Product Monotony Makes It Increasingly Difficult for XGIMI Technology to Compete

![]() 05/17 2024

05/17 2024

![]() 510

510

This article is the 792nd original work of Shenqian atom

Having established a unique advantage, but unable to break through the dilemma of product monotony

Author: Meng Fanliao

Editor: Shenqian atom Studio

Against the backdrop of upgrading experiences, higher cost-effectiveness and younger designs have allowed XGIMI Technology to rapidly break through traditional projection limitations and gain the favor of young people. Later, by entering the household market, XGIMI Technology's market share grew rapidly.

Entering the household market has also transformed XGIMI Technology's competitors. Initially, through differentiated competition, XGIMI Technology's revenue grew year after year. However, due to factors such as concepts, prices, and venue restrictions, XGIMI Technology has been unable to approach the market scale of traditional televisions.

In the blink of an eye, the freshness of the projector market has passed, and the subsequent decline in sales has been severe, with China's household projector market declining by more than 20% in 2023. Undoubtedly, XGIMI Technology, as a market leader, cannot reverse the market trend. Both revenue and profits have declined in 2023 and the first quarter of 2024, and it is difficult to see a reversal trend.

Has XGIMI Technology lost its ability to make money?

On March 3, 2021, XGIMI Technology entered the stock market, leading many to mistakenly believe that this was the beginning of XGIMI Technology's ascension to deity status.

And for a while, that was indeed the case. In 2021 and 2022, XGIMI Technology's revenue exceeded 4 billion yuan, with a revenue growth rate of 42.78% in 2021. Even though this figure declined to 4.57% in 2022, it still maintained growth. XGIMI Technology's share price also soared from its issue price of 133 yuan per share to 883.78 yuan per share.

However, by 2023, XGIMI Technology experienced a significant revenue decline, with total revenue down 15.77% year-on-year to 3.557 billion yuan; net profit attributable to shareholders fell 75.97% to 121 million yuan. Entering 2024, the declining trend in XGIMI Technology's revenue and profit has remained unchanged. In the first quarter of 2024, XGIMI Technology's total revenue was 825 million yuan, down 6.59% year-on-year; net profit attributable to shareholders was 14.32 million yuan, down 72.57% year-on-year, marking the largest annual decline since 2017.

Faced with the reality that XGIMI Technology suddenly cannot make money, the capital market has also begun to view XGIMI Technology rationally. As of May 10, 2023, XGIMI Technology's share price has fallen to 102.27 yuan per share, not only breaking below the issue price but also suffering a significant decline compared to its historical high.

On the other hand, major shareholders have also begun to flee. On April 30, 2024, XGIMI Technology announced that its major shareholder, Baidu, will reduce its stake. Baidu directly and indirectly holds 7.27% of XGIMI Technology's shares through Baidu Netcom and Baidu Biwei. Baidu plans to reduce its stake through Baidu Biwei by no more than 0.34%, while Baidu Netcom plans to reduce its stake by no more than 2.66%.

Regarding the decline in performance, XGIMI Technology stated that due to factors such as the macroeconomic environment, the recovery of consumer demand in the domestic projection market has been slow, and product demand is facing staged pressure. The domestic market is currently the company's main source of income, and the decline in sales of the company's domestic projection products has led to a decline in the company's overall income.

AVC Cloud's full-channel push total data shows that in 2023, China's household smart projection retail volume decreased by 20.3% year-on-year; retail sales decreased by 33.2% year-on-year. Among them, household smart micro-projection decreased by 23.7% year-on-year; retail sales decreased by 38.4% year-on-year.

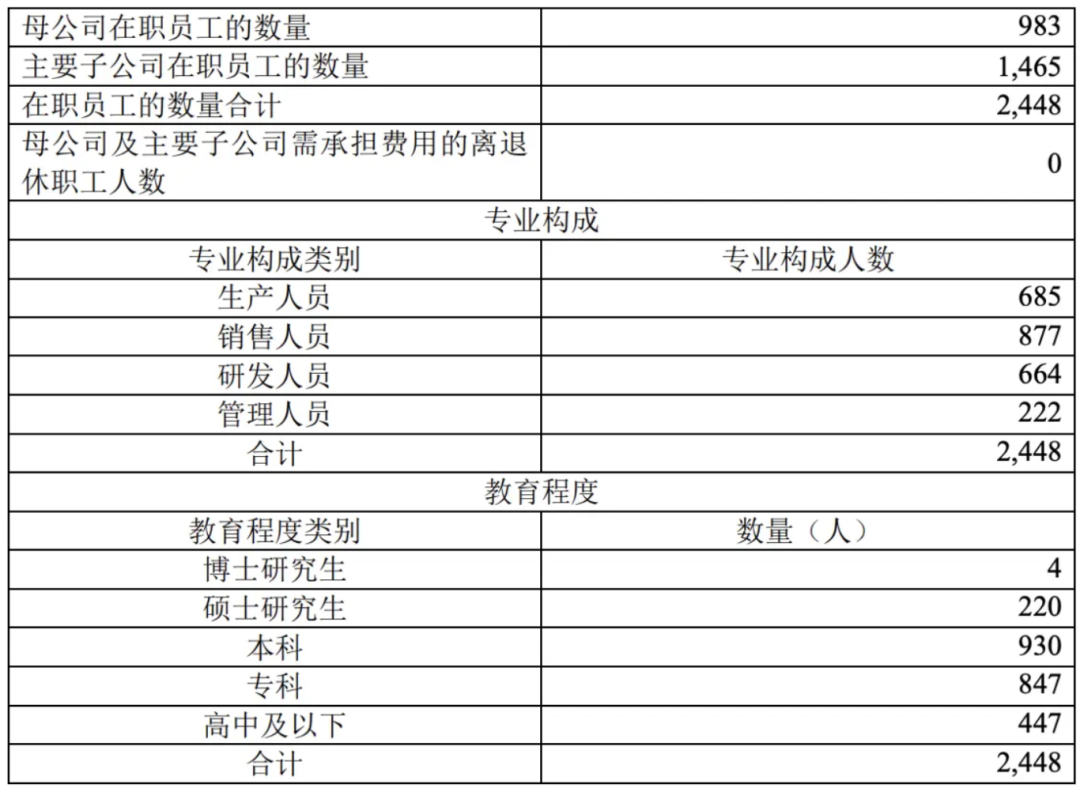

Of course, poor sales conversion rates are also an objective fact in the decline of XGIMI Technology's revenue. In 2023, XGIMI Technology's sales expenses were 644 million yuan, an increase of 7.81% year-on-year. In 2023, XGIMI Technology had a total of 2,448 employees, with the largest number being sales staff, reaching 877. Despite having both human resources and financial resources, total revenue has declined. Should XGIMI Technology optimize its sales strategy?

From a sales model perspective, online sales in 2023 were 2.509 billion yuan, a year-on-year decrease of 17.84%; offline sales were 1.019 billion yuan, a year-on-year decrease of 10.28%. For a company that relies more on online sales, the importance attached to sales staff may be less than that of companies that rely on offline sales.

This explains why the number of stock options granted to sales staff and the exercise price are the most stringent. While this behavior is understandable for a technology company, whether it will cause internal resistance among sales staff is unknown. If sales are defined as unimportant, why bind them through stock options?

The overseas market, it is still unknown when it will mature

According to IDC data, the top five brands in terms of annual shipment volume of projection equipment in 2018 were XGIMI, Epson, BenQ, Sony, and NEC, with domestic brand XGIMI becoming the first brand in annual shipment volume for the first time. However, XGIMI Technology still needs to continuously expand its influence overseas.

Since 2019, XGIMI Technology has begun to vigorously develop overseas markets. It has established overseas companies in the United States, Japan, Germany, Singapore, and other places, continuously expanding its overseas channels and deepening its global marketing network layout. In addition to mainstream online channels such as Amazon and Rakuten Japan, the company's products have entered major offline retail channels in Europe, the United States, Japan, and other regional markets. At the same time, the company has actively explored emerging regions such as Southeast Asia and the Middle East, and achieved shipments in some emerging regions in 2023.

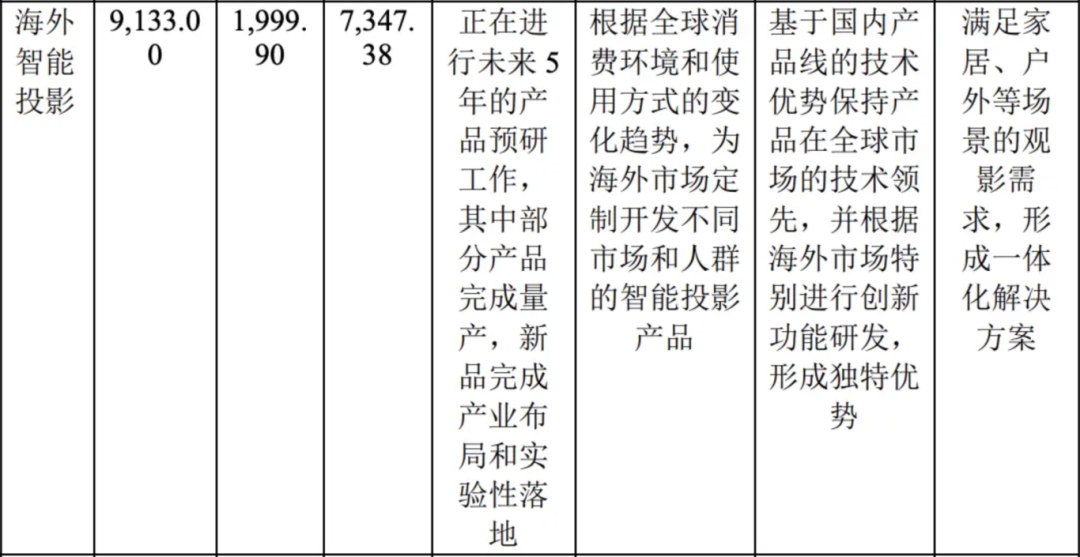

However, due to differences in political environments, economic policies, competitive landscapes, cultures, and consumption habits, the demand for projectors overseas is different. Financial reports show that in 2023, XGIMI Technology continued to invest 19.999 million yuan in developing smart projection products tailored to different markets and groups based on global consumption environments and usage trends, with a cumulative investment of 734.738 million yuan, but there is still a gap of nearly 20 million yuan from the expected investment. In 2023, XGIMI Technology's investment in household smart projection reached 160 million yuan, far exceeding that of overseas products.

In 2023, XGIMI Technology's overseas revenue was 912 million yuan, accounting for 25.6% of total revenue. Although the strategic importance of overseas markets is constantly emphasized, at least based on the actual investment and sales results in 2023, the importance of overseas product development is still not the highest. This means that the overseas market is still unlikely to reverse XGIMI Technology's declining revenue in the short term.

However, interestingly, overseas internet value-added services have been quite helpful to XGIMI Technology. In 2023, XGIMI Technology's internet value-added services generated revenue of 1.148 billion yuan, an increase of 53.1%, which is inseparable from overseas help.

Product monotony makes it increasingly difficult to compete

Focusing on the field of projectors, for XGIMI Technology, which started from scratch, it can better concentrate funds and resources on a few core products, allowing it to establish deep professional knowledge and technical accumulation in this field. However, as the company develops at this stage, the monotony of products limits its ability to expand into other fields.

Since 2023, XGIMI Technology's revenue decline is largely due to the shrinking projector market. Therefore, maintaining the diversity and flexibility of product lines is crucial for XGIMI Technology to adapt to technological changes.

From the retail volume structure of the online market segmented by price range, the proportion of low-end products has increased significantly, mainly products priced below 500 yuan. AVC Cloud's online monitoring data shows that the retail volume of products priced below 500 yuan accounts for 32.8%, an increase of 4.5 percentage points compared to last year, indicating a continuous reduction in the consumption threshold of the online market.

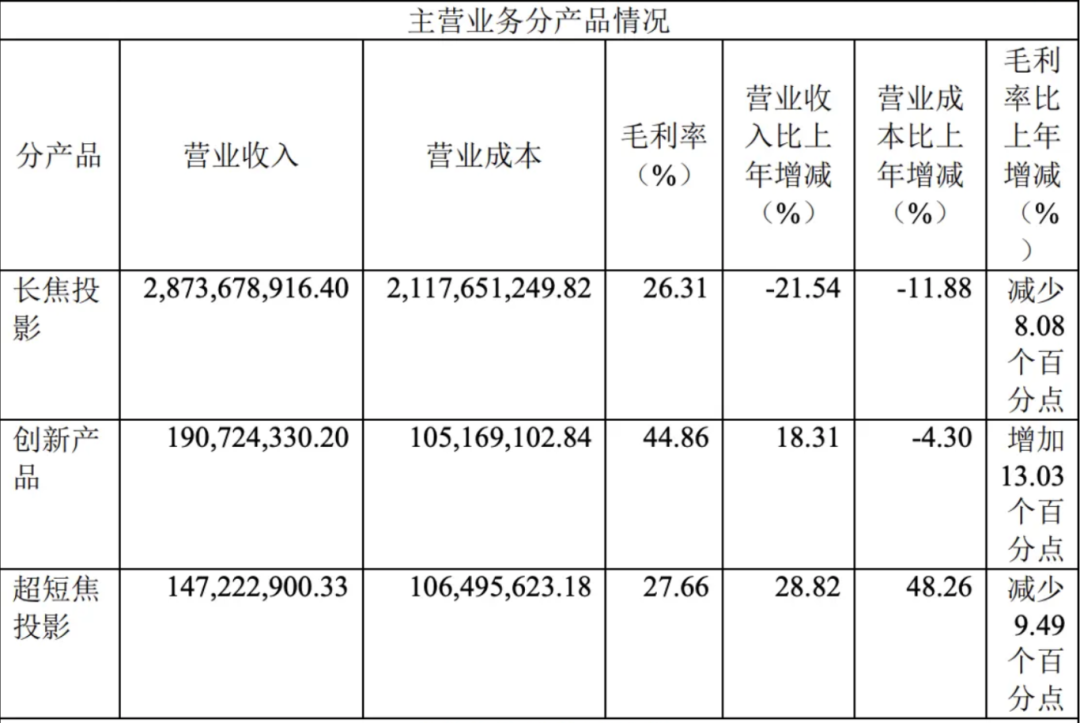

Facing market changes, XGIMI Technology's long-focus projection was affected by competition and price declines in 2023, resulting in a decline in both volume and price. Specifically, long-focus projection revenue accounted for a dominant position at 2.87 billion yuan, while ultra-short-focus projection product revenue was only 147 million yuan.

Of course, XGIMI Technology recognizes the drawbacks of product monotony. It has popularized long-focus projection, ultra-short-focus projection, and innovative products in its main products. In 2023, the production volume of innovative products was 50,955 units, an increase of 23.1% year-on-year; however, sales performance was not ideal, with only 39,689 units sold, an increase of 11.78%; inventory also reached 17,475 units, with a 181.45% inventory growth rate, much higher than the 60.57% growth rate of ultra-short-focus projection and the -20.88% decline of long-focus projection.

Continuously investing in R&D resources, expanding its product line through the development of new products or the acquisition of other companies, increasing market coverage, and reducing reliance on a single product is something that XGIMI Technology has been insisting on. From 2020 to 2023, the company's R&D investment was 139 million yuan, 263 million yuan, 377 million yuan, and 381 million yuan, respectively, showing continuous growth. However, from the results, innovative products have not been able to shoulder the heavy responsibility in the short term.

Launching different products or services for different markets or customer groups to increase revenue sources and reduce market risks is another path for XGIMI Technology to establish its competitiveness. In addition to its core business of projection equipment, XGIMI Technology has also expanded into two major businesses: accessory products and internet value-added services. However, the combined contribution to total revenue has not reached 10%.

It is worth noting that as a home entertainment center, XGIMI Technology's internet value-added services mainly include internet promotion services and revenue sharing from membership services. Revenue can be recognized based on the number of downloads and activations of third-party applications downloaded by users or after reconciliation with third parties based on agreed revenue sharing ratios. This revenue model, similar to that of smart TVs, may carry the same risks. If the number of XGIMI projectors increases, the label of "excessive charging" may be applied, potentially damaging the reputation that XGIMI Technology has painstakingly built.

In 2023, global TV shipments reached 196 million units, down only 3.5%. Although XGIMI Technology ranks first in the global household projection market, its market stability is still inferior to that of traditional televisions.

Through smart projection, XGIMI Technology has established a unique advantage, but it has been unable to break through the dilemma of product monotony. With the difficulties of innovation and the inability of other businesses to generate revenue, XGIMI Technology's path to compete with smart TVs may become increasingly difficult.