Asian Auto Market | April Indonesia: BYD Enters Top 5, Chinese Automakers Stirring Up an 'Intelligent Electric' Storm

![]() 05/20 2025

05/20 2025

![]() 581

581

In April 2025, the Indonesian auto market underwent a structural transformation amidst an overall demand slowdown.

Traditional fuel brands continued to feel the pinch, while Chinese new energy brands, led by BYD, leveraged technology, products, and marketing to accelerate market penetration, achieving historic milestones.

BYD soared to fifth place in wholesale sales, with the Sealion 7 also ranking among the top ten models. Brands like Denza and Chery also accelerated their growth, as Chinese brands comprehensively reshape Indonesia's electrification landscape.

This article delves into the overall market trends and thoroughly analyzes the growth trajectory and strategic value of Chinese automakers.

01

Market Reshaping:

New Energy Breakthroughs Amid Traditional Dominance

In April 2025, light vehicle wholesale sales in Indonesia recorded a year-on-year increase of 5.3%, reaching 51,205 units. Cumulative sales for the first four months stood at 256,368 units, down 2.8% year-on-year, with the retail market continuing to face pressure (retail sales fell 3% year-on-year in April). However, structural growth in specific categories, particularly the surge in new energy vehicles, emerged as the industry's biggest variable.

● From the brand perspective

◎ Toyota maintained its leading position with a market share of 31.4%, slightly higher than the same period last year, but Daihatsu, Suzuki, and Mitsubishi all witnessed double-digit declines.

◎ In stark contrast, BYD delivered a remarkable performance, breaking into the top five for the first time with 3,496 wholesale units, and its market share surged to 6.8%, setting a new record for the brand in the Indonesian market. Another Chinese brand, Chery, also achieved a year-on-year increase of 174.6%, rising to eighth place.

◎ Conversely, Honda's wholesale sales plummeted 34.9%, and retail sales also declined significantly by 30.2%, indicating that traditional Japanese brands are facing challenges related to product upgrades and technological advancements.

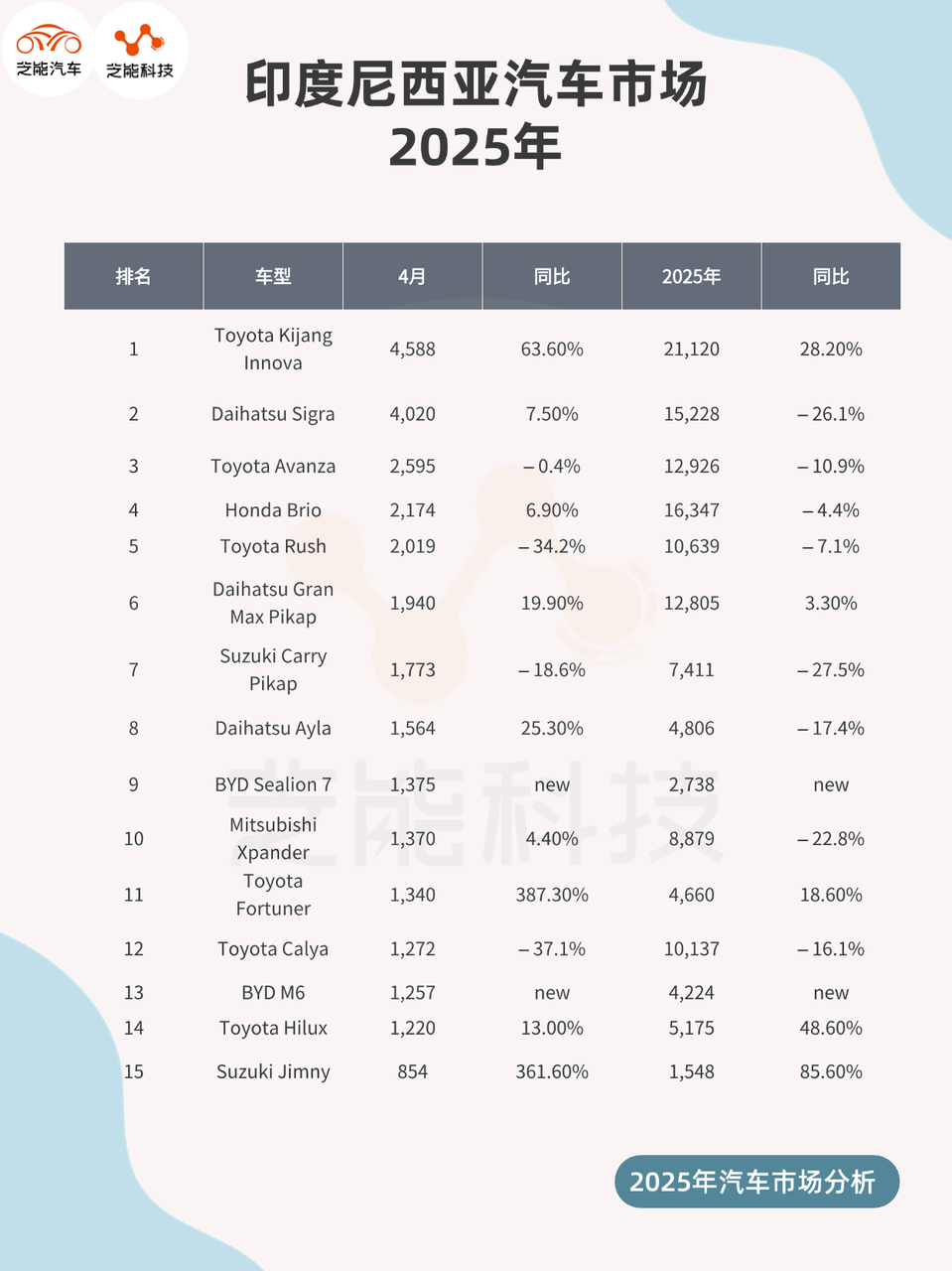

● In terms of models

◎ Toyota Kijang Innova retained its top spot with a year-on-year increase of 63.6%, capturing a 9% market share.

◎ Daihatsu Sigra, Toyota Avanza, and Honda Brio followed closely behind.

◎ However, the real standout was BYD Sealion 7, which debuted at ninth place with 1,375 units sold, becoming the first Chinese new energy vehicle to enter the top ten monthly sales in Indonesia.

◎ More significantly, Denza D9 and BYD M6 also entered the top 20, initially demonstrating the explosive potential of Chinese brands in the mid-to-high-end new energy market.

Currently, the Indonesian market is still dominated by traditional fuel vehicles, with pickup trucks like Gran Max Pikap and Carry Pikap maintaining stability. However, SUVs and electric MPVs have become the focus of a new round of competition. The mass introduction of new models is shaking up the long-standing market structure dominated by Japanese brands, paving the way for deeper electrification penetration.

02

Rise of Chinese Power:

BYD Ignites the Market, Chery, Denza, and Others Bloom in Multiple Areas

In the performance of Chinese brands this month:

◎ BYD was undoubtedly the main protagonist. With 3,496 wholesale units (6.8% market share) and 3,531 retail units (6.2% market share), BYD significantly outpaced other Chinese brands, directly ranking fifth in the overall market.

BYD previously gained market recognition with the Atto 3 and has now established a comprehensive product matrix with more cost-effective and technologically advanced models like the Sealion 7 and M6.

In particular, the Sealion 7, with its high design aesthetics, long range, and intelligent cabin, quickly won the favor of younger consumers. Its mass deliveries have become a key driver for elevating BYD's brand image.

◎ As BYD's high-end series, Denza's D9 model targets the mid-to-large MPV market, enjoying certain localized differentiation advantages. In April, it sold 811 wholesale units, ranking 13th, and retail sales reached 847 units, showing significant growth.

◎ Chery also cannot be overlooked, with 1,620 wholesale units in April, a year-on-year surge of 174.6%, and retail sales reaching 1,549 units, demonstrating the strong performance of its main models like the Tiggo in the mid-range SUV market. As a brand with deep roots in Indonesia, Chery has continuously invested in channels, after-sales services, and brand awareness in recent years, and is expected to achieve breakthrough growth in 2025.

◎ Other Chinese brands like Wuling, although slightly weaker (1,240 wholesale units, +4.4% year-on-year), have a diverse product line, especially in the entry-level MPV and micro-electric vehicle segments, where they still enjoy a price advantage.

◎ While newcomers like Aion, Geely, and Neta have smaller volumes, they have begun testing the waters in the market and are expected to contribute incremental growth throughout 2025.

The collective rise of Chinese brands in the Indonesian market is no longer just about price wars but a state of 'multi-point development and full-scale blooming.'

Representative models exist in various market segments such as mid-range new energy SUVs (Sealion 7), high-end MPVs (Denza D9), mainstream compact SUVs (Chery Tiggo 7/8), and micro-electric vehicles (Wuling Air EV). Technological and channel capabilities have been improved simultaneously, forming a relatively solid competitive barrier.

Summary

In Indonesia, the largest market in Southeast Asia that is still in the cultivation phase for new energy vehicles, April 2025 marked the arrival of a strategic turning point. BYD's surge was not accidental; Chinese brands are entering Indonesia's mainstream market through a new path, directly aligning with local policy orientations and consumer upgrade demands with intelligent electric products. On the other hand, they are also enhancing user stickiness and reputation through brand building and service network optimization. Future competition in the Indonesian market will no longer be solely about 'who is cheaper' but 'who is smarter, safer, and more understanding of users.' From 2025 onwards, they will truly enter a new stage of 'establishing a breakthrough and strategic expansion.'