Bloodbath of Unmanned Delivery Vehicles in Double 11: The "Price Butcher" and "Efficiency Revolution" in the Logistics World. Are Couriers Being "Optimized" by Algorithms?

![]() 10/28 2025

10/28 2025

![]() 717

717

Introduction

At 4 a.m. in the Shunyi sorting center, ten white unmanned vehicles are automatically charging. They don't need rest, don't complain about overtime pay, and won't quit because of the Double 11 backlog.

These unmanned vehicles, costing around RMB 20,000 each, are replacing human couriers earning over RMB 100,000 annually.

"By introducing three unmanned vehicles, we can cover package transfers for five stations, delivering 5,000 orders daily and reducing delivery costs by over 50%," a courier franchisee bluntly stated. Behind him, three Bai Rhinoceros unmanned vehicles are automatically loading goods, preparing for a new day of delivery.

Capital is aggressively betting on this race to replace humans. Neolix just completed a D-round financing of RMB 4.27 billion, setting a record for the largest private financing in China's autonomous driving sector. And this is just the beginning.

I. Price Collapse: From Luxury to Affordability in a Wild Plunge

Five years ago, the cost of an unmanned delivery vehicle was enough to buy a bathroom in Beijing. Today, its price has dropped to less than a high-end smartphone.

The price of LiDAR has plummeted by 95.2% in five years, from RMB 82,000 in 2020 to just RMB 1,400 now. This "eye" of the vehicle, once a major cost component, is now as cheap as a toy part.

"This isn't just a price drop; it's a freefall," an industry insider remarked. He has witnessed the transformation of unmanned vehicles from laboratory luxuries to warehouse consumables.

Jiushi Intelligence's E6 model is priced at RMB 19,800, while Cainiao's GT-Lite is even offered at a limited-time discount of RMB 16,800.

What does this price mean? It's equivalent to two months' salary of a courier, allowing you to acquire an indefatigable replacement.

Even more ruthless is the innovation in business models.

Buying an unmanned vehicle now is like buying a printer—the machine itself can be sold at a slim profit or even a loss, with earnings coming from subsequent "ink cartridges."

Jiushi Intelligence's E6 costs RMB 19,800, but requires a monthly autonomous driving subscription fee of RMB 1,800. Calculating over five years: vehicle price RMB 19,800 + service fee RMB 108,000 = RMB 127,800, with the service fee being over five times the vehicle's price.

"This calculation makes sense," a Jiushi Intelligence salesperson calmly stated.

Of course, it does. This transforms a one-time investment into a continuous cash flow, shifting from a heavy-asset model to a light-asset operation.

The precipitous drop in hardware prices is no accident.

Hesai Technology's ATX has reduced unit costs to less than one-third of the previous generation through self-developed chips. NVIDIA's Orin Y chip maintains sufficient computing power while reducing its price from RMB 3,400 to RMB 2,800.

The localization of core components has transformed unmanned vehicles from "aristocratic toys" to "civilian tools."

An investor made an analogy: "This is like the evolution from brick phones to smartphones. We're just at the beginning; it will get even cheaper in the future."

II. Capital Carnival: The Land Grab Behind RMB 7 Billion in Hot Money

In the 2025 autonomous driving sector, while Robotaxi (autonomous taxis) are still cautiously conducting road tests, unmanned delivery vehicles have embarked on a wild growth spree.

Three leading companies have raised over RMB 7 billion in financing within a year. Neolix completed two rounds of financing in 10 months, with Jiushi Intelligence and Bai Rhinoceros following closely.

Capital is voting with real money, choosing this more down-to-earth sector.

Why is capital more bullish on unmanned delivery?

An investor bluntly stated: "Robotaxi is battling complex road conditions worldwide, while unmanned delivery vehicles are just competing with couriers. Which one has a clearer path to victory is obvious."

SF Express has already deployed over 800 unmanned vehicles and plans to expand to 8,000 by 2025. ZTO Express has over 2,000 unmanned vehicles in operation, while YTO Express has over 170 franchisees using more than 500 unmanned vehicles.

China Post just placed an order for 7,000 unmanned vehicles, the largest in the industry to date.

JD Logistics has made an even bolder statement: purchasing 3 million robots and 1 million unmanned vehicles over the next five years.

The logic of this land grab is simple: whoever reaches the scale inflection point first will dominate the market.

It is widely recognized in the industry that an operational scale of 10,000 units is the inflection point for industry explosion. Once this number is reached, a positive cycle of "technology cost reduction - scenario validation - scale expansion" will form.

Neolix has already completed the delivery of its 10,000th unit, and Jiushi Intelligence is about to reach the same milestone. This means that unmanned delivery has officially transitioned from experimental products to commodities.

An industry insider described it as: "This is like the early days of bike-sharing, where everyone is frantically deploying vehicles to secure territory first."

Capital's fervor has a rational basis.

According to China Merchants Securities, the market potential for unmanned delivery vehicles ranges from RMB 468 billion to RMB 728 billion. This figure is enough to make any investor's eyes turn green.

III. Efficiency Revolution: How Algorithms Crush Human Limits

In Huangdao District, Qingdao, unmanned delivery vehicles complete all package transportation from the logistics hub to store stations with just two round trips daily. They don't get tired, thirsty, or demand salary increases.

Shandong SF Express has deployed 52 unmanned vehicles across 10 cities in western Shandong, with 48 used for direct transit. The results show a RMB 1.32 reduction in transportation cost per ticket and a 30% increase in efficiency.

A securities firm calculated more directly: the transportation cost per ticket for manned vehicles is RMB 0.16, while unmanned vehicles can reduce it to RMB 0.05, a cost reduction space of up to 69%.

Behind these numbers lies a dimensional reduction attack on human-powered delivery.

A staff member at a Beijing courier station described the workflow of unmanned vehicles:

"As soon as it arrives at the station entrance, I receive a verification code. I enter the code, the door unlocks, I unload the goods, confirm pickup, and the vehicle leaves automatically. The entire process takes no more than 5 minutes."

In contrast, human couriers need to queue, communicate, and occasionally handle package disputes.

The biggest advantage of unmanned vehicles lies in breaking through human physiological limits. They can operate 24 hours a day without social security contributions, leave requests, or resignations due to stress during Double 11.

"The biggest headache in the courier industry is the labor shortage during peak seasons. Now we have a solution," a courier regional manager stated.

Meituan has launched a "rider + unmanned vehicle" hybrid model in Shunyi District, Beijing: unmanned vehicles handle bulk order transit, while riders focus on the last 100 meters of doorstep delivery. This model leverages both machine efficiency and human flexibility.

Bai Rhinoceros has achieved a daily operational scale of hundreds of units within the SF Express system and is still rapidly expanding. This expansion speed is unattainable for human recruitment.

IV. Survival Crisis: Couriers Being "Optimized" by Algorithms

As unmanned vehicles hit the roads on a large scale, the courier industry is experiencing an unprecedented price war.

From January to May 2025, national courier business volume increased by 20.1% year-on-year, but the average price per ticket dropped by 8.2% to RMB 7.5.

Against the backdrop of "increasing volume but decreasing prices," cost reduction has become a survival line for all courier companies.

In 2025, the average annual salary of delivery personnel in first-tier cities has reached RMB 102,000, growing at an annual rate of 6.2%. Meanwhile, fuel prices remain high at RMB 7.5 per liter. The dual pressures of labor and fuel costs are forcing courier companies to seek alternatives.

In 2024, SF Express's single-ticket labor and transportation costs accounted for 84% of total costs. This figure means that any reduction in labor costs can directly improve profit margins.

The emergence of unmanned vehicles provides courier companies with this tool.

A courier franchisee calculated: based on a vehicle purchase cost of RMB 120,000 (including full-cycle FSD service), the daily cost over five years is approximately RMB 66, plus electricity costs not exceeding RMB 80. This is far lower than the daily cost of employing a courier.

"Especially for night shifts, using unmanned vehicles is both safe and cost-effective," he added.

However, behind this efficiency improvement lies the disappearance of numerous grassroots jobs.

Those couriers labeled as "inefficient, high-cost, and traffic rule violators" are facing the fate of being "optimized" by algorithms. Few of them realize that the threat to their jobs comes not from more diligent peers but from a machine priced at RMB 19,800.

An industry observer pointed out: "Unmanned vehicles are not replacing couriers as individuals but replacing the courier function. It's like how cars replaced not horse carriage drivers but the horse-drawn transportation method."

But for couriers relying on this job to support their families, this distinction is meaningless.

V. Future Battle: The Era of Unmanned Delivery for Everything

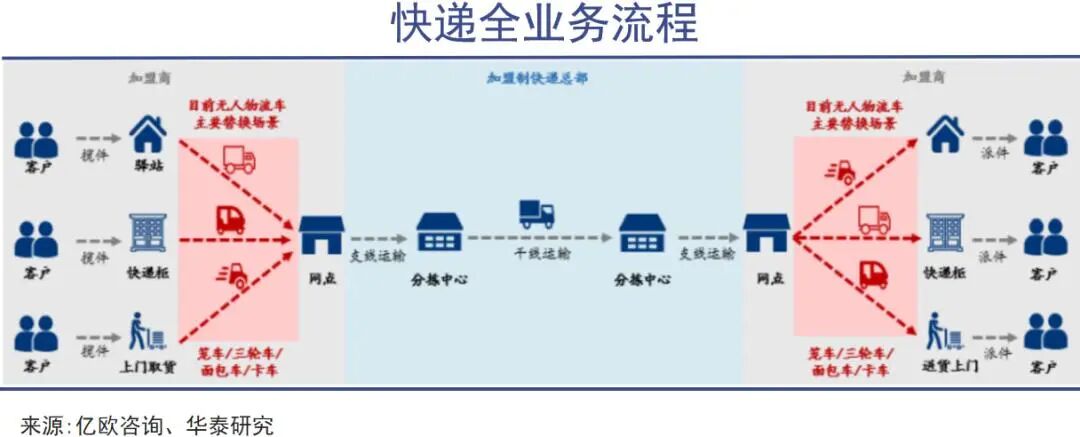

Current unmanned delivery is limited to fixed routes from "hubs to stations," but this is just the beginning.

Yunda Express is already testing unmanned delivery in high-value areas such as medical supplies and fresh produce cold chains. In the first half of this year, Yunda deployed over 500 unmanned vehicles, with 83% sourced from Jiushi Intelligence.

This means that unmanned delivery is expanding from ordinary parcels to broader scenarios.

JD Logistics has an even more aggressive plan: purchasing 1 million unmanned vehicles and 100,000 drones over the next five years to fully deploy them across the entire logistics supply chain.

What does this scale imply? It's equivalent to building a logistics empire entirely composed of robots.

At the policy level, unmanned vehicles have received far more favorable treatment than Robotaxi. Over 1,000 districts and counties nationwide have allowed unmanned vehicles on the road, with Shenzhen granting citywide testing permits for L4 vehicles.

Why are governments so friendly to unmanned vehicles? Besides the clear liability subject (accident liability rests with the vehicle manufacturer rather than the driver), more importantly, unmanned vehicles can effectively reduce total social logistics costs.

In 2023, China's total social logistics costs accounted for 14% of GDP, significantly higher than the 7-9% in developed countries.

Unmanned vehicles are seen as a crucial tool to reduce this ratio.

In conclusion, Unmanned Vehicle Is Coming (WeChat public account: Unmanned Vehicle Is Coming) believes:

Unmanned delivery vehicles are quietly gaining a foothold in the final mile of logistics, especially in short-distance deliveries between hubs and end-point stores or stations, gradually becoming a new asset in the courier industry.

Unmanned vehicles don't complain, don't go on strike, and don't demand Five Social Insurances and One Housing Fund (five social insurances and one housing fund). They just work silently, continuously, and efficiently!

What do you think, dear?

#UnmannedVehicleIsComing #Driverless #AutonomousDriving #UnmannedVehicle