Nvidia's $5 Trillion 'Starry Ocean' and the Looming 'Hidden Crossroads'

![]() 11/20 2025

11/20 2025

![]() 384

384

When Jensen Huang declared during the earnings call that "AI is becoming ubiquitous, doing everything at once," it seemed as though the entire Silicon Valley heard the distinctive rustle of his leather jacket against the microphone. This wasn't a mere metaphor; Nvidia had just unveiled a financial report that smashed expectations, delivering a resounding rebuttal to skeptics of the "AI bubble."

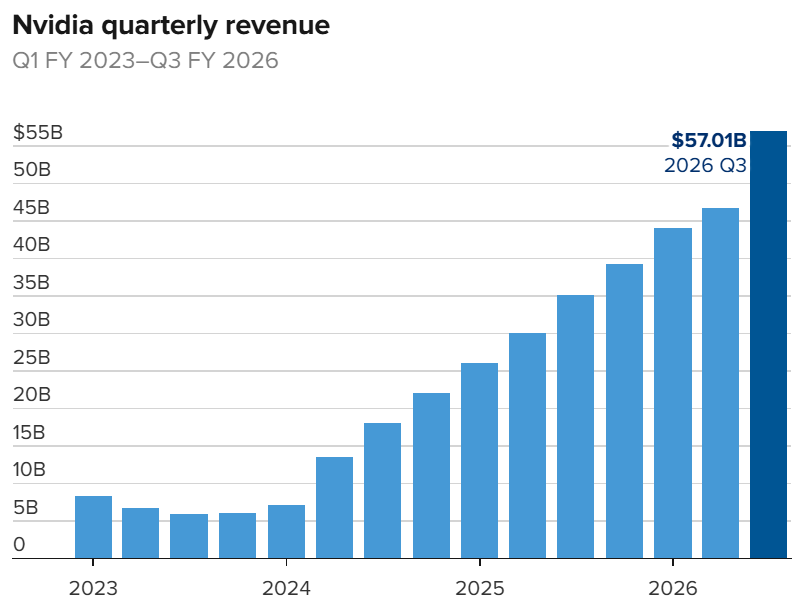

On November 19 (ET), Nvidia released its Q3 financial report for fiscal year 2026. The numbers were staggering: $57 billion in revenue, marking a 62% year-over-year (YoY) increase, and $31.9 billion in net profit, a whopping 65% YoY surge. The driving force behind this "epic" performance was its data center business, which generated $51.2 billion in revenue, a 66% YoY spike, accounting for nearly 90% of the total revenue. This surge boosted Nvidia's after-hours stock price by over 4% and provided a Q4 revenue guidance of $65 billion, once again surpassing Wall Street's expectations.

"There's been much discussion about an AI bubble," Huang told investors during the call. "From our perspective, what we see is entirely different."

The 'Golden Age' of the Computing Power Empire

Huang's confidence is rooted in Nvidia's two ace cards: absolute hardware leadership and a formidable software ecosystem.

The Blackwell Ultra GPU, launched in March, has quickly become a top seller within the company. Huang described its market performance as "off the charts." CFO Colette Kress revealed that AI factory and infrastructure projects announced this quarter involve a total of 5 million GPUs, with demand spanning cloud providers, sovereign nations, enterprises, and supercomputing centers.

More critically, Nvidia is backed by nearly the entire Silicon Valley "capital expedition." Microsoft, Alphabet, Amazon, Meta, and Oracle are projected to spend nearly $400 billion on capital expenditures in 2025. OpenAI has pledged $1.4 trillion for AI infrastructure over the next few years, with $500 billion earmarked for Nvidia chip purchases.

"As of October, Nvidia holds $500 billion in AI chip orders for 2025-2026, with this figure still growing," Kress added during the call.

From a $400 billion market cap in 2022 to surpassing $5 trillion today, Nvidia has achieved a more than tenfold surge in just three years. Its scale now equals the combined market value of the other nine top global chip companies, crowning it the undisputed king of the semiconductor world.

Imbalanced Prosperity: Upstream Exuberance vs. Downstream Bleeding

However, Nvidia's financial glow highlights a fatal imbalance in the AI industry: the stark contrast between the infrastructure-side computing power boom and the application-side profitability struggles.

OpenAI, an industry benchmark, exemplifies this dilemma. Its user growth has been miraculous—ChatGPT reached 800 million weekly active users, while Sora 2 sparked a global AI video creation craze. Yet commercialization remains stalled: paid conversion rates hover around 5%, with $4.3 billion in H1 revenue accompanied by $13.5 billion in losses.

Microsoft's latest earnings revealed a $3.1 billion net profit reduction due to equity method investments in OpenAI. Based on its 27% stake, OpenAI's quarterly net loss approached $11.5 billion, with losses rapidly widening.

Li Xiang, CEO of Li Auto, bluntly noted, "Everyone is aggressively using AI and investing in it, but my work hours haven't decreased, and my results haven't improved." This underscores the core commercialization challenge—technological flashiness fails to create a true productivity value loop.

Despite OpenAI's ambitious goal of $200 billion in revenue by 2030, its feasibility remains highly questionable compared to Meta's $164.5 billion annual revenue supported by 3.54 billion global users.

From Cisco to 'Subprime' Concerns

The current AI investment frenzy exhibits dangerous parallels to historical bubbles, notably the dot-com crash.

Back then, Cisco reigned as the "shovel seller"—a network equipment supplier whose market value soared during the internet infrastructure boom. Cisco expanded market demand through "vendor financing," providing loans to startups to purchase its equipment. When unprofitable internet firms collapsed, Cisco's market value plummeted nearly 90% post-bubble.

Today, Nvidia has forged similar partnerships with OpenAI and others, pledging up to $100 billion in investments to support chip purchases. This model's sustainability hinges entirely on when AI applications achieve scalable profitability.

More alarmingly, tech firms are exploring complex financing models to compete in AI. Meta issued a record $25 billion in bonds, while Oracle raised $18 billion in September. Some companies are packaging data center leases into stratified securities—reminiscent of the 2008 subprime mortgage derivatives.

With rapid AI chip iterations potentially devaluing data centers, these "subprime AI loans" risk triggering cascading defaults, hanging like a Damocles' sword over the industry.

Even "Big Short" investor Michael Burry issued veiled warnings: "Sometimes we see bubbles. Sometimes we can act. Sometimes the only winning move is not to play."

The Hidden Crossroads: Power Restructuring by Super-Companies

More profound than short-term bubbles is the growing global influence of super-companies like Nvidia and their reshaping of the world order.

With a $5 trillion market cap exceeding Germany and Japan's 2024 GDP combined, Nvidia would rank third globally as an independent economy. As the "Magnificent Seven" tech giants approach a $22 trillion total market value—over 70% of U.S. GDP—they've transcended mere commercial entities.

From fundamental research to industrial applications, Nvidia controls AI's core lifeblood, with nearly all leading AI models dependent on its GPUs. This monopoly severely squeezes startups' survival space—either accept stakes from super-companies or face easy replication.

More concerning is the "too big to fail" regulatory dilemma. The U.S. Department of Justice's five-year antitrust lawsuit against Google resulted in only limited data-sharing requirements, while EU fines failed to alter its market behavior.

With weak government oversight and citizens reliant on super-companies' services, the power balance has been shattered. These firms answer only to a few shareholders, with profit-maximizing goals potentially conflicting with public interests yet lacking effective checks.

Nvidia's financial report undoubtedly confirms the authenticity and sustainability of AI computing demand, with Huang's "virtuous cycle" theory holding true at the computing power level. However, beneath this surface lie three hidden fault lines: application profitability struggles, geopolitical risks (e.g., setbacks in China), and financial leverage concerns.

Nvidia stands at a critical crossroads: one path leads to tremendous productivity potential from technological breakthroughs, while the other harbors bubble risks and power imbalance anxieties from historical shadows. The financial report marks not an endpoint but the starting gun for the next race. The future hinges on whether application-side commercialization can match infrastructure investments and how the global computing power landscape reshuffles amid geopolitical tensions.