The Life and Death of Zeekr: A Pivotal Turn in the New Energy Vehicle Industry

![]() 05/20 2025

05/20 2025

![]() 709

709

The new energy vehicle industry stands at its most fiercely competitive juncture.

/

Produced by | Business Show

At a critical post-privatization moment, Zeekr Technology unveiled its Q1 2025 financial report on May 15, marking the first such report since its privatization and return to Geely.

Revenue for the first quarter of 2025 totaled RMB 22.019 billion, up 1.1% year-on-year but down 37.8% sequentially. Gross margin hit a record high of 19.1%. Deliveries of Zeekr and Lynk & Co. vehicles totaled 114,011, driving vehicle revenue to RMB 19.096 billion, a 16.1% year-on-year increase.

Performance-wise, Zeekr appears to be steering in a new direction. However, delving into the strategic rationale behind its moves, doubts linger about the "swift merger of Geely Automobile and Zeekr, returning to one Geely."

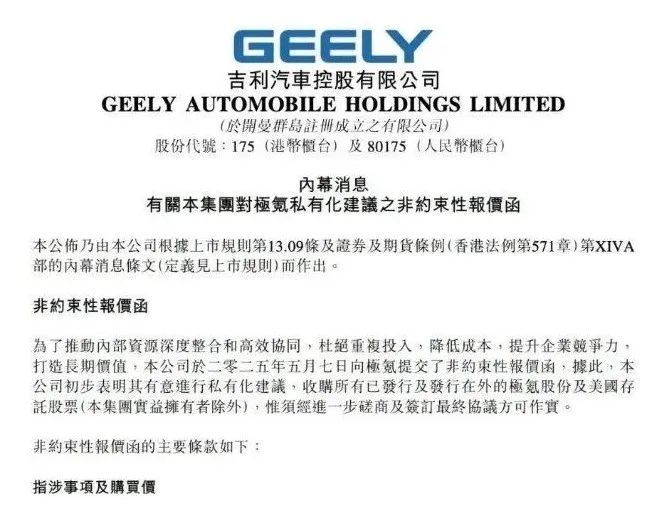

On the 7th of this month, Geely Automobile abruptly announced the privatization of Zeekr at USD 25.66 per share, aiming to acquire the remaining 34.3% of shares for full integration. This bombshell news shocked the automotive industry, executed with unprecedented secrecy and speed.

Notably, Zeekr listed on the US stock market in June 2024, less than a year ago. Its tenure on the US stock market lasted barely a year, an unusually short listing period for a new energy vehicle company.

In June 2024, Zeekr made a triumphant debut on the NYSE, hailed as "the fastest IPO among new carmakers in history." Trading commenced with a high opening price, reflecting the capital market's high expectations for its future. Geely Group also viewed it as a crucial part of its new energy strategy.

However, reality took a sharp turn. Less than a year later, on May 7, 2025, Geely Automobile suddenly announced the privatization of Zeekr at USD 25.66 per share, aiming to acquire the remaining 34.3% of shares for full integration. This caused a seismic impact in the automotive industry and capital markets.

In terms of capital market performance, Zeekr's share price exemplifies a "high open, low close" scenario. As of May 19, 2025, its share price had plummeted to USD 29.34, a drop of over 50% from its issue price. Data reveals that in 2024, Zeekr incurred a net loss of USD 893 million, with an asset-liability ratio soaring to 131%, while its parent company Geely Automobile's return on equity for the same period was merely 19.17%.

Why the rush to privatize Zeekr? What new narrative and potential does privatization hold for Zeekr and Geely? In the fiercely competitive new energy vehicle industry, Zeekr's delisting and privatization case holds significant metaphorical value for the sector.

-Business Show-01

Undoubtedly, competition in the new energy vehicle market has now reached boiling point. According to data from the China Association of Automobile Manufacturers, the overall growth rate of the new energy vehicle market slowed down in Q1 2025.

In April 2025, China's automobile production and sales stood at 2.619 million and 2.59 million units, respectively, down 12.9% and 11.2% month-on-month but up 8.9% and 9.8% year-on-year.

Globally, Tesla, with its strong brand influence and cost control, continues to wage price wars, repeatedly slashing prices to gain market share through volume. Xiaopeng Motors has significantly increased R&D investment in intelligent driving, introducing competitive features to attract consumer attention. Cross-border giants like Xiaomi and Huawei have entered the market with capital and technology, leveraging their smart ecosystem and software development advantages to swiftly gain a foothold.

In such a fiercely competitive environment, Zeekr faces immense survival pressure.

Once the main sales driver, the Zeekr 001 reached monthly sales of 14,000 units, becoming a popular pure electric model in the 300,000 yuan price range. Now, sales have plummeted. Data shows monthly sales diving from over 10,000 units in 2023 to 2,174 units in April 2025.

This decline is closely linked to Zeekr's product update strategy. The launch rhythm and product changes of the 2025 Zeekr 001 and 2025 Zeekr 007 dissatisfied some old users, who felt that "the new cars had significantly upgraded configurations and performance, undermining their rights and interests." During the new car launch, Zeekr's official live stream was flooded with complaints from old car owners, forcing the company to disable audience comments.

Some agitated car owners even protested directly at Zeekr's headquarters. Photos circulated online showed car owners holding banners with slogans like "Zeekr Auto, Consumer Fraud, Betraying Owner Trust" and "Grinding Three Swords in a Year," expressing strong dissatisfaction with Zeekr's product strategy and treatment of old users.

This rights protection incident not only eroded old users' brand loyalty but also negatively impacted potential consumers' purchase decisions. Car quality website data shows that in March 2025, the Zeekr 001 ranked high in complaints for pure electric models priced above 250,000 yuan. Issues such as power battery failures, limited power, and unfulfilled intelligent driving functions were the focus of complaints. Frequent quality issues triggered a trust crisis among car owners, and consumers' doubts about vehicle quality and safety undoubtedly reduced their willingness to purchase the Zeekr 001, leading to declining sales.

This is also related to the intensifying competition in the overall new energy vehicle market. When the Zeekr 001 first launched, the luxury shooting brake market priced above 250,000 yuan was nearly vacant, allowing it to attract a large user base with its unique positioning. However, with the booming new energy vehicle market, many competitors have entered the fray.

For example, leveraging Xiaomi's brand influence in technology, excellent performance, and high cost-effectiveness, the Xiaomi SU7 has attracted numerous consumers, diverting potential customers from the Zeekr 001. With a pricing below 200,000 yuan, the Xiaopeng P7i has seized some market share originally belonging to the Zeekr 001 due to its high cost-effectiveness. Models like IM Motors L6 and Starry Era ES have also joined the competition, making this market segment increasingly crowded. The Zeekr 001 faces immense competitive pressure, impacting its sales.

Moreover, as a listed company, Zeekr found itself shackled by decisions such as pricing strategy and technology roadmap. Each product price adjustment required comprehensive consideration of shareholder interests, capital market requirements for product gross margin, and competitor pricing strategies. This complex decision-making often delayed the company's response in market price wars, causing it to miss opportunities.

Therefore, merger or integration seems to be the inevitable strategic path.

-Business Show-02

In September 2024, Li Shufu, Chairman of Geely Holding Group, announced the "Taizhou Declaration," stating that Geely would shift from strategic expansion to strategic focus and integration, comprehensively sorting out Geely's various business segments, promoting deep integration and efficient fusion of internal resources, clarifying each brand's positioning, straightening out equity relationships, reducing conflicts of interest and duplicative investments, and enhancing resource utilization efficiency.

On February 14, 2025, Geely Holding Group's Zeekr completed the swift transfer of a 51% equity stake in Lynk & Co. This move appeared to be a crucial step in Geely Group's resource integration and brand layout optimization. However, it exposed underlying issues in the development of Zeekr and Lynk & Co.

There is clear overlap between Zeekr and Lynk & Co. in product positioning and price range, with the Zeekr 001 and Lynk & Co. Z10 directly competing in the 250,000-350,000 yuan price segment. This internal competition not only leads to resource dispersion but also causes severe internal consumption.

Data from the first three quarters of 2024 shows that while the combined sales of Zeekr and Lynk & Co. accounted for 30% of Geely Group's total sales, the gross margin gap between pure electric and hybrid models widened to 8 percentage points. In the first month of the Lynk & Co. Z10's launch, it diverted up to 12% of Zeekr 007's orders, and the overlap rate of the dual-brand dealer channels exceeded 40%.

Geely Chairman Li Shufu once lamented, "When two sons fight over the same piece of cake, the father must redistribute the plates." This internal competition has significantly hindered Zeekr's access to resources and market expansion.

In research and development, both brands previously established intelligent driving teams of over 2,000 people each, investing heavily in redundant L3 autonomous driving system development. However, due to a lack of unified planning and coordination, R&D achievements failed to achieve sharing and complementarity, resulting in severe resource waste.

In supply chain management, to secure battery quotas from Contemporary Amperex Technology Co. Limited (CATL), Zeekr once locked in production capacity at a 5% premium, directly delaying the delivery of Lynk & Co.'s hybrid models and undermining consumer trust in the Lynk & Co. brand.

An industry insider told "Business Show" that while the integration of dual-brand procurement channels reduced BOM costs by 5%-8% after the equity transfer, the previous chaos posed considerable obstacles to Zeekr's development. It is evident that the dispersion and internal consumption of resources prevented Zeekr from focusing on enhancing product competitiveness and market share, leading to overall operational inefficiency and high costs.

Despite this, on May 15, Li Donghui, CEO of Geely Holding Group and Vice Chairman and Executive Director of Geely Automobile Holdings Limited, stated that after the full integration of Geely Automobile and Zeekr, internal estimates currently project annual savings of tens of billions of yuan in R&D expenses. Preliminary attempts at joint procurement last year saved an additional tens of billions of yuan beyond the original budget.

This appears to be a "Normandy Landing"-style self-rescue for Zeekr and a market gamble for Geely regarding capital and products.

Zeekr's developmental journey has touched upon key areas such as the capital market, market competition, internal enterprise integration, and product technology. Each issue has significantly impacted the company's trajectory.

From a capital and risk hedging perspective alone, privatizing Zeekr is not merely a capital operation for a single enterprise but also reveals the resource integration logic and risk hedging strategies of Chinese automakers in global competition.

However, for Zeekr to re-emerge victorious in future market competition, in addition to optimizing capital operations, it must address "real issues" such as enhancing product competitiveness, strengthening internal integration, and improving user experience, formulating practical solutions. Otherwise, in the fiercely competitive new energy vehicle industry, it risks gradual marginalization or even elimination.

After all, the new energy vehicle industry has now reached its most competitive phase. [End]