Musk's Robotaxi Makes Its Debut Amidst Cheers; Baidu's RoboTaxi Also Deserves Attention

![]() 06/27 2025

06/27 2025

![]() 669

669

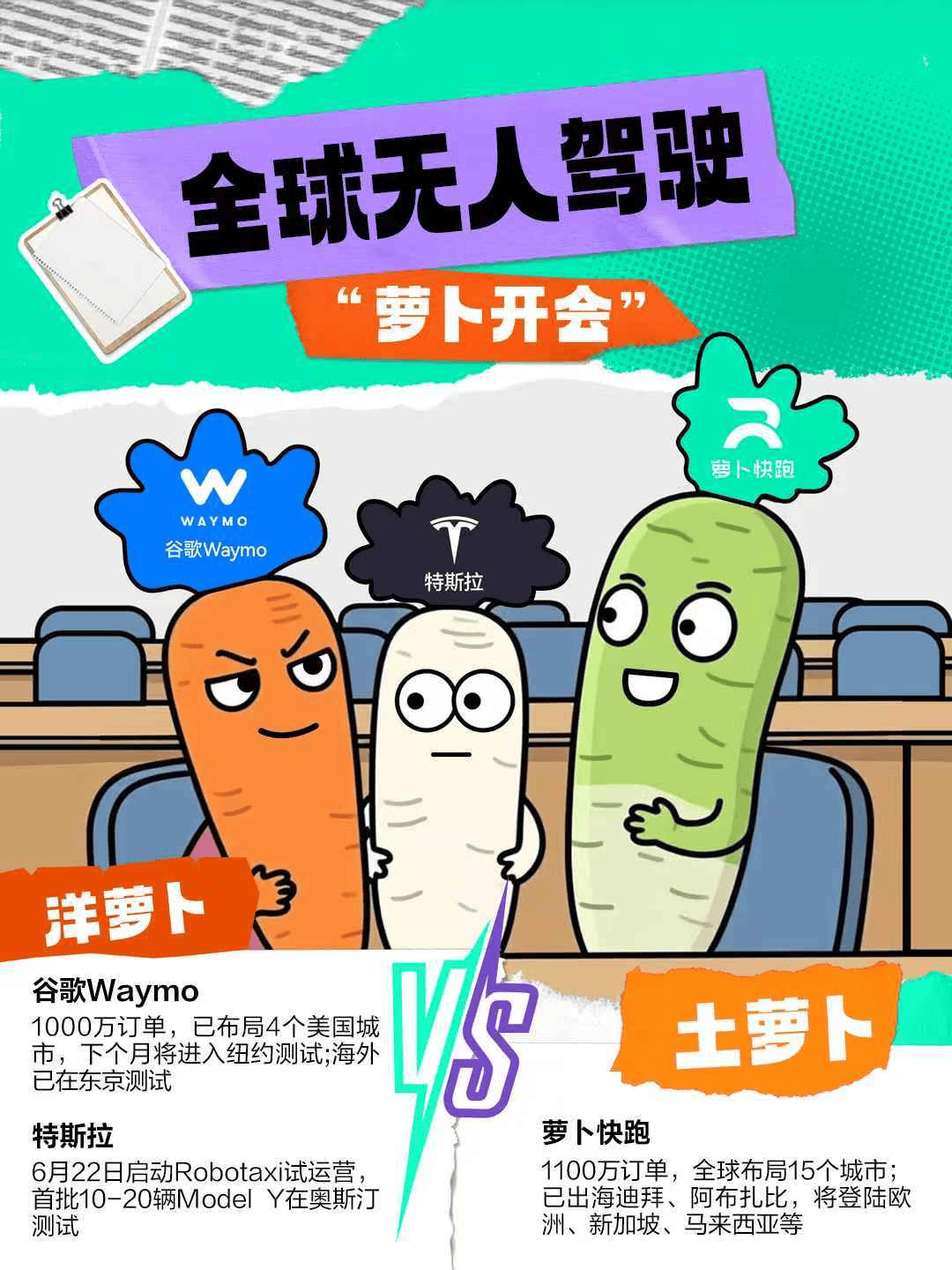

The top three Robotaxi players in China and the US are now in a neck-and-neck race, with Baidu's RoboTaxi squaring off against two American giants.

By Wan Tiannan

Edited by Chen Jiying

After stepping down as CEO and returning to his role as Chairman, Musk finally delivered on his promise this time.

Tesla's autonomous taxi (Robotaxi) hit the road as scheduled – on June 22, the first batch of approximately ten Model Y vehicles began trial operations in Austin, Texas, picking up paying passengers.

However, this debut was far from flawless.

The vehicles on the road were not the highly anticipated Cybercab from last year but ordinary Model Y vehicles, with a driver in the front passenger seat, and the operating area was quite limited, avoiding downtown areas.

On the day of the trial operation, Tesla gave its passengers quite a scare. Videos posted by users showed that the Tesla Robotaxi not only crossed the double yellow line into oncoming traffic but also made an emergency stop mid-ride.

Despite this, Tesla still received positive reviews from public opinion both domestically and internationally. Musk officially announced it as the culmination of a decade of teamwork and vowed to deploy over 100,000 vehicles in the coming year.

With Tesla's entry into the market, the global autonomous driving industry has formed a competitive landscape among Baidu's RoboTaxi, Tesla, and Waymo.

However, the competition among these three giants transcends national borders and has already seen close encounters globally – Baidu's RoboTaxi has landed in 15 cities worldwide and will gradually enter the Middle East, Southeast Asia, Europe, and other markets, while Waymo has also ventured to Tokyo, Japan, for trial operations.

For both China and the US, this major battle between the "local" and "foreign" players is a "game that cannot be lost." Whoever can take the lead in establishing a relevant industrial chain will have the ability to define the sector, achieve self-reliance, and export technology products to other countries.

However, compared to Tesla, which received a standing ovation right from its debut, Baidu's RoboTaxi has been progressing amidst controversy. Despite having landed in 15 cities worldwide and not having a single major accident in 11 million services, with an accident rate lower than that of human drivers by a factor of 1/14, it is still questioned by some netizens.

Now, as Baidu's RoboTaxi faces this 1:2 major competition between China and the US, the pressure is immense. It would be great if we could give more applause and less criticism to China's local innovative enterprises.

I. The Three Giants Compete, and the "Local Player" Challenges the "Tesla Cult"

2025 will be a pivotal year for the expansion of Robotaxi.

In addition to Tesla's Robotaxi trial operations, Musk has vowed to deploy over 100,000 vehicles by the end of next year; Waymo also plans to double the Robotaxi production capacity of its Arizona factory by the end of 2026.

In China, Baidu's RoboTaxi saw its orders in Q1 2025 increase by 75% to 1.44 million. As of May this year, it has completed 11 million services, surpassing Waymo's 10 million.

As the giants chorus "1, 2, 3, go," the global competition for autonomous driving has officially begun.

In addition to its US base, Waymo has also begun testing in Tokyo, using it as a bridgehead for its global layout; Baidu's RoboTaxi, on the other hand, is making all-out efforts to expand overseas, gradually entering the Middle East, Europe, Southeast Asia, and other markets.

In March this year, Baidu's RoboTaxi landed in Dubai and Abu Dhabi; Bloomberg also revealed that Baidu's RoboTaxi plans to enter the Southeast Asian market as soon as the end of 2025, with Singapore and Malaysia as the preferred destinations. Additionally, Switzerland and Turkey are also within the scope of Baidu's RoboTaxi's overseas expansion plans, and it intends to establish a physical company in Switzerland as a precursor to its autonomous driving business entering the European market.

In terms of overseas expansion, Tesla's Robotaxi is a latecomer, with its trial operations currently limited to Austin, where its headquarters are located. However, as the global leader in electric vehicles, Tesla's autonomous driving technology is expected to be installed in all its vehicles in the future, and globalization is also a must for the company.

In terms of safety, both Baidu's RoboTaxi and Waymo, which have both completed over 10 million services, are on the same level, with safety performance far surpassing that of human drivers.

In contrast, Tesla's current pure vision and end-to-end technical safety solutions, due to the lack of redundant sensors such as lidar and radar, may face safety risks in foggy, rainy, and bright light conditions.

Musk is well aware of this. Tesla's Robotaxi service will suspend trial operations once bad weather such as wind and rain occurs; the testing area is also relatively limited, operating only in a small area south of Austin; unlike Baidu's RoboTaxi and Waymo, which are already unmanned, Tesla's Robotaxi vehicles are equipped with human safety officers who can intervene in the vehicle as necessary through emergency stop buttons and other devices.

Waymo's shortcoming lies in cost. Currently, Baidu's RoboTaxi has the lowest cost per vehicle, at around $28,000, a 60% reduction from the fifth generation. In comparison, it is lower than Tesla's $30,000 and only one-seventh of Waymo's $200,000.

Despite having certain comprehensive advantages, the competition between China and the US is still fierce. After all, in the first tier, China only has Baidu's RoboTaxi going it alone, facing Waymo and Tesla in a one-to-two battle. In terms of numbers, China cannot afford to be complacent.

II. On the Eve of the Robotaxi Boom, Let's Give More Applause and Patience

With safety, technology, and cost hurdles cleared, Robotaxi is on the cusp of a major boom.

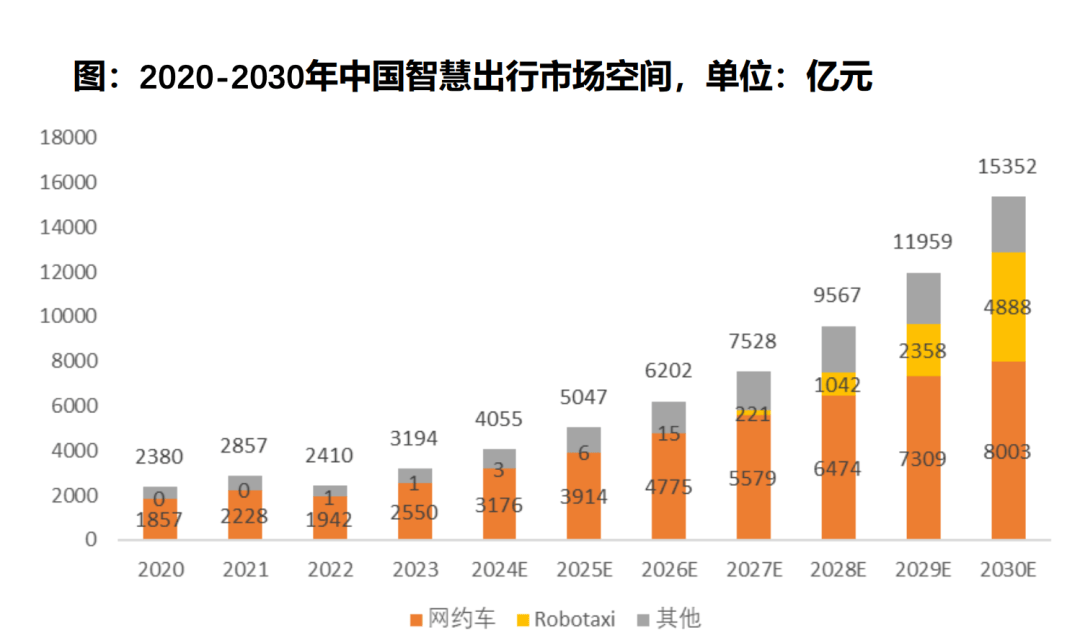

According to Frost & Sullivan, the total market size for Robotaxi is expected to reach RMB 834.9 billion by 2030, with China poised to become the largest Robotaxi market, accounting for about 58.5% of the global autonomous driving travel service market by 2030.

However, to achieve a truly major boom, it requires increased public tolerance and the green light from regulatory policies.

The pull effect of national policies on the industry can be seen in the electric vehicle industry.

In May this year, BYD surpassed Tesla for the first time to top the global sales chart for pure electric vehicles. BYD's ascension to the top and China's position as the world's largest electric vehicle market have both benefited from policies such as subsidies for trading in old electric vehicles for new ones.

Now, both Waymo and Tesla are expanding their Robotaxi businesses aggressively. Waymo has announced its entry into New York for testing and is currently operating in cities such as Austin, Los Angeles, and San Francisco, with plans to enter Atlanta, Miami, and Washington in the future. This is also due to the green light from US regulatory authorities.

At the end of last year, the world's first policy and regulatory framework specifically for Robotaxi, the AV-STEP draft, came into effect in the US, setting clear rules of the game for the commercialization of autonomous vehicles. It clarified for the first time key issues such as who is eligible to participate, how to participate, where to participate, and how to apportion liability in the event of an accident.

Texas, where Tesla's headquarters are located, is particularly supportive of autonomous driving. For seven or eight years prior, Texas had explicitly prohibited cities from regulating autonomous vehicles individually.

In contrast, domestic regulatory policies for Robotaxi are relatively strict, with no clear national legislation. Although some cities have opened the floodgates first, there are strict restrictions on the operating hours and areas of Robotaxi, leading to the "speed-limited" development of autonomous driving players.

With Tesla's entry into the market, the global competition for autonomous driving is heating up, which is not only a battle for corporate interests but also a showdown of strength between China and the US.

Currently, the three major players are on par in strength and have room for improvement. This competition is never a game for "perfectionists" but a marathon for "perseverance."

Facing the encirclement of Waymo and Tesla, Baidu's RoboTaxi, as China's "trump card" in international competition, is running hard, using its wheels to measure the boundaries of technological innovation and consolidate the safety baseline.

Global competition is urgent, and for China's local innovative enterprises, society should be less demanding for "perfection" and more tolerant of "trial and error"; less irrationally admiring of "foreign brands" and more patient with the technological iterations of "local players."