The Decline of Pure Vision Cars Amidst the Rise of LiDAR Technology

![]() 05/21 2025

05/21 2025

![]() 486

486

Pure vision technology, which triumphed in both public opinion and sales in 2024, has struggled to maintain its popularity just one year later. This decline is not merely due to recent public opinion battles among car companies but is supported by the latest sales data. Post-May Day holiday, the automotive market gradually transitions into its traditional off-season as temperatures rise. The latest third-party inspection data reveals the weekly sales results for major automotive brands from May 12 to May 18: BYD recorded approximately 70,000 new orders, NIO surpassed 11,000, HarmonyOS Intelligent Drive exceeded 11,000, Leapmotor reached over 9,500, and XPeng amounted to roughly 7,000.

Expanding the time frame to May 5 to May 11, BYD secured around 80,000 new orders, NIO notched 15,000, HarmonyOS Intelligent Drive reached 11,000, Leapmotor hit 8,500, and XPeng exceeded 7,000. From April 28 to May 4, BYD saw over 100,000 new orders, HarmonyOS Intelligent Drive surpassed 20,000, NIO exceeded 14,000, Leapmotor surpassed 11,000, and XPeng surpassed 10,000.

Analyzing the data, it's evident that consumer enthusiasm waned post-May Day holiday. Despite fluctuations in each company's data, NIO, HarmonyOS Intelligent Drive, and Leapmotor have maintained relatively high positions among the new forces. Consequently, the recent public opinion battle among car companies regarding intelligent driving assistance has reignited.

Ideal, NIO, and Huawei Clarify Stances, Sparking Public Opinion Feuds

As May draws to a close, the public opinion battle over intelligent driving assistance has flared up again, though tracing its origin is challenging. A collective choice by leading car companies is to fully integrate LiDAR into new vehicles. Statements made since the Shanghai Auto Show include:

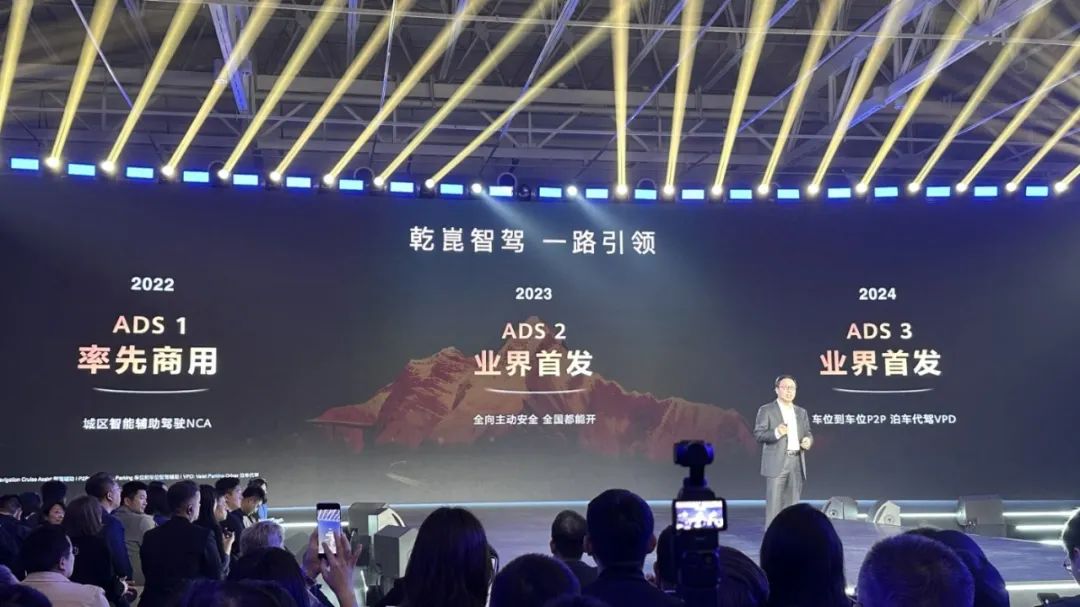

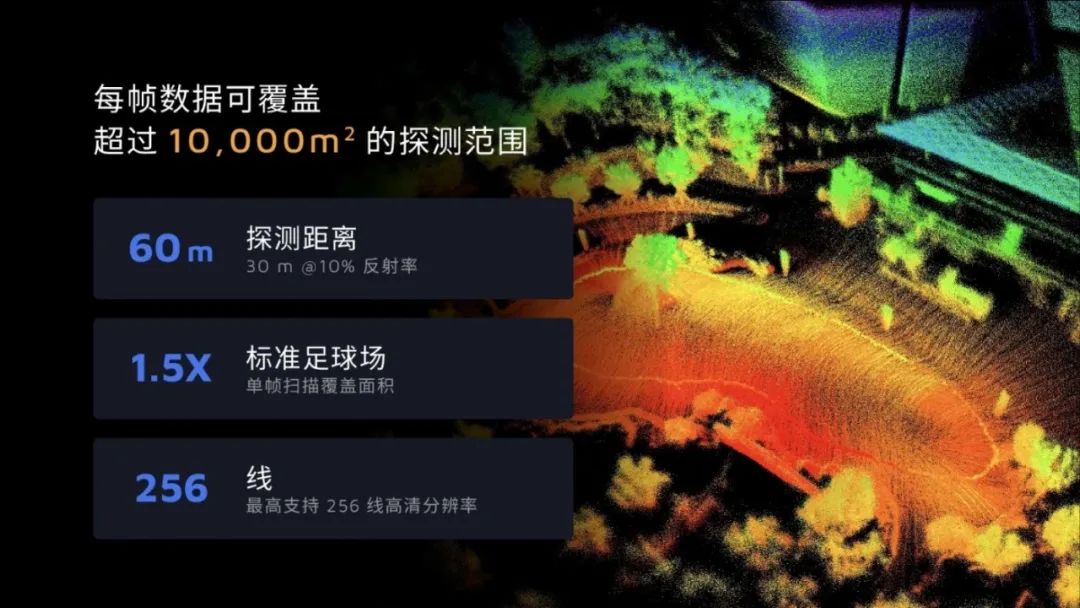

Jin Yuzhi stated that Huawei's Qiankun Intelligent Driving does not believe autonomous driving can be achieved solely through pure vision sensors like cameras. Hence, Huawei's solution employs a series of LiDARs for blind spot detection and has launched the new hardware ADS4 accordingly.

Post-Shanghai Auto Show, the AITO M8 was officially launched, with all six models equipped with two LiDARs. Ideal Auto then introduced intelligent upgrades for the L6, L7, L8, and L9. A significant change was that the entry-level Pro versions of each model line, originally reliant on a pure vision solution, now come standard with LiDAR.

Next, NIO's four models in the 5566 series underwent upgrades. The industry advised Li Bin to cut high-cost hardware to reduce prices and boost sales and profits, but Li Bin chose to stay the course and gradually replace all models with new self-developed intelligent driving chips.

Looking back further, there's also the Leapmotor B10, which began presales in March 2025. The LiDAR-equipped version is priced at the 120,000 yuan level, with the 510 LiDAR Intelligent Driving version being the primary sales model among presales orders. However, post-official launch, the highest sales shifted to the 510 Joy version with a guided price of 109,800 yuan. Users at this price point are relatively price-sensitive and less concerned with intelligent driving assistance. Nonetheless, these developments have prompted car companies with technological differences to respond in marketing.

With successive launches of new cars, the pressure is on XPeng, which focuses on pure vision technology. During Ideal's press conference and user explanations, they made their stance clear. Discussing why LiDAR is now standard, they highlighted scenarios like night reverse light intersections, high-speed nighttime trucks, and visually deceptive obstacles, emphasizing LiDAR's superior performance compared to pure vision.

Li Bin, often portrayed as a "nice guy," publicly responded as early as August 2024 when Musk claimed LiDAR was useless. His exact words were, "If anyone thinks LiDAR is useless, I think they must be either stupid or malicious."

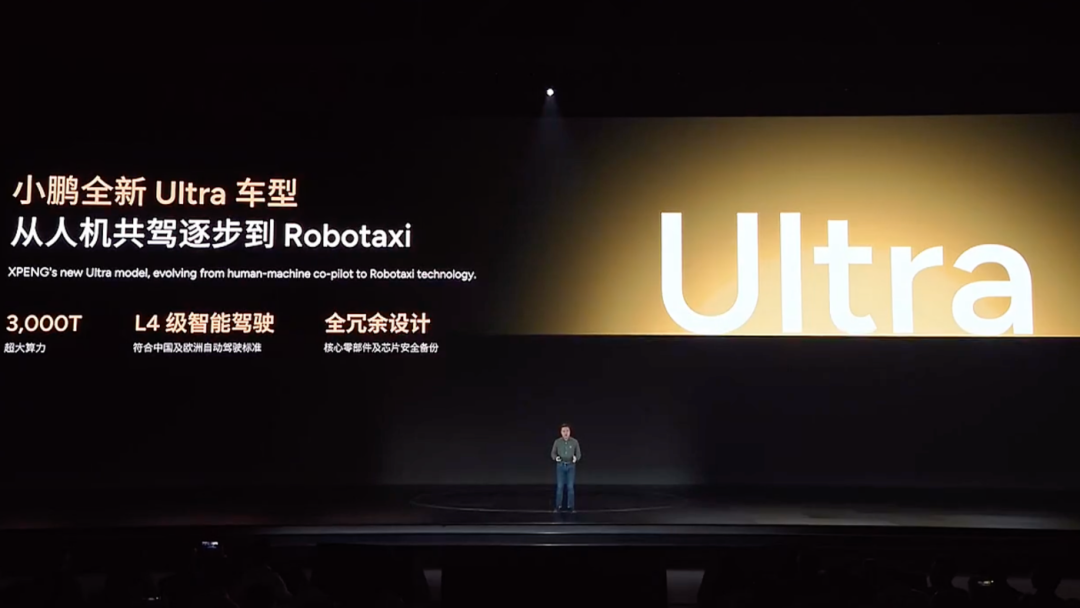

Adding another twist, Xiaomi's YU7 is scheduled to release news on May 22. Insiders revealed that initially, Xiaomi YU7 followed the same approach as Xiaomi SU7, with the entry-level version relying primarily on pure vision. However, it has now been converted to an entry-level version equipped with LiDAR, which will be announced at the May 22 press conference.

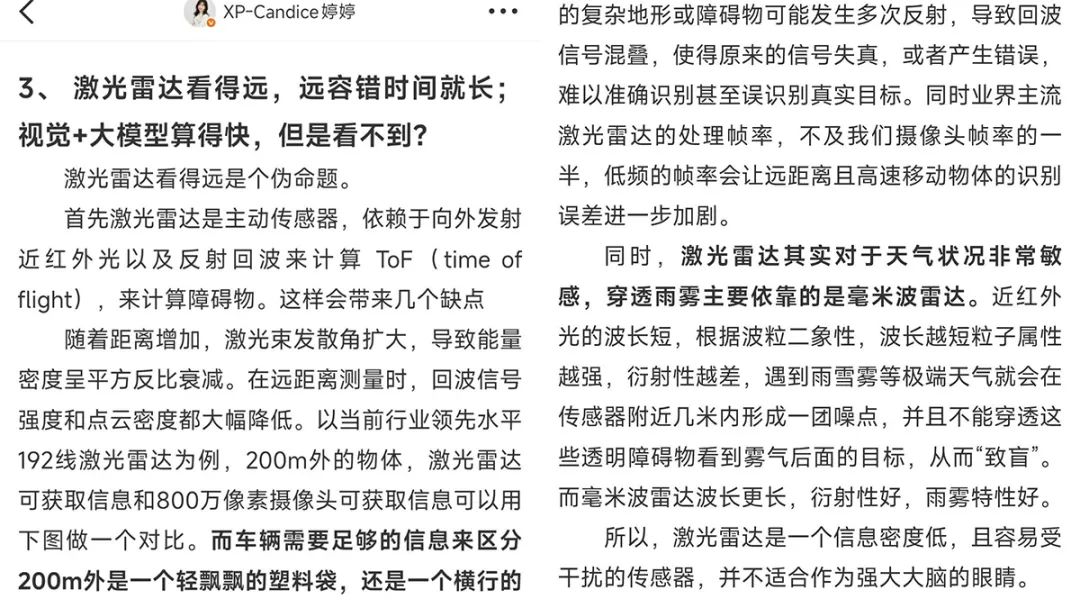

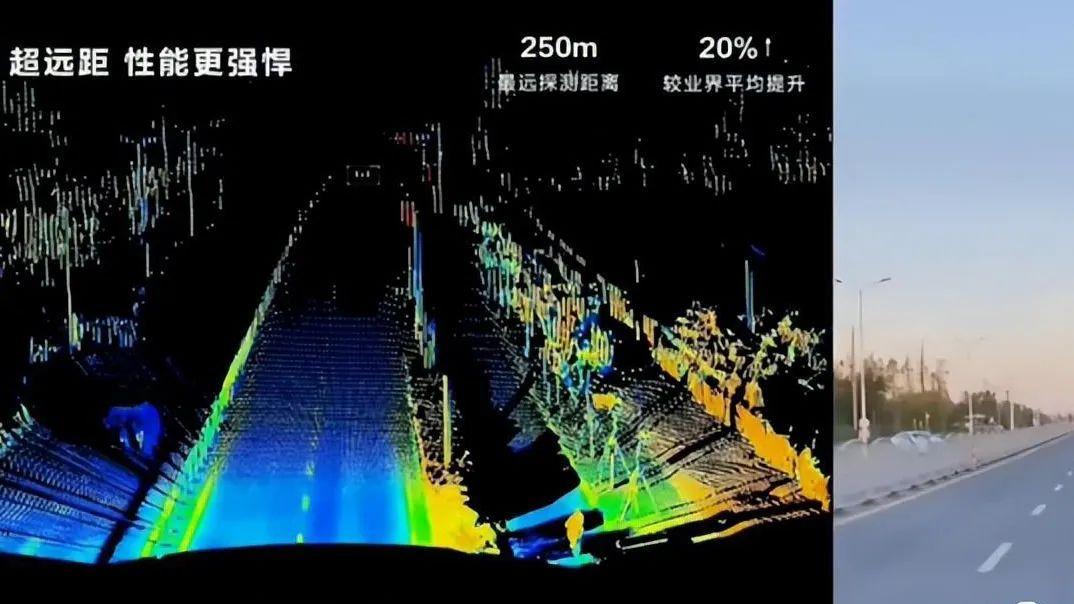

With these changes, car companies focusing on pure vision technology have embarked on a new round of public opinion battles. Yuan Tingting, Senior Director of Autonomous Driving Products at XPeng Motors, publicly refuted on social media that "LiDAR's ability to see far is a false proposition." She listed extreme scenarios where LiDAR technology falls short, such as decreased ability to distinguish between plastic bags and hazardous objects beyond 200 meters or inadequacies in rainy or foggy weather.

Her most significant statement was, "XPeng Motors' shift to a pure vision solution is not a 'technological downgrade' but an inevitable choice based on data accumulation and algorithmic breakthroughs." In this perception battle, no one has truly convinced the other. Each side highlights their technological strengths but avoids directly debating whether "pure vision" or "pure vision + LiDAR" is superior.

Technological Differences Are Subtle, but LiDAR Players Have Changed Tactics

"If we only consider the technological upper limit, LiDAR is definitely better, but the current challenge for car companies developing intelligent driving systems lies in information complementarity," said engineer Wang Yong. In their circle, there's little discussion about the merits of pure vision versus LiDAR + pure vision.

In terms of technological upper limits, systems with LiDAR are superior. However, current intelligent driving assistance systems are primarily vision-based. The debate in the technology community revolves around which sensor's signals can better complement each other.

A simple example is when a vehicle is equipped with both cameras and LiDAR. If the information is consistent, there's no issue. But if it's inconsistent, which data should be trusted—LiDAR's or the camera's? The mainstream technical school of thought aligns, with pure vision as the primary decision-making entity and LiDAR assisting with blind spot detection. However, these statements are both true and not true.

They are true in that each statement has its merits, and it's challenging to determine the other is wrong. They are not true because current intelligent driving assistance systems have nothing to do with autonomous driving. In the event of an accident, human drivers bear full responsibility. Although car companies offer various intelligent driving insurance policies, they are either supplementary after using compulsory traffic insurance and third-party liability insurance, or the recognized terms and conditions are harsh.

The technological debate between pure vision and LiDAR has persisted since 2022, initially settled in 2024. The deciding factor wasn't technological superiority but which technology's price reduction exceeded consumer expectations, leading to rapid sales momentum. Once this momentum forms, other car companies feel compelled to follow suit to avoid consumers perceiving a lack of novelty. In fact, car companies now heavily utilizing LiDAR have already shifted their approach. They are gradually steering away from the unanswerable debate about which intelligent driving assistance is better. The new focus is on who can stop their cars earlier, making car companies specializing in pure vision technology the passive party.

Tesla, focusing on pure vision, is currently under attack from all angles, from technology to marketing. In April 2025, Tesla sold 58,400 electric vehicles, including sales in China and exports to other markets. Tesla China sold 28,700 vehicles, a year-on-year decline of 8.6%. As more similar and priced new models undergo rapid technological upgrades and iterations, Tesla, with minimal changes, struggles to retain potential buyers holding onto their money. Additionally, while FSD has been tested in China and received praise from testers, it has fallen into a strange cycle regarding intelligent driving.

"In stores now, sales consultants have already changed their scripts for cars equipped with LiDAR," said Wang Yong. As Wang Yong's team develops new technologies like end-to-end and large models, the latest shift is in thinking. The competition is no longer about who can get closer to autonomous driving but who can reduce car accidents more. For instance, automatic avoidance when the intelligent driving system detects an impending collision or the long-debated AEB, which now focuses not only on braking early to avoid hitting objects in front but also on dangerous vehicles behind and to the side to prevent accidents. Ideal, Huawei HarmonyOS Intelligent Drive, and NIO are pioneers in conveying this technology to consumers. The first two have already started adjusting their scripts, no longer talking about end-to-end, parking space to parking space, etc., but guiding users towards the topic of "our system is less likely to cause collisions." For example, after the media test drive of the new car, Ideal continued to intensify public testing.

The Li Xiang L6 Pro version equipped with LiDAR tested its front and rear collision prevention functions. For instance, at 120 km/h, the AEB can perform emergency braking. When an obstacle appears in front of the vehicle at 120 km/h and the vehicle cannot stop, the AES will perform emergency avoidance. Another example is the LCC-assisted driving emergency avoidance of construction occupying the road at 120 km/h. There's even a simulation of the vehicle reversing towards an obstacle when the accelerator is mistakenly pressed, with the R-MAI rearward misacceleration suppression. Huawei HarmonyOS Intelligent Drive also shifted its focus during the Shanghai Auto Show in April. Since then, its communication theme has shifted to "constantly emphasizing safety." As the industry understands its technology, phrases like "can be driven nationwide and becomes easier to drive" are less frequent. NIO follows a similar trajectory, releasing the latest cases and data of AES automatic emergency avoidance every Tuesday, essentially emphasizing safety.

Written at the end

Essentially, the current landscape indicates that LiDAR players are gradually shifting lanes in their competitive endeavors. The aggressive push for "intelligent driving for all" was halted by new requirements in April, rendering the previous model—focusing on superior takeover and completion rates of intelligent driving assistance—significantly less meaningful. Consequently, consumers are adjusting their purchase decisions based on the evolving situation. Notably, major automakers have successively held press conferences emphasizing safety. For instance, Chery's safety night event led to a notable surge in consumer attention. Similarly, Great Wall Motors and Geely Auto have promoted their Gaoshan and Boyue L models, respectively. Great Wall Motors boasts that its "intelligent driving assistance system offers early warning and active avoidance in various complex road conditions," while Geely Auto claims that "Boyue L is the safest fuel SUV." As the hype around intelligent driving subsides, the current competition shifts from who is more radical or bold to a refocused emphasis on safety. Thus, it becomes evident why pure vision-based solutions are being overshadowed by LiDAR-related solutions in today's context.