Industry's Largest Financing Round! ByteDance Alumni Launches AI Video Startup, Secures $430 Million from Alibaba with Over 100 Million Users

![]() 09/17 2025

09/17 2025

![]() 438

438

The AI-generated video sector has recently set a new benchmark: AIShion Technology has secured over $60 million in Series B financing, with Alibaba as the lead investor. This funding round, approximately 426 million yuan, has established a new domestic record for the largest single-round financing in the AIGC video industry.

So, what hidden opportunities lie behind this investment that enticed Alibaba to make such a substantial commitment?

- 01 -

AIShion Technology was founded by Wang Changhu, a post-80s entrepreneur (born in 1982) from Benxi, Liaoning. In 2009, he earned his Ph.D. from the University of Science and Technology of China and joined Microsoft Research Asia, where he spent eight years honing his expertise.

In 2017, he transitioned to ByteDance as the Director of AI Lab, spearheading the development of video AI capabilities for Douyin and TikTok from the ground up.

Wang Changhu's background is firmly rooted in AI video technology. During his time at USTC, his research focused on computer vision, video understanding, multimedia retrieval, and machine learning. At ByteDance, he further specialized in AI video applications.

Later, he shifted from ByteDance to Longfor Group, taking on a new role as General Manager of the AIoT Engine Team, where he oversaw digital and intelligent transformation initiatives.

It wasn't until April 2023 that he founded AIShion Technology, returning to his roots in the AIGC video sector.

In terms of product strategy, AIShion Technology adopted a "global-first, domestic-later" approach. In January 2024, it launched PixVerse, an overseas AI video creation platform: users input photos or text, and PixVerse generates high-quality videos in return.

In June 2025, AIShion Technology introduced "Paiwo AI," the domestic counterpart to PixVerse.

This is a fiercely competitive field, surrounded by industry giants. International players like Runway, Google, and OpenAI pose significant challenges, while domestic leaders such as ByteDance (with Jianying and Jimeng) and Kuaishou (with Kling) also dominate the market.

Of course, ByteDance is Wang Changhu's former employer. Stories of alumni leaving to start their own ventures and eventually surpassing their former employers are rare but not unheard of.

From an entrepreneurial standpoint, securing a strong partner in such a competitive sector is ideal. In its latest funding round, AIShion Technology did just that by partnering with Alibaba.

Although Alibaba has its own AI video initiatives, such as Tongyi's video large model "Tongyi Wanxiang" and Alimama's tomoVideo for e-commerce marketing AI videos, innovation often thrives on a combination of internal incubation and external investment through equity stakes.

For AIShion Technology, Alibaba's ecosystem resources—including computing power, AI technology, application scenario collaborations, and financial support—provide a robust countermeasure against other industry giants.

- 02 -

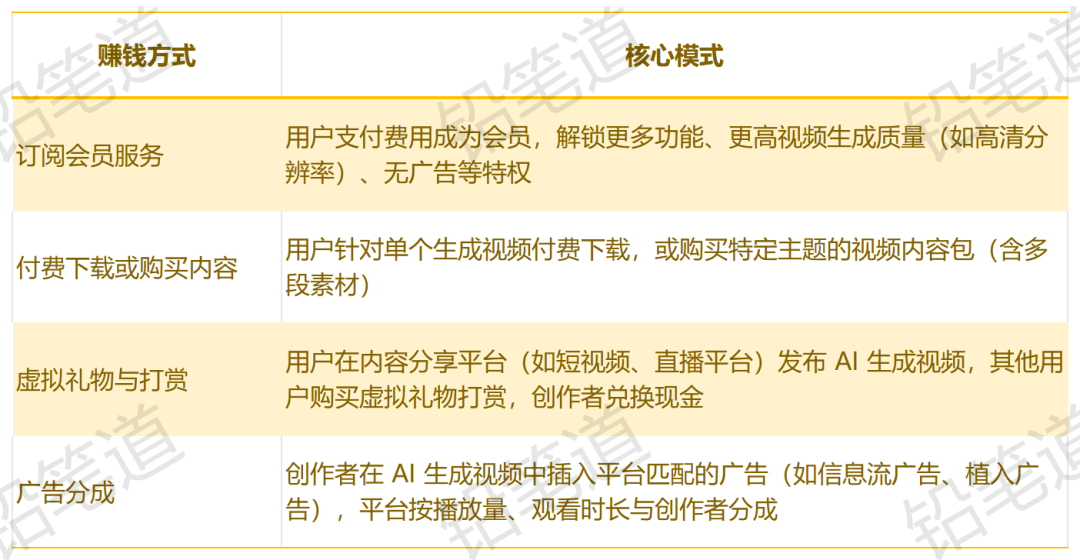

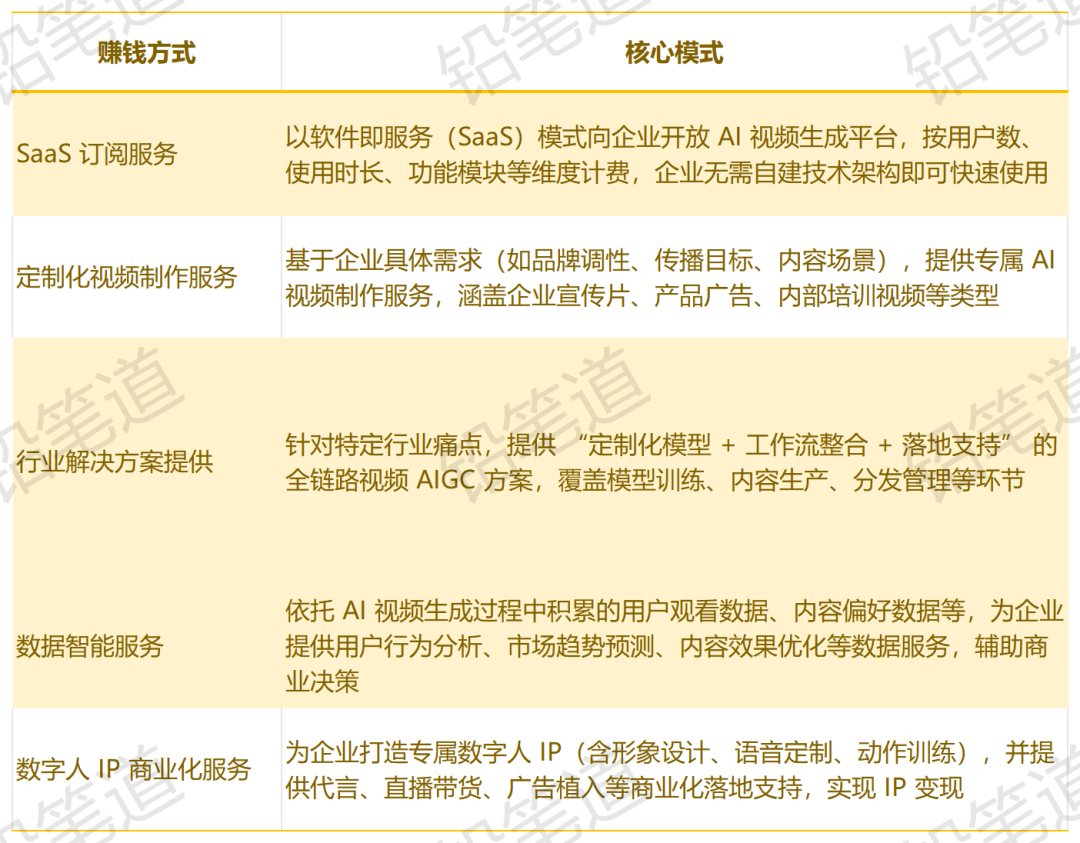

There are several monetization paths for video AIGC, each leading to different outcomes: consumer-facing (ToC) and business-facing (ToB).

How does ToC generate revenue? For example, through subscription memberships priced at 98 yuan per month (see details below).

How does ToB generate revenue? For example, through SaaS sales, video production services, and industry-specific solutions (see details below).

How does AIShion Technology generate revenue? By pursuing both paths simultaneously.

One avenue is ToC subscription membership services: its global user base has reportedly surpassed 100 million, with subscription revenue covering operational costs.

The other is ToB services. In early 2025, AIShion Technology launched its B-end business, focusing on advertising, short dramas, and gaming, with offerings including API access and customized video generation.

For example, in gaming, it provides solutions like character motion design and bulk scene asset generation. In advertising, it produces SKU-customized ads and real-person spokesperson materials for enterprises.

These two directions require vastly different corporate capabilities. AIShion Technology's dual approach seems like a trial-and-error strategy.

The ToC subscription model tests product capabilities and customer acquisition skills, directly competing with giants like ByteDance. Specifically, AIShion Technology's product experience must surpass that of ByteDance, while its customer acquisition efficiency must match or exceed it.

This hinges on team R&D strength, product excellence, and financing capabilities—no small feat.

The ToB model also faces significant challenges.

Previously, Pencil News interviewed Luo Jiangchun, founder of Yilan Technology, who summarized the main challenges of the ToB model as follows:

1. Customer Perception vs. Demand Mismatch: "Results Over Tools."

ToB customers prioritize "achieving business metrics through content" (e.g., customer acquisition, engagement, revenue growth) over "using AIGC tools."

More specifically, customers only care whether the final delivered content meets KPIs (e.g., video conversion rates for e-commerce clients, user engagement time for banks), not whether it was AI-generated or manually produced. Thus, AIGC's technical advantages struggle to directly drive customer payments.

2. Technical Evolution Bottlenecks.

Efficient video generation remains elusive. For at least the next 3-5 years, one-click generation of satisfactory content is unattainable.

From AI-generated drafts (e.g., hundreds of images, multiple script versions) to professional team refinement (image retouching, script rewriting) and multi-round reviews, every stage relies on human judgment, making "cost reduction and efficiency enhancement" an elusive goal.

3. Non-Standardized Customer Demands: High Matching Costs, Scaling Difficulties.

ToB customers demand "personalized, scenario-specific" solutions, which AIGC struggles to deliver through standardized tools or services, posing a core challenge to "scaling."

4. Chaotic Competitive Landscape: Big Players Squeeze + Industry Overcrowding Limits Startup Survival.

The sector is crowded with players (startups and incumbents), but lacks a "dominant leader." Some firms compete by "lowering prices or offering free services," compressing industry-wide profits. Meanwhile, many players "enter and exit quickly," destabilizing market demand and service quality.

- 03 -

Globally, some potentially lucrative sectors have emerged.

1. Virtual Humans.

Synthesia, a UK-based company specializing in AI virtual human video production, creates innovative video expression methods for marketing, training, and media dissemination through facial and voice synthesis. By April 2025, its annual recurring revenue (ARR) exceeded $100 million after securing strategic investment from Adobe.

2. AI Video Generation and Creative Tools.

Runway, a U.S.-based comprehensive platform for AI video generation and creative tools, offers solutions spanning image-to-video conversion, multi-scenario special effects generation, and real-time mobile editing. According to The Information, Runway's annualized revenue reached $84 million in December 2024.

3. Video Advertising.

Tencent Advertising performed strongly in 2024, with full-year ad revenue reaching 121.4 billion yuan, up 20% year-over-year. Its AIGC creative platform, Miaosi, enhanced ad material production efficiency and click-through rates through text-to-image, image-to-image, and digital human features.

Among these cases, the B2B monetization model stands out. Companies like Synthesia and Runway have achieved significant revenue by providing enterprise-grade AI video solutions, such as AI digital human video SaaS. Synthesia's ARR reached $150 million, while Runway's hit $80 million.

This article does not constitute any investment advice.