Apple's Triple-Play in Robotics

![]() 05/13 2025

05/13 2025

![]() 754

754

Author | Mao Xinru

Editor | Bai Xue

Apple is pressing the accelerator on its robotics business.

Recently, Apple CEO Tim Cook restructured the company's AI division, separating the robotics team from the AI and machine learning department and transferring it to the hardware division.

Analysts point out that this is a major move by Apple to shift its strategic focus towards deeper integration of hardware and AI and accelerate product commercialization.

At the same time, the team leader has been changed from the original AI chief John Giannandrea to John Ternus, senior vice president of hardware engineering.

Left: Tim Cook, Right: John Ternus

Giannandrea, who was removed from this role, had just lost control of Siri at the end of March this year.

Ternus, who took over the robotics team, has extensive experience in major hardware products such as the iPhone and Mac and has been responsible for the development of home mobile robots and multi-functional robots equipped with the "ELEGNT" framework.

This leadership change is seen by the outside world as Apple aiming to make robots a new growth curve.

Apple wants to proactively seek change amidst strategic passivity

Amidst the current frenzy of AI and robotics, Apple has found itself in a somewhat passive strategic position.

In 2024, Apple introduced the system-level AI assistant "Apple Intelligence" at the WWDC conference, but its launch was delayed for various reasons.

In March this year, Apple announced that the Siri function of its intelligent AI would also be delayed for technical reasons, to be launched within the next year.

Even the Apple executive in charge of Siri joked, "The delay in the release of Apple Intelligence is both ugly and embarrassing."

It has to be acknowledged that in the past few years of rapid development of AI technology, Apple has transitioned from a frontrunner to a follower.

In the field of robotics, Apple's explorations are equally fraught with contradictions.

Currently, Apple has made substantive explorations in three directions in the field of robotics.

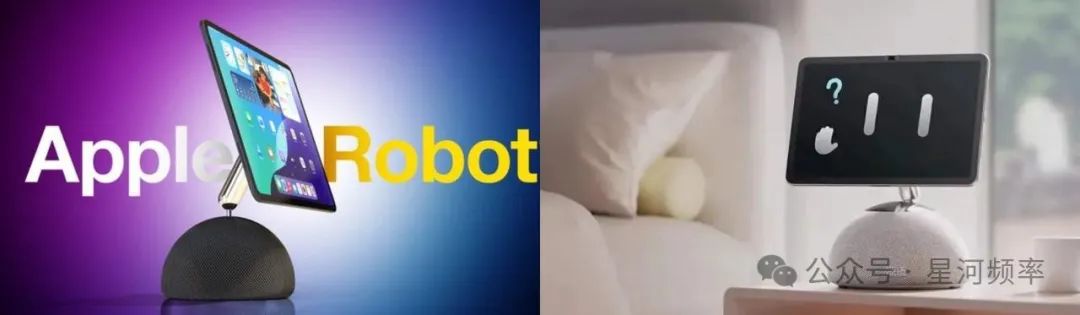

In August 2024, Apple developed a desktop robot, with renderings leaked online.

This robot is equipped with an iPad-like display mounted on a slender robotic arm, allowing the display to tilt up and down and rotate 360 degrees.

This desktop device will serve as a "home command center" for FaceTime video calls and can also be used as a home security monitoring tool.

It is reported that Apple aims to launch this product in 2026-2027 with a price tag of approximately $1,000.

Rather than calling it a robot, it is more of an upgraded smart speaker. Frankly, based on the current envisioned design, this robot does not offer much innovative content, and many design concepts and functions have already been realized in existing smart devices.

Baidu launched the "Tiantian" AI tablet robot in 2024, which is similar in appearance and design concept to Apple's robot. The only difference is that Baidu's product is already in mass production, while Apple's is still in development.

Left: Apple Desktop Robot Rendering, Right: Baidu Tablet Robot

Subsequently, at the end of 2024, Apple developed a robot perception system called ARMOR.

ARMOR enhances the robot's "spatial awareness" through hardware and software collaboration, enabling dynamic collision avoidance. The Apple team deployed ARMOR on the Fourier GR-1 robot for testing.

The experimental results showed that compared to using four head-mounted and externally installed depth cameras, ARMOR reduced collisions by 63.7%; compared to the sampling-based motion planning expert system cuRobo, the computational efficiency of ARMOR-Policy was 26 times higher than the original system.

Image of ARMOR deployed on the Fourier GR-1 robot for testing

In February this year, Apple released the "ELEGNT" framework, with the current prototype being a lamp-shaped device resembling the "Luxo Jr." from Pixar animations.

Through the "ELEGNT" framework, the non-humanoid lamp robot takes on a "human touch".

When users give commands, the robot will "look" at the user and create a sense of listening by tilting or nodding its head, and it will also dance along with the rhythm when playing music.

Although Apple has presented three projects to the outside world, the pricing of the desktop robot and whether the lamp robot is a real need or "overly showy" have been topics of discussion.

Behind this lies Apple's ambivalence about whether it wants to make "tool-type robots" or "emotional carriers".

In addition, there are also reports that Apple is planning to develop a more mobile robot.

This mobile robot is similar to an iPad with wheels, targeting Amazon's Astro robot, capable of performing simple tasks, making phone calls, and answering user questions.

As for humanoid robots, perhaps Apple will draw on the SLAM technology from its autonomous driving project to explore bipedal walking and complex task execution capabilities for robots.

Apple is indecisive in the field of robotics. After abandoning car manufacturing and experiencing ineffective Siri updates, it is clear that Apple does not want to give up on robotics as a new growth curve.

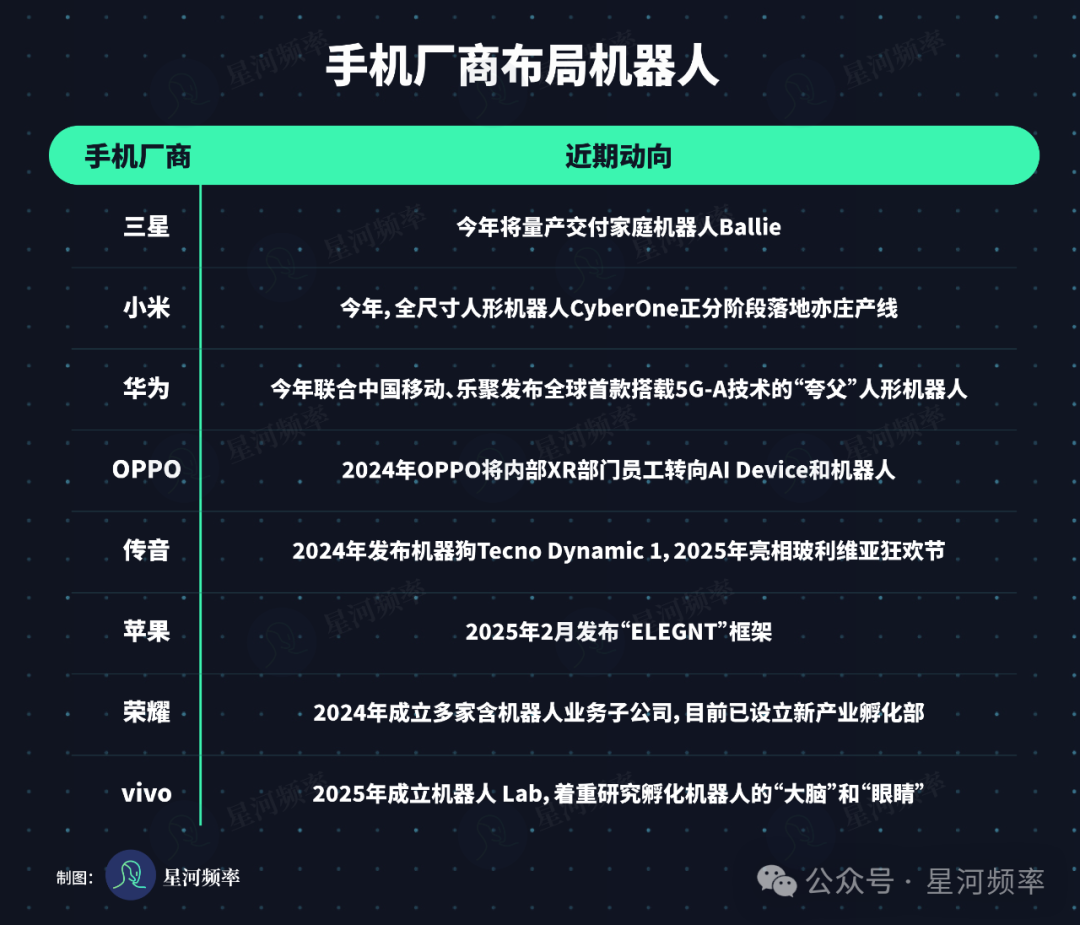

Cross-border ventures by phone manufacturers are nothing new

While Cook was discussing innovation in Hangzhou, Huawei's Kuafu robot, in collaboration with LEJU, was already capable of completing tasks such as barcode scanning, logistics handling, and tin dipping processes in factories, while Xiaomi's CyberOne was also being phased in on its own manufacturing lines.

In fact, it is no longer unusual for phone manufacturers to venture into robotics, and they have already embarked on a beachhead battle.

Phone manufacturers with technological advantages in AI algorithms, image sensors, vision algorithms, chips, operating systems, etc., have natural advantages in technology migration and reuse when venturing into robotics.

At the same time, facing the ultimate goal of C-end robots, phone manufacturers have also accumulated rich marketing experience. Compared with some robot manufacturers that adopt a hard-core technology style, phone manufacturers understand better how to sell a robot.

Currently, 8 phone manufacturers have entered the robotics race, forming a differentiated competitive landscape.

Among them, Xiaomi and Huawei are at the forefront of achievements, and their different layout strategies represent two typical paths for cross-border ventures into robotics.

Xiaomi: Full-Chain Ecological Type

As one of the earlier entrants, Xiaomi constructs a robotics ecosystem through a dual-wheel drive of "investment + self-research".

In August 2021, Xiaomi released its first quadruped robot, CyberDog, priced at 9999 yuan. At that time, Xiaomi adopted an application-based sales model, selecting 700 users in two batches.

In 2022, Xiaomi launched the full-size humanoid robot CyberOne, standing at 177cm tall and capable of emotion perception, recognizing 85 environmental semantics and 45 human emotions, marking Xiaomi's advancement towards complex interactive scenarios. However, the cost of CyberOne at that time was between 600,000 and 700,000 yuan, and the technology was not optimally realized when it was launched, so it has not been released to the public.

In 2023, Xiaomi launched CyberDog 2, equipped with visual, auditory, and tactile functions, priced at 12999 yuan. CyberDog 2 sold nearly 2,000 units but encountered a wave of returns, with after-sales damage reaching 50%.

In February 2025, CyberOne was phased in on the production line at Xiaomi's Yizhuang Smart Factory in Beijing.

CyberOne showcases Xiaomi's self-researched technology in robotics. Equipped with Xiaomi's self-developed Mi-Sense depth vision module, it possesses complete three-dimensional spatial perception capabilities, enabling person identity recognition, gesture recognition, and facial expression recognition.

Through XiaoAi Tongxue, CyberOne also possesses emotion perception and cognition capabilities.

In addition, Xiaomi has invested in companies such as Xiaoyu Robotics, Luoshi Robotics, and Thinking Robotics, covering the entire industrial chain of robot production, paving the way for industrial chain integration and cost reduction in robot research and development.

Huawei: Technology Empowerment SchoolHuawei's positioning in the field of robotics is very clear - it only does the "brain" and does not touch the "limbs".

Huawei Cloud is responsible for the robot's brain, the vehicle BU is responsible for the robot's eyes, the digital energy department is responsible for the robot's battery life, and the hardware part is handed over to partners.

Among a host of partners, the collaboration between LEJU Robotics and Huawei is particularly noteworthy.

In 2024, at Huawei's HDC Developer Conference, the humanoid robot Kuafu, equipped with Huawei's Pangu large model, made its debut.

Equipped with the Pangu embodied large model, Kuafu has strong generalization capabilities in both factory and home environments.

Whether it's completing logistics handling, performing dirty, tiring, or dangerous tasks such as tin dipping in factories, or having smooth conversations with the owner in the kitchen at home, understanding the owner's preferences, matching ingredients, and cooking delicious meals, it can handle them all with ease.

At the 2025 Mobile World Congress, China Mobile, Huawei, and LEJU jointly launched the world's first humanoid robot equipped with 5G-A technology - "Kuafu".

With the support of 5G-A technology, Kuafu can achieve high-precision positioning in large scenarios, reduce the hardware burden on the robot itself, and improve computation speed. It can also break through the limitations of indoor Wi-Fi and support real-time remote control of humanoid robots by users.

In addition, Huawei applied for the registration of the "MATEROBOT" trademark this year, suggesting the possibility of launching its own robot products.

At the same time, companies like Samsung and TECNO have also found their own "safe havens" in the competitive race.

Samsung, as one of the earliest phone manufacturers to start laying out robotics, due to technological bottlenecks and difficulties in commercialization, has shifted its robotics focus from humanoid robots to home robots.

At the end of last year, Samsung acquired core technologies related to humanoid robots through its holding of Rainbow Robotics and further concentrated its R&D resources on home robots.

Samsung's AI companion robot Ballie will be launched in the first half of this year. Ballie supports voice control and can glide freely, responding to user needs at any time.

In addition, Ballie is equipped with the world's first switchable lens projector, capable of close-range and long-range projection. This is not only Samsung's reuse of its mature technology in robotics but also its layout for product ecologization in the home environment.

TECNO, which has always focused on the African and Southeast Asian markets, chose to make robot dogs. In 2024, TECNO released the Tecno Dynamic 1 at the Mobile World Congress.

This is not only a safe approach to exploring the field of robotics but also more in line with the consumption level of TECNO's current customer base.

vivo, one of the "Huami OV" quartet of manufacturers, also officially announced the establishment of a robotics laboratory this year, entering the field of home robots.

Unlike Huawei and Xiaomi, vivo's long-term development layout has been biased towards being a "pure" phone manufacturer. Therefore, in this robotics layout, vivo has also indicated that it will focus on the robot's eyes and brain.

Based on vivo's existing Blue Heart large model and its experience in image spatial perception technology, vivo aims to enable robots to "understand scenes, comprehend needs, and provide responses."

Whether driven by competition or actively seeking change, this trend of mobile phone manufacturers "chasing the wind" is irreversible, and the ultimate goal of these mobile phone giants is still to seek a second growth curve.

Apple's cross-border move, amplifying strengths and solving difficulties in parallel

Although Apple has been secretly exploring the field of robotics, the replacement of business executives in consecutive months also demonstrates Apple's anxiety.

On the one hand, the saturation of the mobile phone market and Apple's decline in the Chinese market inevitably bring anxiety; on the other hand, Apple needed to find a new business growth level after abruptly discontinuing its autonomous vehicle project last year.

From the development paths of manufacturers that have already achieved significant results, it can be seen that the underlying logic of cross-border robotics is to transfer the advantages of making mobile phones to making robots.

For example, Xiaomi has an ecological industry chain, so it chooses to develop a complete humanoid robot by itself; Huawei focuses on technology, so it chooses to cooperate with robotics companies; vivo, which has been researching imaging technology, will apply its self-developed MR headset and "real-time spatial computing technology" to focus on incubating the "brain" and "eyes" of robots.

Based on its own advantages, Apple is targeting home robots.

Apple's biggest core advantage in the market has always been its well-established iOS ecosystem.

Through iCloud data synchronization, Apple can realize smart interconnection between users' iPhone, iPad, Mac, Apple Watch, Apple Vision Pro, and other smart devices with household robots, further connecting "people and machines" to form a strong ecological effect.

At the same time, the audience of the iOS system often has stronger user stickiness. Apple has built a strong user stickiness moat through an ecological closed loop, consistent experience, brand premium, etc. Focusing on home robots is not only Apple's bet on the global smart home life and smart home market but also a powerful tool for iOS ecosystem to attract and retain fans.

In addition, Apple has independently developed chip technology and is comprehensively promoting the development and application of generative AI, which, combined with the iOS system, provides Apple with three moats for robots in terms of performance, interaction, and privacy.

In terms of chips, there are the Apple Silicon series for Mac computers, the A series for mobile phones, and plans to launch the "Glennie" and "Nevis" chips for AirPods and Apple Watch in 2027.

Self-developed chips can achieve a balance between high performance and low energy consumption through on-device computing power and energy efficiency optimization, allowing robots to operate for extended periods. Customized hardware and multi-module interaction enable robots to have more generalization capabilities in home scenarios.

In terms of generative AI, it is the Apple Intelligence system that Apple has been building. The deep integration capabilities of Apple Intelligence allow robots to understand complex instructions and call upon local knowledge bases or cloud services to execute tasks.

Apple's self-developed "ELEGNT" framework also enables robots to generate anthropomorphic movements or expressions, making them more human-like in emotional interactions, which is also more in line with the essential emotional interaction capabilities of home robots in their operating environments.

For Apple, which started slightly later, realizing "perfectionism" in robots requires not only amplifying its advantages but also overcoming the challenges of cross-border mobile phone manufacturers.

The first challenge is the talent issue, which is even a problem that every manufacturer needs to face before the technology competition.

There is a big difference in technical thinking between making a mobile phone and making a robot. Therefore, for cross-border mobile phone manufacturers, to achieve overtaking, they must first find more professional "veterans".

Most mobile phone manufacturers have entered the robotics racetrack relatively late, and compared with some companies that purely make robots, they no longer have a time advantage. Therefore, it is particularly important to establish a professional team in a short period of time.

In mobile phone factories, most engineers are mainly in vertical tracks, such as image algorithms or chip design, and the team settings are relatively independent. However, robotics engineers need to integrate interdisciplinary knowledge across mechanics, electronics, software, and other fields, and also require cross-functional collaboration among team members.

In terms of innovation direction, engineers in the mobile phone field are mostly focused on optimization and upgrades based on the original foundation, such as improving battery life and response speed. However, robotics engineers need to explore new interaction methods and new application scenarios.

Another issue is the data scenario. Mobile phone products only need limited data based on mobile phone usage scenarios, but robots need to construct interactive simulation scenarios in the physical world to form a data closed loop.

Currently, with the soaring popularity of embodied intelligence, many technical experts from large companies have left their old employers and stand at the crossroads of choice.

Compared to "blazing new trails" at mobile phone manufacturers, more people still choose to go to more professional and pure robotics companies.

For example, Zheng Yu, the former head of control at Tencent Robotics X, left in 2024 and chose to join UBTech.

Luo Jianlan, who previously served as a senior research scientist at Google and held positions in multiple robotics departments, also officially joined Zhiyuan this year as Chief Scientist.

The departure of big names to vertical companies has brought pressure on talent recruitment for many cross-border companies. To quickly complete team building, vivo has offered an annual salary of up to more than 1.2 million yuan to recruit a chief robotics scientist.

Now in the field of robotics, the annual salary of senior algorithm engineers has also exceeded 800,000 yuan, which is 50% higher than that in the mobile phone industry.

Before the long research and development cycle, major manufacturers need to first overcome the difficulty of talent acquisition.

For Apple, while solving the problem of talent quantity, it must also consider the trend of team youthification.

The second challenge is that manufacturers need to adapt to different market strategies for robots and mobile phones.

The mobile phone market has clear functional segmentation. Based on users' different needs in imaging, gaming, business, etc., mobile phone manufacturers can launch vertical products according to differentiated needs and simultaneously update and upgrade products within vertical tracks.

However, robots are more scenario-driven, requiring generalization capabilities across multiple scenarios. In industrial scenarios, robots are designed to replace repetitive labor and some high-risk processes; in home scenarios, robots are explored in the directions of cleaning, cooking, and emotional interaction.

Mobile phones mostly meet users' explicit needs, such as pursuing the latest chips, systems, high battery life, etc. Mobile phone manufacturers can stimulate consumption through rapid iteration and marketing.

Robots are more about exploring potential needs in scenarios. Currently, the deployment scenarios of robots are slightly clearer, but functionality has become a "competitive weight" that needs to be explored.

Perhaps Apple can turn the tide through this team reorganization and leadership change, or perhaps it will be in vain like its automotive project.

But innovation and risk coexist. Apple's choice to develop robots is clear-headed and courageous.

Years ago, when Apple chose to abandon car manufacturing, Li Xiang made the following statement on Weibo: "If Apple succeeds in developing toC artificial intelligence, it will become a company worth 10 trillion dollars; if artificial intelligence fails, Apple will become a company worth 1 trillion dollars."

After all, in the arena of innovation, there are no eternal kings, only relentless explorers.