Navigating 50% Penetration: Is Geely Auto Still a Solid Choice for Investors?

![]() 05/21 2025

05/21 2025

![]() 730

730

"There are no successful enterprises, only enterprises of the era."

In the current automotive landscape, Geely Auto stands out as the quintessential success story of a traditional automaker transforming amidst the sector's transition.

The latest sales figures reveal that in April, Geely Auto sold 230,000 vehicles, marking a 53% year-on-year growth and a 0.8% month-on-month increase. This performance ranks it second only to SAIC, which sold 380,000 vehicles with a 4.6% year-on-year increase but a 2.4% month-on-month decrease. Geely has also widened its gap with Changan, which reported a significant 9.3% month-on-month and 29% year-on-year decline to 190,000 vehicles.

Even when compared to new independent or emerging forces that have demonstrated robust growth resilience in recent years, Geely Auto's growth rate remains remarkable. In the same month, BYD, NIO, Li Auto, and XPeng achieved sales of 380,000, 41,000, 35,000, and 34,000 vehicles respectively, with year-on-year growth rates of 21%, over 170%, over 270%, and 32%.

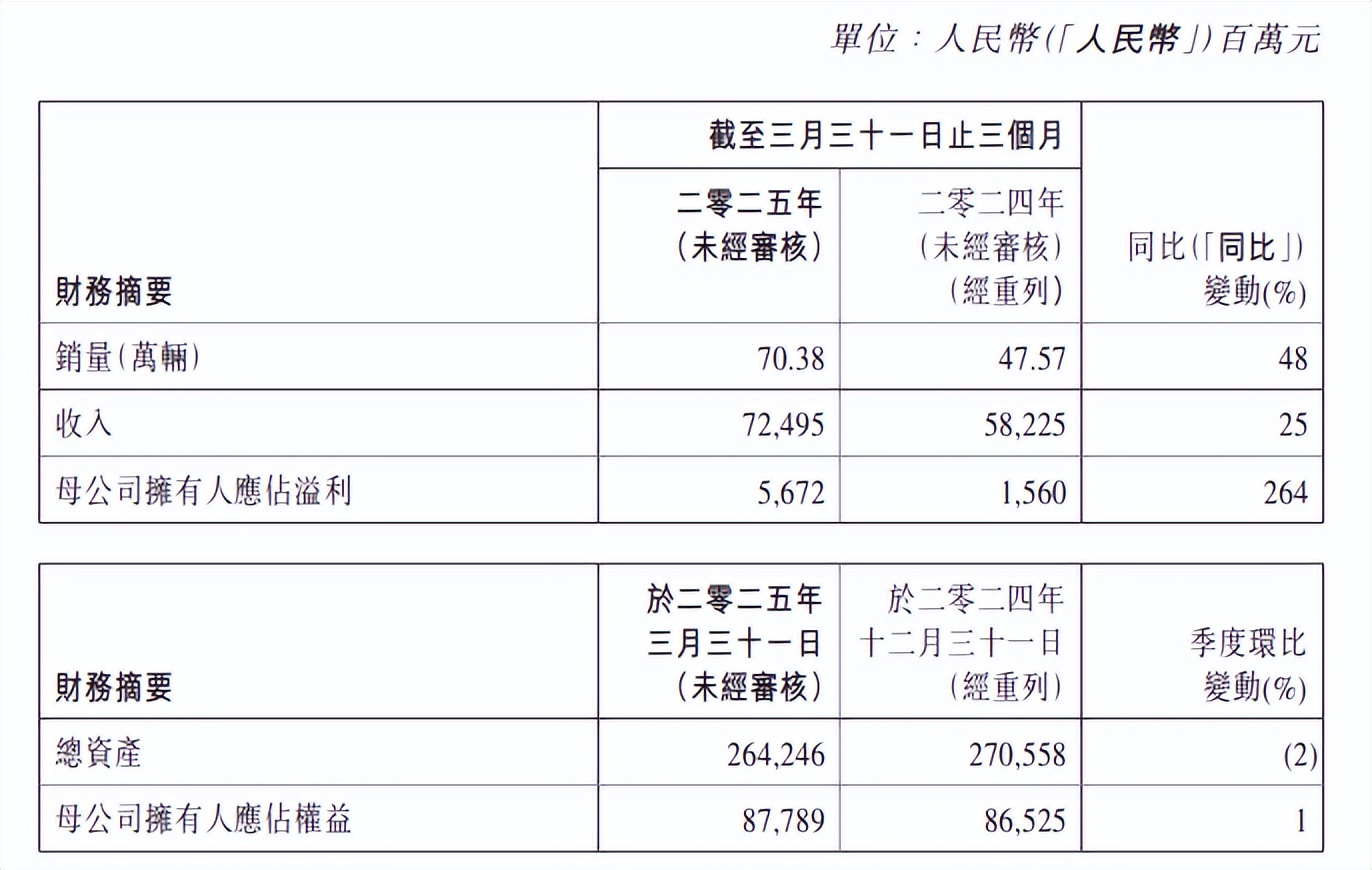

Amidst robust sales growth, Geely Auto delivered strong financial performance in Q1 2025 as anticipated: revenue increased by 24.5% year-on-year to RMB 72.5 billion; net profit attributable to shareholders of the parent company reached RMB 5.67 billion, with the growth rate surging to 263.6% from the high of 213% in 2024, showcasing a continuous surge in profitability.

However, in the capital market, Geely Auto's (00175.HK) technical bullish trend today is not as pronounced as that of BYD, NIO, Li Auto, XPeng, and Xiaomi Auto during the same period.

Nonetheless, Geely Auto might still be a prudent choice for investors seeking deterministic returns.

"Top Student" in the Automotive Market: Geely Continues to Prosper Amidst 50% Penetration

During the reporting period, Geely Auto's sustained sales and performance growth were in harmony with the significant tensions exhibited by the overall passenger vehicle market as it navigates its transformational journey.

Data indicates that passenger vehicle retail sales in the first quarter of this year achieved a year-on-year growth rate of 6% under policy stimulation, with demand growth slightly exceeding the previous expectations of the China Passenger Car Association (CPCA).

The market as a whole continued to display characteristics of "new energy dominance and structural differentiation," with the penetration rate of new energy vehicles successfully surpassing 50% in March. Simultaneously, benefiting from the effectiveness of independent brands' transformation and upgrading, domestic passenger vehicle retail sales achieved the highest year-on-year growth rate in nearly a decade in March, at 14.4%.

As a prime example of successful transformation among the four major domestic traditional independent automakers, Geely has significantly contributed and reaped substantial benefits.

In the first quarter, Geely achieved a new quarterly sales high of 704,000 vehicles, with a growth rate of 48%. Among these, new energy vehicles accounted for 48%, reaching 339,000 units; the domestic new energy penetration rate even exceeded 50% (reaching 52.2%), firmly securing a place in the first tier of new energy brands.

Behind the continuous sales surge are the dual effects of "Geely Galaxy brand explosion" and "Zeekr high-end breakthrough":

On one hand, in the core battleground where major independent brands are focusing their efforts, namely the price range of RMB 100,000-200,000, the company officially upgraded the Geely Galaxy series to the "Geely Galaxy brand."

Based on the brand's core strategy of "providing intelligent experience at the price of fuel vehicles," its sales in a single quarter during the reporting period reached nearly 260,000 vehicles, with a year-on-year increase of 214%. Among these, the popular series - Geely Xingyuan sold more than 35,000 vehicles per month for two consecutive months, becoming the cumulative sales champion of all categories from January to April with a terminal sales volume of 117,000 units.

Moreover, combining the total sales data of Geely Xingyuan at the end of April, which exceeded 930,000 units, and the growth momentum revealed by the enterprise in technological breakthroughs, product renewal, and value reconstruction, it is reasonable to speculate that Geely's first new energy brand to surpass one million sales will emerge soon.

On the other hand, facing the mid-to-high-end market, after completing the integration of the Lynk & Co brand in February, Zeekr's brand premium capability was further strengthened.

In the first quarter, the total sales of Zeekr, including Lynk & Co, increased by 21.1% year-on-year to 114,000 vehicles. Although due to the pricing of Lynk & Co, the total revenue of the series increased by only 1% to RMB 21.96 billion, the gross margin increased by 1.8 percentage points to 18.8%, demonstrating the premium power of high-end products.

Next, it is expected that the delivery volume of Lynk & Co 900, with over 30,000 confirmed orders, will continue to climb. With the launch of new models such as Zeekr 9X, scheduled for release in the third quarter, and Zeekr 007GT, which achieved 10,000 offline deliveries in the first month after its launch, Zeekr's brand strength as a leading high-end luxury brand in China is expected to continue to be unleashed.

Unlike BYD, which has become the sole Chinese new independent automaker with its "full industrial chain advantage," Geely has gradually completed its transformation through a unique "brand matrix synergy" model, finding its own path amidst the technological shifts of the era. Both have taken different routes but have validated the high growth potential of the new energy market.

Slow Revenue Growth? Geely, Back to "One Geely," is Highly Profitable

Perhaps through this quarterly report, Geely might face questions about "exchanging price for market share" due to its quarterly revenue growth rate being significantly lower than its sales growth rate.

However, for a sunrise sector, internal drive is crucial in assessing a company's long-term investment value.

Notably, Geely's sales growth has not compromised its profit margins: in the first quarter, its gross margin increased by 0.2 percentage points year-on-year to 15.8%, and both the selling and administrative expense ratios decreased year-on-year and month-on-month, affirming the transmission of the company's scale effect to operating quality.

For instance, on the brand side, the Geely Galaxy brand rapidly increased sales through cost-effective models, diluting fixed costs. Zeekr maintained high gross margins through high-end models, forming a profit structure that "covers high, medium, and low ends."

According to disclosures, in the first quarter, Zeekr achieved a significant year-on-year turnaround in net profit per vehicle, reaching RMB 4,500, and the brand's quarterly net profit reached RMB 510 million, performing exceptionally well.

A substantial reason for the brand profitability's inflection point lies in cost changes driven by supply chain synergy. According to the company's calculations, after the merger of Zeekr and Lynk & Co, their joint procurement and combined BOM costs will decrease by 5%-8%, capacity utilization will increase by 3%-5%, and research and development costs will decrease by 10%-20% after research and development synergy. This point is evident in the change in Zeekr's (including Lynk & Co) gross margin in the first quarter.

And according to the "Taizhou Declaration" issued by Geely last year, the company will accelerate its entry into a new stage of strategic transformation through five core initiatives: "strategic focus, strategic integration, strategic synergy, strategic robustness, and strategic talent."

Currently, Geely is at the crucial stage of "focus, integration, and synergy." The company's next management priority will also be advancing the merger of Zeekr and Geely Auto.

Upon completion, the four major brands under the Geely Group - Geely, Geely Galaxy, Zeekr, and Lynk & Co - will return to the same listing platform, Geely Auto. Simultaneously, the synergistic effects of its supply chain will also be further unleashed.

As Executive President Gui Shengyue publicly stated: "Facing fierce market competition and an increasingly complex environment, Geely Auto can only prevail in the fierce competition by changing the situation where brands were small, scattered, and disorganized in the past, and condensing resources into a single punch."

Based on the company's ability to demonstrate synergistic cost reduction through multi-brand integration and the future production ramp-up of high-end new models such as Lynk & Co 900 and Zeekr 9X, China International Capital Securities expects that Geely Auto's high-end product positioning will likely continue to contribute to profit elasticity.

Prerequisites for Expectations of Deterministic Growth

It is evident that returning to "One Geely" will provide Geely Auto with abundant deterministic expectations.

However, it should be noted that the premise for fulfilling this expectation is that brand demand maintains a steady growth trend.

To ensure the realization of this premise, intelligent equality and globalization are both directions that Geely Auto needs to focus on.

In the field of intelligent driving, in early March, Geely launched a unified intelligent assisted driving solution, "Qianli Haohan," unifying all intelligent assisted driving systems of the entire group into one organizational structure.

As planned, the ultra-luxury SUV Zeekr 9X and large luxury SUV Zeekr 8X, which will be launched by Zeekr in the second half of this year, will both be equipped with the Haohan super electric hybrid technology. Lynk & Co will also release its first EM-P mid-to-large-sized hybrid sedan, equipped with the NVIDIA Thor chip and using the Qianli Haohan H7 solution, covering the more premium ultra-luxury market, thereby stabilizing and enhancing the brand's strength in the luxury sector.

It is expected that the company will continue to promote the deployment of intelligent assisted driving systems to products in lower price segments in the future. It is reported that Geely's self-developed "Qianli Haohan" intelligent assisted driving system has entered the mass production stage.

To implement this step, research and development investment is indispensable. In the first quarter of this year, Geely's research and development expenses increased by 24.5% year-on-year to RMB 3.328 billion, primarily used for core technologies such as intelligent assisted driving and three-electric technology.

Regarding Geely's exports, they are indeed a current shortcoming for the company. Gui Shengyue, Executive President of the company, also stated during this earnings release that although Geely's total exports have not declined, there has been no strong growth due to the company's slow response to overseas markets and insufficient resource investment.

Data shows that exports in the first quarter amounted to nearly 90,000 vehicles, ranking fifth in vehicle exports, but with only a 2% increase, the growth rate lags behind the industry, reflecting the challenges of overseas market layout.

Conclusion

Geely's quarterly report data affirms that the company possesses impressive profitability amidst fierce competition. Essentially, this is also a victory of the company's "strategic perseverance + execution."

However, in the face of increasingly fierce competition, the company's fault tolerance space has become increasingly narrow, especially after traditional independent automakers have achieved transformational success.

In the "second half of intelligence," Geely Auto needs to find a new balance between technological leadership, global operational capabilities, and profit quality. If it can continue to fulfill its technology commercialization and globalization goals, it is not impossible for Geely to compete for the top 2 position among independent automakers.

Source: Hong Kong Stocks Research Institute