles globally, retaining its title as the world's best-selling automaker. An automotive consulting firm said, "Automakers are doing everything they can to try to shift production to the United States, although there won't be huge changes (immediately) because it takes time to shift production." Trump lashed out last month at the huge disparity between Japanese car exports to the United States and U.S. car exports to Japan.

Toyota is the second-largest automaker by sales in the United States, selling more than 2.3 million vehicles there last year, while GM, the leader of the U.S. automotive industry, sold only 587 Chevrolets and 449 Cadillacs in Japan.

Experts say Japan's narrow roads—too narrow for many American models—and the reputation of Japanese cars for quality and fuel efficiency are part of the reason for this situation. "They don't import our cars, but we import millions of theirs!" Trump said in April, accusing Japan of "treating allies very badly on trade."

Analysts are divided on whether Toyota's expectations regarding the risk of U.S. President Trump's tariffs on imported cars and auto parts will materialize.

"Are they just sticking their heads in the sand?" said Christopher Richter, senior analyst at CLSA Asia-Pacific Markets. "They're only assuming tariffs for April and May. I don't think this is a truly conservative forecast. Unless Trump suddenly caves, it doesn't make sense at all."

Richter said that if tariffs continue, it will be difficult for Toyota to meet its new profit expectations. "Currently, the situation in the United States is very optimistic, mainly because consumers are panicked and rushing to the market to buy cars. But what will happen if these tariffs continue? You need to raise prices," he said. "In that case, can you still increase sales? I doubt it."

Koji Endo, senior analyst at SBI Securities Co. in Tokyo, believes that Toyota may have significant pricing power, in part because the company will launch redesigned top models, including the RAV4 crossover and the Lexus ES sedan.

Endo said, "Toyota is confident that it can offset most of the costs of tariff impacts after June. Clearly, they will have to start raising prices."

Miyazaki said that Toyota is rapidly diversifying its revenue sources to hedge risks.

In the current fiscal year, the company expects operating revenue from new car sales to be overshadowed by revenue from parts, accessories, sales financing, used cars, and connected services. This is part of a long-term strategy aimed at leveraging the 150 million vehicles produced by Toyota as a source of recurring revenue.

But like many automakers, Toyota is indeed taking advantage of a large group of customers who want to buy cars before Trump's tariffs truly take effect. The big question is how much of this sales surge is driven by future demand and how much sales may decline afterward.

Lagging Behind in More Than Just Electric Vehicles

China's leading position in the field of electric vehicles is just the beginning. Toyota warns that "we don't have much time left" as China prepares to take the lead in another emerging technology after electric vehicles—hydrogen fuel cell vehicles.

By now, it's no secret that China is leading the transition to electric vehicles. Last year, global electric vehicle sales exceeded 17 million vehicles. According to Rho Motion data, China accounted for 11 million, or over 60%.

Despite major OEMs like Volkswagen, Hyundai, and Kia introducing new electric models, China's growth rate still surpasses that of any other country. In the first three months of 2025, China sold over 2.4 million electric vehicles, accounting for nearly 60% of the global sales of 4.1 million vehicles.

According to SNE Research data, by 2024, CATL and BYD alone accounted for more than 55% of the global electric vehicle battery market. With surging overseas sales in major markets such as Southeast Asia, Europe, and Central and South America, BYD is not only selling more electric vehicles but also more batteries needed for electric vehicles.

Now, Toyota warns that following electric vehicles, China will take the lead in another emerging industry. Misumasa Yamagata, president of Toyota's hydrogen business, warned that hydrogen fuel cell vehicles will face the same fate as electric vehicles.

According to the Financial Times, Yamagata said, "We don't have much time left, and it's important to speed up."

Toyota has been developing hydrogen fuel cell vehicles for over 30 years. However, just like electric vehicles, China is rapidly capturing market share.

China already accounts for the majority of hydrogen fuel cell commercial vehicle sales. Yamagata pointed out, "China is the most advanced country in the world for hydrogen fuel cell trucks. China is determined to turn major logistics routes into hydrogen highways."

China is rapidly expanding hydrogen refueling stations while reducing costs, with the current cost of hydrogen refueling stations in China being only one-third of that in Japan. China has established 540 hydrogen refueling stations across the country. Sales of hydrogen fuel cell buses and trucks in China reached 7,069, higher than the combined total of all other markets.

While electric vehicles are becoming increasingly popular in China and elsewhere, Yamagata said that electric vehicles put severe pressure on the power grid and are not suitable for long-distance transportation of heavy goods. On the other hand, hydrogen provides a compelling alternative—especially in China, where hydrogen is much cheaper.

In China, the price of one kilogram of hydrogen ranges from 500 to 1,000 yen (approximately $3.5 to $7), while in Japan, the price of one kilogram of hydrogen is around 2,000 yen ($14). This price advantage comes from large-scale hydrogen production, especially for the steel industry to decarbonize.

Yamagata believes that Japan and other countries still have a chance to catch up, but it is crucial to act quickly. "We don't have much time left. It's important to act swiftly."

(This article incorporates reports from Automotive News, Reuters, The Jakarta Post, and Electrek, with some images sourced from the internet)