Asian Auto Market | Vietnam April 2025: Local Newcomer VinFast Emerges as Market Leader

![]() 05/23 2025

05/23 2025

![]() 764

764

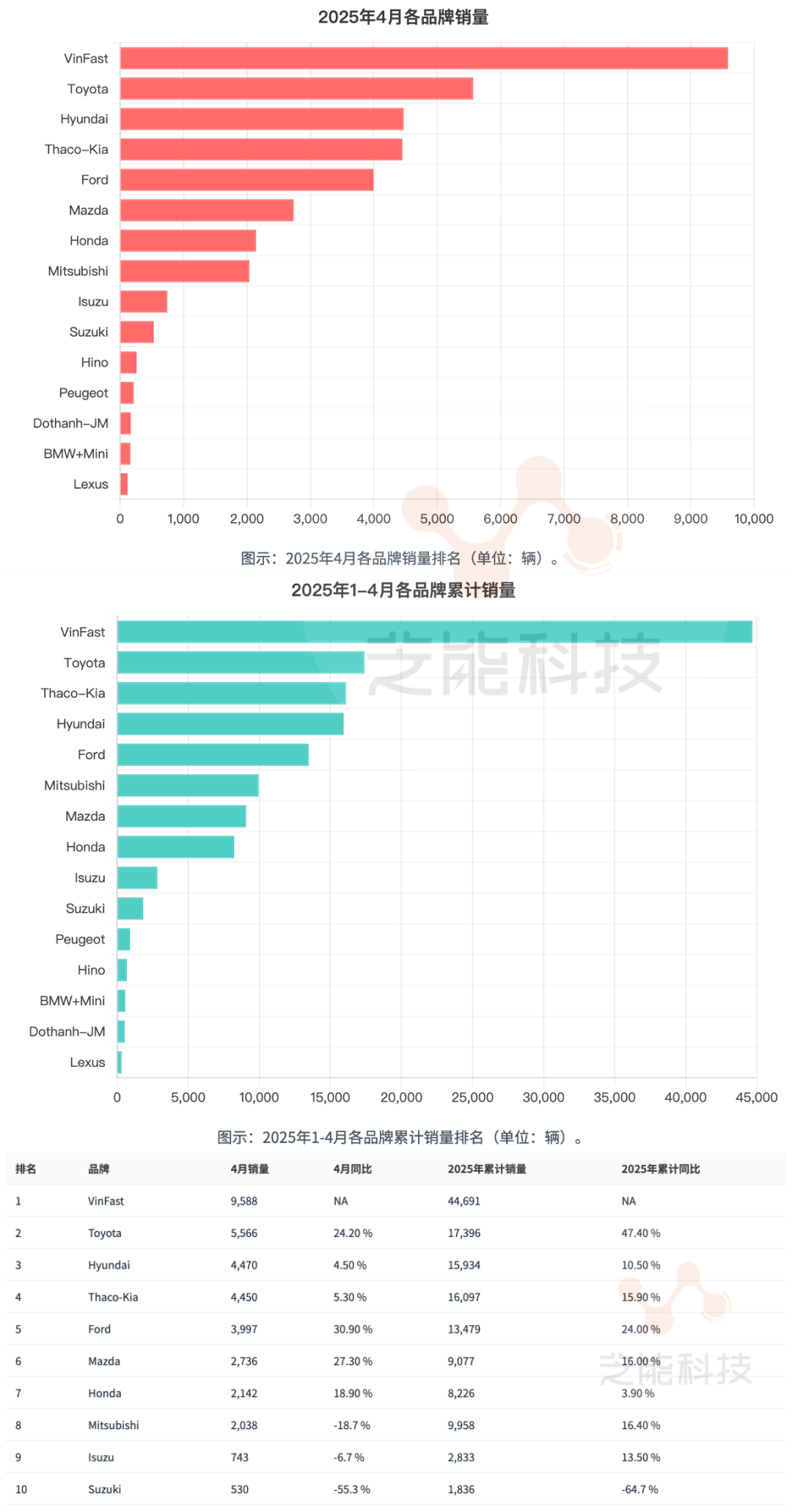

In April 2025, Vietnam's automotive landscape was once again dominated by VinFast, with the VF 5, VF 3, and VF 6 models securing the top three sales positions. This marks the second time in three months that VinFast has swept the top spots, underscoring the brand's formidable grip on the market.

Amidst an overall market growth of 19% year-on-year, VinFast claimed the top spot with a 22% market share, temporarily sidelining Chinese automakers in the Vietnamese market.

01

The Ascent of VinFast:

Beyond Local Appeal

Vietnam's new vehicle market expanded by 19% year-on-year in April 2025, tallying 34,055 units. Cumulative sales from January to April reached 117,768 units, up 21.5% year-on-year.

Total sales, inclusive of VinFast's contributions, amounted to 43,643 units. VinFast sold 9,588 units in April, capturing a 22% market share. From January to April, its cumulative sales stood at 162,459 units, representing a 27.5% share.

In April 2025, VinFast sold 9,588 units, accounting for 22% of the overall market. Although this figure dipped from the year's peak of 27.5%, it maintained a substantial lead over competitors.

Remarkably, VinFast's VF 5, VF 3, and VF 6 models occupied the top three sales spots. The VF 5 retained its lead with 3,731 units sold, closely followed by the VF 3 with 2,378 units and the VF 6 with 1,763 units.

This market dominance underscores VinFast's not only brand recognition but also its robust product portfolio, spanning from A0-segment micro electric vehicles to small SUVs.

From a product standpoint, the popularity of the VF 3 and VF 5 is not coincidental; it aligns perfectly with Vietnamese urban consumers' preference for small electric vehicles.

These models offer compact size, affordability, and youthful, stylish designs, precisely catering to first-time car buyers and younger demographics.

Furthermore, VinFast's local manufacturing, flexible pricing, and advanced infrastructure (such as battery swapping and charging networks) have fortified its competitive barriers.

The rapid resurgence of the VF 6—its sales ranking surged from seventh in March to third this month—signals that VinFast's foray into the compact pure electric SUV market is bearing fruit, unveiling new avenues for growth.

02

International Brand Competitions

and Segment Market Variations

Joint venture and foreign brands in Vietnam continue to hold sway in certain market segments. For instance, Mazda CX-5 witnessed a 77% increase this month, vaulting to fourth place, indicating robust demand in the traditional fuel SUV segment. Models like Ford Ranger and Everest also maintained stability, with Everest seeing a 42.3% growth, hinting at potential in the pickup truck and large SUV markets.

Korean brands like Hyundai and Kia are progressively refining their product structures and pricing strategies. Hyundai Creta's sales surged by 109.3% year-on-year this month, underscoring the explosive growth potential in the compact SUV segment.

Models such as Ford Territory and Honda City also recorded over 100% year-on-year growth, attesting to the allure of mid-range product updates and configuration enhancements.

However, some brands are facing challenges. Suzuki's sales plummeted by 55.3% year-on-year this month, while Mitsubishi and Isuzu declined by 18.7% and 6.7% respectively, reflecting issues with product competitiveness, pricing strategies, or supply chains.

As competition intensifies between VinFast and other brands, those failing to deliver timely product updates or differentiate their positioning risk being swiftly marginalized.

Summary

VinFast stands not only as a symbol of trust among Vietnamese consumers but also as a pivotal representative of Vietnam's automotive industry's journey towards self-sufficiency and the maturation of autonomous brands. Its ascent has disrupted the long-standing dominance of Japanese and Korean brands in Vietnam, compelling traditional players to adapt more swiftly to local needs and emerging energy trends. This narrative mirrors the evolution seen in both Vietnam and China.