Double Down on Robotaxi: The Breakout Battle for the "Second Largest Ride-hailing Company"

![]() 06/27 2025

06/27 2025

![]() 486

486

Source: Auto Intelligence

On June 25, 2025, Caocao Mobility, a ride-hailing platform incubated by Geely, made its debut on the Hong Kong Stock Exchange, raising a net amount of approximately HK$1.718 billion at an issue price of HK$41.94 per share.

However, its stock price fell on the first day of trading, opening at HK$33.8 per share (19.41% lower than the issue price) and closing at HK$36 per share (down 14.16%), with a total market value of HK$19.59 billion. This performance underscores both Caocao Mobility's operational pressures and the collective survival anxiety among ride-hailing firms rushing to go public.

Falling Share Price on Debut: Triple Pressures Behind the Glittering Fundraising

Despite oversubscribing 21.14 times in the Hong Kong public offering and attracting six cornerstone investors, including Mercedes-Benz, Mirae Asset Securities (Hong Kong), Infinity Capital, Guoxuan High-Tech (Hong Kong), EVE Energy Asia, and RoboSense, Caocao Mobility faced a muted response from the capital market, reflecting investors' deep concerns about its business model.

The funds raised will be used to enhance car service solutions, launch customized vehicles, invest in autonomous driving technology, and expand geographical coverage.

"Sandwich Dilemma" of Market Share

In 2024, Caocao Mobility ranked second in China's ride-hailing market with a 5.4% share. However, it faces a "sandwich" dilemma: Didi dominates with a 70.4% share, while T3 Travel trails closely with 5.3%. This fragility is evident in order volume: Didi's 2024 transaction volume reached RMB 219.6 billion, 12.99 times that of Caocao Mobility's RMB 16.9 billion.

Source: Cyber Auto

Notably, Caocao Mobility's market share growth has stagnated. From 2022 to 2024, its order volume increased at a CAGR of 24.9%, but Didi's order scale remained over 10 times larger.

"Double-edged Sword" of Aggregated Platform Dependence

To overcome traffic bottlenecks, Caocao Mobility partnered with aggregated platforms like Gaode Maps. This drove short-term order growth but led to over 80% of its business relying on third-party platforms for traffic, weakening brand independence.

High commission expenses, accounting for 7.2%-7.5% of GTV, totaled RMB 1.055 billion in 2024. This dependence has deprived Caocao Mobility of brand premium, as users choose its services based on aggregated platforms' traffic distribution rather than brand recognition.

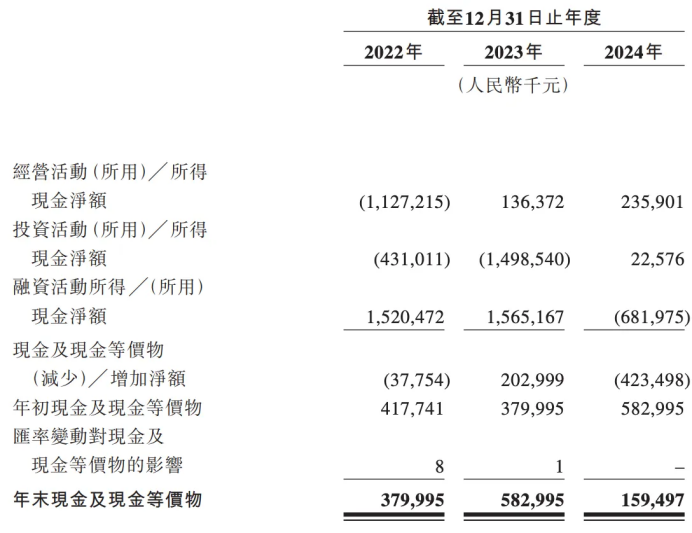

"Loss Trap" in Financial Data

Despite revenue growing from RMB 7.631 billion in 2022 to RMB 14.657 billion in 2024 and gross margin improving to 8.1%, Caocao Mobility reported net losses of RMB 2.007 billion, RMB 1.981 billion, and RMB 1.246 billion respectively, totaling RMB 5.2 billion over three years. Based on 2024's 598 million orders, each incurred a loss of RMB 2.08.

Driver salaries and subsidies are the main profit eroders. In 2024, sales cost reached RMB 13.47 billion, with driver income and subsidies accounting for over 80%. Caocao Mobility also faces high debt and tight cash flow, with total liabilities of RMB 11.283 billion and net current liabilities of RMB 8.146 billion as of 2024-end, while cash and equivalents were only RMB 159 million.

Customized Vehicles and Robotaxi: The Dual-Engine Breakthrough of the Geely Group

To overcome profitability challenges and capital pressures, Caocao Mobility focuses on customized vehicles and Robotaxi, leveraging Geely Holding's industrial resources.

Customized Vehicles: "Geely Solution" for Cost Reduction and Efficiency Enhancement

Since 2021, Caocao Mobility has deployed customized vehicles, currently comprising the Maple Leaf 80V and Caocao 60. By 2024-end, it had over 34,000 customized vehicles in 31 cities, the largest fleet in the industry. The TCO for these vehicles is RMB 0.53 and RMB 0.47 per kilometer, 33% and 40% lower than typical EVs.

Source: China News Service

Customized vehicles not only reduce hardware costs but also optimize the entire operating system. Through Geely's ecosystem, Caocao Mobility achieves synergy in energy replenishment and maintenance, improving operational efficiency and reducing costs. The proportion of customized vehicle orders increased from 4.8% in 2022 to 25.0% in 2024, with GTV also rising to 25.1%.

Caocao Mobility plans to purchase 8,000 customized vehicles annually from 2025 to 2027, expecting 50,000 by 2027-end. This could increase customized vehicle order proportion to over 30%, driving unit cost reduction and gross margin improvement. The strategy also enhances driver loyalty by optimizing vehicle design, forming a differentiated competitive edge.

Robotaxi: Betting on the "Autonomous Driving Card" of the Future

Caocao Mobility invested 17% of IPO funds in Robotaxi, launching the "Caocao Zhixing" autonomous driving platform in February 2025 with pilot services in Suzhou and Hangzhou. This relies on Geely's technical reserves and vehicle resources, forming a "vehicle + L4 technology + mobility platform" model.

Funds were allocated as follows: 1% for retrofitting autonomous driving software and hardware, 5% for new autonomous driving customized vehicle models (expected by 2026-end), and 6% for purchasing Robotaxi vehicles from Geely. This deep cooperation allows Caocao Mobility to rapidly advance autonomous driving services without significant upfront investments.

Robotaxi's strategic value lies in improving operational efficiency, reducing driver dependence, and transforming Caocao Mobility into an intelligent mobility service provider, exploring new scenarios in smart cities and transportation.

However, Robotaxi commercialization faces challenges in technology maturity, regulations, and public acceptance. Time will tell if Caocao Mobility can transform this "future narrative" into real competitiveness.

Industry IPO Wave: Collective Anxiety and Breakout Paths of Ride-hailing Platforms

Caocao Mobility's IPO share price fall reflects the ride-hailing industry's collective predicament. Since 2024, multiple platforms have listed or sought listings, highlighting industry-wide survival pressures.

"Two Extremes" in the Capital Market

Despite successful listings, ride-hailing platforms' share prices have generally underperformed. Ruqi Chuxing's share price fell over 76%, Dida Chuxing's over 80%, and Caocao Mobility's 14.16% on its debut. This reflects investors' concerns about the ride-hailing business model's scalability and profitability.

The bumpy listing journey also highlights regulatory scrutiny and platforms' financial and business model issues, with the listing process becoming a "stress test" for compliance.

Robotaxi: "New Bubble" Under Industry Consensus?

Amid sluggish ride-hailing growth, Robotaxi has become the "new story" for multiple platforms. Ruqi Chuxing invested 40% of funds in autonomous driving, far exceeding the 20% for existing business expansion. Hello Inc. is also accelerating Robotaxi layout. This shift reflects recognition of the traditional model's ceiling and the need for a second growth curve.

However, Robotaxi commercialization prospects remain uncertain due to technological immaturity, high costs, and societal resistance. Whether Robotaxi is the industry's "cure" or a "new bubble" remains to be seen.

The Key to Breakthrough: Differentiated Positioning and Ecosystem Synergy

In the Didi-dominated market, the breakthrough for second-tier ride-hailing platforms hinges on cultivating distinctive competitive advantages. Caocao Mobility's strategy of customized vehicles and Robotaxi deployment fundamentally leans on the resource integration of the Geely ecosystem, fostering a unique "automaker + mobility platform" model. This model's strength lies in its seamless connection of vehicle R&D, production, and operation, creating barriers in cost control and service standardization.

Other platforms are equally exploring varied paths to differentiation: Qichi Mobility, backed by GAC Group, emphasizes vehicle supply and localized services; Enjoyway Mobility, leveraging SAIC Motor, targets the mid-to-high-end business travel segment; while Dida Chuxing focuses on ride-sharing niches to steer clear of direct competition with Didi. The success of these differentiation efforts critically depends on whether the platforms can establish market segment-specific advantages and fully harness ecological synergies with their parent companies.

Navigating Uncertainty in a Capital Winter

Caocao Mobility's failed IPO underscores the real-world challenges confronting the ride-hailing industry: operational hurdles from slowing user growth and elevated cost pressures, coupled with capital markets' waning patience for the cash-burn model. Amidst this dual pressure, strategic initiatives like customized vehicles and Robotaxi serve as both immediate solutions and long-term bets on the future.

For Caocao Mobility, the immediate focus is on cost reduction and efficiency gains through customized vehicles, aiming for break-even swiftly and demonstrating commercial viability to the capital market. In the medium to long term, it must persist in investing in the Robotaxi sector to secure a foothold in the autonomous driving commercialization wave. For the ride-hailing industry as a whole, Caocao Mobility's experience serves as a cautionary tale: in a capital winter, only by solidifying fundamentals and building differentiation barriers can one secure survival and development amidst fierce competition.

The journey ahead is arduous, and whether Caocao Mobility can surmount the obstacles on its path to autonomous driving and successfully transform from a ride-hailing platform to a technology giant in intelligent transportation remains to be seen by time and the market.

Disclaimer:

All works on this official account labeled "Source: XXX (not Zhidechekeji)" are reproduced from other media. The purpose of reproduction is to disseminate and share more information and does not imply endorsement of their viewpoints or responsibility for their authenticity by this platform. The copyright belongs to the original author. Please contact us for deletion if there is any infringement.