Over $14 Billion Acquisition: Is HPE Making a Timely "Big Bet" on Juniper?

![]() 07/09 2025

07/09 2025

![]() 500

500

Background: Hewlett Packard Enterprise (HPE) has announced the successful acquisition of Juniper Networks. Valued at $14 billion, or roughly RMB 100.282 billion, the deal received conditional approval from the US Department of Justice in late June. This acquisition doubles the size of HPE's networking business, establishing an industry-leading cloud-native and AI-driven IT portfolio that encompasses comprehensive modern networking solutions. This move accelerates HPE's transition towards high-margin, high-growth segments.

Undeniably, HPE's acquisition of Juniper Networks signifies a substantial shift in the global IT infrastructure landscape. With a deal size exceeding $14 billion, or nearly RMB 100 billion, it stands as one of the most significant mergers and acquisitions in the tech industry in recent years.

Initially announced in January 2024, the deal received conditional approval from the US Department of Justice in late June 2024 and was officially completed in early July 2025. The Department of Justice's review centered on antitrust concerns and ultimately approved the deal with undisclosed conditions, potentially involving technology or market openness commitments. This underscores HPE's strategic objectives. Juniper's advanced networking technologies, such as the AI-driven Mist AI platform and cloud-native solutions, will bolster HPE's competitiveness in hybrid cloud and AI data center domains. Juniper's AIOps (Artificial Intelligence for IT Operations), SD-WAN, and cybersecurity capabilities will synergize with HPE's GreenLake hybrid cloud platform, potentially posing a direct challenge to networking giant Cisco.

By leveraging strength, acquisitions directly expand market presence. Juniper's market share in the telecom carrier and large enterprise networking industries will enable HPE to transcend enterprise hardware boundaries and enter high-growth areas. As mentioned, the combined annual revenue of HPE and Juniper approaches $65 billion, with the networking business scaling to second globally, trailing closely behind Cisco's approximately 40% share. (Data sourced from the internet for reference only.)

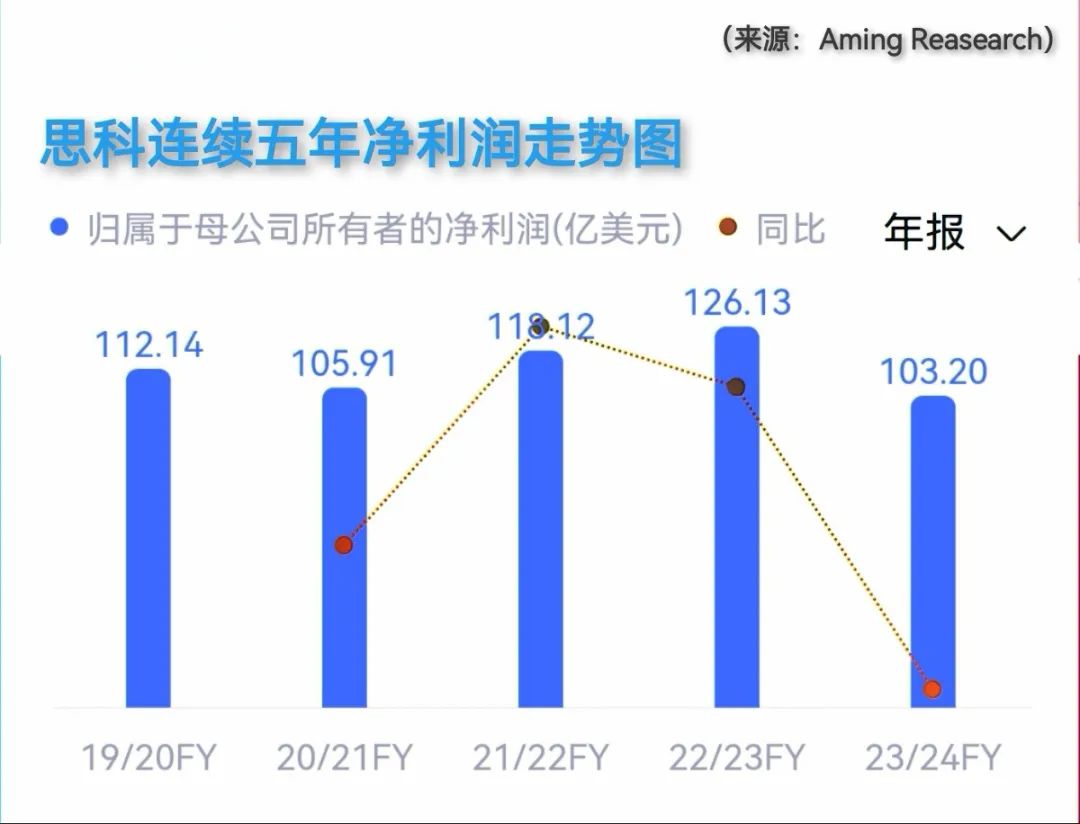

Cisco's net profit and revenue trends over the past five years reveal an annual net profit that has not dipped below $10 billion, or roughly RMB 70 billion.

From the perspective of solution innovation and integration, Juniper's Mist AI technology will expedite the integration of HPE's AI servers and intelligent networks, addressing enterprises' demands for low-latency, automated networks.

While product line integration may cause channel adjustments and short-term turbulence, customers are expected to benefit from more comprehensive cloud-to-edge solutions in the long run. This acquisition positions HPE more favorably in the infrastructure race during the AI era. If HPE successfully integrates Juniper's AI networking technology, it could achieve breakthroughs in various scenarios. However, history suggests that companies acquired by HPE often "disappear" afterward. Why? Industry insiders attribute this to HPE's proficiency in integration, meaning it adeptly assimilates acquired companies into its comprehensive portfolio.

Looking optimistically ahead, HPE's acquisition of Juniper not only offers enterprises an "AI-ready" network architecture spanning edge computing to data centers but also provides networking as a service (NaaS) through the GreenLake platform, competing against public cloud vendors. Simultaneously, it captures market share in high-growth markets such as 5G private networks and the Internet of Things. According to IDC projections, the AI networking infrastructure market will grow at a CAGR of 28% until 2027. HPE's substantial bet is on this promising trajectory, and the coming years will determine whether it can transform $14 billion into sustainable technological leadership.

Stay tuned.

Aming Calligraphy: Big Bet

- END-

What do you think?

Welcome to comment and share your thoughts at the end of the article!

【Tech Talk | Global Storage Watch | Global Cloud Watch | Aming Watch】Focusing on technology company analysis, using data to provide insights. The views expressed in this article and the author's responses are personal opinions and do not constitute investment advice.