Expanding the Automotive 'Circle of Friends': Xiaomi Charts Its Own Course

![]() 06/13 2025

06/13 2025

![]() 531

531

On June 12, netizens stumbled upon a meeting between Lei Jun, CEO of Xiaomi, and Xu Zhijun, Huawei's rotating chairman. The same day, at GAC Toyota's Technology Day, Huawei and Xiaomi made a 'century-long frame' together. GAC Toyota announced an in-depth collaboration with local technology giants such as Huawei, Xiaomi, and Momenta, integrating their technologies into its new models, including Momenta's assisted driving, Huawei's HarmonyOS cabin system, Huawei's DriveONE motor, Xingshan car keys, HiCar 5.0, and Xiaomi's ecosystem.

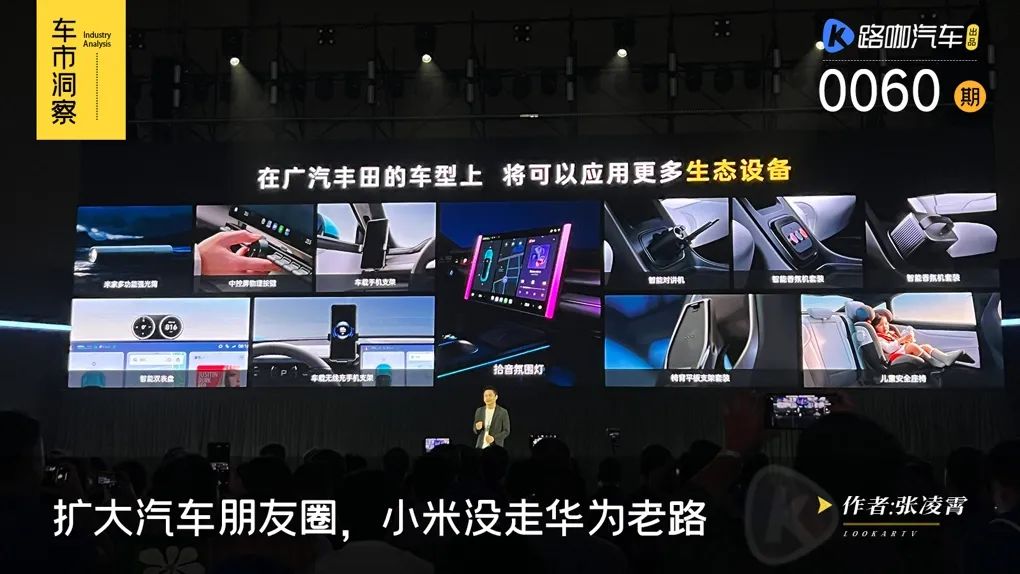

The GAC Toyota Bozhi 7, unveiled at this year's Shanghai Auto Show, is the first vehicle to be integrated into Xiaomi's ecosystem. By unifying the hardware interface, it will be compatible with all Xiaomi in-car devices, including aroma diffusers, tablet holders, ambient lights, smart dials, etc., and can connect to the Mijia APP...

A year ago, Lei Jun led a team to visit NIO, where he suggested to Li Bin that 'making a rear screen is expensive and should have a unified standard.' This is not the first time Lei Jun has discussed the unification of the in-car ecosystem. Earlier at the Beijing Auto Show, he made a similar suggestion to BYD's Wang Chuanfu.

What the two 'Juns' discussed remains unknown, but the scenario of Huawei and Xiaomi appearing in the same automaker's 'circle of friends' may become more common in the future.

Xiaomi's Auto Journey Diverges from Huawei's Path

Bozhi 7 becomes the third model to be integrated into Xiaomi's ecosystem, following Xiaomi's SU7 and YU7, and the first outside the Xiaomi brand.

Beyond Toyota, who else will allow Xiaomi and Huawei to coexist in the same frame?

At GAC Toyota's Technology Day, the company announced that Bozhi 7 will not only be the first joint venture automaker to feature the HarmonyOS cabin system but will also utilize Huawei's DriveONE motor on the same technical platform as the AITO M9.

The HarmonyOS cabin HarmonySpace 5.0 system to be equipped on Bozhi 7 has recently been integrated into new cars such as Haval H6S and SL03.

This collaboration represents a microcosm of Huawei's automaker partnership strategies, which include the Tier 0 model of Smart Selection Car - HarmonyOS Smart Travel, the Tier 1 model where Huawei supplies standard components like motors, modules, and lidar to OEMs as a parts supplier, and the Tier 0.5 model where Huawei provides a comprehensive smart car solution, deeply involved in everything from R&D to software and hardware integration.

The Tier 0 model has the most limited resources. Yu Chengdong recently admitted at the Future Pioneer Conference that resources are finite, and there will likely not be new 'sectors' beyond the current 'five sectors.'

Under these three models, Huawei's automotive 'circle of friends' can encompass almost all OEMs, ultimately converging into Huawei's automotive ecosystem.

Similarly, in terms of cross-border automotive ventures, Xiaomi does not intend to replicate Huawei's path. In addition to manufacturing cars under its own brand, Xiaomi is exploring a new business model as an ecosystem service provider in the automotive industry.

At the launch event, GAC Toyota announced that Bozhi 7 will incorporate Xiaomi's pad series, in-car audio, intercom, and other devices into the new car through a unified interface, enabling the front camera of the rear pad to be accessed via the central control screen. Additionally, other accessories can be universally compatible with Xiaomi, allowing users to freely choose and install them.

During the conference, Xiaomi executives demonstrated that by connecting Bozhi 7 to the Mijia APP, users can view home scenes through the camera. Whether more scenarios will be introduced in the future remains to be seen. Although the collaboration between Bozhi 7 and Xiaomi is still a step away from Xiaomi's true 'people-car-home' ecosystem, leveraging Xiaomi's unique advantages, as more automakers are integrated, Xiaomi will be poised to achieve a closed-loop business model.

The Ambitions of 'Xiaomi and Others' Extend Beyond One Automaker

Whether Xiaomi can replicate its collaboration model with GAC Toyota to other automakers hinges on the success of Bozhi 7. As a direct competitor to Xiaomi's SU7 and BYD's Han, Bozhi 7 is likely to have a different starting price, potentially positioning it within the RMB 200,000 range.

Earlier this year, GAC Toyota's Bozhi 3X quickly gained popularity with its advanced assisted driving system at the RMB 100,000 price point, delivering nearly 20,000 units in just three months after its launch, setting a record for the delivery speed of joint venture pure electric vehicles. Not long ago, FAW-Toyota released the pure electric SUV bZ5, led by the Chinese team, with a starting price of RMB 129,800, aiming to turn the tide. Then there's Nissan's N7, priced under RMB 150,000, with sales exceeding that of Xpeng's P7... In summary, joint venture automakers have recognized the significant market impact of fully loaded hardware and appropriate pricing.

Therefore, Bozhi 7, which continues the strategy of Bozhi 3X, is still expected to make a splash in the RMB 200,000 market. As the pioneer, how much will GAC Toyota's introduction of Xiaomi's ecosystem bolster the new car?

In fact, breaking through the connection from mobile phones to cars is not just a Huawei and Xiaomi endeavor but is also being pursued by automakers. The same applies to Geely and NIO's foray into the mobile phone business. Whatever users utilize has the potential to be integrated into cars, and mobile phone manufacturers have a natural advantage. Xiaomi's advantage lies in the fact that even if users do not use Xiaomi mobile phones, they can still interconnect with other devices in Xiaomi's ecosystem through the Mijia APP. Earlier this year, Lei Jun publicly stated that Xiaomi's AIoT platform has connected over 900 million devices.

At the EV100 Forum in March this year, Lei Jun emphasized in his speech that Xiaomi has reached an agreement with multiple automakers to share hardware ecosystem products, including smart aroma diffusers, in-car intercoms, smart dials, etc., and called on the industry to 'unify interface standards.' Therefore, Xiaomi's ambitions in the automotive industry are certainly not limited to just one car like Bozhi 7 or one company like GAC Toyota. At the same time, the extent to which Xiaomi's ecosystem is open to automakers will not be confined to hardware such as aroma diffusers and pads.

Some netizens joked, 'Will we have to check compatibility with Xiaomi's ecosystem when buying a car in the future?' While Lei Jun has publicly emphasized that sharing resources is for the mutual benefit of the industry, not for monopolization, there are still voices of doubt, claiming that Xiaomi may use its ecological advantage to form a 'software and hardware binding' and curtail automakers' discourse power. Just as when Huawei entered the automotive industry, traditional automakers mostly had doubts and suspicions, but now most of them have actively joined Huawei's 'circle of friends.' In the face of sales, the so-called 'soul' and 'discourse power' can take a back seat.

Whether to allow mobile phone manufacturers' ecosystems to be integrated into cars is just one aspect of OEMs' cooperation intentions. Essentially, it is driven by consumer demand. Whether it's Xiaomi, Huawei, OPPO, or others, when consumers are not in the car, mobile phones are the best platform to continue engaging with them. This trend is inevitable; it's just a matter of who takes the lead in integration and promotion. When Huawei dominates this sector through the Smart Selection Car model, the rest can be Xiaomi's blue ocean.