Zotye Auto: A Cautionary Tale

![]() 05/28 2025

05/28 2025

![]() 760

760

Introduction

Internet-famous automakers without core technology are destined for a short-lived success.

Recently, Zotye Auto found itself in the spotlight following a warning letter from the Zhejiang Regulatory Bureau of the China Securities Regulatory Commission (CSRC).

The decision highlights that on January 15, 2025, Zotye Auto issued the "Announcement on Correction of Previous Accounting Errors and Retroactive Adjustments," revising financial data disclosed in relevant periodic reports for the first half of 2021-2024. These corrections reflect inaccuracies in the company's previously disclosed financial information.

The Zhejiang Regulatory Bureau stated that Zotye Auto's actions violate Article 3 of the "Measures for the Administration of Information Disclosure by Listed Companies" (CSRC Order No. 182), and seven individuals, including Chairman Hu Zeyu, violated Articles 4 and 51 of the same measures, bearing primary responsibility for the violations.

From creating a sales myth of its own brand to being warned by the CSRC, this automaker, once boasting annual sales of 330,000 vehicles, is now exposed for inaccurate financial data. In 2024, it set a dismal industry record with annual sales of only 14 vehicles, halted production lines, and incurred losses of 1 billion yuan. Zotye Auto finds itself in an extremely precarious situation.

Furthermore, transitioning from a topic brand known for its imitation label to a problematic sample in the capital market, Zotye Auto's collapse serves as a warning for the development of China's automotive industry – internet-famous automakers without core technology will eventually falter. Only by embracing long-termism and building systematic capabilities can they remain resilient amidst industrial changes.

01 Behind the Drastic Decline

Examining Zotye's development history, its rise and fall can be described as a textbook case in the industry.

As a former dark horse in the Chinese auto market, Zotye achieved remarkable success with its unique market strategy and product positioning. At its peak, it operated nine production bases with a designed capacity of 685,000 vehicles and nurtured multiple sub-brands such as Hanteng and Junma. Notably, in 2016, Zotye sold 333,100 vehicles, ranking ninth among independent brands with a year-on-year increase of 50%. That same year, it achieved a valuation of 11.6 billion yuan through the acquisition of Jinma Corporation for backdoor listing, and its peak market value surpassed 30 billion yuan.

During this period, the company continuously launched popular models, sparking heated market discussions. For instance, the T600 (imitating Audi Q5) launched in 2013 exceeded annual sales of 120,000 units, ranking among the top ten SUVs in China. The SR9 (imitating Porsche Macan) launched in 2016 was an even more phenomenal product, with orders exceeding 20,000 within three days of its launch, earning it the nickname "Boxster".

Among them, the Zotye SR9, with its design resembling the Porsche Macan, even garnered the attention of Porsche's CEO.

Admittedly, models like the Zotye SR9 did capture the attention of many consumers with their appealing designs, but beneath the surface lay quality issues. From steering wheels falling off to engine oil leaks, from leaking sunroofs to reduced range, quality issues emerged endlessly, severely damaging the brand image and deterring many potential car owners.

Since 2018, with the frequent occurrence of quality issues, the lack of compliant models post-implementation of the National VI emission standards, and the withdrawal of subsidies, Zotye's sales plummeted, even falling into a crisis of production suspension and bankruptcy reorganization. During this period, Jiangsu Sunshine Holding acquired Zotye for 2 billion yuan and promoted the resumption of production of models such as the T300. However, its strategy of relying on imitation and neglecting core technology research and development laid hidden dangers, rendering Zotye's competitiveness non-existent until its production volume fell to zero in 2024, with only 14 vehicles sold throughout the year.

Behind the dismal sales figures lie the harsh realities of idle production lines and the collapse of the dealer system. Even more ironically, while sales fell to zero, 336 inventory vehicles were still piled up in the factory area, indicating that its products had completely lost market competitiveness.

Additionally, the announcement of corrections to accounting errors disclosed by regulators also revealed the tip of the iceberg of Zotye Auto's data inflation.

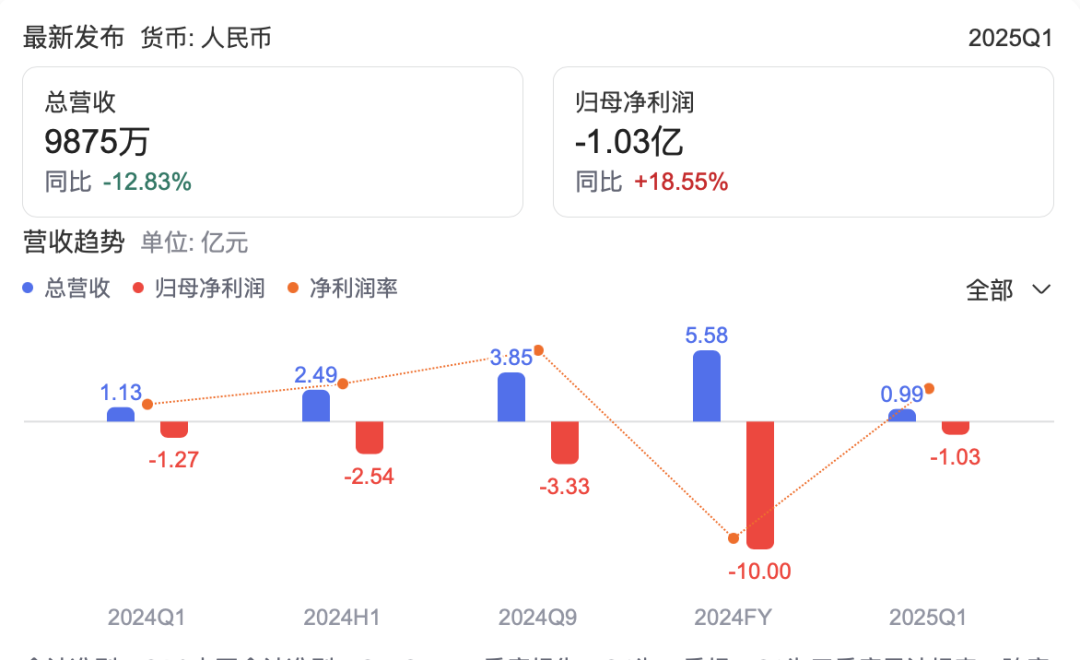

In April this year, Zotye's 2024 performance report showed that in 2024, Zotye Auto's operating revenue was 558 million yuan, a year-on-year decrease of 23.96%; the net profit attributable to shareholders of listed companies was -1 billion yuan, an increase in losses of 6.82%; and the non-recurring net profit attributable to shareholders of listed companies was -1.469 billion yuan, an increase in losses of 49.28%.

Regarding the performance loss, Zotye pointed out that the main reason was the company's vehicle business still being in the recovery stage, coupled with the impact of the external environment, resulting in low vehicle production and sales volume and low total sales revenue during the reporting period. However, according to the disclosure of the Zhejiang Regulatory Bureau, some financial data of Zotye from 2021 to 2024 were untrue, reflecting the loss of control in corporate governance.

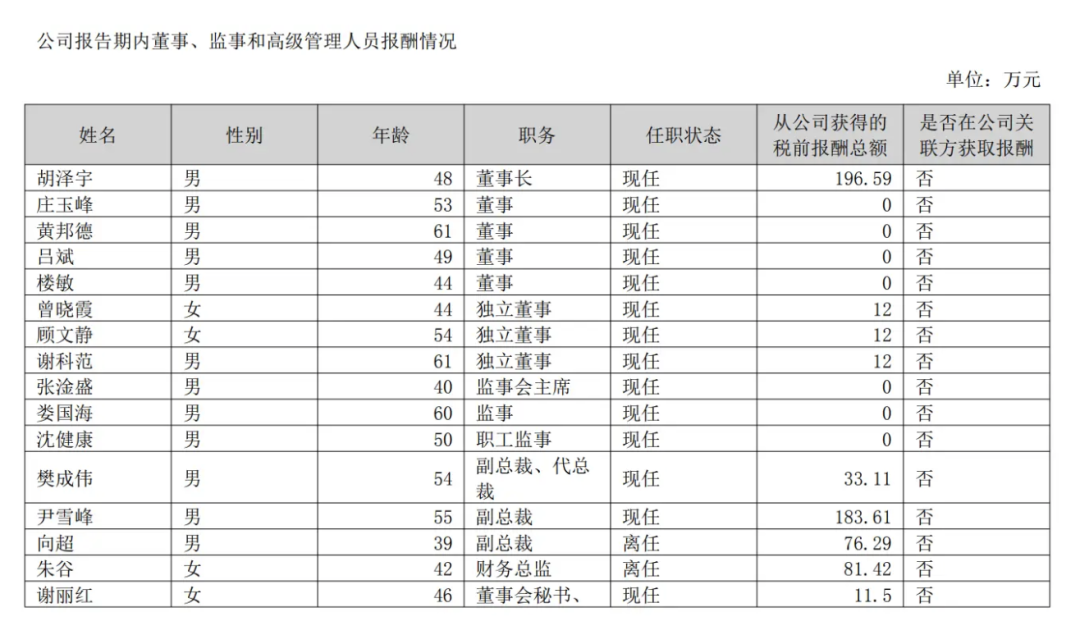

Meanwhile, against the backdrop of revenue falling to 558 million yuan year-on-year and net losses expanding to 1 billion yuan, the company's 16 directors, supervisors, and senior management personnel received a total remuneration of 9.5491 million yuan. This phenomenon of "losing the company but not the executives, letting others suffer while enriching oneself" exposes the governance black hole of insider control and imbalance of power and responsibility.

02 The Lessons of Zotye

On the surface, Zotye's collapse began with the auto market's cold winter in 2018, the withdrawal of subsidies, and the advent of the new National VI emission standards. However, the root cause lies in the fatal flaws of the "tape measure car-making" model.

Known for its "tape measure department," Zotye quickly occupied the third- and fourth-tier markets by imitating luxury car designs (such as Porsche Macan, Audi Q5, etc.), achieving sales of 330,000 vehicles in 2016 and a market value of over 30 billion yuan. However, long-term reliance on imitation solidified the brand image as a low-end imitator, and consumers lost trust in its original creativity.

During this period, core components such as engines and transmissions were long-term dependent on outsourcing. From 2016 to 2018, research and development expenses accounted for only 0.8%, far below the industry average, hardly supporting technological iteration. Consequently, when the National VI emission standards were implemented in 2018, Zotye had no compliant engines available.

At the same time, the market dividends obtained through imitation in the early stages transformed into negative assets for the brand as consumers matured. According to complaint data from third-party platforms, the complaint rate of quality issues with Zotye models has long ranked among the top in the industry. Problems such as SR9 transmission failures, T700 steering wheel lockups, and sunroof leaks occurred frequently, leading to a surge in consumer complaints and a rapid deterioration of brand reputation.

Under the influence of declining sales and collapsing brand trust, Zotye's after-sales system began to crumble. The phenomenon of dealers collectively safeguarding their rights due to losses exceeding 10 million yuan emerged endlessly, with a large number of 4S stores closing down. Car owners had to wait half a year for repair parts, and user trust was completely destroyed.

Moreover, the sharp decline in sales also highlighted the aftermath of overcapacity resulting from its blind expansion.

Zotye's nine production bases had a designed capacity of 685,000 vehicles, but actual sales were insufficient, leading to extremely low capacity utilization and tight capital chains. Coupled with the exodus of senior executives resulting in chaotic internal decision-making and frequent changes in strategic direction, as well as being backfired by capital operations and falsification of financial data, Zotye's crisis was exacerbated.

As one of the pioneers of domestic new energy vehicles, Zotye launched its first pure electric vehicle, the 2008 EV, as early as 2008. In the early stages, it relied on government subsidies to launch low-quality electric vehicles such as the Yun 100 with a range of 80km, but quickly exited the market after subsidies were withdrawn. Subsequently, during the critical period of the industry's transition to electrification from 2018 to 2020, Zotye's strategic transformation was sluggish, missing the window of opportunity for transformation.

In summary, Zotye's decline in 2018 was the cumulative result of long-term reliance on imitation, neglect of core technology, loss of product quality control, and strategic errors, ultimately leading to its elimination during the industry transformation. At the same time, Zotye's failure is also a typical case of the collapse of the "copycat model" in the automotive industry, revealing the underlying laws governing China's automotive industry.

First, innovation is a crucial moat for enterprises. Data shows that automakers with R&D investment exceeding 5% have an average profit rate of about 8%, while copycat automakers generally suffer losses. It is evident that in the era of intelligent electrification, the depth of technological accumulation determines an enterprise's survival.

Simultaneously, financial health determines an enterprise's endurance. Zotye's asset-liability ratio has consistently been higher than 85% since 2018, far exceeding the industry warning line of 60%. In the first quarter of this year, Zotye's total assets were 3.505 billion yuan, and its total liabilities were 3.368 billion yuan, with an asset-liability ratio of 96.10%. The tight capital chain has prevented the enterprise from continuously investing in research and development, leading to insufficient market competitiveness.

Currently, China's automotive industry stands at a critical juncture of intelligent transformation. Zotye's lesson underscores a truth for the market: internet-famous automakers without core technology are destined for a short-lived success. Only by embracing long-termism and building systematic capabilities can they remain invincible amidst industrial changes.

For those enterprises still hesitant on the path of imitation shortcuts, Zotye's current plight serves as a cautionary tale of their potential future.

Editor-in-Charge: Cui Liwen Editor: He Zengrong