Humanoid Robots: Forging Alliances and Securing Resources

![]() 09/12 2025

09/12 2025

![]() 456

456

In essence, the current wave of collaborations serves a dual purpose: providing mutual support in challenging times and binding companies with upstream, downstream, and cross-sector partners. This is akin to 'casting a vote' for the future landscape of the industry.

Editor: Lv Xinyi

Who dares to go it alone in today's world?

Over the past month, the humanoid robot sector has witnessed a significant expansion of its 'circle of friends,' with robot manufacturers actively seeking allies across diverse sectors. Whether it's Fourier and BASF collaborating on the application and development of engineering plastics, polyurethane, and thermoplastic polyurethane in robots and their components; or UBTECH signing a substantial $1 billion strategic partnership agreement with the renowned international investment firm InfiniCapital, focusing on financial support and industrial synergy; or Oyi Technology forging strategic partnerships with LY Itech, Sichuan Tianlian Robotics, and Guohua Intelligent...

A prime example is the strategic partnership between Shenzhen Huizhi IoT and AI Square. Over the next three years, Huizhi IoT plans to deploy over 1,000 embodied intelligent robots at HKC's global production bases for use in warehousing and logistics, material handling, component assembly, and quality testing. This collaboration, reportedly valued at nearly 500 million yuan, marks the world's largest humanoid robot procurement contract.

Image source: AI Square

All these developments point to a clear trend: humanoid robots, eager for commercialization, 'need a reliable partner.'

The underlying rationale is that humanoid robots represent a demand-driven industry. Only by addressing pain points on the demand side can commercialization succeed, enabling self-sustaining growth, attracting investment, extending viability, and transmitting momentum upstream to drive standardization, cost reduction, and continuous evolution in the supply chain, thereby forming an ideal industrial closed loop.

The concept that 'demand enables possibility' is not new in the humanoid robot sector. Previously, multiple sources and the Embodied Intelligence Research Institute noted that some humanoid robot manufacturers have even started requiring investors to 'bring orders to invest.'

In this context, orders serve as both short-term commercial PR narratives and seeds for long-term operations. After all, without sales or practical applications, humanoid robots will remain confined to the laboratory ivory tower. When clear demand entry points are lacking, partnering with investors offers a mature and validated path.

Now, as the industry matures, deep collaboration with investors alone can no longer satisfy the ambitions of robot manufacturers. Hence, the narrative of expanding the 'circle of friends' emerges.

Seeking Shorter Paths to Deployment

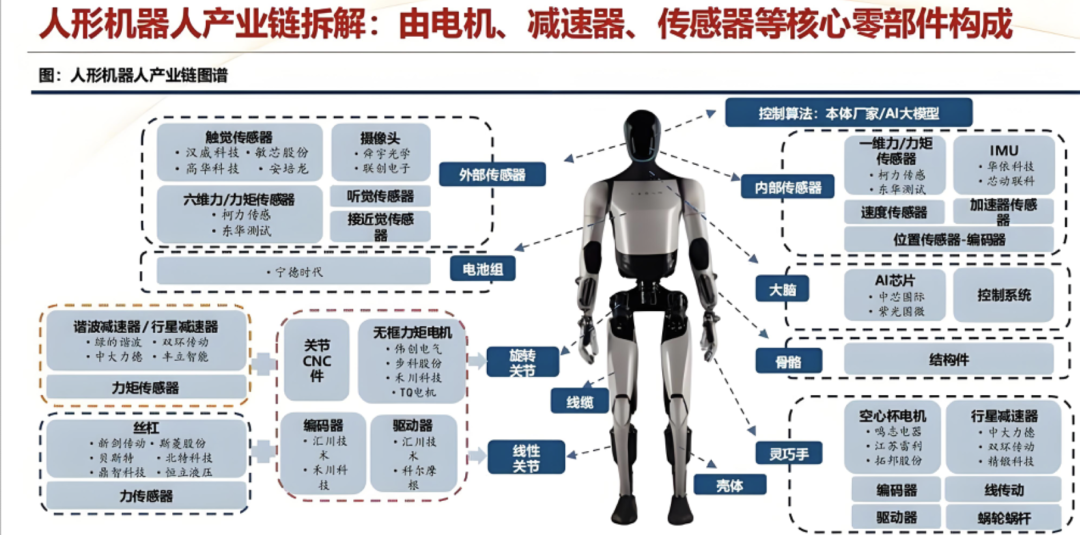

Humanoid robots pose a complex systems engineering challenge, with products comparable in complexity, scalability needs, synergy, and industrial spillover effects to the automotive industry. Even recently, at the Munich Auto Show, He Xiaopeng admitted, 'Compared to cars and airplanes, robot R&D is more challenging.'

This high level of difficulty means that while humanoid robots share similarities with other industries, they cannot simply 'copy homework' and must find their own solutions. Currently, humanoid robots are still in their infancy, with supply chain maturity and market scale lagging far behind the automotive sector.

As he put it, '50 billion yuan in R&D investment is just the entry ticket,' making solo endeavors incredibly daunting. But companies need more than just capital—they need shorter paths, using funds to buy time and space in the market.

Most current collaborations adhere to this underlying logic.

Integrating advanced technologies like AI, high-end manufacturing, and new materials, humanoid robots represent the pinnacle of advanced manufacturing. Their development requires coordinated innovation across mechanics, electronics, sensing, software, communications, AI, and other fields, making it impossible for a single company to lead in all areas. This drives the need for cross-sector collaboration.

Image source: Internet

Thus, collaborations among midstream manufacturers focus on technical partnerships, pooling strengths to tackle challenges and refine products. As discussed earlier by the Embodied Intelligence Research Institute, tech firms often fall into the trap of building 'moats' through closed innovation. However, in the 'technology-product-market' chain, technology must translate into usable products early to achieve commercialization and market penetration. In the blue ocean of humanoid robots, gaining a first-mover advantage through rapid product iteration is critical.

Going it alone is unviable—neither product completion nor technical validation cycles can wait. Collaboration accelerates breaking through technical bottlenecks and enables faster market entry.

At the market entry level, another form of industrial collaboration comes into play. Humanoid robots urgently need real-world scenarios. For example, in the partnership between Tiangong and Harson, Harson provides manufacturing lines, warehousing hubs, and retail terminals as triple real-world testbeds, while Tiangong transforms these scenarios into validation grounds for technological commercialization.

You'll notice that traditional emerging industries often attract VC funding early on, but the humanoid robot sector differs—here, industrial investors dominate, directly providing scenarios or even orders to robot firms. This 'feeding' process is a necessary 'infancy stage' for the humanoid robot market.

Turning to upstream collaborations, many financing cases involve partnerships with upstream component suppliers, such as Wolong Electric's mutual investments with Zhiyuan Robotics...

Through these, humanoid robot manufacturers secure stable, controllable supply chains, gaining an edge in scalable, low-cost production. Simultaneously, deep collaborations help upstream suppliers clearly understand midstream component standards, fostering standardization across the upstream supply chain.

The Essence of Collaboration is 'Symbiosis'

Humanoid robot companies resemble ivy—on the steep 'embodied intelligence' market wall, only more touchpoints prevent them from falling.

Fundamentally, companies in this market face immense pressure—it's a high-investment, high-risk sector with pronounced winner-takes-all dynamics.

Investors see this clearly. Lan Chi Venture Partners' Cao Wei stated, 'In 3-5 years, the number of humanoid robot players will shrink.' Vita Dynamics founder Yu Yinan bluntly predicted, 'Only three top players will survive in the embodied intelligence market.' To avoid being left behind, humanoid robot firms must expand business collaborations, growing together while sharing risks.

This is where ivy's strengths shine.

For individual firms, broad collaborations rapidly address shortcomings—linking to downstream entities for scenarios, partnering with midstream peers for technical problem-solving, or binding with upstream suppliers for stable supply chains. They also lock in premium resources—whether scarce application scenarios, core technical patents, or stable component production—forming 'exclusive moats' to avoid passive resource scrambles in future competition.

In the market's early stages, 'securing positions' matters more than 'single-point breakthroughs.' Each additional collaboration touchpoint increases survival odds during industry shakeouts.

However, ivy has two drawbacks: first, breadth without depth—lacking specialized domains or technical advantages; second, overextension leading to resource fragmentation or technical integration issues. The former highlights the need to balance collaboration with self-reliance, while the latter relates to startup pacing.

Short-term, early-stage firms lack resources—funding, manpower, and supply chains are constrained. Whether through cross-sector moves, partnerships, or order fulfillment, humanoid robot firms cannot exceed current scale thresholds without risking product delivery, financial management, or operational disruptions.

This is no exaggeration. Referencing the closest parallel—new energy vehicles (NEVs)—both sectors share 'capital-intensive, long-cycle, supply-chain-dependent' traits. NIO's collapse, driven by reckless production line expansions and IPO rushes, serves as a stark warning: early-stage firms that pursue 'hyper-scale growth' beyond their resource capabilities—whether in order fulfillment, capacity expansion, or cross-sector collaborations—risk cascading crises from 'ambition outpacing resources.'

It's also crucial to emphasize that 'symbiosis' can imply 'entanglement.'

In essence, the current collaborations serve a dual purpose: providing mutual support in challenging times and binding companies with upstream, downstream, and cross-sector partners. This is akin to 'casting a vote' for the future landscape of the industry: the higher-quality the bound resources and the more comprehensive the covered segments, the greater the likelihood of becoming 'survivors' chosen by the industry and market in the final head-to-head competition. When the market transitions from 'wild growth' to 'refined operation,' only firms with established collaboration networks and resource reserves can adapt swiftly to market shifts and stabilize during industry contractions.

Conversely, fragmentation or rigidification risks greater dangers when technical or commercial paths remain unresolved. For instance, a roadblock in a software/hardware technical route or a corporate scandal could damage the entire ecosystem.

In summary, the humanoid robot industry is fundamentally a grand experiment in 'symbiosis' and 'evolution.'

From an industrial perspective, it's not a solitary battle for a single technology or firm but a complex systems engineering challenge requiring whole-industry collaborative innovation. Its development follows a 'demand-driven, technology-powered, ecosystem-win-win' logic—like ivy, humanoid robots are climbing the steep market wall.