Behind the Privatization of Zeekr: Geely's New Energy Strategy Embraces 'Unified Synergy'

![]() 05/13 2025

05/13 2025

![]() 665

665

Introduction: The current competitive landscape for new energy vehicles poses significant challenges to the Geely system.

01 A Strategic Lever

On May 7, 2025, Geely Automobile Holdings Limited (Geely Automobile, 00175.HK) announced the submission of a non-binding offer to privatize Zeekr (ZK.US), proposing a share price of $2.566 per Zeekr share or $25.66 per American Depositary Share (ADS).

Currently holding approximately 65.7% of Zeekr's shares, Geely's plan, if completed, will see Zeekr delist from the NYSE and fully integrate into the Geely system.

The offer represents a 13.6% premium over Zeekr's last trading day close and a 20% premium over its 30-day average trading price, closely aligning with Zeekr's IPO opening price of $26.

Despite investors' initial optimism, the stock's performance from listing to potential delisting suggests no significant capital gains. However, given the uncertainties of the U.S. stock market, Geely finds this privatization an acceptable outcome without significant additional cost.

Moreover, Zeekr serves as a crucial lever for the Geely Group at this juncture.

02 Ending Internal Competition

The ongoing strategic adjustments within Geely and Zeekr's operational conditions necessitate integration.

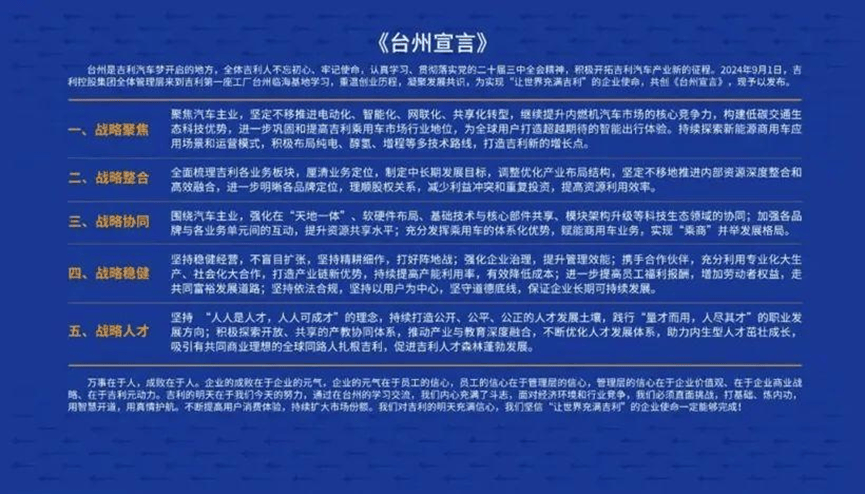

In September 2024, Geely Group's management team convened at its Linhai factory in Taizhou, issuing the "Taizhou Declaration," emphasizing strategic convergence, integration, and efficiency enhancement across business segments.

Subsequently, Lynk & Co. merged with Zeekr, and Geometry integrated with other brands like Yizhen, marking a shift from a multi-brand "quantity over quality" strategy to a more calculated approach.

Market performance underscores the urgency of these measures. Within Geely's passenger vehicle portfolio, Geometry excelled with its competitive pricing and high-configuration strategy, selling over 490,000 vehicles in 2024. However, brands in the above 200,000 yuan segment, excluding Zeekr, struggled.

For instance, Polestar sold 3,114 vehicles and Lotus 3,018 in 2024, which could be attributed to niche market focus before Xiaomi's SU7 launch. Post-SU7, such explanations fell flat as the SU7, also a pure electric sedan, surpassed 10,000 monthly sales in June 2024 and breached 20,000 in October.

The multi-brand model within Geely, akin to "horse racing" or "internal strife," hindered overall market performance. Effective group collaboration, exemplified by Volkswagen's synergy, emphasizes clear brand boundaries and efficient technology sharing, yielding a 1+1+1>3 result.

Geely's recent brand strategy, however, has been somewhat confusing, with mismatches in configuration, pricing, and model positioning. For example, the high-performance Lotus brand lacks Geely's advanced drive system, which appears on the similarly priced Zeekr 001 FR.

Moreover, the Zeekr 001, priced at 269,000 yuan, boasts an 800V architecture, LiDAR, and an NVIDIA chip with 508 TOPS, while the higher-end Polestar 4 still uses a 400V system and a less powerful Mobileye EyeQ5H chip.

Another example is the resource competition in brand strategy, with Lynk & Co., initially focusing on fuel and hybrids, launching pure electric models, while Zeekr, a pure electric brand, preparing a plug-in hybrid.

Such strategies divide sales volume and increase costs, jeopardizing profitability. If trends persist, models like Lynk & Co. Z10 may struggle to achieve profitability throughout their lifecycle.

03 Zeekr's Stellar Performance

Given these issues, Geely urgently needs to review its high-end new energy brands. The ideal leader for this review must be a fully controlled Geely brand with proven success in new energy.

Zeekr fits this bill perfectly. From 2022 to 2024, Zeekr sold 72,000, 119,000, and 220,000 units respectively, impressive in the luxury EV market.

Zeekr is not just a successful brand but also serves as Geely's "new energy electrification test field," distinguishing itself with An Conghui's leadership, a direct sales model, user co-creation, and innovative practices like free infotainment system upgrades.

Post-privatization, Zeekr rejoins Geely's passenger vehicle portfolio as a "lineage" brand, enhancing communication and efficiency within the system.

For Zeekr, this return is also beneficial. 2025 has been tumultuous, with Zeekr and Lynk & Co.'s merged group selling 165,300 units from January to April, of which Zeekr contributed 55,000, only 17.2% of its 320,000-unit annual target.

Moreover, Zeekr's persistent financial losses since its inception in April 2021, totaling billions of yuan annually, are particularly glaring as competitors like NIO, AITO, and Li Auto turn profitable.

04 Post-Return Strategy

In the new energy vehicle market, sales battles and profitability secrets hinge on "knifework" precision.

Cost control is paramount for Zeekr, Geely, and all new energy enterprises. Post-privatization, R&D and labor costs within Geely's passenger vehicle system will likely cease overlapping, and supplier negotiations will become more assertive.

As An Conghui noted in December 2024, the Zeekr-Lynk & Co. integration reduced R&D expense ratios by 5% and BOM costs by 3%. With Zeekr's official privatization, these savings will scale up significantly at the Geely Group level.

Cost savings will translate into pricing competitiveness, bolstering Zeekr's confidence against rivals like Xiaomi and Hongmeng Zhixing.

Valuation-wise, Zeekr's continued presence in the U.S. stock market is meaningless. With no prospect of U.S. market entry and unfriendly valuation, coupled with threats of delisting Chinese companies, a departure seems prudent.

Both Hong Kong and A-share markets support the return of Chinese concept stocks, with precedents like NIO, XPeng, and Li Auto's secondary listings. Zeekr's future re-listing faces few obstacles.

Zeekr's privatization is not a simple "return" but a strategic reflection, addressing both Geely's internal need for a promising brand and the external tumult, favoring a steady homeward development.