Global Venture Capital Booms in Q2 2025: AI Reigns Supreme as Capital Flows to Industry Giants

![]() 07/09 2025

07/09 2025

![]() 440

440

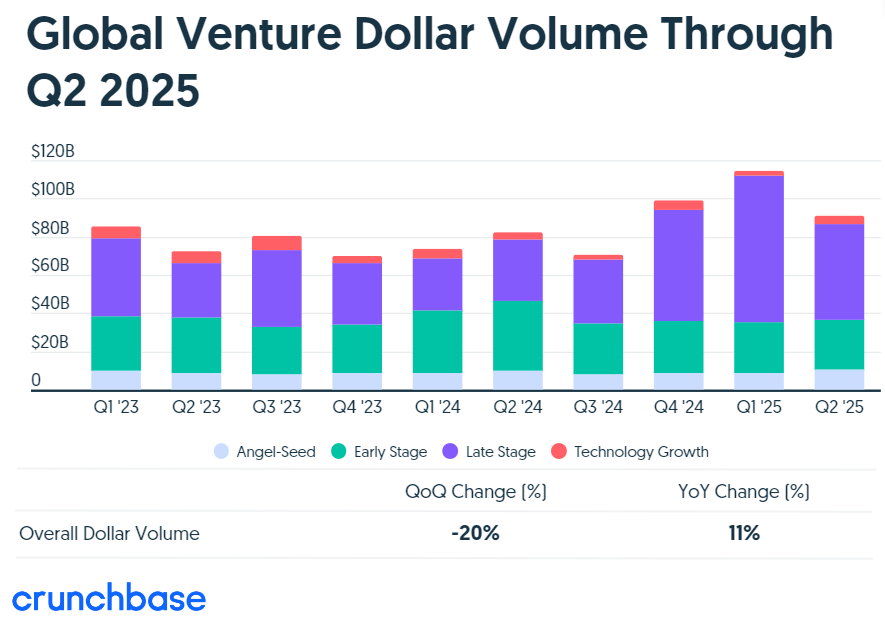

The second quarter of 2025 saw a significant uptick in the global venture capital market, with Artificial Intelligence (AI) emerging as the focal point of capital investment. According to Crunchbase data, global venture capital reached $91 billion in Q2 2025, up from $82 billion in Q2 2024, representing a year-on-year increase. However, compared to the $114 billion recorded in Q1 2025, there was a quarter-on-quarter decline, albeit from an already elevated level—the highest since Q3 2022.

Over the past three quarters, global venture capital has consistently shown year-on-year growth, largely fueled by significant financing in the AI sector. Notably, AI research laboratories and data and infrastructure providers have attracted substantial funding. In Q2 2025, capital concentration intensified, with nearly one-third of funds flowing to 16 companies that raised $500 million or more. Notably, Scale AI alone raised an astonishing $14.3 billion.

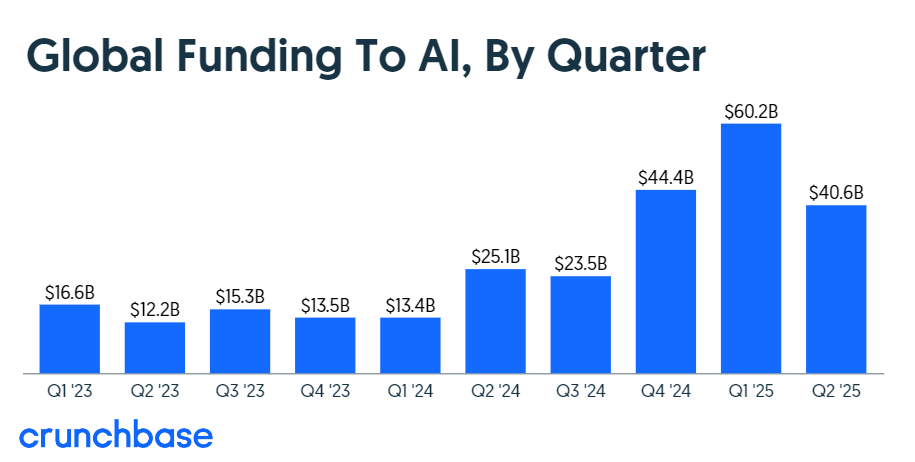

AI: The King of Capital Attraction

The AI sector undeniably stole the show this quarter, accounting for approximately 45% of global venture capital flows, totaling around $40 billion. Notably, Scale AI alone accounted for over one-third of this funding. Over the past three quarters, AI funding has repeatedly hit new highs, with foundational model companies raising $5.5 billion in the previous quarter. For instance, nascent AI research laboratories like Thinking Machines Lab and Safe Superintelligence, both established within a year, each raised $2 billion. Other notable raises include Anduril Industries ($2.5 billion), Grammarly ($1 billion), Anysphere ($900 million), and Helsing ($694 million).

Healthcare and Finance Trail Closely Behind

Apart from AI, healthcare and biotech companies also performed impressively in Q2 2025, raising $14.8 billion in venture capital, making it the second-largest sector for the quarter. The financial services sector came in third, raising $10.8 billion. This underscores that while AI garners significant capital, other sectors maintain robust appeal.

U.S. Dominance in Global Venture Capital

Despite increasing capital concentration, the United States remains the dominant force in global venture capital. In Q2 2025, American companies secured $60 billion in venture capital, accounting for two-thirds of the global total. This highlights that despite global investment surges in AI and other sectors, the U.S. continues to be the primary destination for capital flows.

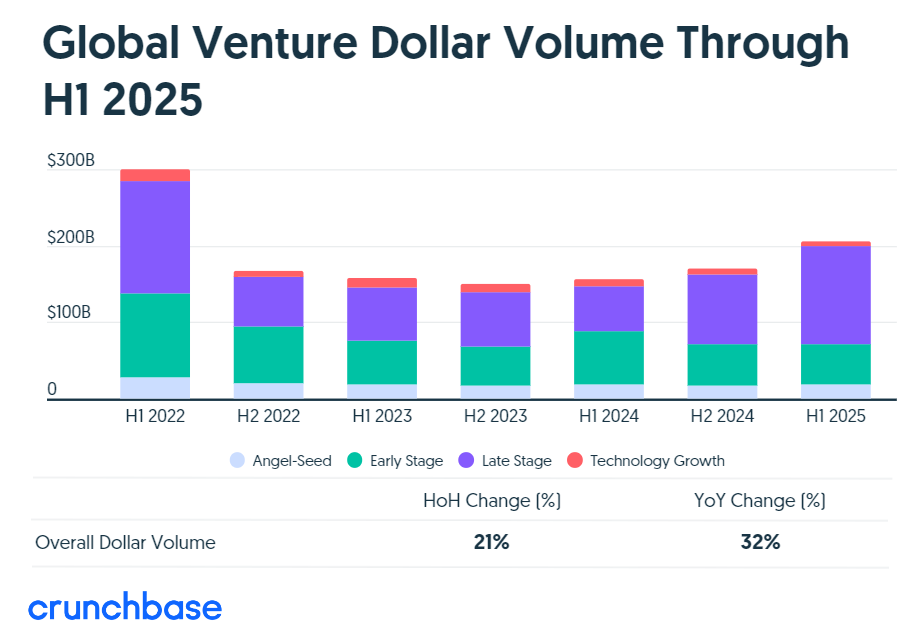

Robust Venture Capital Activity in H1 2025

The first half of 2025 witnessed the strongest venture capital activity since H1 2022, with a total of $205 billion raised, marking a 32% increase from H1 2024. Notably, over one-third of these funds flowed to 11 companies that raised $1 billion or more. The year's two largest venture capital investments went to Scale AI ($14.3 billion) and OpenAI ($40 billion), both occurring in H1 2025, underscoring the AI sector's strong appeal.

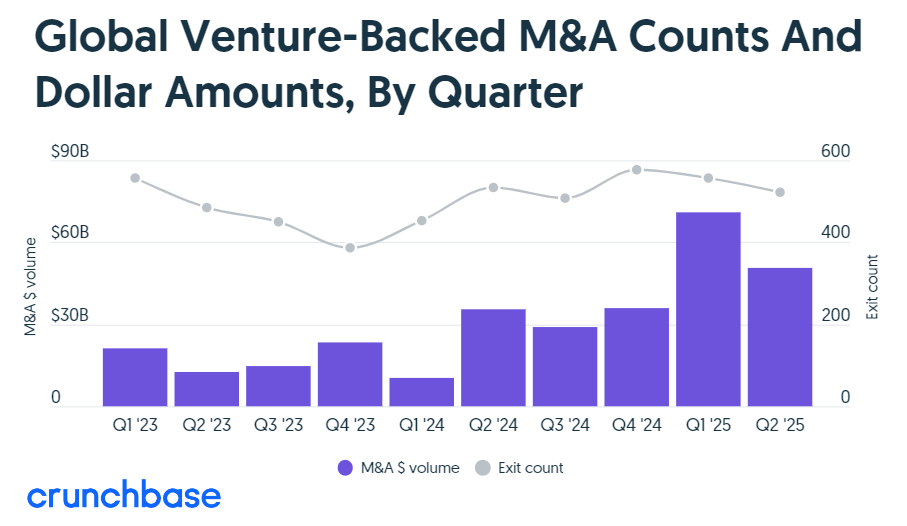

Active M&A Market in 2025

Q2 2025 recorded the second-highest quarter for startup M&A values since 2021, with reported exit values reaching $50 billion. While this figure is lower than Q1 2025's $71 billion—which included Google's $32 billion acquisition of Wiz, the largest-ever private company acquisition—OpenAI emerged as the most active acquirer in Q2 2025, acquiring four companies, including Io for $6 billion and Windsurf for $3 billion. During this quarter, 18 companies were acquired for over $1 billion, half of which were acquired by public companies, three by private equity firms, and six by private venture capital-backed companies, such as Databricks' acquisition of the open-source SQL database Neon.

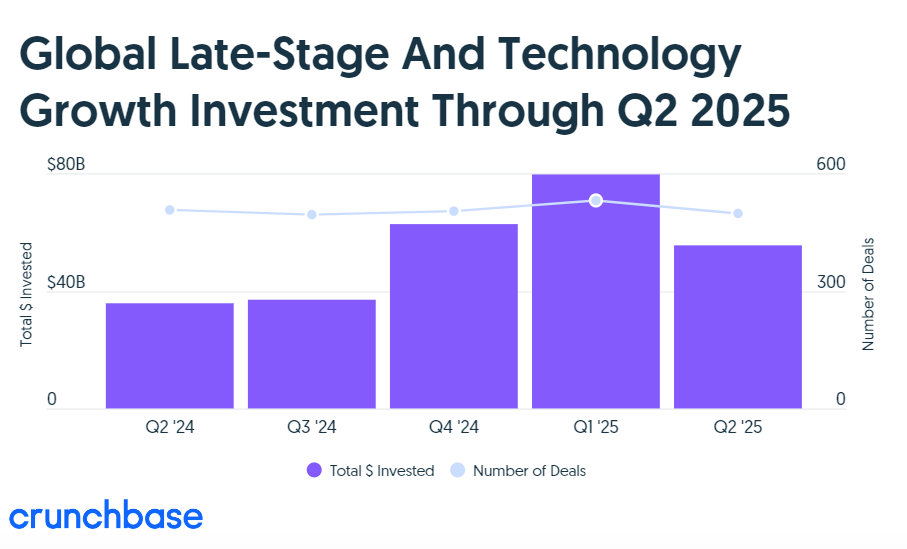

Late-Stage Financing Soars, Early-Stage Remains Steady

In Q2 2025, late-stage financing surged by over 53% year-on-year to $55 billion but decreased by nearly one-third quarter-on-quarter. Conversely, early-stage financing remained stable at $26 billion, involving 1,600 companies, with the largest round amounting to approximately $220 million. Larger A and B rounds emerged in sectors like quantum computing, energy, autonomous driving, therapeutic technologies, satellite technologies, human resources, and chat software services, with B rounds predominating. The annual decline in early-stage financing compared to Q2 2024 is primarily due to multiple billion-dollar B rounds for AI companies in Q2 2024.

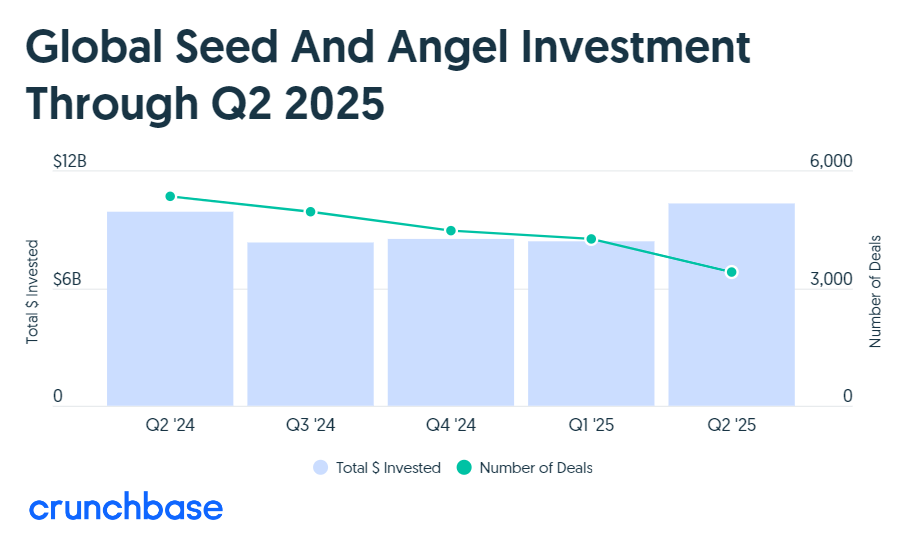

Seed-Stage Financing Grows

Seed-stage financing reached $10.3 billion in Q2 2025. Notably, Thinking Machines accounted for 20% of this with a $2 billion seed round, the largest-ever recorded seed-stage financing. Excluding this round, seed-stage financing would have remained flat compared to the previous quarter and declined year-on-year. Typically, the total amount of seed-stage financing increases over time as additional seed rounds are added to the Crunchbase dataset post-quarter/year.

M&A Market Recovery

In H1 2025, the proportion of funds in the AI sector continued to rise, and capital concentration improved. As more funds pour into private companies, the good news is that the M&A market has grown for two consecutive quarters, comparable to the peak M&A values in 2021.

Editor's Opinion

Crunchbase data reveals that the global venture capital market's performance in Q2 2025 is undoubtedly remarkable. The explosive growth in the AI sector has not only attracted substantial funds but also propelled rapid technological advancements. However, the trend of capital concentrating towards larger companies raises concerns. While this helps giants consolidate their market position and accelerate technological innovation and application, it may also challenge smaller startups, who may face heightened competition and financing hurdles.

It's noteworthy that AI technology's development extends beyond the virtual world. With the rise of large physical AI models, AI is increasingly penetrating the physical realm. For instance, companies are developing AI networks based on multi-modal data fusion, integrating sensor data from cameras, radars, and textual information to achieve real-time perception and understanding of the physical world. This technology holds vast potential, poised to revolutionize fields ranging from autonomous driving and intelligent transportation to industrial automation and smart homes.

Furthermore, the U.S.'s dominant position in global venture capital remains unshaken, reflecting its robust innovation capabilities and market appeal in the technology sector. However, as the global technology market evolves, other countries and regions are catching up, promising increased competition and cooperation opportunities in the future.

Lastly, M&A market activity brings both new opportunities and challenges to the technology industry. Through M&A, companies can swiftly integrate resources, expand business horizons, and enhance market competitiveness. However, it's crucial to monitor potential integration risks and market monopoly issues that may arise during the M&A process.

In summary, the global venture capital market's Q2 2025 performance provides a critical lens to observe technology industry trends. The AI sector's rise, increased capital concentration, and M&A market activity indicate that the technology industry is poised for a more intense phase of competition and innovation. The emergence of large physical AI models opens new horizons for AI technology applications, warranting continued attention.