What Lies Ahead for BYD Amid Negative Domestic Growth? Outpacing Hyundai Motor, Eyeing 1.5 Million Overseas Sales | Mirror Pro

![]() 11/17 2025

11/17 2025

![]() 472

472

After enduring two consecutive months of negative growth domestically, BYD has shifted its focus to seeking incremental growth in overseas markets.

Recently, a Citibank report disclosed that during a recent management meeting, BYD set an ambitious sales target of 1.5 to 1.6 million vehicles for overseas markets by 2026. This indicates that BYD aims to achieve an additional 600,000 to 700,000 units in overseas sales next year, marking a year-on-year growth of roughly 70%. According to Citibank, which referenced information from BYD's meeting, the primary catalyst for BYD's overseas market growth next year will be the launch of new vehicles.

Given the uncertainty surrounding BYD's full-year sales plan for 2026, calculating the proportion of next year's overseas target increase in the overall target increase is impossible. Using the 2024 sales figure of 4.27 million units and the 2025 target of 4.6 million units as a reference, BYD's sales increase this year is 330,000 units. However, BYD aspires to double this year's overall market increase solely through overseas markets next year.

This target may appear aggressive, but it is a necessary step for BYD. Over the past few years, BYD has capitalized on the electric vehicle trend to surpass competitors and emerge as China's largest automaker by sales volume. Specifically, in 2024, BYD's annual sales reached 4.27 million units, a 41% year-on-year increase, accounting for over one-third of China's new energy vehicle market share. In 2024, BYD's revenue soared to RMB 777.1 billion, a 29.02% year-on-year increase; its net profit exceeded RMB 40.2 billion, a 34% year-on-year increase, placing it among the top 10 most profitable automakers globally for the first time.

Behind these impressive numbers, BYD's "crisis" has become evident. Since the beginning of this year, BYD's sales growth has slowed significantly. Particularly since September, BYD's monthly sales have declined year-on-year for two consecutive months. In terms of sales structure, BYD's main sales drivers remain the Wangchao (Dynasty) and Ocean Networks. Recently, the Fangchengbao brand has witnessed rapid sales growth, primarily driven by two relatively affordable models, the Tai 3 (RMB 133,800-177,800) and Tai 7 (RMB 179,800-219,800). The Dengfeng brand has performed moderately, while the Yangwang brand has seen a sales decline.

Nevertheless, from a scale perspective, BYD's sales from January to October this year still surpassed 3.7 million units, ranking first among domestic automakers. Reflecting on the financial report, BYD's net profit in the third quarter was RMB 7.823 billion, a 32.6% year-on-year decrease; the cumulative net profit for the first three quarters was RMB 23.333 billion, a 7.55% year-on-year decrease. This suggests that amid increasingly fierce domestic market competition and price wars, BYD is facing dual pressures on sales volume and profit growth.

In essence, BYD has also hit a performance ceiling. This outcome was inevitable for BYD. The core of BYD's success lies in its price advantage stemming from a vertical supply chain and its cognitive edge as a pioneer in electric vehicle technology. This has enabled BYD to establish an unparalleled advantage in the price range of RMB 50,000 to RMB 200,000. As the scale further expands, this advantage is magnified, allowing BYD to initiate multiple rounds of price reductions that competitors cannot match.

However, this advantage is not insurmountable. In fact, companies like Geely and Chery have devised core strategies to challenge BYD. For all of BYD's popular products, independent brands adopt a strategy of offering larger, more feature-rich products at prices equal to or slightly lower than BYD's. This has posed severe challenges to BYD's products in multiple core market segments, such as the Dolphin, Seagull, Qin, Han, Yuan, and Song, whose sales have declined in recent years.

At the same time, other competitors are gradually adopting cost advantages derived from economies of scale and vertical integration models by shifting their focus to supporting complete vehicles at the component level. A prime example is SAIC, whose senior management explicitly mandates that components prioritize enhancing the competitiveness of complete vehicles over profitability. Additionally, due to the overly intense price wars in the new energy vehicle sector, leading to a deteriorating industry ecosystem, policies are guiding the industry toward higher-dimensional development. In this context, BYD's previously relied-upon competitive strategies are no longer sustainable. Given these circumstances, it was only a matter of time before BYD reached its ceiling.

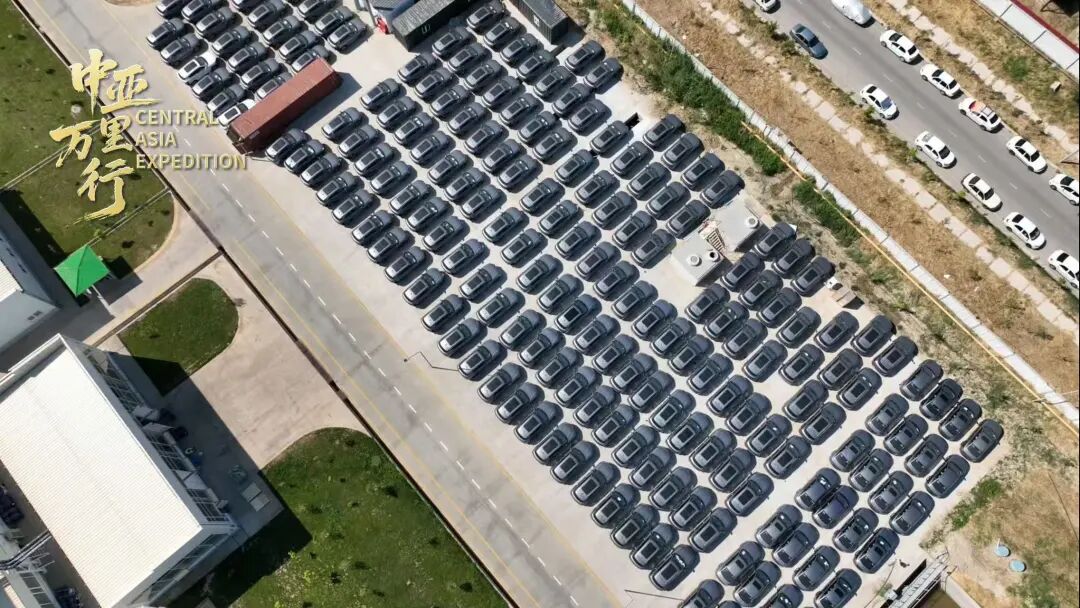

Since BYD is already under siege in the domestic market and breaking through is challenging, achieving performance breakthroughs inevitably requires turning to overseas markets. Firstly, BYD enjoys a favorable brand image overseas and is experiencing rapid growth there. From a data perspective, overseas markets have also been the biggest highlight of BYD's market performance this year. In October, BYD's overseas sales reached 83,524 units, a 155.5% year-on-year increase, setting a new historical high. From January to October this year, BYD's cumulative export volume was 785,483 units, a more than 140% year-on-year increase.

Based on current sales trends, BYD's overseas sales are expected to reach 900,000 to 1 million units this year, accounting for approximately 20% of its annual sales (based on a full-year sales target of 4.6 million units). According to Citibank, BYD's current overseas sales structure is evenly distributed across different regions, and by 2025, BYD is expected to account for one-third of its total overseas sales in Europe, North America, and ASEAN markets, respectively.

Secondly, if BYD aims to become a truly global automaker, it must complete its overseas market expansion and achieve a transformation in its sales structure.

A review of the market layouts of global leading automakers also shows that their overseas sales volumes surpass their domestic markets. Taking the top three global automakers as examples, Toyota's global sales in 2024 were 10.82 million units; its domestic sales in Japan were only 1.44 million units; overseas sales were 9.38 million units, accounting for 87% of the total. Volkswagen Group's global sales in 2024 were 9.04 million units; its domestic market sales in Germany were 1.13 million units; overseas sales were 7.90 million units, accounting for 87% of the total. Hyundai Motor Group followed a similar pattern, with global sales in 2024 of 7.23 million units; its domestic market sales in South Korea were approximately 1.25 million units; overseas sales were 5.98 million units, accounting for 83% of the total.

Compared to the above three automakers, which have overseas sales accounting for over 80% of their total, BYD's contribution from overseas markets at around 20% indicates that its globalization process is still in its early stages. If BYD aims to become a truly global automaker, the proportion of its overseas sales needs to increase further. Additionally, considering that China itself is a very large market, a slightly higher proportion of the domestic market is normal.

However, if BYD can secure approximately 3 million units in sales overseas, it can compete with Hyundai Motor. If BYD can achieve a 1:1 ratio between its overseas and domestic markets—a sales structure that at least international automakers achieve—it will have an annual sales volume of 8 million units, becoming one of the top three global automakers and achieving a true transformation. In fact, this may also be an inevitable goal for BYD, especially since it already ranked fifth in global automaker sales in 2024 with 4.272 million units sold.

If the overseas market achieves 1.5 million units next year, there will be a 700,000-unit increase, bringing the total sales volume to 5 million units. Assuming sustained growth in overseas markets and stability or slight decline in the domestic market, BYD has the potential to become the third-largest global automaker within five years.

Of course, overseas market expansion can not only drive sustained sales growth for BYD but also further optimize its financial performance. According to calculations by Rhodium Group, the Seal U (Song PLUS) can generate a profit of €14,300 (approximately RMB 118,000) per unit in Europe, compared to only €1,300 (approximately RMB 11,000) per unit in China. Based on this estimate, the profit per unit for certain models in Europe is ten times that in China. Additionally, BYD's financial report for the first half of the year also shows that the gross profit per vehicle domestically is approximately RMB 17,900, while the gross profit per vehicle overseas reaches RMB 47,700, nearly 2.7 times that domestically. The significantly higher profitability in overseas markets is another crucial reason for BYD to expedite its overseas market expansion.

Among Chinese automakers, Chery currently leads in exports. From January to October this year, Chery's cumulative overseas sales were 1.06 million units, accounting for 46% of its total sales (2.29 million units). Additionally, from January to October this year, Great Wall Motors accounted for 37% of its sales overseas; Changan Automobile accounted for 22%; and Geely accounted for 14%. If BYD achieves the aforementioned overseas sales target next year, it may surpass Chery to become the leading exporter among Chinese automakers.