2025 Auto Market Mid-Year Report: BYD Leads, Geely Surges, Joint Ventures Return to the Battlefield

![]() 07/11 2025

07/11 2025

![]() 653

653

The second half of the year has kicked off with a bang.

As more than half of 2025 has passed, major automakers are beginning to release their mid-year results.

Overall, BYD continued to lead, followed closely by SAIC, becoming the only automotive group to exceed 2 million vehicles. Among new forces, NIO, Li Auto, Xpeng, Xiaomi, and Hongmeng Zhixing have formed a new first tier. Brands that cannot rely on large groups began to fall behind.

Notably, mainstream joint venture automakers generally saw sales growth, demonstrating a strong recovery. Among them, FAW Toyota, FAW-Volkswagen, SAIC Volkswagen, SAIC GM, and GAC Toyota all achieved positive year-on-year growth, with the highest increase reaching 16%.

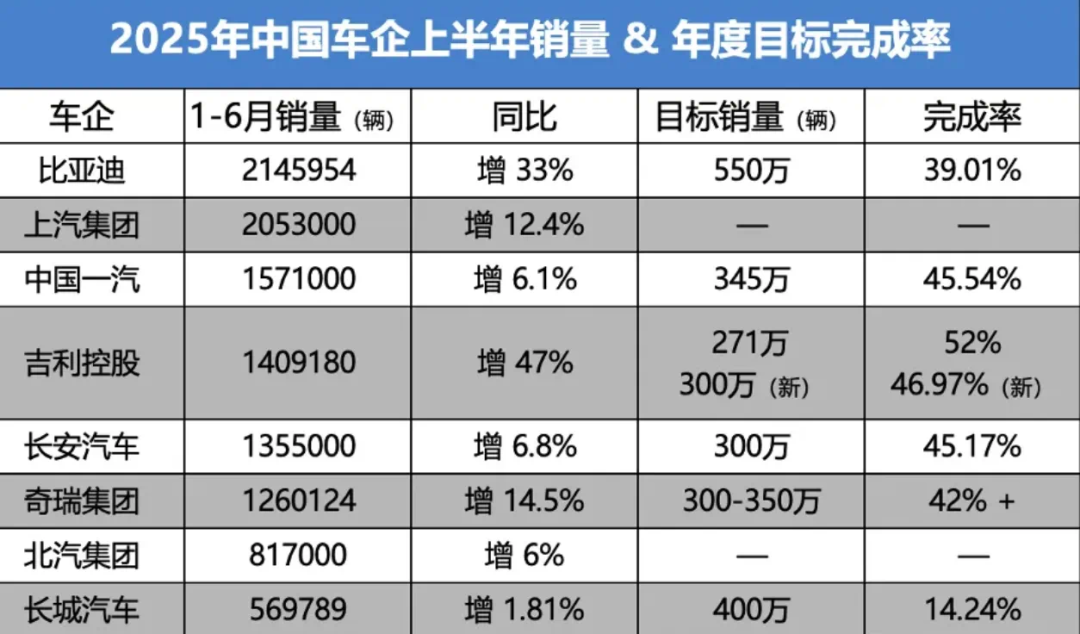

In terms of target achievement rates, Geely performed best, with the highest completion rate among the automotive groups in the statistics. Next were China FAW, SAIC Group, and Changan Automobile, with target achievement rates of 46%, 46%, and 45%, respectively, close to the benchmark of "half the time, half the task". Chery was at 40%, and BYD was at 39%.

"Following BYD's Path"

In absolute terms, BYD is still the undisputed sales champion.

From January to June this year, BYD Group sold a total of nearly 2.146 million vehicles, a year-on-year increase of 33%. Overseas sales of passenger vehicles and pickups exceeded 470,000 vehicles. Its overseas sales of passenger vehicles in 2024 were 417,000 vehicles, and the first half of this year has already surpassed last year's total.

The Dynasty and Ocean series were the main contributors, selling a total of 342,737 vehicles, accounting for nearly 90% of total sales. The FANGCHENGBAO brand sold 18,903 vehicles due to its hardcore off-road positioning, showing outstanding performance. Denza secured a foothold in the high-end market with sales of 15,783 vehicles.

Although the YANGWANG brand currently only delivers 205 vehicles per month, its pricing at the million-yuan level still represents the flagship of domestic brands.

BYD's product line covers various price ranges from 150,000 yuan to over a million yuan. In terms of categories, except for pickup trucks sold abroad, it basically covers all domestic and foreign markets.

It should be emphasized that BYD still set an ultra-high annual sales target of 5.5 million vehicles on a huge base plate, which can be seen as self-imposed intensity.

The current domestic competition is like sailing against the current; if BYD does not "wipe out" its competitors in advance, even if it is in a high position, it may fall from the pedestal.

Among independent automakers, Geely has begun to follow BYD's path of multiple category hits. Whether it's the Yinhe E5, Xingjian 7 EM-i, or Xingyuan, they are basically hit products modeled after BYD's.

This approach has also allowed Geely to taste success.

In the first half of this year, Geely sold a total of 1,409,180 vehicles, a year-on-year increase of 47%, setting a record high. This terrifying growth rate also reminds people of BYD in 2021. Among them, sales of new energy vehicles (including Geely, Lynk & Co, and Zeekr) reached 725,151 vehicles, a year-on-year increase of 126%, with the new energy penetration rate exceeding 52%.

Surprisingly, against the backdrop of difficult maintenance for all parties, based on strong sales performance in the first half of the year, Geely Automobile decided to increase its original annual sales target by 11%, from 2.71 million to 3 million vehicles.

Even if calculated based on the latest sales target, Geely Automobile's annual sales target achievement rate has reached 47%, still ranking first among major automotive groups.

As a major exporter, Chery Group achieved over 1.26 million vehicles in the first half of the year, a year-on-year increase of 14.5%. The highlight was that exports exceeded 550,000 vehicles in the first half of the year, a year-on-year increase of 3.3%, maintaining its position as the number one exporter among Chinese automakers, with cumulative exports exceeding 5 million vehicles.

In the domestic market, Chery has also begun to play with integration, shifting from a multi-brand strategy to a single Chery strategy, as if the company based in Wuhu is spinning in place.

Recently, Chery Automobile established the Chery Brand Domestic Business Group, which consists of four major business units: Xingtu Business Unit, Aihu Business Unit, Fengyun Business Unit, and QQ Business Unit.

Among the four business units, the Xingtu Business Unit focuses on the premium brand Xingtu, the Aihu Business Unit focuses on the two classic products Arrizo and Tiggo, the Fengyun Business Unit focuses on the new energy brand Fengyun, and the QQ Business Unit focuses on small vehicle products.

In addition, Chery's Zhijie brand in cooperation with Huawei, iCAR brand in cooperation with Smartmi, and Jietu brand will continue to operate independently.

After clarifying the brands, it is hoped that Chery can concentrate resources to further expand the domestic market.

Changan Automobile sold 1.355 million vehicles in the first half of the year. Although its sales report did not list specific export data, its overseas activities were very intense in the first half of the year. In March, it held a European brand launch event, and in May, the Rayong factory in Thailand was put into operation. More than 30 global brand events were held. Currently, the construction and operation of 9 overseas vehicle factories in countries such as Egypt and Thailand have been completed, and several more overseas factories are being planned. There are over 14,000 global sales and service outlets, and Changan's presence can be seen in five major regional markets.

Great Wall Motor had the lowest growth rate among the major domestic automotive groups, selling 569,789 new vehicles in the first half of the year, a slight year-on-year increase of 1.8%. Among them, 160,400 new energy vehicles were sold, and 197,700 vehicles were sold overseas.

It has to be admitted that in recent years' horizontal comparisons, Great Wall Motor has fallen behind and failed to keep up well with the team. In the second half of this year, with more intense competition, Great Wall will have fewer and fewer cards to play.

Joint Venture Counterattack

In the sales statistics for the first half of this year, the recovery of joint venture brands was a huge highlight.

From the results, in the first half of this year, FAW Toyota sold 377,800 new vehicles, a year-on-year increase of 16%; FAW-Volkswagen sold 436,100 new vehicles, a year-on-year increase of 3.5%; SAIC Volkswagen sold 523,000 vehicles cumulatively in the first half of the year, a year-on-year increase of 2.3%; SAIC GM sold 245,100 vehicles cumulatively, a year-on-year increase of 8.64%; GAC Toyota sold 364,200 vehicles cumulatively, achieving positive year-on-year growth.

Even Beijing Hyundai sold more than 100,000 vehicles in the first half of the year, with June's sales soaring 66% month-on-month. Models such as the Elantra and Tucson L contributed significantly. This series of data indicates that joint venture brands have gradually found a balance point for transformation after experiencing the impact of new energy.

Under the strong impact of new energy in the past, joint venture brands were either timid and stagnant or made a lot of noise but accomplished little, forced to transform amid contradictions and complex emotions.

Such a mentality could only lead to a series of deformed products. In addition, with supply chain advantages, independent brands engaged in intense price wars, and even luxury brands continued to put pressure on them, causing huge impacts on joint venture brands.

After several years of pain and exploration, joint venture brands seem to be on the right path.

In terms of new energy transformation, the strategy has shifted from the previous false "all in" to "gasoline and electricity with intelligence". Joint venture brands have injected intelligent genes into fuel vehicles.

For example, FAW Toyota upgraded the Prado with super hybrid technology and launched four sub-models to cover off-road demand; SAIC GM Buick GL8 Lushang is equipped with the "True Dragon Plug-in Hybrid" system, achieving a comprehensive range of 1,420 km, breaking the inherent contradiction between energy consumption and power of MPVs. Data shows that sales of intelligent fuel vehicle models such as the TAYRON L and the Envision Plus increased by more than 200% year-on-year.

In terms of electrification, they have also abandoned their blind faith in their own technology. The focus has shifted from "global technology introduction" to "China market-led". FAW Toyota's electric vehicle share reached 49%, and the first locally developed model bZ5 saw orders surge after its launch, becoming a hit among joint venture new energy vehicles.

Toyota is restructuring its strategy with the Chinese market as the main body, achieving the transformation from "Toyota standards, global R&D" to "Toyota standards, Chinese R&D" through decentralization of management and decision-making rights, localization of R&D systems, and localization of supply chains. Without changing the standards, it shifts from global users posing questions to Chinese users posing questions, with Chinese local teams providing answers.

Dongfeng Nissan officially stated that it will use China's most complete new energy industrial chain and China's development speed to create products that Chinese consumers like. Dongfeng Nissan N7 received over 20,000 large orders within 50 days of its launch.

SAIC GM has launched multiple new energy vehicles based on the "Xiaoyao" architecture, with products "defined in China", and plans to launch over 10 products in 2025-2026, achieving full coverage of the L2++ intelligent driving system.

The relationship between joint venture automakers and Chinese local suppliers is no longer limited to mere learning and utilization but is evolving into ecological cooperation, truly embarking on localization. GAC Toyota has brought in "giants" such as Huawei, Xiaomi, Tencent, and Momenta, and established a chief engineer system in China, essentially transferring the decision-making chain to China. It also stated that all GAC Toyota models will be developed and led by Chinese engineers.

In addition, against the backdrop of the price war, joint venture brands have joined the battlefield in the form of "fixed prices", reshaping the consumer experience through price transparency.

To some extent, this is currently the most practical time to buy a joint venture car.

How long can NIO lead?

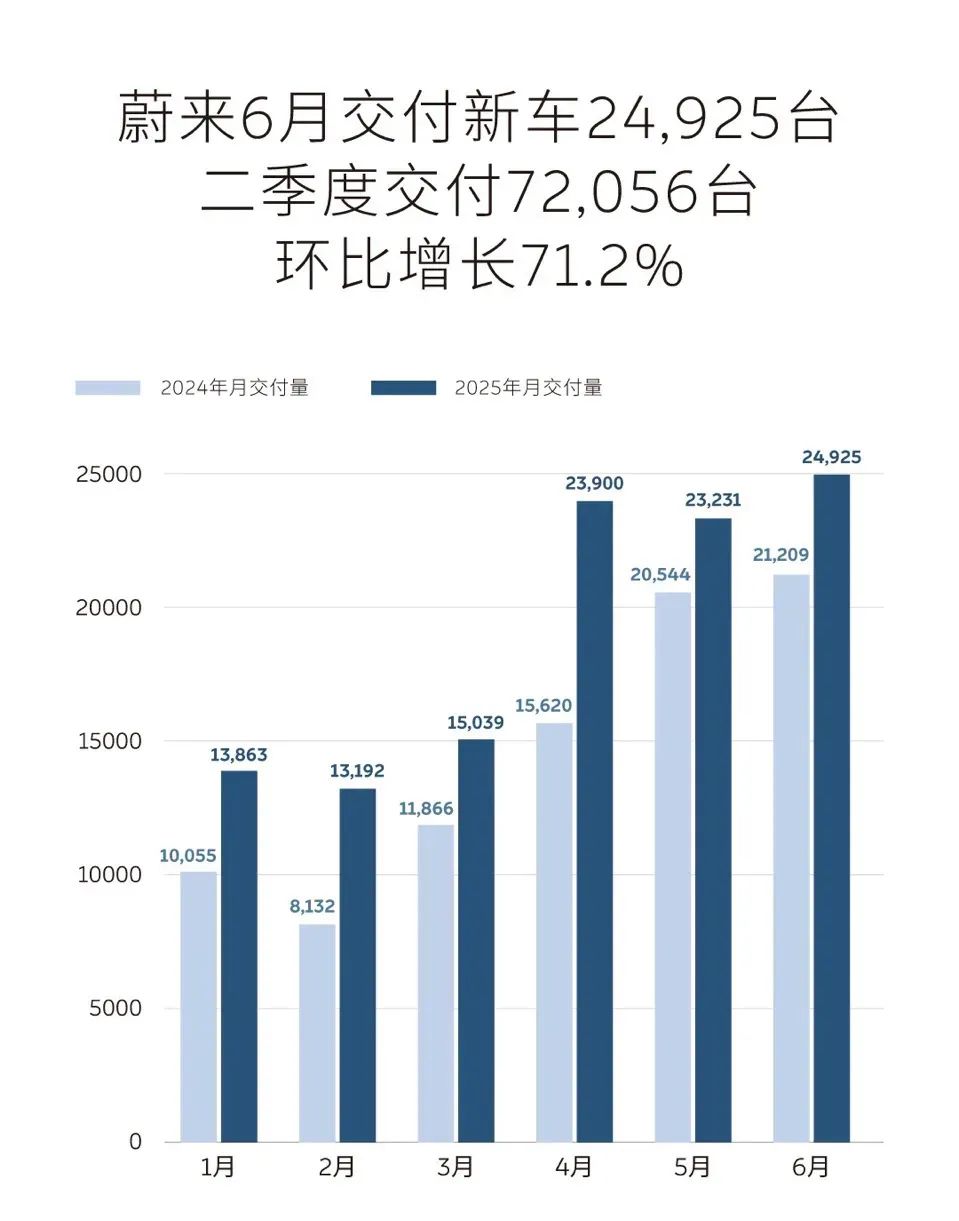

In the new force sector, although Huawei's Hongmeng Zhixing and Xiaomi are undoubtedly the hottest trending topics in terms of volume, NIO has been leading in sales for several months.

NIO sold over 220,000 vehicles in the first half of 2025, a year-on-year increase of 138%, firmly occupying the front rank of new energy vehicles. The average monthly sales exceeded 48,000 vehicles, and since April this year, NIO has been the sales champion among new forces for three consecutive months, with June being the third time it topped the sales list among new forces.

In terms of product strategy, it accurately targets the mainstream 150,000-250,000 yuan market. The C series wins over family users with its intelligent experience and sense of quality, while the dual routes of pure electric and extended range solve range anxiety. The T series meets the needs of large families. NIO's monthly sales are about to reach the 50,000-vehicle threshold, with some room for growth.

As a special force among new forces, Huawei's Hongmeng Zhixing has indeed had a huge impact on the entire automotive ecosystem. It took only 39 months to achieve cumulative deliveries of 800,000 vehicles, setting a record for the fastest delivery among new force automakers. However, as the number of sub-brands increases, problems are becoming increasingly apparent along with rising sales.

Of the 52,747 new vehicles delivered in June, the Wenjie series delivered 44,685 vehicles, accounting for 84.7% of total sales. Among them, the Wenjie M9 delivered 13,718 vehicles in a single month, with cumulative deliveries exceeding 200,000 vehicles, and the Wenjie M8 delivered 21,185 vehicles, absolutely deserving to be called the main force.

This also means that the other series are gradually being marginalized in full market competition. It is worth noting that this year, Hongmeng Zhixing set a sales target of up to one million vehicles, which is currently only 20% completed.

It seems that Huawei's golden signboard is not always applicable everywhere.

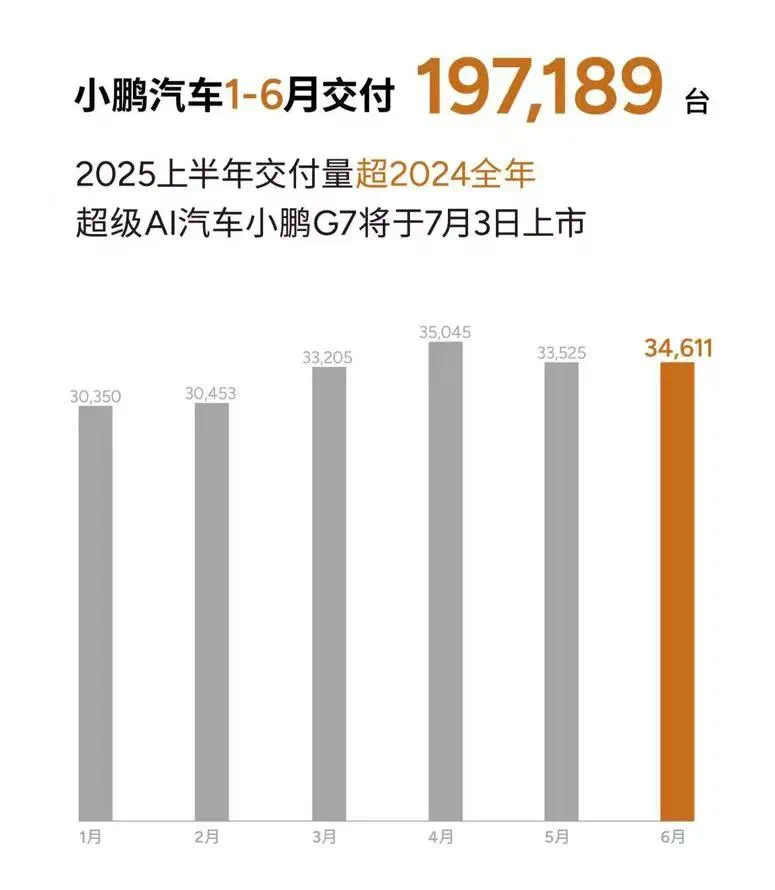

In contrast, Xpeng is the only new force brand that has met its target, with a target sales completion rate exceeding 50%.

In the first half of this year, Xpeng delivered a total of 197,189 new vehicles, surpassing the total deliveries for the entire year of 2024, with a huge year-on-year increase of 279%.

In terms of products, the Xpeng MONA M03 and Xpeng P7+ combined sold over 136,000 vehicles, accounting for 69% of its overall sales, serving as the absolute sales mainstay. The Xpeng G6 and Xpeng G9 sold nearly 35,500 vehicles together, accounting for 18% of the total.

Moreover, the mid-sized SUV Xpeng G7, which was launched this month, received over 10,000 orders within just 9 minutes of going on sale, demonstrating impressive market performance. The first extended-range model built on the G9 platform will be launched in the fourth quarter. The launch of these models is expected to become another pillar of Xpeng's sales, leading the brand to continue growing.

After Wang Fengying's arrival, Xpeng's sales increased, but so did its prices decrease. After resolving the sales crisis, Xpeng needs to achieve profitability even more.

On July 1, the 10th anniversary of Li Auto, the company released a less-than-ideal sales report. In the first half of this year, Li Auto delivered a total of 208,000 vehicles, accounting for 29.7% of its original annual sales target of 700,000 vehicles. Sales in June declined by 24% year-on-year, with the main L series models falling by over 16% month-on-month, and the pure electric MEGA becoming the only bright spot.

On May 22, Li Auto announced that it had lowered its sales target from 700,000 to 640,000 vehicles, but even after the adjustment, sales in the first half accounted for only 32.5% of the target.

A month later, on June 27, Li Auto once again announced through the Hong Kong Stock Exchange that its second-quarter delivery expectations were revised downward from 123,000-128,000 vehicles to 108,000 vehicles, a decrease of approximately 15,000 vehicles.

In the second half of this year, Li Auto plans to launch two pure electric SUVs, the i6 and i8, all at once. Therefore, there will be no new heavyweight models from the L series in Li Auto's plan this year, which is one of the factors contributing to the bottleneck in sales. These two pure electric products will undoubtedly determine Li Auto's trend next year.

With the support of NIO's Lido and Firefly models, NIO's sales have begun to pick up. In the first half of 2025, NIO delivered a total of 114,150 new vehicles, a year-on-year increase of 30.6%. For NIO, the recovery in sales is a positive signal, which may indicate that the dark night is about to end, and dawn is approaching.

Prior to this, Li Bin expressed his intention to achieve profitability in the fourth quarter of this year. As this milestone approaches, the outside world does not seem optimistic. Although sales performance has improved, it is still insufficient to address NIO's financial pressures.

In the second half of this year, NIO will also launch three new models: the third-generation NIO ES8, Lido L90, and Lido L80. Perhaps after the launch of these three main products, they will provide a qualitative boost to the company.

In summary, the underlying logic of the market has been reconstructed. The price war has shifted from an "elimination round" to a "value war," technological competition has shifted from "parameter introversion" to "scenario definition," and the overseas market strategy has shifted from "single exports" to "global operations."

At the start of the second half of the year, BYD with a target of 5.5 million vehicles and Geely with a target of 3 million vehicles will compete for the position of leading autonomous brand; the technological counterattack and new energy breakthroughs of joint venture brands may rewrite the existing market structure; among the new forces, new top players will emerge as they navigate the trade-off between scale and profitability. In this race for the fate of the industry, there are no eternal leaders, only those who continuously evolve can stay ahead of the curve.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.

-END-