Suspicions Remain Over Nabai Chuan's IPO: Heavy Reliance on CATL, Adjustments in R&D Team

![]() 06/14 2024

06/14 2024

![]() 621

621

Recently, Nabai Chuan New Energy Co., Ltd. (hereinafter referred to as "Nabai Chuan") responded to the second round of inquiry from the Shenzhen Stock Exchange. Bedofinance learned that Nabai Chuan submitted its prospectus in September 2023, planning to list on the ChiNext of the Shenzhen Stock Exchange.

According to the prospectus, Nabai Chuan is engaged in the research, development, production, and sales of thermal management products related to new energy vehicle battery packs, thermal management of fuel vehicle power systems, and energy storage batteries. Its main products include battery liquid cooling plates, battery integrated boxes, fuel vehicle engine radiators, heaters, and warm air systems.

Currently, Nabai Chuan is a leading player in the segment market of thermal management for new energy vehicle battery packs in China, collaborating with new car manufacturers such as "Wei Xiaoli" and established automakers like Geely, Changan, and GAC. In recent years, the company has initiated and completed over 270 product projects,适配车型160余款.

In this round of inquiries, Nabai Chuan's customer relationships, operating efficiency, and R&D strength remain key concerns for the Shenzhen Stock Exchange.

I. Reliance on Major Customer CATL

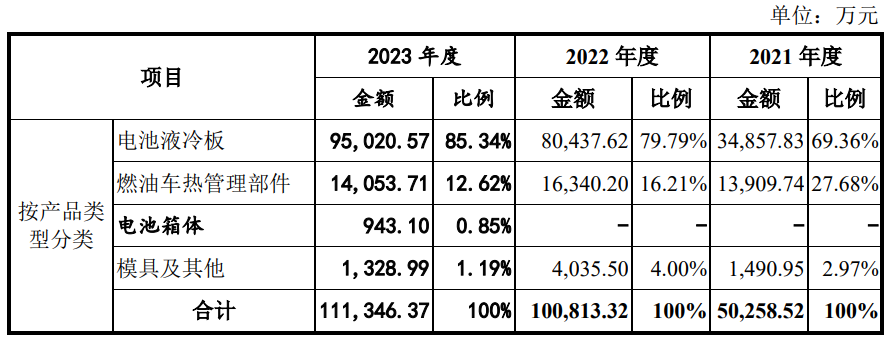

In 2021, 2022, and 2023, Nabai Chuan's revenues were 520 million yuan, 1.031 billion yuan, and 1.136 billion yuan, respectively, with a compound annual growth rate of 47.86%. Among them, revenues from battery liquid cooling plates were 349 million yuan, 804 million yuan, and 950 million yuan, accounting for 69.36%, 79.79%, and 85.34% of the main business income, respectively.

Nabai Chuan is a strategic supplier of CATL, and the two have maintained a cooperative relationship since 2015. In addition to direct sales to CATL, Nabai Chuan's main customers include battery box manufacturers such as Ningde Kaili, Ningde Jueneng, and Zhejiang Minsheng, who purchase battery liquid cooling plates from Nabai Chuan and then assemble them with battery boxes before selling them to CATL.

During the reporting period, the proportion of Nabai Chuan's revenue from direct sales and indirect sales to CATL through battery box manufacturers and other accessories suppliers accounted for 50.33%, 53.73%, and 48.94% of its total revenue, respectively, accounting for half of its income. In other words, Nabai Chuan heavily relies on CATL.

Nabai Chuan stated that this situation is mainly due to the concentration of the power battery industry and CATL's high market share, but reliance on major customers remains a pain point for the company. The Shenzhen Stock Exchange required Nabai Chuan to explain the stability of its cooperation with CATL and the expected contribution of other orders in hand to the company's future revenue.

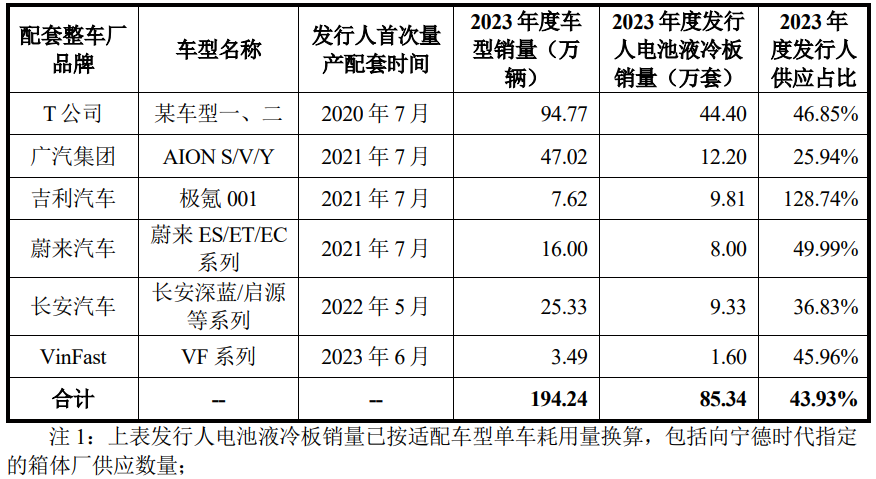

Through the response letter, it can be seen that Nabai Chuan provides customized battery liquid cooling plates for multiple best-selling models such as GAC AION S/V/Y and ZEEKR 001 through CATL. As of the end of 2023, the company supplied 853,400 sets of battery liquid cooling plates to CATL's existing mass production projects, accounting for 43.93% of the total sales of the corresponding models.

It is worth noting that among the disclosed data of Nabai Chuan, there is a partner under the alias of "Company T," which refers to Tesla. The company mentioned "Tesla" a total of 12 times in its previous prospectus and stated that it has gradually developed battery liquid cooling plates suitable for Tesla models such as Model 3 and Model Y, corresponding to "Model One" and "Model Two" in the response letter.

Nabai Chuan added that its share of supply to CATL's liquid cooling plate products is about 10% to 20% higher than that of CATL's second-largest supplier, demonstrating a strong share advantage. As of the end of March 2024, Nabai Chuan's orders in hand for the next three months from CATL totaled 140 million yuan, indicating good future revenue contributions.

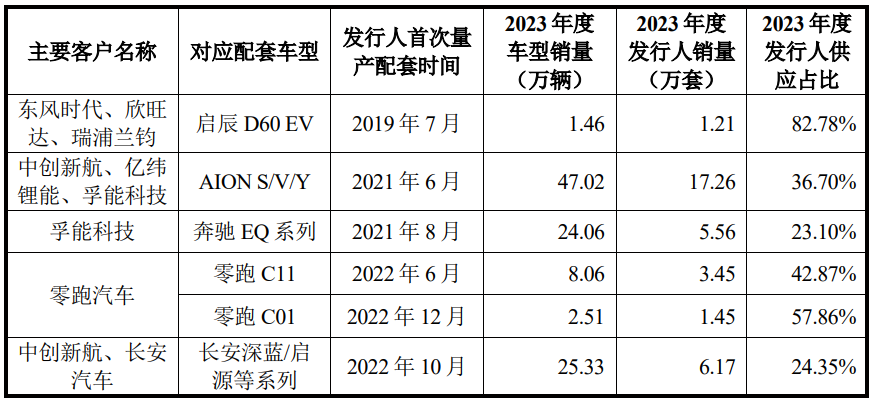

In addition to CATL, Nabai Chuan added 42, 66, and 55 new customer-specific projects for OEMs, battery manufacturers, and energy storage system integrators from 2021 to 2023, realizing revenues of 108 million yuan, 292 million yuan, and 418 million yuan, respectively. As a tier-one supplier, the company directly supplies products to OEMs such as Zero Run and Changan.

In the first quarter of 2024, Nabai Chuan added 14 new customer-specific projects apart from CATL, with sales revenue from such customers increasing by about 10% compared to the same period in 2023. Orders in hand for the next three months amount to approximately 152 million yuan, covering major power battery manufacturers such as Zhongchuang Xinhang and Fueneng Technology, indicating a balanced order structure.

Therefore, Nabai Chuan believes that with its stable product quality and delivery capabilities, it has occupied an important share in the battery liquid cooling plate supply chain, and the risk of CATL reducing its procurement share or terminating cooperation is relatively low.

II. Declining Gross Margin for Consecutive Years

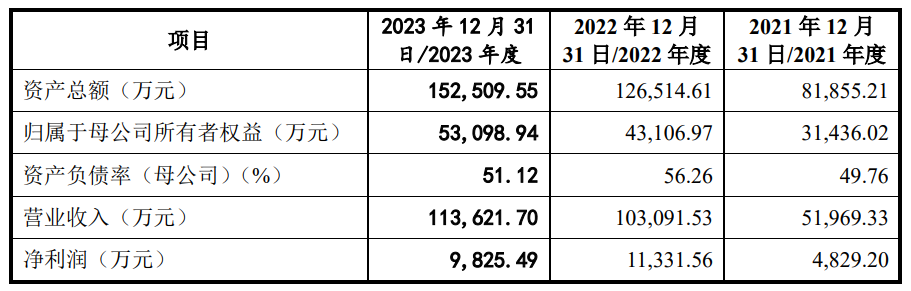

Bedofinance found that while Nabai Chuan's revenue increased by 10.21% year-on-year in 2023, its net profit actually decreased instead of increasing.

Specifically, Nabai Chuan's net profit dropped from 113 million yuan in 2022 to 98.2549 million yuan in 2023, and its net profit after deducting non-recurring items also decreased from 111 million yuan in 2022 to 89.2578 million yuan, resulting in a situation of "increased revenue but decreased profit."

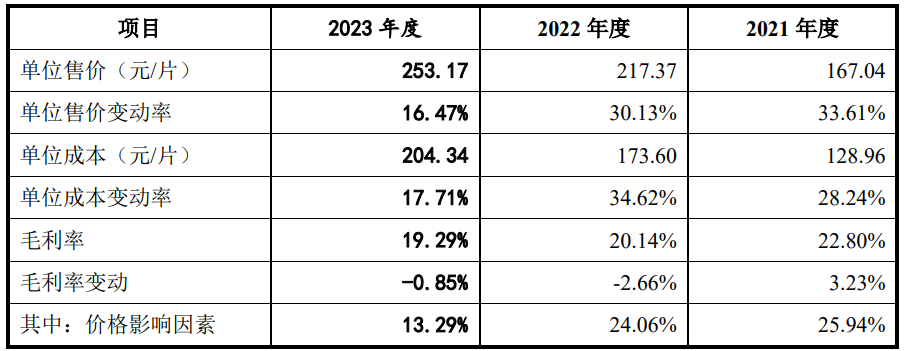

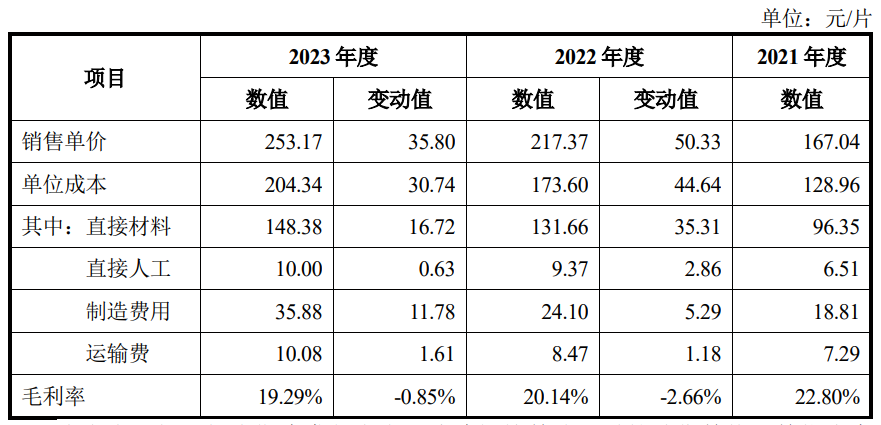

Meanwhile, the gross margin of Nabai Chuan's core product, battery liquid cooling plates, was 22.80%, 20.14%, and 19.29% for 2021, 2022, and 2023, respectively, showing a decline for two consecutive years. The company explained that the decrease in gross margin was due to the combined effects of an increase in sales of larger-sized products, an increase in the average selling price and average cost of battery liquid cooling plates.

During the reporting period, the average selling price per unit of Nabai Chuan's battery liquid cooling plates, calculated based on a single unit, was 167.04 yuan, 217.37 yuan, and 253.17 yuan, respectively. The average selling price per set, calculated based on the amount used per vehicle, was 555.30 yuan, 609.76 yuan, and 603.12 yuan, respectively. The selling prices were higher than those of comparable companies in the industry such as Kechuang Xinyuan and Xinfu Technology.

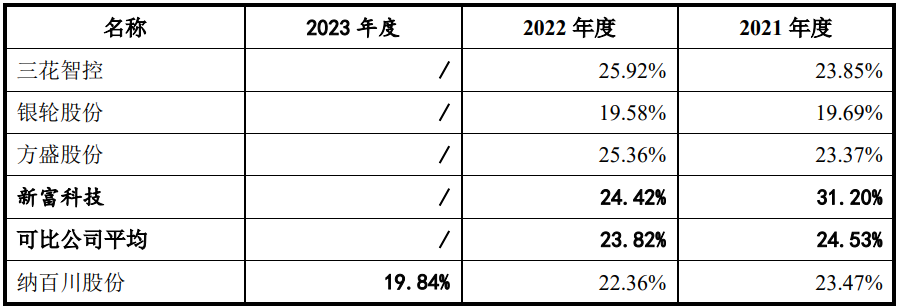

Unusually, Nabai Chuan's gross profits from its main business for 2021 to 2023 were 118 million yuan, 225 million yuan, and 221 million yuan, respectively, with gross margins of 23.47%, 22.36%, and 19.84%, respectively. The gross margins for the first two years were both lower than the average values of 24.53% and 23.82% for comparable companies in the industry.

As a result, the Shenzhen Stock Exchange remains skeptical about the stability of Nabai Chuan's gross margin and requires the company to explain the sales price, gross margin level, and reasons for its changes, as well as the reasons for its higher sales prices compared to peers, based on the battery cost structure and proportion, and the amount consumed per vehicle.

In its response letter, Nabai Chuan stated that to comply with the iterative requirements of power battery integration technology solutions from CTM to CTP and CTC/CTB, the company's battery liquid cooling plate products are also developing towards increasing contact area, improving thermal conductivity, and improving temperature uniformity, which has led to an increase in the size and material consumption of battery liquid cooling plates.

At the same time, the price of aluminum, the main material used in Nabai Chuan's production of battery liquid cooling plates, has continued to rise, coupled with the underutilization of production capacity at the Chuzhou production base, resulting in an increase in manufacturing costs. The average selling prices of these products in 2022 and 2023 increased by 30.13% and 16.47% year-on-year, respectively; while the unit costs increased by 34.62% and 17.71% year-on-year, respectively.

The main reason why the increase in sales price is slightly smaller than the increase in unit cost is that Nabai Chuan has proactively adopted a positive pricing strategy. In some product projects, it has participated in market competition with lower quotes to meet the cost reduction needs of downstream customers, preventing other competitors from entering the market and gaining market share through customer concessions.

Regarding the issue of higher pricing compared to peer companies, Nabai Chuan stated that Kechuang Xinyuan and Xinfu Technology have relatively small overall operating scales and fewer product types. Price differences mainly stem from differences in specific product structures, and Nabai Chuan's price range covers the selling prices of both companies.

Overall, the differences in sales prices between Nabai Chuan and comparable companies in the industry, Kechuang Xinyuan and Xinfu Technology, are mainly due to differences in size specifications caused by different battery packs and models adapted to specific products. Compared with comparable companies in the industry, Nabai Chuan's product prices are within a reasonable range, with no significant anomalies.

III. Adjustments in the R&D Team

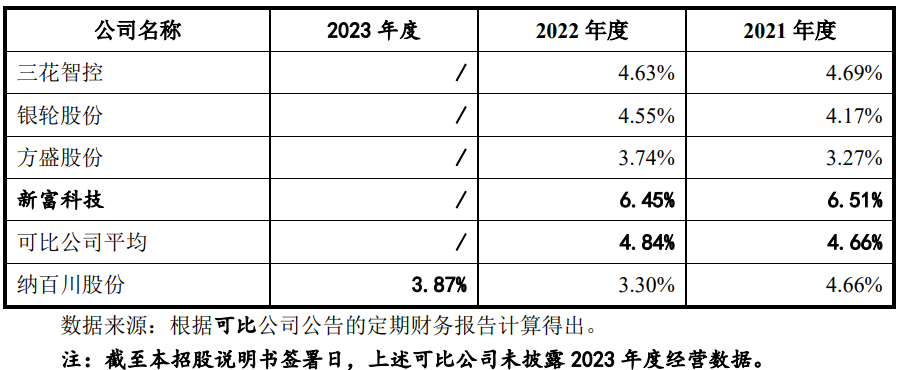

To冲刺创业板上市, the technological barriers, core competitive advantages, and sustained innovation capabilities of a company's R&D are undoubtedly key considerations. From 2021 to 2023, Nabai Chuan's R&D expenses were 22.4265 million yuan, 34.0696 million yuan, and 43.9405 million yuan, respectively, with a compound annual growth rate of approximately 34.68%.

However, unlike the increase in R&D investment, Nabai Chuan's R&D expense ratio has been declining, from 4.66% in 2021 to 3.87% in 2023, a decrease of 0.79 percentage points over two years. Furthermore, the company's R&D expense ratio of 3.30% in 2022 was significantly lower than the average of 4.84% for comparable companies in the industry.

Nearly one-third of Nabai Chuan's R&D expenses are used to pay employee salaries, amounting to 7.3378 million yuan, 13.3093 million yuan, and 17.0896 million yuan, respectively, showing a significant increase. At the same time, the company's R&D personnel has also increased from 65 in 2021 to 128 in 2023, indicating the expansion of the R&D team.

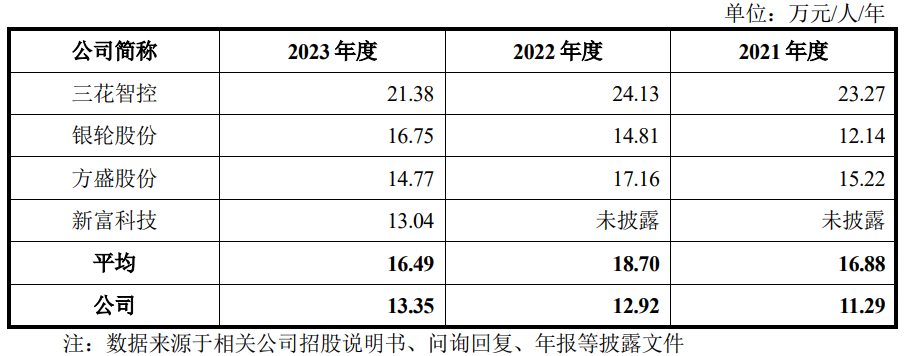

Generally speaking, the increase in employee compensation expenses and the expansion of the R&D team size are manifestations of a company's emphasis on R&D investment. However, the average salary of Nabai Chuan's internal R&D personnel was 112,900 yuan, 129,200 yuan, and 133,500 yuan, respectively, which is significantly lower than the industry averages of 168,800 yuan, 187,000 yuan, and 164,900 yuan.

This issue has also attracted the attention of the Shenzhen Stock Exchange, which has requested Nabai Chuan to explain whether its R&D personnel were temporarily recruited or transferred from other departments, whether their professional backgrounds and work experiences match R&D activities, whether they possess R&D capabilities and make actual contributions, and the reasons for the differences in R&D personnel compensation levels compared to peers.

Nabai Chuan replied that during the product prototype trial production stage, the company needs a group of personnel familiar with product structure and performance, with certain practical experience, to participate in R&D. During the reporting period, a total of 27 personnel were transferred to increase the R&D team. It is not difficult to see that Nabai Chuan's R&D team consists of not only highly educated R&D talents but also some sampling technicians.

In 2022, Nabai Chuan, which was under pressure due to the tight configuration of existing R&D personnel, recruited 24 sampling personnel into the R&D team. These operators have relatively low academic requirements, focusing on practical skills and experience, while an additional 23 R&D engineers were added. In Nabai Chuan's view, both of these types of workers belong to "full-time R&D personnel."

Nabai Chuan added that the company's full-time R&D personnel include personnel from the project R&D department and the process department. The project R&D department oversees the experimental center and the prototype group, and full-time R&D employees do not engage in production activities. When the R&D department conducts R&D activities, it will borrow some production personnel as needed to assist in prototype sampling work.

It is precisely because of the inclusion of sampling personnel with an overall educational level dominated by junior college degrees, shorter work experience, and relatively low compensation levels that the average salary of Nabai Chuan's R&D personnel is significantly lower than that of companies in the same industry. From this perspective, a portion of Nabai Chuan's actual R&D investment may have gone towards customized product pilot production.