What has happened to those who benchmarked against Tesla?

![]() 05/19 2025

05/19 2025

![]() 637

637

Introduction

A clear brand value core surpasses mere benchmarking of parameters.

On May 31, 2019, Tesla announced the official opening of reservations for the China-made Model 3, priced at 328,000 yuan, with an estimated delivery time of 6 to 10 months (i.e., the first quarter of 2020). In November of the same year, Tesla unveiled real-life images of the locally produced Model 3, confirming the addition of the Chinese "Tesla" logo on the rear, and announced that deliveries would commence in the first quarter of 2020.

In January 2020, deliveries of the domestically produced Model 3 Standard Range Plus version began, with the starting price adjusted to 355,800 yuan (gradually reduced due to subsidy policy adjustments). On January 1, 2021, the new domestically produced Model 3 was launched, priced at 249,900 yuan and 339,900 yuan, respectively. Since then, the Model 3 has embarked on a rapid growth trajectory in the Chinese market.

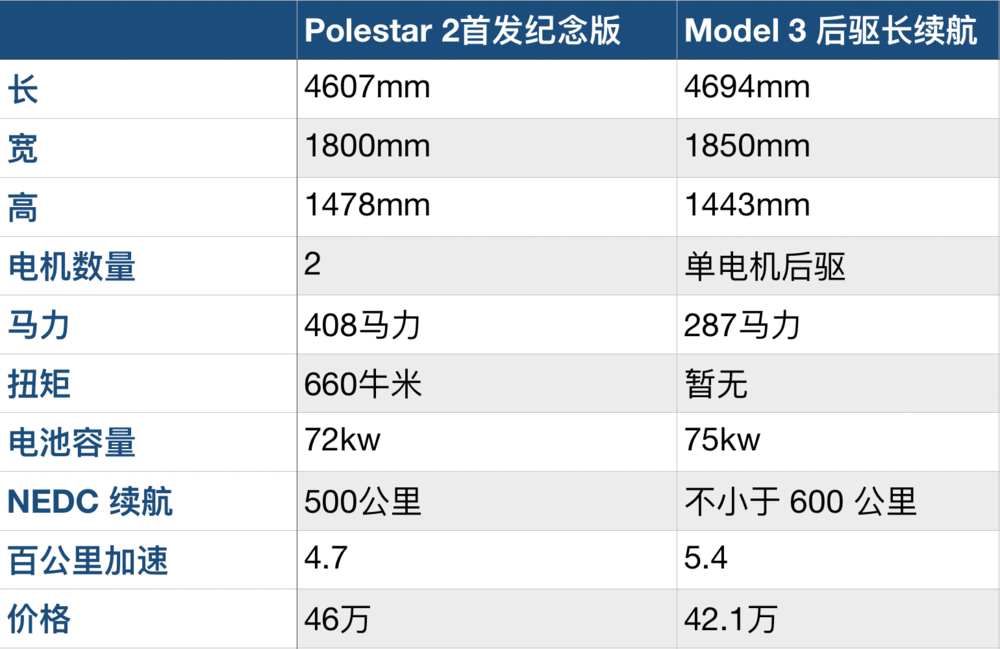

As the Model 3 continues to set new sales records, many domestic new energy vehicle manufacturers appear to have recognized the immense potential of the mid-sized pure electric sedan market, launching "alternative" models aimed at capturing market share with higher configurations, larger spaces, and lower prices, leveraging differentiated product advantages.

Models such as the Deep Blue SL03, Nezha S, IM L7, Hyper GT, etc., were formidable competitors at the time, with some even directly benchmarking their data against the Model 3 during launch events. Despite impressive data, the Model 3's sales volume remains high, while these alternative models have failed to dent its market share.

This reflects more than a simple competition of configurations and pricing; it is a profound contest of the underlying logic of the new energy vehicle market.

01 Alternatives are not as good as being unique

On the surface, the "three-pronged approach" of domestic alternative models—superior configurations, ample space, and affordable pricing—accurately targets consumers' demand for "cost-effectiveness." However, in the era of new energy, driven by technological revolution, the automotive technology manufacturing system and cognitive value system have been completely reshaped, disrupting the existing competitive landscape.

So, how can one grasp the opportunities of the times under this new competitive landscape? He Songsong, partner at RDI Strategic Consulting in China, recently provided insights into why models that benchmarked against the Model 3 encountered setbacks. He believes that it is both a battle for mindshare and a battle of technology.

"Creating new categories is the most effective way for automakers to differentiate themselves and achieve breakthroughs. Essentially, it's about identifying and grasping gaps in mindshare based on consumers' understanding of category differentiation logic and factors of concern."

Tesla has spent over a decade cultivating its image as a "technological pioneer," planting a cognitive anchor in users' minds—choosing the Model 3 is not just buying a car, but joining an ecosystem that represents future mobility. In contrast, most domestic new brands are still stuck in the "parameter benchmarking" stage, failing to establish a clear brand value core.

He Songsong stated that a brand's mindshare determines its market share, and the fundamental way for automakers to win in competition is to establish a clear and differentiated cognitive label in consumers' minds, enabling consumers to lock in the brand first based on this cognitive label when making purchasing decisions, thereby driving the market and promoting sales through mindshare.

For example, Li Xiang, the founder of Li Auto, despite being an early Tesla fan, did not dive headfirst into the pure electric market when founding Li Auto to compete directly with Tesla. Instead, he chose the family car market, focusing primarily on the extended-range route, and created the category of "luxury 6-seat smart electric SUVs."

By addressing range anxiety through standard extendable energy solutions that can run on either gasoline or electricity, and providing consumers with an ultimate comfort experience with "refrigerators, TVs, large sofas," and ample six-seat space, Li Auto successfully created a differentiated cognitive label for the brand as a "dad's car," becoming the preferred choice for large families in the high-end car travel market.

As a result, Li Auto has also become the object of imitation for many automakers. Of course, there are many similar cases, such as BYD Han EV successfully breaking into the high-end market through technological breakthroughs in blade batteries, and Zeekr 001 gaining a loyal following with its unique positioning as a shooting brake and outstanding handling performance.

These cases prove that rather than blindly pursuing "alternatives," it is better to focus on niche markets to create "uniqueness." In fact, in the era of new energy, led by industry trends, there are only more new shapes, new functions, and new scenarios that cars can realize, presenting more mindshare opportunities compared to the era of fuel vehicles.

However, in this fierce battle between domestic new energy vehicles and the Model 3, the entry of Xiaomi Automobile and HarmonyOS Smart Mobility has introduced new variables.

02 Direction is more important than effort

Xiaomi Automobile made a strong debut with its first model, the SU7, and Lei Jun did not benchmark the SU7 against the Model 3 at the launch event but instead aimed at the higher-end Porsche Taycan. From range, power to acceleration performance, the Xiaomi SU7 indeed demonstrates strong capabilities on the data level.

For example, the Xiaomi Motor V8s boasts a rotation speed of up to 27,200 rpm, and the adopted CTB integrated battery technology achieves a battery volume efficiency of 77.8%, both industry-leading. Inside the intelligent cabin, the self-developed HyperOS operating system enables multi-screen interaction, providing an excellent user experience. For several months, the sales volume of Xiaomi SU7 surpassed that of the Tesla Model 3, enjoying a moment of glory.

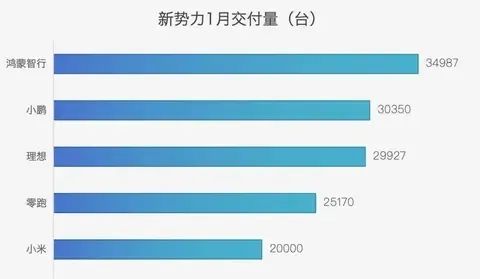

HarmonyOS Smart Mobility is also coming on strong, with its four brands: Zenith, Enjoy, AITO, and Zhinjie. Its core competitiveness lies in the HarmonyOS cabin and Kunlun Intelligent Driving, both backed by Huawei. In January 2025, HarmonyOS Smart Mobility sold 35,000 vehicles, an increase of 3.9% year-on-year, ranking first in the retail sales ranking of new energy manufacturers, posing a significant force.

This is also part of the battle for mindshare. According to the report "New Species, New Concepts, New Trends - Insights and Predictions for New Energy Vehicle Consumption (2024-2025)" jointly released by the China Electric Vehicle Hundred People Forum and RDI Strategic Consulting, which focuses deeply on the consumption trends of new energy among the younger generation:

Generation Z consumers prefer expert brands in new energy. An expert brand refers to a brand or factory that specializes in this category, including AITO, Xiaomi, and the initial WXP trio (Weilai, XPeng, Li Auto), among others. According to consumer research, 65% of consumers have already chosen new energy expert brands as their first choice for car purchases.

The strong rise of new energy expert brands is not accidental but rather an industry transformation driven by technological beliefs and value resonance. This generation of consumers grew up in an era of technological explosion and have a natural admiration for "professionalism." They are more willing to pay for the Huawei HarmonyOS intelligent ecosystem behind AITO, Xiaomi's vision of "full ecosystem connectivity between people, cars, and homes," and NIO's service philosophy of being a "user enterprise."

It is reported that Generation Z's brand preferences for purchasing new energy vehicles may surprise everyone. Traditional joint venture brands have a very low preference among them, accounting for only 5% today. This means that out of every 100 people, only 5 might consider looking at new energy products launched by joint venture brands, while the remaining 95 pass them by.

In the era of new energy, expert brands are the basic condition for participating in competition. Compared to extended brands of traditional fuel vehicles, they have the cognitive advantages of stronger professionalism and more advanced technology, which will directly influence consumers' car-buying behavior. This is also why, except for a few large manufacturers like BYD and Geely that have been able to open up new battlefields, new energy brands like Changan, Chery, and Great Wall are still finding their way.

These companies often face multiple challenges such as wavering technological paths, rigid organizational structures, and fragmented brand perceptions. They want to retain the brand assets of the fuel vehicle era while trying to build a new image for new energy, viewing new energy products as simple substitutes for fuel vehicles. Naturally, it is difficult for them to establish differentiated cognition in the minds of users, ultimately leading to vague product positioning and difficulty in accurately meeting the consumption needs of Generation Z.

Looking back, there are still many automakers at the lower end of the new energy sales rankings. These automakers are not uncommitted or lacking in technology, funds, or talent support; rather, they have chosen the wrong development direction. Of course, it is easier said than done, but if these automakers can correct their course in time, they may be able to start anew.

Editor-in-Chief: Du Yuxin, Editor: He Zengrong