Zhang Xinghai Seeks 'Security' for Thalys in Hong Kong IPO

![]() 05/25 2025

05/25 2025

![]() 470

470

Building a kingdom is easy; maintaining it is hard.

By He Ying

Edited by Zhang Xiao

When Huawei sought a partner in automaking, Thalys Chairman Zhang Xinghai was the first automotive executive to hit it off instantly.

No one dared predict the outcome of this collaboration. At the time, Huawei was in a trough in its mobile phone business, and Thalys, as an established automaker, had little influence. It was an uncertain gamble.

However, Zhang Xinghai, a sharp and decisive figure in the automotive industry for decades, made a choice that proved more impactful than the effort itself. After that collaboration, Thalys's Huawei Smart Selection SF5 sold over 8,000 units that year. The subsequent launch of AITO brought Huawei and Thalys performance beyond expectations.

In 2024, Thalys became the third profitable automaker in the new energy vehicle sector after Tesla and BYD. During this period, Huawei HarmonyOS Intelligent Drive also gained brand recognition through AITO, forming the 'Five Circles' family.

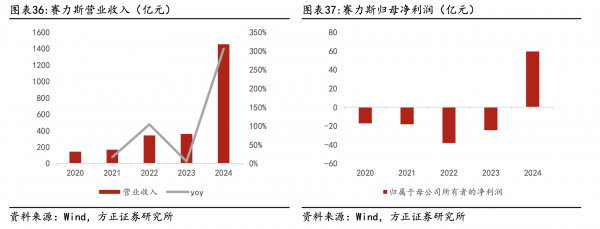

Image/Founder Securities

Behind this seemingly win-win outcome, as HarmonyOS Intelligent Drive's 'circle of friends' expands, Thalys, once reliant on Huawei, begins to feel a sense of crisis.

Currently, Huawei HarmonyOS Intelligent Drive's partners include not only Thalys but also numerous automakers such as Chery, JAC, BAIC, GAC, and SAIC. Thalys needs to find its unique selling point.

Zhang Xinghai and Thalys are once again at a crossroads. Four years ago, Zhang Xinghai used AITO to revive Thalys. Four years later, Zhang Xinghai continues to lead Thalys in search of security.

On April 28, Thalys submitted an IPO application to the Hong Kong Stock Exchange. If successful, Thalys will become another Chinese automaker listed on both the A-share and Hong Kong stock markets, following Great Wall, BYD, GAC, and Dongfeng.

By going public at this time, Zhang Xinghai needs to prove to the market that Thalys can still survive independently in the competitive market after HarmonyOS Intelligent Drive's resources are no longer exclusive to Thalys. This self-verification path is undoubtedly challenging, with AITO's sales declining and market attractiveness waning. To defend the kingdom built by AITO, Zhang Xinghai faces visible challenges.

01

Thalys is profitable, but Zhang Xinghai can't relax yet

A few months ago, during the Spring Festival Gala at the Chongqing venue, Thalys's factory showcased hundreds of vehicles, including an AITO M9, becoming a famous scene on social media platforms.

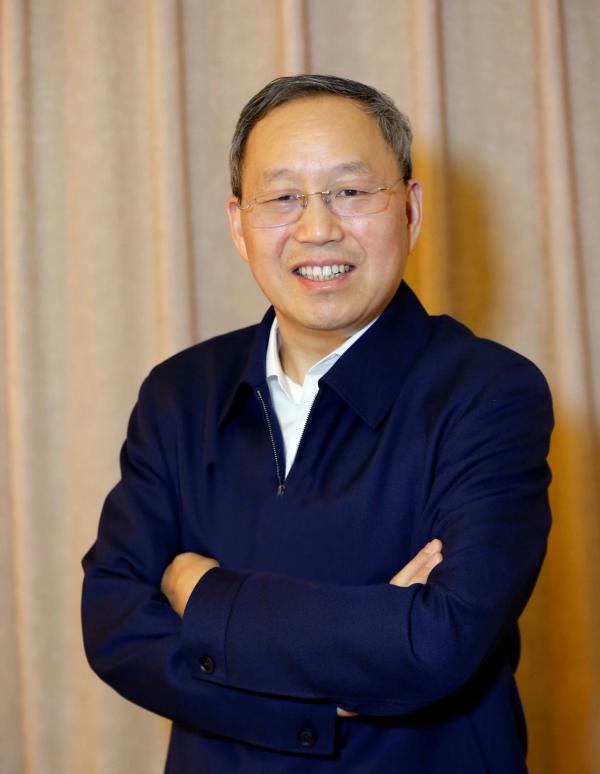

Behind Thalys is Zhang Xinghai, a 'veteran' with over 30 years in the automotive industry. In 2024, the founder smiled happily.

In 2024, Thalys delivered its flagship model AITO M9 on a large scale, and the new AITO M5 and AITO M7 Ultra were successively launched. Thalys's new energy vehicle sales soared, directly boosting Thalys's 2024 performance.

After three years of losses, Thalys achieved profitability in 2024. The 2024 financial report shows that Thalys achieved operating revenue of RMB 145.176 billion, an increase of 305.04% year-on-year; net profit attributable to shareholders was RMB 5.946 billion, successfully reversing the situation of consecutive six-year losses in non-deductible net profit, becoming the fourth globally profitable new energy automaker.

Thalys's achievements are obvious to all and have injected a booster shot into the capital market. In December last year, Thalys set a new stage high share price of RMB 149.56 per share, with a market value exceeding RMB 200 billion.

2024 can be considered a milestone year for Thalys, with the market joking that Zhang Xinghai is one of the luckiest people in the automotive circle in 2024.

However, after the short-lived joy brought by profitability, Zhang Xinghai's heart may not have been too relaxed. Thalys is far from being able to relax.

Since 2025, Thalys's sales have taken a turbulent turn. Thalys's sales continued to decline in the first three months of 2025, with total sales for January-March falling by 45%, 39%, and 34% year-on-year, respectively. Over the same period, monthly sales of new energy vehicles were 17,906 units, 17,841 units, and 18,805 units, with year-on-year declines of 51.39%, 41.04%, and 32.19%, respectively.

Faced with this start-of-year performance, Zhang Xinghai previously responded to Chinese Entrepreneur: "This is a normal phenomenon. Rhythmic fluctuations are within controlled range. It's like the sun rising and setting."

From the perspective of the entire market, the first quarter is a low season for automaker sales, and sales fluctuations are normal.

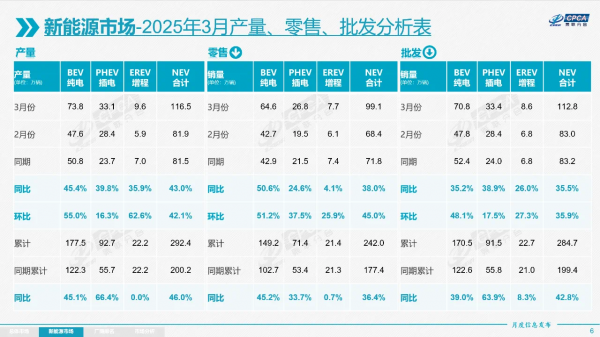

However, from the perspective of the overall market, the growth of domestic new energy vehicles in March was impressive. According to preliminary statistics from the China Passenger Car Association, retail sales of passenger vehicles in China reached 1.94 million units in March 2025, an increase of 14.4% year-on-year and 40.2% month-on-month. Among them, the new energy vehicle market performed strongly, with retail sales of 991,000 units in March, an increase of 38% year-on-year and 45% month-on-month.

Image/China Passenger Car Association

While the overall market is growing, Thalys is declining. The comparison curve confirms that Thalys faces more severe market competition. Taking the luxury vehicle market represented by AITO M9 as an example, brands such as Denza, LYNK & CO, Chery, and ARCFOX have successively launched luxury SUV flagship models. The luxury SUV market is visibly a red ocean. The introduction of models with price advantages like Denza N9 means that Thalys faces considerable pressure.

More troublingly, Thalys itself is in an awkward position.

Currently, HarmonyOS Intelligent Drive has more than one partner, including SAIC, Chery, BAIC, and many others. The flagship model AITO can no longer exclusively enjoy Huawei's dividends.

As Huawei's first partner in the Smart Selection model, Huawei's technology, brand influence, and sales channels provided strong support for Thalys's rapid rise. However, as brands such as Enjoy Circle, Supreme Circle, Smart Circle, and Shang Circle have been successively launched, Huawei's resources and R&D focus have inevitably been dispersed.

The Huawei advantage once exclusively enjoyed by Thalys is gradually being diluted, and the fading of the 'Huawei halo' poses greater challenges for Thalys in market competition.

Internally, AITO also faces direct competition. The AITO M7 and Smart Circle R7, both positioned as mid-to-large sedans and targeting the RMB 250,000 extended-range segment, have already formed internal competition.

The continued decline in sales, like the sword of Damocles hanging over Thalys, casts a shadow over its future development. With Huawei now focusing on other circles, Thalys needs to be self-reliant to capture a larger market share.

Moving towards the Hong Kong stock market at this juncture is undoubtedly one of Zhang Xinghai's breakthrough measures for Thalys.

02

Can the Hong Kong stock market give Thalys security?

'With Huawei, even BMW won't work.' When asked about why Thalys partnered with Huawei, Zhang Xinghai said emphatically.

At that time, as HarmonyOS Intelligent Drive's first partner, Huawei brought Thalys enough security. From product promotion to resource sharing, Thalys enjoyed the treatment of a 'firstborn son.'

However, now that industry competition has intensified and Huawei's resources are dispersed, Thalys needs to find security on its own. Capital operations are a more direct way.

On April 28, the Hong Kong Stock Exchange's Disclosure Easy website showed that Thalys officially submitted an initial public offering application to list on the main board of the Hong Kong Stock Exchange. Prior to this, Thalys was already listed on the A-share market as 'Xiaokang Stocks.'

With the continuous increase in enthusiasm for 'A+H' listings, listing on the Hong Kong stock market may be a crucial step for Thalys to break the deadlock. From releasing the listing signal at the end of March to quickly submitting the prospectus at the end of the month, the rapid progress of Thalys's Hong Kong stock market listing plan underscores its urgent desire for funding and new development opportunities.

It should be noted that while Thalys achieved profitability in 2024, its balance sheet reveals hidden concerns. Despite revenue exceeding RMB 100 billion, the asset-liability ratio of 87.38% far exceeds the industry average, with current liabilities accounting for 92.49% of total liabilities.

If sales continue to decline and more funding cannot be found, Thalys may easily face the risk of tight capital chains, which is a big taboo for automakers. In the first quarter of this year, Thalys announced a financing plan, with its holding subsidiary Thalys Motors intending to increase capital and introduce strategic investors, with a total increase in capital not exceeding RMB 5 billion.

If Thalys successfully lists on the Hong Kong stock market, it will gain more market attention and thereby broaden its financing channels. The prospectus shows that Thalys intends to allocate 70% of the net proceeds from this IPO to R&D investment, 20% to diversified new marketing channels, overseas sales, and charging network services to enhance global brand awareness, and 10% for working capital and general corporate purposes.

Among them, R&D investment is self-evident and a rigid demand for automakers to establish themselves in the market. For Thalys, investment in marketing channels is a significant variable.

In this era where 'even good wine needs no bush,' Thalys has lost Huawei's exclusive support, but it still has many models awaiting market support, which naturally requires real money.

Image/Thalys Official Website

In addition to the continuous promotion of AITO M9, Thalys launched the new model AITO M8 in April this year, positioned as a mid-to-large SUV, priced between RMB 359,800 and RMB 449,800. As a new model, pre-promotion and post-delivery are tests of automakers' capital chains.

It is worth noting that promotion in the automotive circle cannot be separated from the person who steps forward to promote it. Like Huawei's Car BU and Yu Chengdong, Xiaomi's automobiles and Lei Jun, endorsing their own automakers is a clever way.

Starting last year, the usually low-key Zhang Xinghai began learning how to step forward.

At the end of last year, led by Yu Chengdong, Zhang Xinghai and Chery Chairman Yin Tongyue, BAIC Chairman Zhang Jianyong, and JAC Chairman Xiang Xingchu appeared together on a CCTV live broadcast. On March 7, at the second 'Members' Channel' session of the 14th National Committee of the Chinese People's Political Consultative Conference, Zhang Xinghai made his debut on the 'Members' Channel' of the National Two Sessions.

Once Thalys relied on Huawei and was deeply tied to it. Although it was 'carried' by Huawei, it also faced a passive situation. To become independent, moving towards the Hong Kong stock market is the first step, and building its own brand image is the second step. Now, Zhang Xinghai needs to step forward and let the market become familiar with a more independent Thalys.

03

Keeping a kingdom is not easy, and Zhang Xinghai faces new challenges

At the CCTV live broadcast at the end of last year, among the chairmen of the 'Four Circles,' Zhang Xinghai was the most noticed.

The host Sa Beining joked, 'Everyone says that since they started cooperating with Huawei, they can't sleep well because they keep laughing awake when they sleep, especially in the middle of the night. Laughing all night makes it hard to sleep. Is this true?'

Zhang Xinghai responded, 'When you sleep, you should still sleep... But I'm really happy.'

This happiness is inseparable from Zhang Xinghai's courage back then. Yu Chengdong once said directly, 'Mr. Zhang has very keen insights and decisiveness. At that time, Huawei did not have experience in making complete vehicles, and many state-owned enterprises and central enterprises did not understand the Smart Selection model, but Mr. Zhang decisively chose to cooperate deeply with Huawei and went all in without any distractions.'

Zhang Xinghai, Image/Thalys Official Weibo

Since Zhang Xinghai firmly chose Huawei, Thalys has been like a chosen one, soaring to the top, and AITO has become the first model to enjoy the dividends of Huawei's brand. In 2022 alone, AITO M5 sold 75,000 units, setting the fastest record for a new brand vehicle to deliver over 10,000 units in its first year on the market.

The Thalys prospectus shows that AITO M7 became the best-selling self-owned brand model in the RMB 300,000 segment in the Chinese market, with approximately 200,000 units delivered in 2024; AITO M9 became the sales champion in the RMB 500,000 segment in the Chinese market, with over 150,000 units delivered in 2024.

According to Frost & Sullivan, the AITO brand topped the new energy vehicle reputation list in the second half of 2024 with an NPS (Net Promoter Score) of 82%, and the AITO brand achieved total deliveries of 387,100 units in 2024, an increase of 268% year-on-year.

There is no doubt that Thalys quickly gained a foothold in the new energy vehicle market with AITO, achieving a breakthrough from 0 to 1.

In the first half, on the one hand, Huawei was fully committed, and on the other hand, AITO filled the early market gap. With the right timing, location, and people, AITO helped Thalys build its new energy kingdom.

In the second half, Thalys's path is far from as smooth as imagined.

First, it is necessary to clarify the cooperation model between Thalys and Huawei. Under the Huawei Smart Selection model, automakers are more like contract manufacturers, slightly passive. This passivity is reflected not only in the right to speak but also in the revenue-sharing model.

According to AutoReport, insiders at Huawei have previously disclosed that under the Smart Selection model, Huawei and Thalys share revenue on a 1:9 ratio. While Thalys appears to take the majority share, Huawei's channel costs are offset by sales revenue from mobile phones and electronic products. Conversely, Thalys bears the significant costs associated with factory and production line construction and maintenance, implying that increased sales volumes place greater pressure on Thalys in terms of cost control.

In essence, Thalys earns most of its profits from selling vehicles through hard work and investment.

For instance, in the first half of 2024, Thalys reported revenues of approximately RMB 65 billion with a net profit of RMB 1.625 billion. During the same period, Huawei's revenue amounted to RMB 10.435 billion, yet its net profit was significantly higher at RMB 2.23 billion.

Additionally, at the technical level, Thalys's intelligent driving system heavily relies on Huawei, lagging behind automakers with similar market positioning in terms of autonomy. As Huawei's Smart Selection partner network expands, the resources and support available to Thalys decrease proportionally, potentially diluting future cooperation revenue and complicating the balance between input and output.

Simultaneously, the allure of the AITO brand is waning. Initially, AITO leveraged Huawei's intelligent driving technology to establish a market differentiator, attracting numerous consumers. However, as other brands rapidly advance in intelligent driving, AITO's competitive edge in this area is gradually diminishing. If AITO fails to innovate and upgrade its intelligent driving technology continuously, its advantages will become less pronounced.

As Huawei diversifies its resources to other 'sectors', Zhang Xinghai must solidify Thalys's current market position, reduce dependency on Huawei, and strive for financial security. Thalys's decision to go public in Hong Kong could be pivotal in determining whether its market value of 200 billion is a starting point or a peak.