Tesla FSD Price Cut: Final Window of Opportunity Approaches

![]() 06/23 2025

06/23 2025

![]() 688

688

The fiercest competition since the advent of the automobile has already commenced.

In 2025, Musk is confronted with a novel scenario that has not emerged for many years. Historically, stock prices would surge upon the unveiling of a new car or technology, followed by a decline, and ultimately a rebound. However, Tesla's stock price began to decline three days prior to the launch and was forcibly stabilized afterward.

The reasons are multifaceted: Firstly, a Model 3 equipped with FSD got stuck on a train track and subsequently experienced a minor collision. Secondly, there is skepticism regarding the potential launch of autonomous driving, including a confirmed 10-day delay in the release of autonomous vehicles, with the reasons undisclosed, leading some to speculate technical issues. Thirdly, reports indicate that the Austin factory will halt production for a week, which Tesla attributed to maintenance downtime. Nonetheless, this coincides suspiciously with the launch timing of autonomous taxis, fostering speculations. Lastly, there is capital anxiety stemming from the Iran-Israel conflict.

Following the previous "those who understand, understand" scenario, Tesla's stock price plummeted to levels last seen three years ago. Now, its counterattack sentiment is palpable. The large-scale deployment of autonomous vehicles is also highly valued by the global automotive industry, as a successful endeavor by Musk could potentially rewrite the automotive development model.

Tesla's Technological Battle: Autonomous Driving More Achievable than FSD

Describing Musk's current situation with the phrase "bittersweet" is apt. The good news is that commercial projects can finally be trialed and implemented, but the challenge lies in the new path presenting fresh obstacles, and with Chinese competitors, victory is far from guaranteed.

Surprisingly, with the implementation of commercial projects, technical difficulty has become a secondary issue.

On June 22, 2025, Musk's first batch of autonomous driving models finally hit the market. Prior to the release, there were several setbacks, as the trademark registrations for Cybercab and Robotaxi were rejected due to the presence of too many similar technologies from rival companies. Fortunately, the trademark registration for Tesla FSD holds promise.

As Tesla's preheating campaign commenced, the local area was the first to respond practically. Someone publicly tested a Model Y with FSD and found that it could not comply with regulations, such as stopping for school buses and failing all dummy tests in all simulated ghost probe scenarios. However, this did not cause an uproar because Tesla has clearly stated in its product manual that it still cannot fully ensure accurate handling of all school bus-related scenarios.

Essentially, there is a marked difference between a Model Y equipped with FSD and an autonomous taxi using FSD.

In terms of technological trends, Musk initiated his counterattack with reinforced logic during the preheating period before the release. On June 16, he released a video stating that road systems worldwide are designed for intelligence, neural networks, and eyes, not for lasers emitted from eyes. This is not the first time Musk has mocked LiDAR, emphasizing Tesla's pure vision advantage. Additionally, he retweeted news that Tesla is the sales champion of pure electric vehicles in the Chinese market from January to May this year, maintaining its lead.

This aligns well with the laws of communication and poses no apparent issues. However, considering Musk's behavior in 2023, when he was at the pinnacle of being the world's richest man, his remarks were equally assertive, such as stating that Mars is part of the United States and that Tesla is the safest car in the world.

Returning to the technology itself, Tesla's logic remains consistent: inject massive amounts of data, observe the road using human eye patterns, and navigate using human brain patterns. As long as the computation is sufficiently powerful, autonomous driving can be achieved. The market consensus is that in the U.S. market, Tesla has no direct competitors and only needs to gradually expand its relevant technology vehicles beyond California. If it fails to progress in other U.S. states, it will turn to overseas markets.

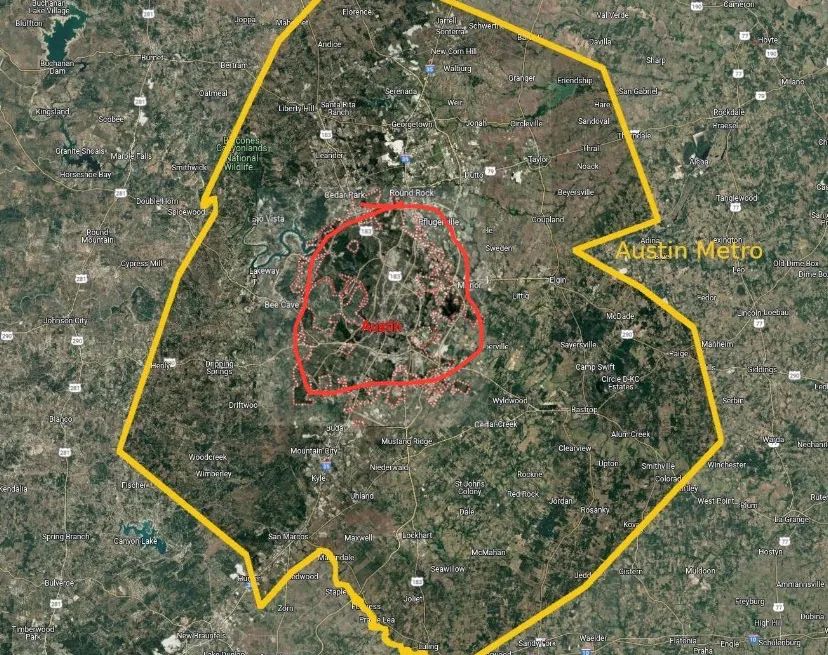

Technologically, Tesla's autonomous driving excels in usable range, manufacturing costs, and accident rates. From the perspective of autonomous driving's usable area, the once world-leading Waymo is no match for Tesla. For instance, in terms of operational areas, Waymo only operates in central areas, while Tesla covers a broader area. In terms of specific experience, although large-scale production for users will not officially commence until June 28, tech enthusiasts and media have already compared Waymo and FSD on Model Y, and the outcome is evident.

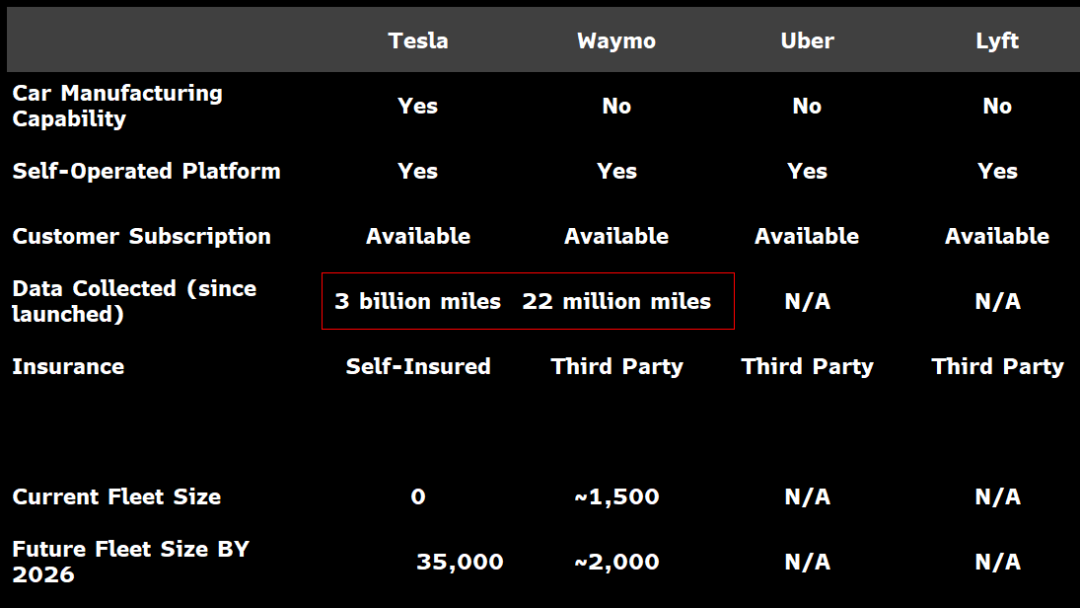

On June 16, Musk also retweeted news about the technological competition between Waymo and FSD. The key information point is the accident rate per million miles of autonomous driving, which is 0.15 for Tesla, 1.16 for Waymo, and 3.90 for the U.S. average. Tesla's current safety factor is 26 times the U.S. average.

In terms of manufacturing costs, it is also significantly lower than Waymo's model and is currently the closest to mass production. Regarding technical details and credibility, there are also new verifications. In terms of technical details, within days of its launch in China, FSD received widespread praise, and the same is true in the United States. Based solely on FSD on Model Y, the conclusion is already that it outperforms Waymo during driving. For example, on the same road segment, FSD arrives earlier than Waymo. In left and right turn scenarios, Waymo has a longer waiting time, while FSD, once it detects available time and space, moves like an experienced driver.

Even before June 22, someone had already captured a video of a person sleeping in the passenger seat while the driver's seat was unmanned. In other words, while many question and oppose it, there is also a high percentage of people interested in it. As long as it can continuously dispel doubts and attract the attention of new users, it will be easier to break through the circle of autonomous driving. After all, this is one of the turning points in automotive history.

FSD Price Reduction: The Final Window Period Opens

The reality is that nowadays, when Musk or Tesla claims to be the world's number one, it is indeed a fact.

However, how long such an advantage can be sustained and whether it can remain a magic weapon for Musk to overcome the current dilemma remains a significant question mark.

Still from a technical perspective, Tesla's autonomous taxi has a relatively vague positioning, neither conforming to traditional L3 nor L4 definitions.

Although there is indeed no one in the car to drive or supervise, the vehicle is still remotely supervised by humans who can take over, which is logically consistent with the unmanned driving and unmanned chauffeur functions developed by Baidu. Moreover, as more vehicles are deployed, Tesla also needs to increase its remote supervision staff.

Currently, Musk's solution is scheduled for the second half of 2025, assuming there are no delays. Musk believes that the existing HW4.0 and AI4 chips are insufficient, so he announced AI5 as early as 2024. There are varying claims about the chip's peak computing power, one being above 2000 TOPS, and another being more than 10 times that of the AI4 chip, exceeding 7000 TOPS.

This is still logically sound, but the final conclusion depends on the actual product, as delays are not uncommon in Tesla's development history.

Moreover, technology needs to be applied practically to achieve commercialization and closure. The challenges facing Tesla are substantial. Firstly, in the United States, the previous promotion of FSD has encountered numerous obstacles, with the NTHSA conducting multiple investigations, and unsupervised FSD will be even more cumbersome.

Except for a very few countries, such as Norway, which recently approved Tesla's testing for two years, the universal understanding and choice is to initially adopt supervised L3 autonomous driving. After achieving sufficient performance, it will be upgraded from quantitative to qualitative change to L4 autonomous driving.

In other words, even if Tesla's current technology is sufficiently advanced, it still needs a potentially long time to resolve the deep conflicts in its underlying logic.

Because the collective choice of Chinese automakers, who can compete head-to-head with Tesla globally, is to first explore L3 autonomous driving. Currently, about 10 Chinese companies have made official announcements, and those that can achieve L3 by 2025 include:

1. GAC Group announced that it will mass-produce and market the country's first L3 autonomous driving passenger car in the fourth quarter of 2025.

2. The L3 autonomous driving technology architecture for the Zeekr 9X is expected to have mass production vehicle delivery capability by the end of 2025.

3. Xpeng's description is more specific, announcing that it will bring an L3 experience in the second half of 2025, directly stating the experience.

4. IM Motors also announced L3.

5. Huawei's Kunlun Intelligent Driving will swiftly enter the market with the launch of the Zenith S800.

Currently, it is unnecessary to delve too deeply into technical topics because the most crucial aspect is the stage of demystification and perception change. Obviously, in this regard, Tesla's current autonomous taxi does not hold any advantage.

Tesla's model is to conduct trials on a very small scale and gradually expand thereafter. For instance, the current small batches are only available to those invited internally. In contrast, the L3 model of Chinese companies, with just a few thousand Zenith S800 owners, can obviously bring Chinese users to accept and recognize autonomous driving earlier.

The reality is that within the fastest half a year and the slowest one year, the business model of L3 autonomous driving will be fully operational in China. For Tesla, whether it can expand to more than 10 states in the United States within one year is uncertain.

So, the clichéd topic arises: how much core competitiveness will Tesla retain in the future. Recent spy shots have proven that Tesla will not counterattack based on the traditional automotive business model. For instance, the latest models are either a smaller version of the Model Y or seven-seaters installed in existing models, both signaling a lower-price route.

And then the clichéd topic also surfaces: when will Tesla's FSD, priced at RMB 64,000, truly arrive in China, and will it be discounted upon arrival? Of course, these two questions are not particularly critical. The question that needs to be answered now is, with Chinese companies rolling out L3 autonomous driving within half a year, how many people will still be willing to learn about and accept Tesla afterward.

Postscript

In fact, Tesla has several internal solutions, such as reducing the price of FSD. Many have calculated for Musk that since the marginal cost of software capability in the later stages is nearly zero, with a change in scale, FSD can swiftly become a killer feature.

For instance, the current price of RMB 64,000 is the unit price for one vehicle, but it can be equivalent if sold to three vehicles at RMB 20,000 each or to six vehicles at RMB 10,000 each.

Ultimately, it depends on how Tesla decides its attack rhythm in the Chinese market. It has numerous cards up its sleeve. For example, it can reduce the price of FSD and enter the market after L3 autonomous driving is universally recognized within one year; or, to boost a new round of sales, it can adjust the price within 2025 to drive its global performance data.

After all, the market conditions this year are vastly different from those Musk encountered before.