Alibaba Spearheads AI Trend, Hong Kong Stock Market's Tech Boom Makes a Comeback

![]() 09/12 2025

09/12 2025

![]() 692

692

This week, with Alibaba at the helm, Hong Kong-listed tech stocks have set sail on a fresh voyage. Leading players like Alibaba and SMIC are inching closer to their highest points of the year so far.

Missed out on Alibaba's pleasant surprise? No need to fret. Earlier on, short-term fundamental disruptions kept other major stocks at their lowest points of the year. But now, with those short-term issues resolved, foreign capital flowing back into Hong Kong, and southbound funds upping their stakes, Hong Kong-listed tech stocks are poised for a strong showing.

The Hang Seng Index has hit a new high for the year, while the Hang Seng Tech Index, a barometer for tech stocks, is still 7% shy of its peak. In this global tech boom, jumping on the tech stock bandwagon is a smart move. However, picking the right stocks is tricky, so investing through the China Southern Hong Kong Stock Connect Tech ETF (159269) is a solid option.

A Fresh Start for Hong Kong's Tech Market

Right now, both the US and A-share markets are riding a tech wave, and it looks like the Hong Kong stock market is set to follow suit.

Looking back at the first half of the year, Alibaba was the driving force behind Hong Kong's tech rally. Whenever Alibaba's AI story resurfaces, it's expected to draw more market capital to undervalued Hong Kong-listed tech stocks that haven't seen big gains yet. For instance, foreign investors who missed out earlier are likely to start increasing their tech stock holdings for several reasons.

1. On a macro level, tech rallies have historically been fueled by loose liquidity. Currently, China is doubling down on its 'moderately loose monetary policy.' Meanwhile, recent US macro data has been showing signs of weakness, with the Federal Reserve likely to slash interest rates by 50 basis points in September, kicking off a new credit cycle. With both China and the US releasing liquidity, this environment is a boon for tech stocks.

Moreover, with strong industrial policy support for artificial intelligence and humanoid robots, technological advancement is clearly a priority for the coming years. In short, picking the right industry is key, followed by selecting the right companies.

It's also worth mentioning that, when compared to the long-term trends of the A/H-share tech sectors, Hong Kong-listed tech stocks have delivered significant excess returns relative to the market over the past two decades.

2. From a market narrative standpoint, the market is currently at a crossroads.

Previously, concerns about Alibaba's food delivery war with Meituan hurting internet stock profits, along with short-term factors like new energy vehicle production capacity and fierce competition, dragged down short-term valuations. As a result, several major stocks underperformed earlier, with the market even failing to give Alibaba Cloud a separate valuation before the second-quarter earnings report. It's safe to say that Hong Kong stocks lost their strongest AI valuation narrative for a while.

The tide turned with Alibaba's earnings report, where Alibaba Cloud's revenue blew past expectations, drawing foreign capital's attention back to Hong Kong-listed tech stocks. In essence, Alibaba can be seen as Hong Kong's AI bellwether—whenever its story is strong, sentiment towards Hong Kong-listed tech stocks improves.

Goldman Sachs noted in its report that second-quarter capex growth has boosted market confidence in Alibaba Cloud's growth. With more certainty around Alibaba Cloud's growth, Goldman Sachs raised its valuation to $36 per share. Goldman Sachs calls Alibaba a viable AI investment target in Hong Kong, predicting that its outperformance will continue into the fourth quarter due to previously low institutional investor allocations.

3. From an incremental capital perspective.

From the vantage point of southbound funds and foreign capital, they're more inclined to invest in narratives centered around AI growth. When the significance of AI growth overshadows narratives about intense competition in sectors like food delivery, the market is more willing to brush aside competition concerns and directly opt for tech stocks with higher valuation potential. Meanwhile, the tech sector is currently underrepresented in institutional portfolios, as the Hong Kong market has been primarily driven by consumer stocks and innovative pharmaceuticals lately. Now, the market is undergoing a style shift.

For example, Alibaba's recent surge reflects a revaluation of Alibaba Cloud, while AI beneficiaries like Tencent have also been on a roll lately, nearing their all-time highs.

Judging by the net inflow of southbound funds, they're entering a new phase of tech stock allocation.

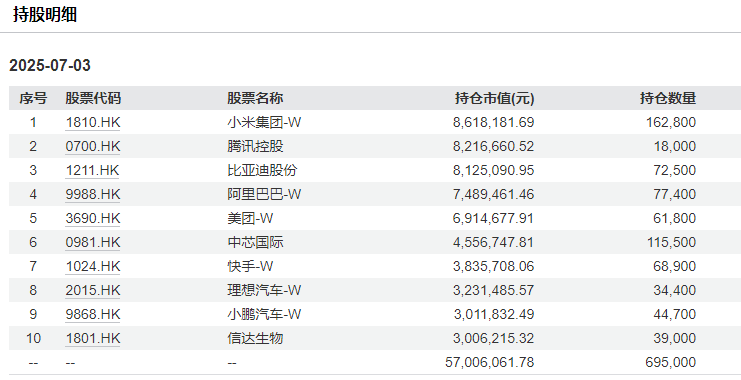

According to WIND data, as of September 11, in the past five days, southbound funds have net bought HK$14 billion worth of Alibaba shares, HK$3.3 billion of Meituan, HK$2.3 billion of BYD, HK$1.3 billion of Xiaomi, and HK$1.2 billion of Tencent.

According to Goldman Sachs data, before Alibaba's earnings report, emerging market and Asian mutual funds were underweight by 76 basis points, and due to global institutional capital flows, Goldman Sachs' PB leaned towards net selling. After the earnings release, foreign capital flows towards Alibaba have turned net positive, primarily driven by institutional capital.

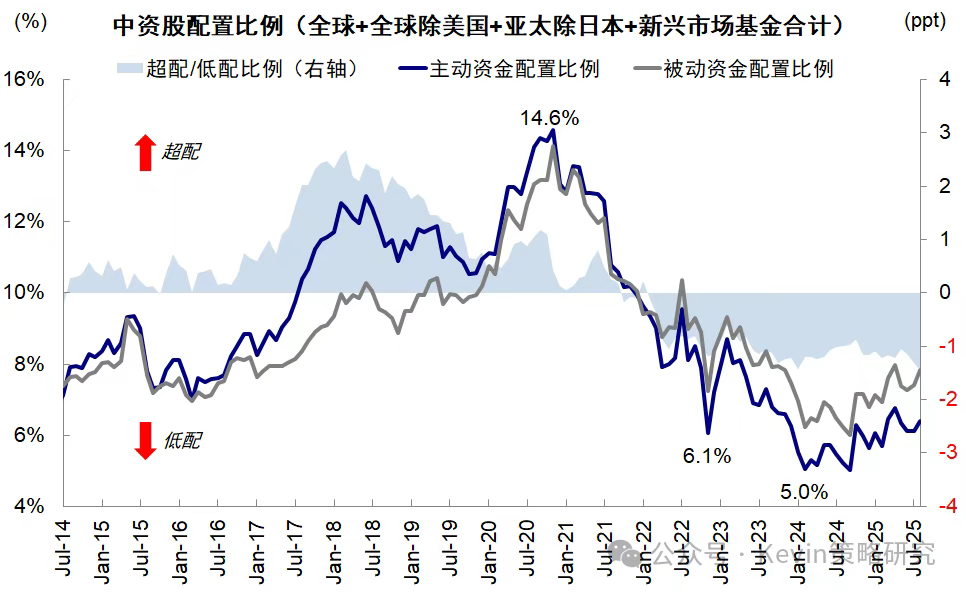

As shown in the chart below, according to CICC data, active funds are underweight in Chinese stocks by 2.3%, while passive funds are underweight by 1.3%. This allocation remains at historically low levels.

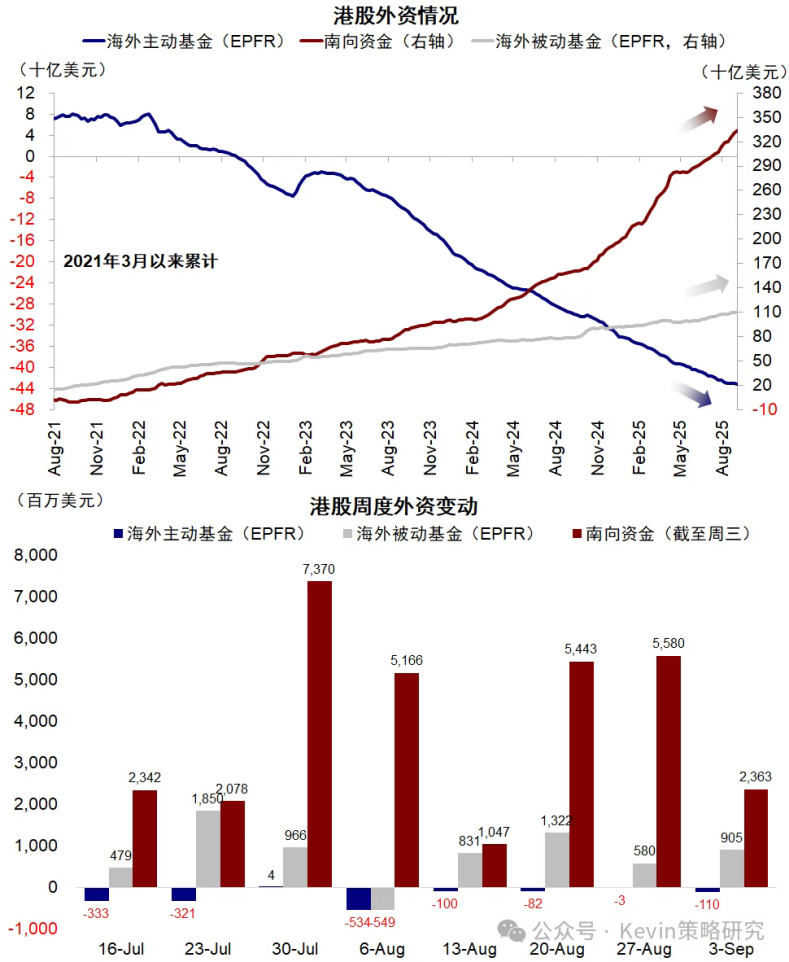

According to CICC data, as shown in the chart below, the magnitude of net inflows into Hong Kong stocks started to pick up last week. What foreign capital is snapping up in Hong Kong are tech stocks like Alibaba, Tencent, and Xiaomi—not only are these the easiest tech narratives for foreign capital to grasp, but they also represent the industrial trend with the highest growth certainty.

Therefore, against the backdrop of Alibaba's sudden turnaround in leading Hong Kong's tech narrative, most market capital has yet to catch up with the shift. Both domestic and foreign capital allocations remain underweight in tech stocks, and most tech stocks haven't seen significant gains yet, such as Xiaomi, BYD, Meituan, Kuaishou, and Li Auto. Thus, now is still a prime time to allocate to tech stocks. By investing alongside major market funds, your chances of success will be significantly higher.

So, after figuring out the direction, it's also crucial to choose the right allocation method. For example, the China Southern Hong Kong Stock Connect Tech ETF (159269) tracks the CSI Hong Kong Stock Connect Tech Index.

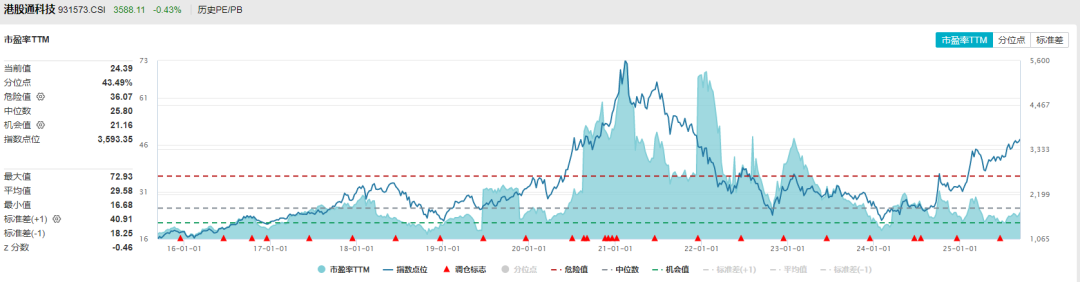

It's worth noting that the Hang Seng Tech Index hasn't yet hit a new high for the year, but the CSI Hong Kong Stock Connect Tech Index has recently done so. In other words, this index is expected to deliver superior returns in a bull market due to its more balanced sector allocation. As of September 11, the index's valuation is still at around the 43rd percentile historically, remaining relatively low.

Therefore, amid the spreading sentiment of an A-share tech boom, following the allocations of southbound funds and foreign capital, the China Southern Hong Kong Stock Connect Tech ETF (159269) is an excellent choice.