Qianli Technology Seeks Hong Kong Stock Exchange Listing: Heavily Reliant on Geely, with Zero Revenue from AI Intelligent Driving Transformation

![]() 11/17 2025

11/17 2025

![]() 616

616

Recently, Chongqing Qianli Technology Co., Ltd. (hereinafter referred to as "Qianli Technology") filed a listing application with the Hong Kong Stock Exchange, with China International Capital Corporation Limited acting as its sole sponsor.

Public records reveal that Qianli Technology's predecessor, Lifan Industry (Group) Co., Ltd. (hereinafter referred to as "Lifan" or "Lifan Shares"), was listed on the Shanghai Stock Exchange on November 25, 2010, under the stock code "601777". Following bankruptcy reorganization, it was acquired by Geely Group and transformed into a company centered around AI intelligent driving.

Under the leadership of Chairman Yin Qi, Qianli Technology is rapidly advancing into the "AI + Mobility" sector. The planned public issuance of H-share listing shares this time is geared towards propelling its AI strategy forward, bolstering technological reserves and industrial chain integration, deepening its global footprint, and accelerating overseas business expansion.

However, judging by Qianli Technology's current performance, the strain on performance growth and financial health caused by its bet on intelligent driving, along with concerns over its independence due to excessive reliance on Geely Group, continue to cast a shadow over the company.

Amidst a backdrop of both opportunities and challenges, can Qianli Technology successfully list in Hong Kong this time around?

I. Geely Group Takes the Reins, Yin Qi Drives Intelligent Driving Transformation

Let's rewind to 1992. Lifan Shares, the forerunner of Qianli Technology, embarked on its journey in the motorcycle industry. During its heyday, its products were exported to over 160 countries and regions worldwide. In 2010, it made a successful debut on the main board of the Shanghai Stock Exchange, earning the moniker "the first private passenger vehicle stock." It was truly the "king of motorcycles."

However, as the external market environment shifted, Lifan's passenger vehicle business volume dwindled, leading to a significant drop in revenue and profits. By the end of 2019, its asset-liability ratio had soared to 85.4%. Large-scale overdue debts resulted in defaults, severely impacting its financial credibility. Eventually, it was declared bankrupt and initiated judicial reorganization in August of the following year.

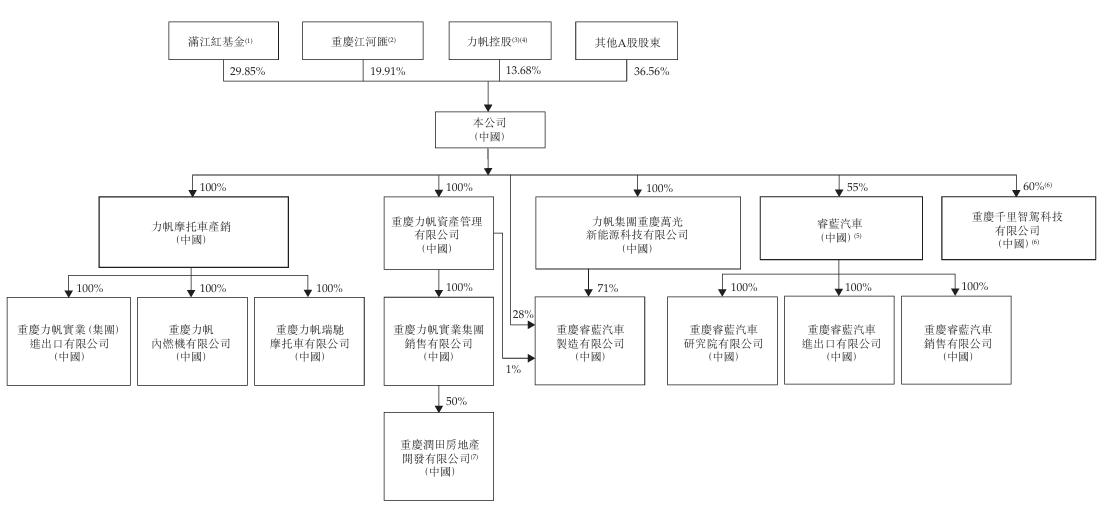

In that same year, the Manjianghong Fund stepped in and became Lifan Shares' controlling shareholder. A closer look reveals that Chongqing Liangjiang New Area Industrial Development Group Co., Ltd. holds a 36.18% stake in the Manjianghong Fund, while Geely Group, with a 50.94% stake, emerged as the actual controller post-reorganization.

Following Geely Group's takeover, Lifan's business overhaul officially commenced. Alongside retaining the motorcycle sales business, the two entities launched a new brand, "Livan," in 2022, offering both fuel and new energy vehicle models. From 2022 to the present, the company has sold a total of 196,900 vehicles and 1.3 million motorcycles.

In July 2024, Yin Qi, the co-founder of Megvii Technology, one of the "AI Four Little Dragons," invested 2.43 billion yuan in Lifan and assumed the role of chairman in October of the same year. On the eve of its Hong Kong stock IPO, Lifan underwent a brand reshaping and changed its company name to the current Qianli Technology.

Prior to this listing, the Manjianghong Fund, jointly established by Liangjiang Fund Management and Geely Group, holds a 29.85% stake in Qianli Technology, making it the controlling shareholder. Chongqing Jianghehui holds a 19.91% stake, Lifan Holdings holds a 13.68% stake, and other A-share shareholders hold a 36.56% stake.

It's worth noting that on September 25, 2025, Lifan Holdings signed a share transfer agreement with Mercedes-Benz Digital Technology, a subsidiary of Mercedes-Benz, agreeing to transfer 136 million A-shares, equivalent to approximately 3.00% of the total issued shares at that time. Currently, the share transfer is still undergoing relevant registration procedures.

Under Yin Qi's stewardship, Qianli Technology has gradually evolved from an initial automobile and motorcycle manufacturing enterprise into an AI-centric technology enterprise. According to the prospectus, the company has developed leading vertical AI model capabilities and advanced multi-modal interaction models, enabling rich multi-modal interactions.

According to China Insights Consultancy, Qianli Technology is the first company to achieve large-scale deployment of end-to-end RLM (Reinforcement Learning - Multi-modal) models in intelligent driving scenarios and has developed the industry's first AGI L3 agent-level intelligent cockpit system.

Currently, Qianli Technology has forged a full-stack, model-centric "AI + Mobility" capability, encompassing manufacturing, AI capabilities, and software and hardware R&D. It can provide innovative and model-driven solutions, primarily covering three areas: intelligent driving, intelligent cockpits, and Robotaxi.

Among them, Qianli Technology's intelligent driving solution portfolio includes vertical AI models, software, hardware, and closed-loop data systems to achieve L2 to L4 autonomous driving in complex traffic scenarios. The intelligent cockpit solution is underpinned by proprietary multi-modal interaction models and an AI-native Agent OS.

II. Traditional Businesses Encounter Hurdles, AI Commercialization Prospects Remain Unclear

Although Qianli Technology emphasizes in its prospectus that its "transformation has yielded remarkable results" and reveals that it has launched the Afari Autonomous Driving System 1.0, which provides L2-level intelligent driving capabilities, since the company's AI solutions have not yet been widely deployed, the "AI + Mobility" model has not generated any revenue.

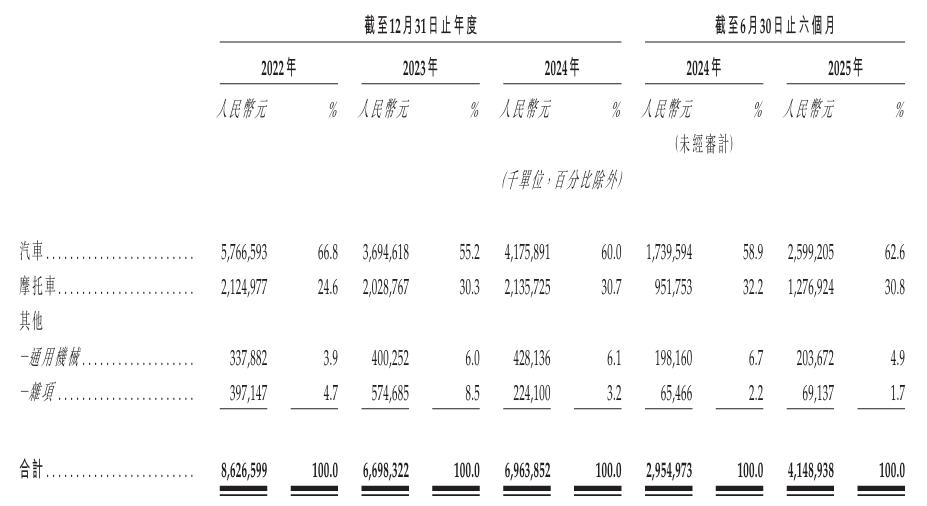

During the reporting period of 2022, 2023, 2024, and the first half of 2025 (hereinafter referred to as the "reporting period"), revenue from Qianli Technology's "traditional business" of automobile and motorcycle sales accounted for over 85%. Additionally, the company generated a small portion of other revenue through the sales of general machinery, real estate, spare parts, and other miscellaneous items.

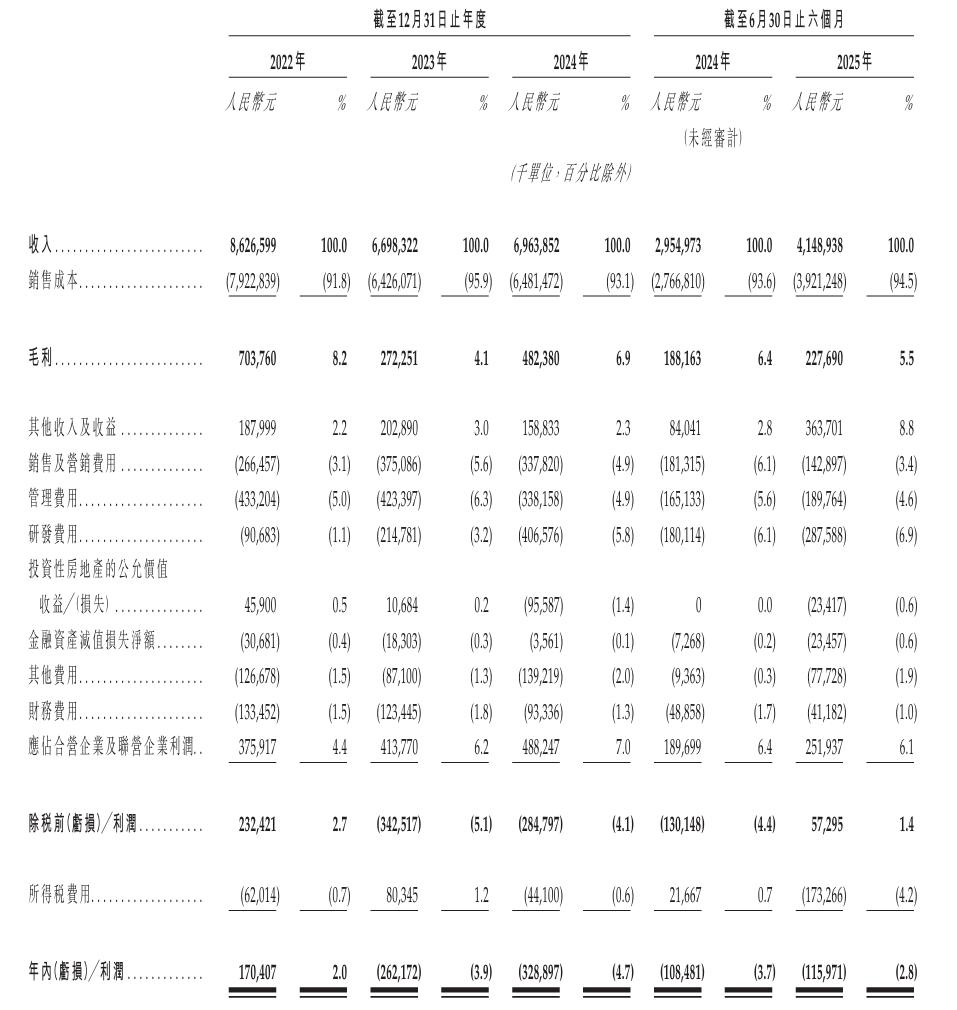

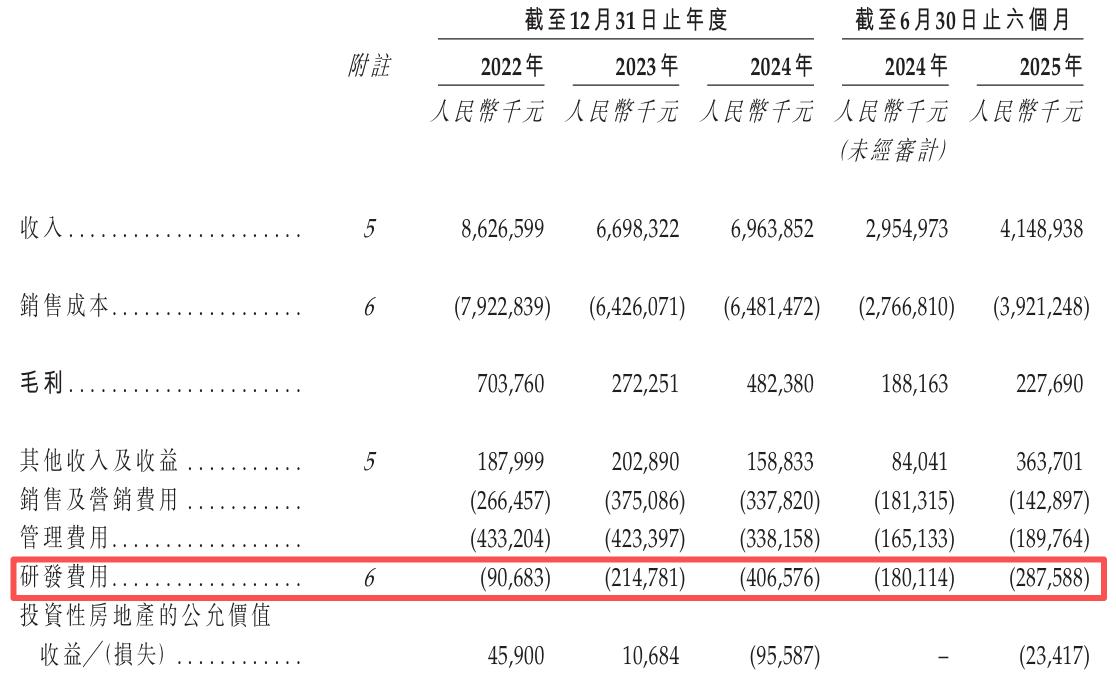

Even with the support of traditional businesses, Qianli Technology's overall revenue remains unstable. During the reporting period, the company's revenue was 8.627 billion yuan, 6.698 billion yuan, 6.964 billion yuan, and 4.149 billion yuan, respectively. In 2023, revenue showed a significant decline of 22.4%, primarily due to market competition and industry restructuring.

It's particularly noteworthy that Qianli Technology exhibits a significant reliance on Geely Group. During each period of the reporting period, revenue from Geely Group accounted for 39.7%, 33.6%, 30.8%, and 33.2%, respectively. The proportion of procurement amounts was 50.4%, 50.1%, 29.3%, and 29.7%, ranking first among its major customers and suppliers.

While selling vehicles to "Geely-affiliated" companies, Qianli Technology also purchases complete vehicles, complete vehicle kits, and automotive parts from them. It is anticipated that the company will provide intelligent driving solutions to Geely Group in the future. This situation of high reliance on related parties at both the supply and sales ends will undoubtedly raise market concerns about its independence.

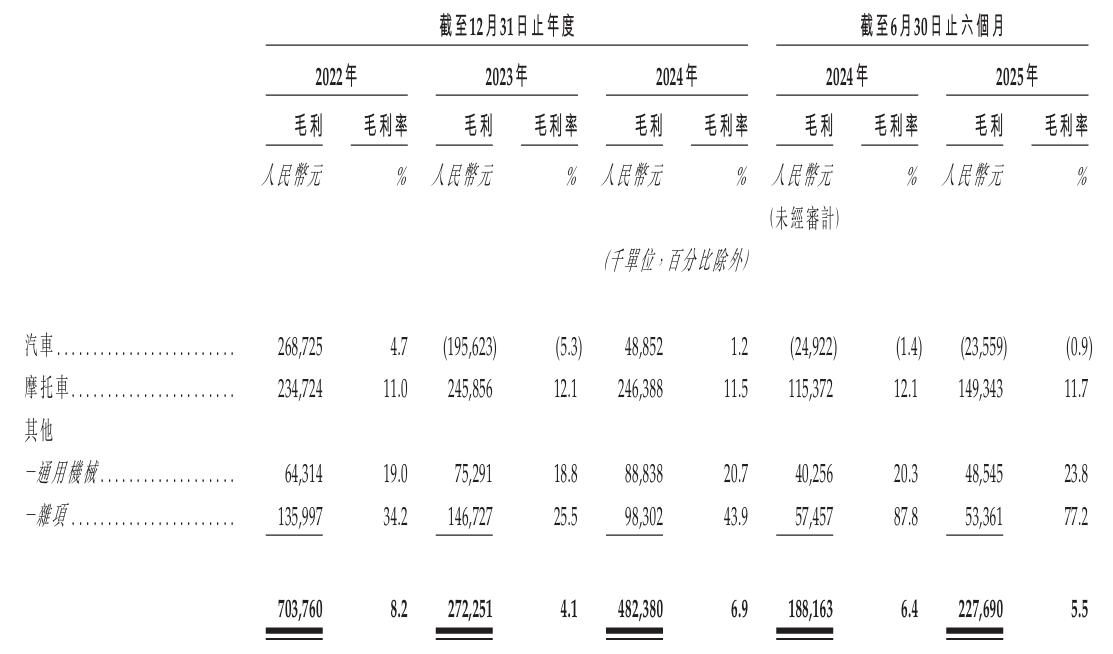

Moreover, after turning from a profit of 170 million yuan in 2022 to a loss of 262 million yuan in 2023, Qianli Technology has continued to incur losses, with net losses of 329 million yuan and 116 million yuan recorded in 2024 and the first half of 2025, respectively. Its gross profit margin also decreased from 8.2% in 2022 to 5.5% in the first half of 2025.

The automobile business, which contributes the largest revenue to Qianli Technology, is precisely the culprit dragging down its gross profit level. During the reporting period, the gross profit margin of this business was 4.7%, -5.3%, 1.2%, and -0.9%, respectively. Since 2023, it has started to show a situation of selling more but losing more, and the profitability of traditional businesses is no longer optimistic.

On the other hand, the expansion of the "AI + Mobility" model's intelligent driving business necessitates substantial technological and financial investment. This has directly led to Qianli Technology's R&D investment doubling from 90.683 million yuan in 2022 to 407 million yuan in 2024. In the first half of 2025, the company's R&D expenses further increased to 288 million yuan.

Although Qianli Technology promises to expand AI-enabled high-configuration vehicle models, lock in cost reductions through platformization, and enhance its ability to mitigate input cost fluctuations, the current "money-burning" speed has significantly squeezed its profit margins. In the absence of a profitable closed loop for emerging businesses, endless consumption poses a significant constraint on the company.

Looking at the overall industry development trend, the "AI + Mobility" driving market is still in its infancy. The pace of growth and popularization of Qianli Technology's AI-native solutions remains highly uncertain. On the long road to commercialization and monetization, Qianli Technology faces a daunting task in crafting an AI transformation story that convinces investors.