Nissan Strives to Stem Losses and Embrace Rebirth

![]() 05/21 2025

05/21 2025

![]() 527

527

Nissan has navigated its most challenging fiscal year in over two decades.

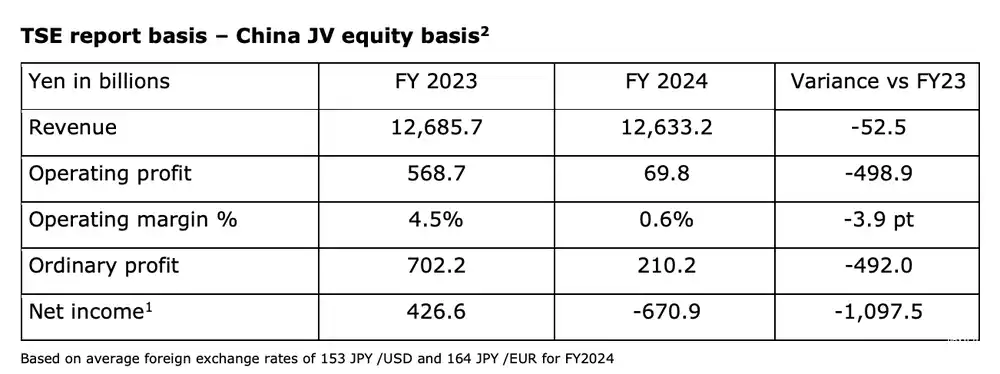

Recently, Nissan unveiled its final financial results for fiscal year 2024. Consolidated net sales amounted to JPY 12.6 trillion, marking a 0.4% year-on-year decline. Operating profit plunged 87.7% to JPY 69.8 billion, while net loss soared 257.3% to JPY 670.9 billion, a stark contrast to the JPY 426.6 billion net profit recorded in the previous fiscal year. Analyzing market segments, sales in Japan dipped nearly 5%, Europe witnessed a near-3% decline, and other markets saw a drop of over 1%. However, sales in North America, Nissan's largest market, increased by over 3.3%, reversing the downward trend.

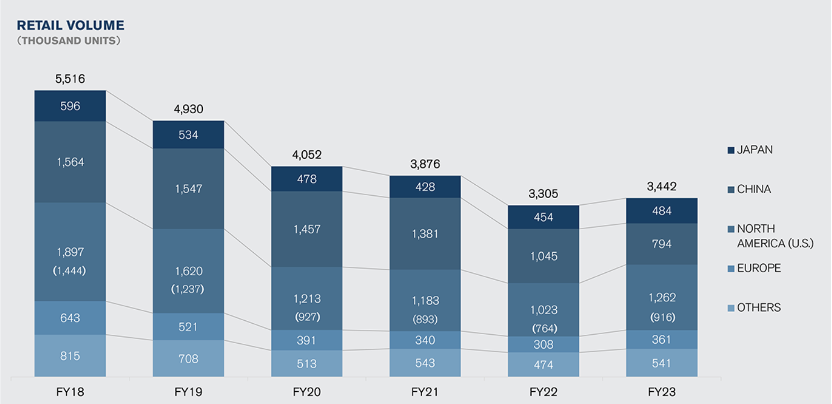

Notably, sales in China, Nissan's second-largest market, declined by over 12%, translating to a net loss of 100,000 vehicles. This steep drop in the Chinese market nearly dragged down Nissan's overall performance. Data indicates that Nissan sold 3.346 million vehicles globally in fiscal year 2024, a year-on-year decrease of nearly 3%. Sales in China totaled approximately 690,000 vehicles, down 12.2% year-on-year, marking a significant decline from the 2018 peak. The market outlook for 2025 is equally grim, with first-quarter sales in China totaling 121,000 vehicles, a 29.5% year-on-year drop. As a result of its Chinese market performance, Nissan has revised its global retail sales target for fiscal year 2025 to 3.25 million vehicles, anticipating a 2.9% decline.

The Chinese market, which once accounted for one-third of Nissan's sales, has now become a drag on the company. The rapid development of new energy vehicles (NEVs) in China in recent years has caught traditional fuel vehicle manufacturers off guard, with joint ventures heavily reliant on fuel vehicles facing even greater challenges. From 2014 to 2024, the market share of Chinese joint ventures plummeted from 70% to 35%, halving over a decade. This decline can be attributed to multiple factors, including competition from emerging Chinese automakers and shifts in consumer preferences towards NEVs. However, the primary reason lies in the slow transformation of joint ventures, particularly their overly cautious approach to transitioning to NEVs, with Nissan being particularly cautious.

Carlos Ghosn, Nissan's former CEO, once warned that the company was on the brink of despair, citing "slow decision-making and management issues" as the primary culprits. This assessment holds true, as successive CEOs, with the exception of Ghosn, have focused primarily on cost reduction and efficiency improvements rather than substantial reforms. The contradiction lies in the fact that China, as Nissan's second-largest market, is experiencing robust growth in NEVs. Increasing investment in NEVs barely keeps pace with this growth, making it even more challenging for Nissan, which is already operating under tight financial constraints. Moreover, compared to the once lucrative and large-scale fuel vehicle market, betting on NEVs is undoubtedly a risky move. Nevertheless, Nissan has not given up completely. In recent years, it has launched pure electric models like the Sylphy, super hybrid X-Trail, and the pure electric Ariya in the Chinese market. However, with the discontinuation of the Sylphy EV and the Ariya's single-digit monthly sales, it is evident that the Chinese market does not favor hastily converted "oil-to-electricity" products.

The newly appointed CEO of Nissan has provided a clear answer to the dilemma between "cost reduction" and "revenue generation." In China, Nissan will rely on hybrids to maintain scale while fully collaborating with Dongfeng to introduce NEVs that meet market demand. China will serve as a production base for global exports. It is reported that Dongfeng Nissan's N7 and hybrid pickup trucks under Zhengzhou Nissan will be the first to enter overseas markets. It is worth emphasizing that all future NEVs from Nissan in the Chinese market will leverage Dongfeng's technology. At the Shanghai Auto Show, the newly appointed head of Nissan China, Ma Zhixin, set the tone by pledging an additional RMB 10 billion investment in electric vehicle research and development, while delegating more authority to local R&D teams to fully adapt to the Chinese market.

In May, the Nissan N7, based on the new energy platform "Tianyan Architecture," officially shed its "oil-to-electricity" label. Priced at JPY 1.199 million, the N7 comes standard with features popular among consumers today, such as refrigerators, color TVs, and large sofas, demonstrating considerable sincerity. However, due to the car's close resemblance to Dongfeng's eπ 007 in terms of parameters, rumors have surfaced, causing some controversy. Fortunately, Nissan is learning from its mistakes and leveraging the strengths of the Chinese market through Dongfeng. Nevertheless, whether this reform can pull Nissan out of its current predicament remains to be seen, and relying solely on the N7 is far from sufficient. What Nissan needs most now is not merely to "stop the bleeding" but to embark on a true "rebirth."

(Images sourced from the internet, remove if infringing)