New Milestone for the AI Industry: NVIDIA Becomes the World's First $4 Trillion Market Cap Company

![]() 07/11 2025

07/11 2025

![]() 530

530

Author: Dali Finance

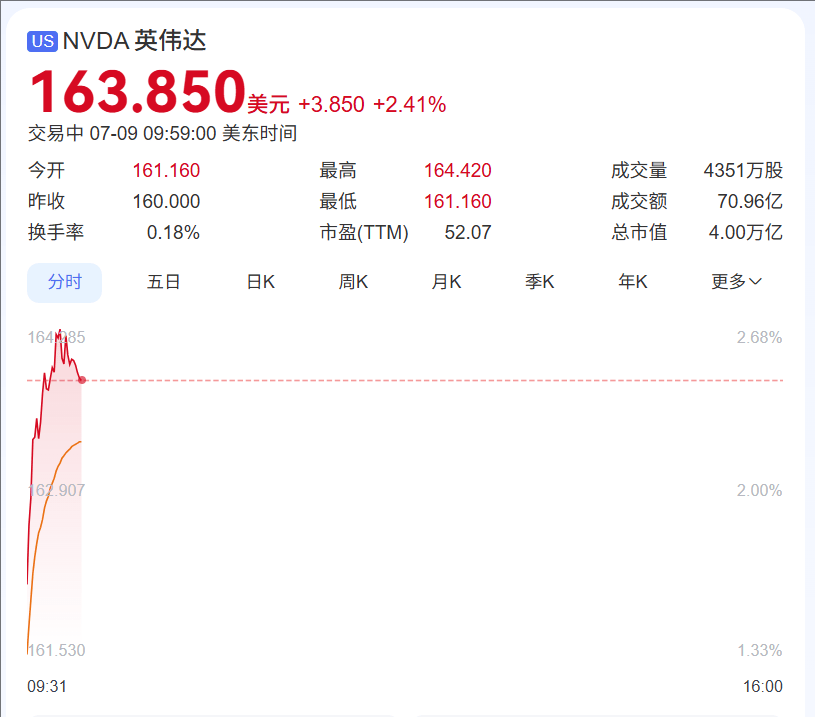

NVIDIA's stock price has soared to unprecedented heights, making it the first company in history to achieve a market capitalization of $4 trillion, surpassing Apple's market value by roughly $1 trillion.

Earlier this year, the introduction of DeepSeek briefly caused a dip in NVIDIA's stock price, as the market perceived it as a potential threat to NVIDIA's dominance in AI. However, NVIDIA CEO Jen-Hsun Huang held a different view, stating confidently that the release of DeepSeek R1 would not diminish the demand for AI computing but rather spur the market to pursue more efficient AI models, thereby driving the entire industry forward.

Huang's prophecy proved accurate. Since April, NVIDIA's stock price has skyrocketed, increasing by up to 89%, while the usage rate of DeepSeek has plummeted from over 50% to just 4%.

Amidst the rapid advancement of AI technology, numerous tech giants such as Baidu, Alibaba Cloud, ByteDance's Douyin, and iFLYTEK Tongyi have extended AI's reach into a broader spectrum of applications. Through intelligent agents, embodied intelligence, AI hardware, and other innovative methods, these companies are propelling AI towards true industrialization and mass production. The global recognition of AI's value and the accelerating process of generalization have positioned NVIDIA, as the cornerstone of computing power infrastructure, as the primary beneficiary of this trend.

01

01

At the end of 2024, Apple briefly held the record for the highest market value at $3.915 trillion but has since seen a decline due to its mediocre AI performance and tariff issues. In contrast, NVIDIA has capitalized on the AI wave, soaring from around $500 billion in 2021 to $4 trillion today.

Joe Saluzzi, a trading manager at a prominent stock trading firm, exclaimed, "It's astonishing to see a company's market value exceed $4 trillion. This underscores the intense current enthusiasm for AI spending, with every investor eager to get a piece of the action."

Recent news of the U.S. government easing some chip export restrictions has further fueled NVIDIA's momentum. On July 3, Siemens announced that the U.S. Department of Commerce had rescinded the requirement for Synopsys, Cadence, and Siemens—the world's top three chip design software providers—to apply for government licenses for their operations in China. This move, while seemingly minor, sends a significant signal that adds to the market's anticipation for NVIDIA's future prospects.

However, NVIDIA's journey has not been without challenges. In May this year, Jen-Hsun Huang lamented that the U.S. government's ban on NVIDIA's H100 chip exports to China had caused substantial losses, including a $5.5 billion write-off of inventory and the forfeiture of $15 billion in sales revenue in the Chinese market.

NVIDIA's rise to a $4 trillion market cap is nothing short of legendary. On May 30, 2023, it became the first chip company in U.S. stock market history to surpass a trillion-dollar market cap. Just nine months later, on March 1, 2024, it breached the $2 trillion mark. By June 5, 2024, it had surpassed $3 trillion in just over three months. The leap from $3 trillion to $4 trillion took only 13 months.

This rapid growth is fueled by NVIDIA's relentless efforts in the AI chip domain. Its chip iteration speed is remarkable, with the new flagship AI chip, Blackwell Ultra, already shipping to customers.

Huang boasts that NVIDIA's chip iteration cycle is measured in years, and the company's ambitions extend beyond just chips. It is also committed to establishing large-scale data center factories globally. Last year, the global data center market was valued at $250 billion and is growing at a rate of 20% to 25% annually, providing a robust foundation for NVIDIA's market cap expansion.

The surge in NVIDIA's stock price is intimately tied to the soaring demand for its AI chips. With the explosive growth of AI technology, the demand for computing power has reached unprecedented levels, both from enterprises and research institutions. NVIDIA's AI chips have emerged as the linchpin behind numerous AI projects, akin to a lifeline in a desert.

02

From a technical standpoint, NVIDIA's dominance in the AI chip market is virtually unassailable. Its robust R&D team consistently launches more powerful chip products.

Market-wise, NVIDIA is involved in virtually all sovereign AI transactions. A Citigroup report projects that, based on higher-than-expected demand for sovereign AI, the AI data center market will reach $563 billion by 2028, presenting a colossal market opportunity for NVIDIA.

Nevertheless, NVIDIA faces several challenges. AMD released its new MI350 series of AI chips in June, claiming superior performance over NVIDIA's offerings. Additionally, Marvell, from the ASIC camp, raised its market target for AI custom chips in the same month.

Google's TPU chips boast a peak computing power of 4614 TOPs, and the number of TPU series connections could reach 9200 this year or next. Furthermore, customers are reluctant to see NVIDIA maintain a gross margin exceeding 60% and are eager to introduce their chip solutions at both the training and inference ends.

Moreover, NVIDIA is subject to policy constraints. The U.S. government's chip export restrictions have dealt a severe blow to NVIDIA in the Chinese market, which was once a significant stronghold. Although there are recent signs of easing restrictions, the uncertainty surrounding future policies still looms over NVIDIA like a sword of Damocles.

Most analysts remain optimistic about NVIDIA's future. Dan Ives, an analyst at American investment bank Wedbush, predicts that NVIDIA's market cap will not only hit $4 trillion this summer but is also expected to reach $5 trillion within the next 18 months.

He believes that enterprises and governments will spend $2 trillion on AI technology and related use cases over the next three years, providing NVIDIA with immense growth opportunities.

03

03

However, skeptics also exist. Jim Chanos, a renowned Wall Street short-seller, believes that the "entire ecosystem surrounding the AI boom" mirrors the dot-com bubble of the early 2000s. If the market retreats, companies reduce capital expenditures, and related projects are shelved, NVIDIA could face a double decline in revenue and performance.

From a market trend perspective, the evolution of AI is unstoppable. As AI applications continue to penetrate various industries, the demand for computing power will persistently grow. If NVIDIA can sustain its technological leadership, consistently introduce more potent chip products, and expand its market share, its market cap has the potential to continue scaling new heights.

Conversely, market uncertainties persist. Tariff issues, policy shifts, and the rise of competitors could all impede NVIDIA's progress. Furthermore, if the AI boom wanes or new technological shifts emerge, it remains unclear whether NVIDIA can adapt promptly.

Dali Finance believes that NVIDIA's achievement of a $4 trillion market cap is undeniably a significant milestone in the AI era, marking a new chapter in the industry's development. With its technological prowess and market position in the AI chip domain, NVIDIA indeed stands a chance to continue reaping the benefits of AI advancement in the future.

Finally: In today's rapidly evolving AI landscape, will NVIDIA maintain its leading position in the AI chip field, or will it be surpassed by emerging players? We welcome your comments and invite you to join the discussion in the comments section.

Matrix Account