Volkswagen Faces Consecutive Defeats in China's Auto Market, as BYD and Geely Rise

![]() 05/25 2025

05/25 2025

![]() 719

719

It's often rumored that Japanese cars are struggling, but in reality, the German automotive giant Volkswagen, long the king of the industry, is also encountering challenges in the Chinese market. Having dominated China's automotive landscape for nearly four decades, Volkswagen lost its crown in 2023. Yet, this setback is not Volkswagen's lowest point; in the past two months, it has been outpaced by another Chinese automaker in its home turf.

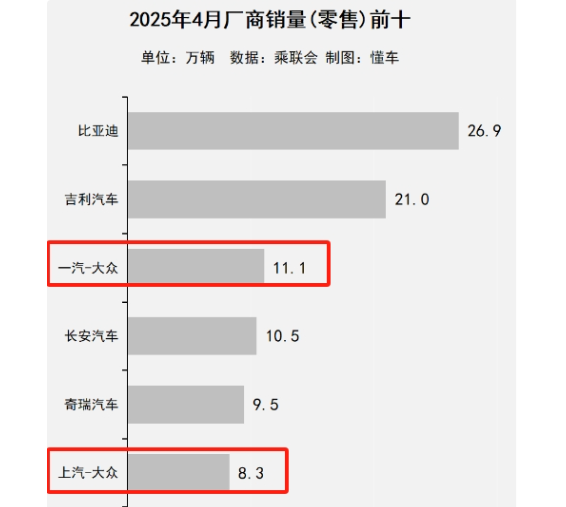

April's sales figures reveal that Volkswagen sold 194,000 vehicles in China, comprising 111,000 units from FAW-Volkswagen and 83,000 units from SAIC Volkswagen. This places Volkswagen in third position in terms of sales.

The top two spots in China's automotive market for April were secured by BYD and Geely, both Chinese brands. BYD reigns supreme in the new energy vehicle (NEV) segment, while Geely has strategically positioned itself in both the traditional fuel vehicle and NEV markets. Their sales volumes amounted to 269,000 and 210,000 vehicles, respectively.

Volkswagen's sales lagged behind Geely not only in April but also in March. This trend suggests that Volkswagen might be overtaken by Geely, sliding to third place this year. Volkswagen's consecutive defeats by BYD and Geely in just over two years are undoubtedly tough pills to swallow.

Compared to Toyota, the Chinese market holds greater significance for Volkswagen. In 2023, Volkswagen sold 2.193 million vehicles in China, contributing to over a quarter of its global sales of 7.85 million. In contrast, China accounted for approximately 17% of Toyota's total sales.

Volkswagen's decline in China can be attributed to its lack of focus on electric vehicles. Despite launching the ID series, sales of these vehicles in the Chinese market remain low. With NEVs accounting for roughly 50% of the Chinese automotive market, Volkswagen's meager electric vehicle sales have contributed to its repeated defeats by Chinese automakers.

As Geely's sales continue to grow, it has started to eclipse Volkswagen, becoming the second-largest automotive brand in China. This shift heralds a fierce competition between Geely and BYD, who are now battling it out not only in the domestic market but also on the international stage.

In sales terms, Geely poses an increasing threat to BYD. In 2024, Geely sold 2.177 million vehicles, while BYD sold approximately 4.27 million. While Geely's sales were just over half of BYD's, April 2024 data shows that the gap between the two has narrowed to 21.9%.

Geely's sales surge is fueled by the rapid growth of its NEV sales. In 2024, Geely sold 888,000 NEVs, accounting for just over a fifth of BYD's sales. In April 2024, Geely sold over 120,000 NEVs, nearly half of BYD's sales.

It's worth noting that there are nuances in the above data. The 269,000 BYD vehicles sold refer exclusively to the BYD brand, while the Geely sales figures pertain only to the Geely brand. Both companies have numerous other brands under their umbrella. In April, BYD's total sales across all brands were 380,000 vehicles, whereas Geely's totaled 234,000 vehicles. Nonetheless, Geely's April sales reached 61.6% of BYD's, indicating a significant narrowing of the sales gap.

BYD, Geely, and Volkswagen are all vying for a piece of the NEV market. In fact, Toyota has also joined the fray, underlining the importance of this segment in determining their positions in the domestic automotive market. However, based on current trends, Volkswagen and Toyota may struggle to compete with domestic brands in China's NEV market.