Technical Barriers Shattered: Unisound's Huang Wei Teeters on the Brink of Lagging Behind

![]() 11/20 2025

11/20 2025

![]() 458

458

Unisound, a seasoned player in the AI voice industry, got an early start but arrived at the finish line relatively late.

Having secured the title of "the first AGI stock listed on the Hong Kong Stock Exchange", Unisound is essentially a product of the first wave of AI development. During that era, startups predominantly focused on vertical sectors within the B2B domain, such as security and enterprise services.

Founder Huang Wei designated "Smart Living" and "Smart Healthcare" as the company's two core sectors. He firmly believes that technology should cater to humanity's fundamental needs for "health" and "happiness". Positioning itself as an AI solutions provider, Unisound primarily markets conversational AI products and solutions tailored for daily life and healthcare applications.

However, behind the glittering facade, concerns have been silently mounting. Today, the company grapples with constraints stemming from customization-driven projects, declining customer retention rates, and outdated computing power compared to industry behemoths in the "Hundred-Model War". Over the past 13 years, Unisound has undergone multiple strategic pivots while contending with fierce cross-industry competition from tech giants.

This veteran company, which has demonstrated its prowess in monetizing technology but remains ensnared in growth challenges, stands at a crossroads between glory and crisis.

01 Steady Revenue Growth, Yet Profitability Remains Elusive

Since its listing, Unisound's stock price has soared, with market valuation expectations continuously on the rise. Its 2025 interim report for the first half of the year reveals that Unisound is at a critical juncture for upward breakthroughs, showcasing strengths in revenue growth, business structure optimization, and core technology monetization. Nevertheless, its shortcomings during the high-investment phase are also glaringly evident.

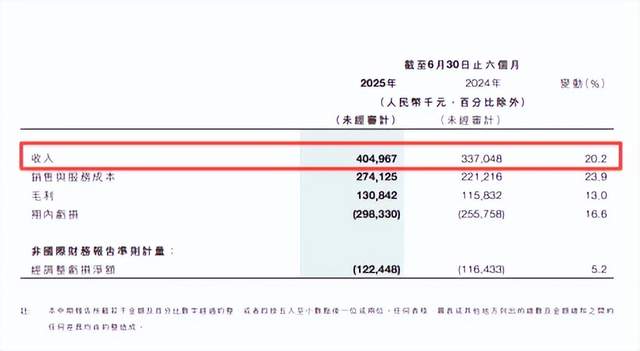

From a revenue perspective, Unisound's total revenue for the first half of the year reached RMB 405 million, marking a year-on-year increase of 20.2%. Amidst intense competition in the AI industry and sluggish growth for many companies, this growth rate is indeed robust.

Notably, the Shanhai Large Model performed exceptionally well, with sales nearing RMB 100 million, a staggering 457.4% year-on-year increase, accounting for nearly 25% of total revenue. This model demonstrates stronger scalability and profitability, effectively transforming core technology into tangible revenue and becoming the company's "cash cow".

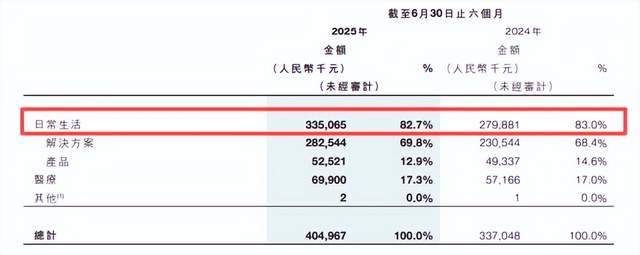

As Unisound's foundational business, Smart Living continued to perform steadily, contributing 82.7% of total revenue. Its solution revenue grew by 22.6%, providing a stable cash flow—akin to a solid "money bag"—that strongly supports the company's exploration of cutting-edge technologies such as large models.

In vertical sectors, Unisound achieved multiple successes. Its healthcare business performed exceptionally well, with each customer contributing an average of RMB 1.013 million, more than doubling year-on-year. This fully demonstrates the high recognition of its products by major clients such as hospitals, which are willing to pay a premium for quality offerings.

The newly launched insurance claims review business also emerged as a strong performer, with revenue nearing RMB 10 million, a year-on-year increase of over 13 times. This data strongly attests to the strong reusability of its technology, enabling rapid adaptation to various high-value scenarios and opening up new profit growth avenues for the company.

In terms of hardware, Unisound has also accumulated deep expertise. Its AI chips have sold nearly 100 million units in total, with shipments reaching 16.5 million units in the first half of the year. This substantial shipment volume lays a solid foundation for building a virtuous cycle of "data-computing power-models" in the future.

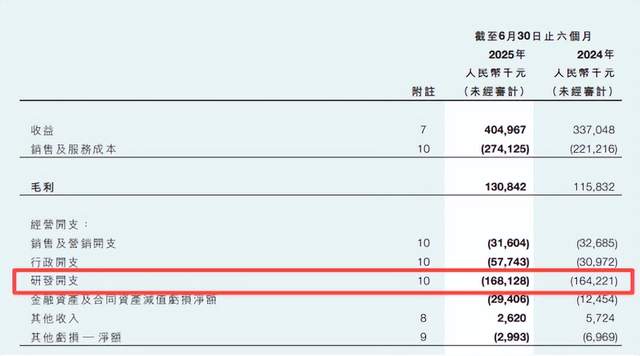

However, behind these impressive achievements lie real challenges. The company is still in a phase of "burning cash for the future", with a loss of RMB 298 million and negative operating cash flow in the first half of the year. This is primarily attributable to high R&D investment, making it difficult to achieve profitability in the short term.

Nevertheless, for AI companies, significant upfront investment to build technical barriers is an inevitable path. Currently, the market's primary concern is whether rapidly growing businesses such as large models and healthcare can continue to expand market share, gradually converting R&D investment into actual revenue, and ultimately achieving overall profitability.

Unisound has proven its ability to "generate revenue" through technology and high-quality business operations. However, transitioning from "revenue generation" to "profitability" requires sustained growth from high-potential businesses to overcome this critical threshold.

02 Mired in the "Project-Based" Quagmire

Unisound's business growth model is deeply entrenched in customization-driven project constraints. While this model acted as a "sweetener" for rapidly entering the market in its early stages, it has now become a "poison" restricting its scalability and profitability.

From a client perspective, Unisound faces the dual challenges of stagnant customer growth and sharply declining customer loyalty. Taking its early core business of medical AI as an example, the number of clients has fluctuated narrowly between 165 and 167 for an extended period, with growth virtually stalled.

More critically, Unisound's customer retention rate has plummeted from 70.4% in 2022 to 53.3% in 2024, meaning nearly half of its cooperative clients no longer choose its services. This indicates that its solutions have failed to effectively build long-term value and irreplaceability.

The Smart Living business segment also faces challenges, with the number of major clients decreasing from 78 to 71 in 2024. Although the company has attempted to sustain revenue growth by increasing the contribution from individual clients—such as raising the average revenue from major medical clients to RMB 1.2 million in 2024—the shrinking client base directly limits its growth potential.

Unisound's client and revenue structures exhibit severe dual dependency risks, further weakening its market control. On one hand, the company's revenue is highly reliant on a few major clients.

Between 2022 and 2024, revenue from the top three clients accounted for as much as 30.8%, 27.4%, and 26.7%, respectively. On the other hand, revenue is heavily dependent on system integrators and agents, with income from these clients reaching 55.1% in 2024. This structure has dulled Unisound's sensitivity to the end market and severely weakened its bargaining power.

The company's set "normal credit period" is 180 days, but the actual trade receivables turnover days extend to 277–283 days. As of the end of 2024, accounts receivable had piled up to RMB 559 million, accounting for nearly 60% of revenue. Previously, the "collapse" of major client Shimao Group directly led Unisound to set aside RMB 26.3 million in bad debt provisions, highlighting the significant financial risks associated with its high client concentration.

A deeper crisis stems from inherent flaws in its R&D model, raising concerns about "technological hollowness". Despite allocating 30–40% of its annual revenue to R&D—with R&D expenditure reaching RMB 370 million in 2024—over 56% of this spending, approximately RMB 210 million in 2024, went toward third-party outsourcing services.

While this highly outsourced model may reduce some R&D management costs in the short term, it means the company struggles to accumulate core, end-to-end technological development capabilities and experience over the long term.

Compared to companies that have built robust technological moats, Unisound faces doubts about its role as merely a "technology integrator", with questions raised about its autonomy and depth in core algorithm development and iterative capabilities.

The interplay between customization-driven projects and outsourced R&D models has locked Unisound into a difficult cycle. Customization restricts product standardization and profit margins, while weak technological foundations limit its ability to create market-competitive standardized products, ultimately leaving it facing prolonged, severe challenges in a fiercely competitive market.

03 Facing Risks of Marginalization

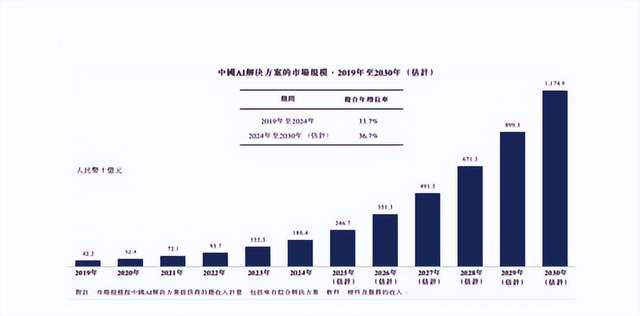

In the fierce competition of China's AI solutions market, Unisound, as a key player, is deeply entrenched in a structural crisis of marginalization. This crisis arises not from a single factor but from the interplay of multiple challenges, including market share, technological strength, strategic focus, and industry competition.

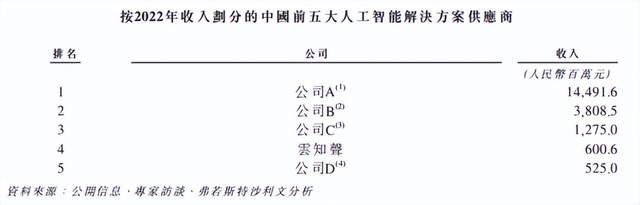

In terms of market share, Unisound's performance is concerning. Currently, it holds only a 0.6% share of China's AI solutions market. While it claims to rank fourth, the gap with leading companies is enormous. For example, the market leader, with a 9.7% share, exists on an entirely different scale.

Such a small market share severely limits Unisound's influence and bargaining power, making it difficult to secure favorable positions in resource allocation and industry standard-setting, thereby posing long-term risks to its development.

Technologically, Unisound faces significant challenges in the "Hundred-Model War". In 2023, it launched the Shanhai Large Model to compete, but numerous hurdles followed.

In terms of computing power, Unisound's 184 PFLOPS lags far behind industry giants such as Baidu (1,840 PFLOPS) and Alibaba (over 300 PFLOPS).

This computing power deficit directly restricts the training efficiency and performance improvements of its large models. Revenue composition further highlights the issue: in 2023, revenue related to large models was only RMB 16.7 million, accounting for about 2.3% of total revenue, with a limited client base. The lack of diverse user scenarios for training and refining large models has caused Unisound to fall behind in the "Hundred-Model War", risking marginalization.

More paradoxically, its AI platform still relies on external large models like DeepSeek to supplement capabilities, undermining the strategic uniqueness of its self-developed models.

Another weakness is Unisound's lack of strategic focus. Over its 13-year history, the company has undergone multiple major strategic shifts, transitioning from intelligent voice technology to a "cloud-endpoint-chip" architecture, then fully committing to medical AI, and finally pivoting to AGI large models. Frequent strategic changes have earned it the reputation of a "strategic oscillation textbook".

Each transformation requires substantial investments in human, material, and financial resources, with average resource allocations reaching tens of millions of yuan per shift and taking several years to implement.

However, these frequent shifts have failed to cultivate sustained core competitiveness. Instead, they have led to fragmented technological accumulation, severe resource misallocation, and an inability to build deep moats in any single area, causing Unisound to miss critical market windows.

The intensity of industry competition further complicates Unisound's situation. In the Smart Living and Smart Healthcare sectors, it faces not only professional rivals like iFLYTEK but also cross-industry pressure from internet giants such as Baidu, Alibaba, and Tencent.

These giants leverage their strong business ecosystems, resource integration capabilities, and financial strength to rapidly advance in AI large models and application promotion. For instance, Alibaba's 2025 capital expenditure plan reaches RMB 31.7 billion, with AI-related revenue achieving sustained high-speed growth for multiple quarters. In an AI arena dominated by giants, the survival space for startups like Unisound continues to shrink.

Unisound's risk of marginalization represents a systemic crisis, with interrelated factors such as its small market share, struggles in large model development, historical strategic inconsistencies, and intense competition from giants. While going public may provide temporary relief, its long-term development remains fraught with challenges unless it achieves substantive breakthroughs in these core areas.