Xiaomi's automotive business is profitable, but the company is still on the eve of a breakthrough

![]() 11/20 2025

11/20 2025

![]() 488

488

Source: Yuan Media Group

Xiaomi has achieved year-on-year revenue growth of over 20% for multiple consecutive quarters. Such sustained high growth has even led to a certain degree of 'aesthetic fatigue.'

On November 18, Xiaomi Group released its financial report for the third quarter of 2025. In this quarter, the Group achieved revenue of RMB 113.1 billion, a year-on-year increase of 22.3%, marking the fourth consecutive quarter with revenue exceeding RMB 100 billion. Adjusted net profit reached RMB 11.3 billion, a significant year-on-year increase of 80.9%, setting a new historical record.

In the first three quarters of this year, Xiaomi's revenue approached that of the entire previous year, while its profit already surpassed the total for the whole of last year.

For many years, the market narrative surrounding the smartphone and automotive industries has seemed stagnant. Whether it's the perception of 'accepting long-term losses' or 'a single business model,' the external understanding of business logic has consistently differed from what insiders see.

Now, a detailed analysis of financial report data and business layout (translation note: ' layout ' is translated as 'strategy' in context) reveals that Xiaomi has constructed a multi-dimensional growth engine consisting of 'smartphone high-endization + AIoT ecosystem deepening + automotive business breakthrough.' Coupled with over RMB 30 billion in annual R&D investment and the strategic depth of the 'Human-Car-Home Full Ecosystem,' Xiaomi's growth ceiling is far from being reached.

01

Automotive Business Achieves Profitability for the First Time

As Xiaomi's most closely watched business, the performance of its automotive segment once again addresses doubts about its 'cross-border car manufacturing success.'

The financial report shows that in the third quarter of this year, revenue from Xiaomi's smart electric vehicles and AI innovation business segments reached RMB 29 billion, a year-on-year surge of over 199%. Among this, smart electric vehicle revenue was RMB 28.3 billion, with other related revenue at RMB 700 million.

In this quarter, Xiaomi's automotive and AI innovation business segments achieved positive operating income for the first time in a single quarter, with operating income reaching RMB 700 million.

Exceptional product strength is the core reason for the profitability of Xiaomi's automotive business. The financial report shows that in the third quarter, Xiaomi delivered a total of 108,796 new vehicles, a new historical high. Since the launch of the Xiaomi YU7 series in June 2025, the product has been highly favored by users. In October 2025, the Xiaomi YU7 series ranked first in SUV sales in mainland China.

In terms of offline channel layout, as of September 30, 2025, Xiaomi has opened 402 automotive sales stores in 119 cities across mainland China and has 209 service outlets covering 125 cities in the region.

During the earnings call following the financial report release, Xiaomi's management provided an updated figure, stating that the annual delivery target of 350,000 vehicles will be achieved ahead of schedule this week.

Additionally, strong cost control and pricing capabilities have endowed Xiaomi's automotive business with robust profitability.

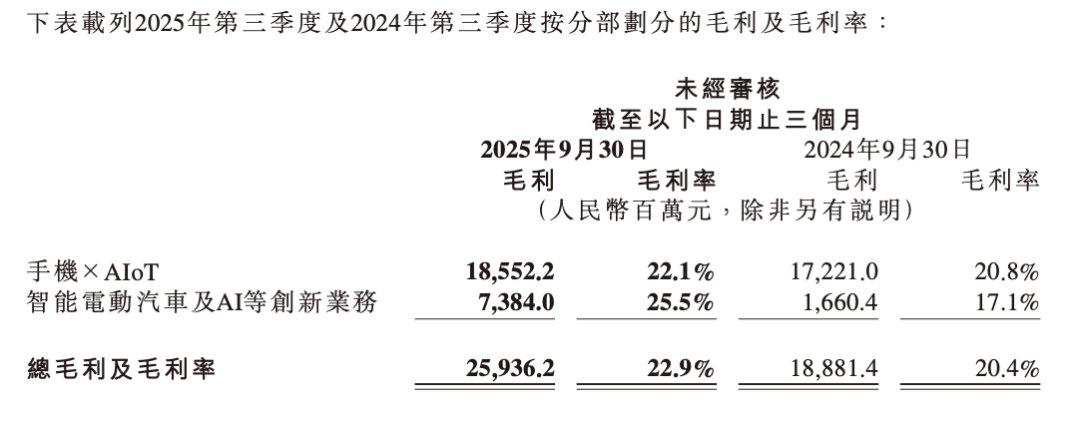

In the third quarter, the ASP (Average Selling Price) of Xiaomi's smart electric vehicles increased by 9.0% to RMB 260,100 per vehicle from RMB 238,600 in the third quarter of 2024. Meanwhile, without engaging in price wars or sacrificing margins for volume, the business achieved a gross profit margin of 25.5%, which is particularly commendable given the delivery of over 100,000 vehicles in a single quarter.

Source: Xiaomi Financial Report

Production capacity has always been a key factor constraining the growth of automakers. Following a surge in orders, Xiaomi's delivery capabilities have been under continuous scrutiny.

Xiaomi's management stated that just 18 months after the launch of its automotive products, total deliveries have exceeded 400,000 units. In July-August this year, deliveries increased to over 30,000 units per month, and in September-October, single-month deliveries exceeded 40,000 units. This week, the annual delivery target of over 350,000 units set at the beginning of the year will be achieved.

Regarding the main reasons for the shortened delivery cycle, Xiaomi's executives stated that efficiency improvements were paramount, with notable enhancements in the overall delivery capabilities of the SU7 Pro and Pro Max models. Due to limitations in the supply of certain materials, efforts will continue to accelerate the delivery cycles of other products.

Overall, with production capacity ramp-up and supply chain optimization, Xiaomi's automotive business is expected to achieve larger-scale deliveries next year. In terms of its vehicle lineup, Xiaomi is accelerating product iterations and new model planning to cover more market segments and further expand its user base.

As economies of scale emerge, supply chain costs optimize, and high-end models are introduced, the profitability of the automotive business is expected to gradually improve, becoming a significant pillar of the Group's profit growth.

02

Resilience of the Smartphone Business

Beyond the automotive business, Xiaomi's smartphone segment continues to advance along its high-end strategy.

In the third quarter, revenue from Xiaomi's smartphone × AIoT segment reached RMB 84.1 billion. Among this, smartphone business revenue was RMB 46 billion, with shipment volumes increasing year-on-year for nine consecutive quarters and maintaining a top-three global position for 21 consecutive quarters. Revenue from IoT and lifestyle consumer products was RMB 27.6 billion, a year-on-year increase of 5.6%. Internet service revenue was RMB 9.4 billion, a year-on-year increase of 10.8%, with overseas internet revenue reaching RMB 3.3 billion, a new historical high.

Against the backdrop of a 'slight recovery' in the global smartphone market, Xiaomi's smartphone business has demonstrated strong growth resilience.

In the third quarter, Xiaomi's global smartphone shipments reached 43.3 million units, a year-on-year increase of 0.5%, marking nine consecutive quarters of year-on-year growth. According to Omdia data, Xiaomi ranked among the top three global smartphone vendors by shipment volume in the third quarter, with a market share of 13.6%, maintaining its top-three position for the second consecutive quarter.

For a long time, the market's core criticism of Xiaomi's smartphone business has been its 'over-reliance on mid-to-low-end models and weak profitability.' However, Xiaomi's high-end strategy has already achieved substantial breakthroughs.

According to third-party data, in the third quarter of 2025, high-end smartphone sales in mainland China accounted for 24.1% of Xiaomi's total smartphone sales, a year-on-year increase of 4.1 percentage points. Among this, its market share in the RMB 4,000–6,000 price segment reached 18.9%, a year-on-year increase of 5.6 percentage points.

Taking the Xiaomi 17 series launched in September this year as an example, sales in the first month after launch increased by 30% compared to the previous generation, with the Xiaomi 17 Pro and Xiaomi 17 Pro Max high-end models accounting for over 80% of sales.

The direct result of high-endization is increased sales volume and higher prices. The financial report shows that in the third quarter, the rising proportion of high-end smartphone shipments in mainland China drove up the ASP.

Meanwhile, despite year-on-year price increases in upstream products like DRAM, Xiaomi successfully offset some cost pressures through product mix upgrades.

Lu Weibing, Xiaomi Group Partner and Group President, revealed during the earnings call that the company has signed 2026 supply agreements with core suppliers to stabilize costs through long-term price locking while continuing to advance its high-end strategy to improve profitability.

From an overall business structure perspective, the AIoT business is Xiaomi's core advantage that differentiates it from other tech companies and represents a significant yet often overlooked value proposition.

In terms of performance, revenue from Xiaomi's IoT and lifestyle consumer products business reached RMB 27.6 billion in the third quarter, a year-on-year increase of 5.6%, with a gross profit margin of 23.9%, a year-on-year increase of 3.2 percentage points.

Among this, revenue from Xiaomi's lifestyle consumer products increased by 20.4% year-on-year, primarily due to increased sales of robotic vacuum cleaners and power banks in the global market, as well as electric scooters in overseas markets. Revenue from wearable products increased by 22.5% year-on-year, mainly driven by increased shipments of smart bands and smartwatches.

In the smart home appliance sector, Xiaomi's high-end industrial closed-loop advantage has become even more pronounced, creating synergistic effects.

In October this year, Xiaomi's smart home appliance factory officially commenced operations in Wuhan, fully integrating the industrial closed-loop of 'design-research and development-production-verification.' With a planned peak annual production capacity of 7 million air conditioners, mass production of air conditioner products will begin next year, fully supporting the manufacturing and delivery of Xiaomi's high-end home appliances.

With the collaboration growth (translation note: ' collaboration 增长' is translated as 'synergistic growth') of these two major businesses, Xiaomi's profitability has also improved. In the third quarter, the gross profit margin of Xiaomi's smartphone × AIoT segment was 22.1%, a year-on-year increase of 1.3 percentage points.

03

Creating Another Xiaomi

If device scale represents the breadth of Xiaomi's AIoT ecosystem, then technological innovation represents its depth.

Currently, Xiaomi's growth potential lies not only in breakthroughs in individual businesses but also in the ecological synergy and global layout (translation note: ' layout ' is translated as 'strategy') of 'smartphone × AIoT × automotive.'

As of now, Xiaomi's AIoT devices (excluding smartphones, tablets, and laptops) have surpassed 1 billion units, with smartphone shipments consistently ranking among the top three globally and rapid growth in the automotive business. The ecological closed-loop formed by these three major businesses will generate strong user lock-in effects and cross-referral value.

More importantly, the synergistic effects between the AIoT ecosystem and the automotive business are becoming evident. Xiaomi automotive users can seamlessly control smart devices at home through the vehicle's infotainment system, while data from IoT devices can provide scenario support for vehicle intelligence. This closed-loop experience of 'Human-Car-Home Full Ecosystem' represents a competitive advantage that traditional automakers find difficult to replicate.

On the other hand, Xiaomi's attitude toward R&D investment, given its cash reserves exceeding RMB 230 billion, is another noteworthy aspect.

The financial report shows that in the first three quarters of this year, Xiaomi's cumulative R&D investment reached RMB 23.5 billion, nearing the total for the entire year of 2024, with an expected investment of over RMB 30 billion this year. Among this, R&D investment in the third quarter was RMB 9.1 billion, a year-on-year increase of 52.1%, setting a new historical high.

A high-caliber R&D team is the core guarantee for technological innovation. As of the end of the third quarter, Xiaomi's number of R&D personnel reached a new historical high of 24,871.

Currently, Xiaomi is accumulating patent reserves in cutting-edge fields such as AI, IoT, and new energy through a dual strategy of 'basic research + applied development,' providing technological support for future growth.

Overall, Xiaomi continues to increase investment in foundational technologies such as large models, chips, operating systems, and intelligent driving. The open-sourcing of the MiMo-Audio voice model, iterations of the HyperOS, and optimizations in intelligent driving algorithms not only support the development of existing businesses but also build long-term competitive barriers.

Meanwhile, the overseas expansion strategy has become a significant outlet for Xiaomi's technological investments and product breakthroughs.

Today, Xiaomi's overseas expansion strategy is shifting from single-product exports to a global layout (translation note: ' layout ' is translated as 'strategy') of 'new retail model + full product matrix.'

In the smart home appliance sector, Xiaomi continues to expand its overseas market share by leveraging its technological edge and cost-effectiveness, deepening its presence in multiple global regions through localized product adaptations and channel construction.

During the earnings call, Xiaomi's management stated that the 'overseas market space for home appliances is enormous' and that significant expansion efforts will be made in 2026.

The construction of an overseas closed-loop new retail model has also become a highlight of Xiaomi's global expansion. Through an integrated online-offline retail system, Xiaomi has built an efficient sales network overseas, enhancing brand exposure and optimizing the user shopping experience.

Currently, Xiaomi operates approximately 300 new retail stores overseas, covering Southeast Asia, Europe, East Asia, and Latin America.

Meanwhile, Lu Weibing revealed that based on its success in the Chinese market, Xiaomi will begin preparations for the overseas launch of its automotive products, with a target of landing by 2027.

In the future, Xiaomi's automotive products are expected to form synergistic effects with home appliances and smartphones, enriching its overseas product matrix and creating another Xiaomi overseas.

The latest financial report data not only demonstrates Xiaomi's strong growth resilience but also reveals its core competitiveness of 'three major growth engines + ecological synergy + technology-driven.' The breakthroughs in smartphone high-endization, the deepening of the AIoT ecosystem, and the breakthrough of the automotive business are forming a combined growth force that is breaking market perceptions of its growth ceiling.

Just days before Xiaomi released its third-quarter report, Goldman Sachs issued a research report stating that in the long run, it believes Xiaomi's robust balance sheet, strong ecological integration capabilities, and cost advantages derived from scale and deep involvement in the electric vehicle supply chain will enhance its competitiveness and appeal in the electric vehicle sector. Furthermore, Xiaomi is expected to leverage its interconnected consumer terminals to build one of the largest consumer-grade physical intelligent ecosystems globally.

Some images sourced from the internet. Please notify us for removal if there is any infringement.