Robots' Potential Peak Lies in Beijing, Yet Their Survival Depends on Guangdong

![]() 11/28 2025

11/28 2025

![]() 463

463

If you take a look back at the primary robotics market over the past year, you'll uncover an incredibly fascinating phenomenon that could be described as a 'cognitive collapse'.

In the first half of the year, Beijing's Haidian District and Shanghai's Zhangjiang were the focal points. Back then, investors would often gather in cafes near universities, engaging in heated discussions about the merits and drawbacks of the Transformer architecture, as well as the limits of its generalization capabilities. During that period, there was a strong, unanimous belief: software is the key that defines everything, models serve as the barriers, and as long as the 'brain' (the software and algorithms) is powerful enough, the 'body' (the physical robot) is merely an executor.

However, as the second half of 2024 kicked off and the State Council's 'Opinions on Deeply Implementing the 'AI Plus' Initiative' came into effect in August, a wave of sober rationality started to permeate through the initial fervor.

When demonstrations evolved into PowerPoint presentations, and these presentations had to be transformed into mass - production plans, the industry's trend indicator subtly shifted. Investors and entrepreneurs were taken aback to discover that in order to seize the national trillion - dollar opportunities and make the transition from laboratory 'prototypes' to commercially viable 'blockbusters', a formidable physical challenge stood in their way:

How can they transfer those algorithms, which performed flawlessly in simulators, onto a physical robot body that costs less than $20,000 and can withstand the real - world's grime, oil, and dust without malfunctioning?

When the focus shifted from 'being smarter' to 'being more durable' and 'cheaper', the center of gravity for China's robot industry inevitably started to drift southward.

Our gaze travels across the Yangtze River, over the Nanling Mountains, and finally converges on an approximately 50 - kilometer arc - shaped industrial belt that stretches from Shenzhen's Nanshan District to Foshan's Shunde District. Here, there's little abstract discussion about 'silicon - based life'. Instead, the focus is intense on calculating BOM (Bill of Materials) costs, NPI (New Product Introduction) cycles, and yield rates.

If Beijing and Shanghai set the 'intellectual ceiling' for Chinese robots, then this 50 - kilometer stretch in the Pearl River Delta is raising the 'floor' for the industry's practical implementation through its formidable engineering capabilities.

Algorithms are not a cure - all; the physical world has its own 'quirks'.

Why is the strategic importance of this '50 - kilometer' stretch being re - evaluated today?

Because the biggest misconception in the humanoid robot industry currently is the excessive faith in 'end - to - end' large models. There's a belief that with enough data, robots will spontaneously acquire general capabilities similar to ChatGPT. However, frontline experts from the Institute of Automation, Chinese Academy of Sciences, and Tsinghua's Institute for Interdisciplinary Information Sciences have pointed out an awkward reality for pure algorithm companies—the 'hallucination of simulated data'.

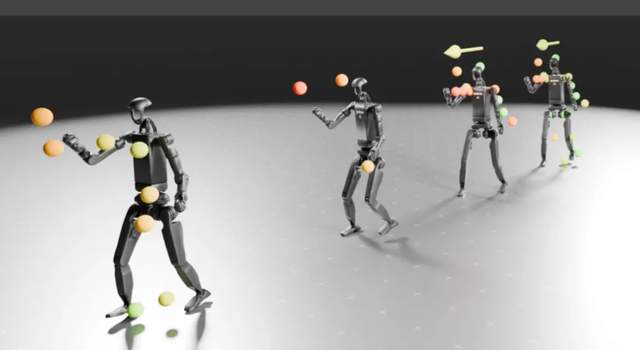

In a computer's simulated environment, a cup's friction remains constant, the lighting is uniform, and the floor is level. But in the real world, the cup might be greasy, the lighting could refract, and the floor might have just been mopped by a cleaner. A perfect grasping algorithm that runs flawlessly in a simulator might struggle to hold a wet glass once it's implemented on a physical robot.

This is the well - known 'Sim2Real (Simulation to Reality)' gap. Crossing this gap cannot rely solely on coding; it requires feedback from the 'body'.

This is the irreplaceable underlying logic of the Pearl River Delta. Here, it's not just about manufacturing motors; it's about providing a vast amount of authentic 'physical feedback data'.

Along this 50 - kilometer corridor, over 8,500 robot - related companies have gathered. This isn't just a cold statistic; it's a massive neural network.

High - precision sensors from Inovance Technology and Tongchuan Precision can capture micrometer - level force feedback, telling large models whether they're holding an egg or a rock. Visual radars from Orbbec and Leishen Intelligent train robots' 'eyes' under extremely complex factory lighting conditions. More importantly, 70% - 80% of the supply chain overlaps with that of new energy vehicles—BYD's battery thermal management technology, Luxshare Precision's wire harness craftsmanship. These technologies, which have been validated millions of times in vehicles, are being directly 'downsized' and applied to robots.

Algorithms need a body to perceive the physical world's 'quirks', and the most sensitive, robust, and cost - effective body can only be manufactured most efficiently in the Pearl River Delta. This is no longer a simple division of labor between 'southern factories and northern stores'; it's a profound evolution of 'software - hardware decoupling and reconstruction'.

Shenzhen: The 'Dual - Wheel Drive' of Policy and Market

After the industrial chain solves the 'can we do it' question, it immediately faces efficiency challenges. In the hardware industry, the speed of NPI (New Product Introduction) often determines a company's survival.

Current humanoid robots are still in a stage of rapid evolution in form and lack standardized metrics, entering a phase of rapid trial and error. At this juncture, a company's core competitiveness lies not in 'big moves' but in 'quick iterations'. Shenzhen's core value lies in providing a globally rare 'policy - backed + market - accelerated' super validation environment.

On one hand, policies like Guangdong's '22 Measures for Making Manufacturing the Pillar' explicitly position embodied intelligence as a strategic pillar for future industries, giving the industrial chain a sense of security. On the other hand, Shenzhen's unique 'money - making' culture fosters an almost instinctive acuity (sensitivity) among its supply chain to new technologies.

An entrepreneur who relocated from Beijing to the south once lamented to me, 'In the north, I had to spend half an hour explaining embodied intelligence and multimodality to suppliers. In Shenzhen, the supplier boss interrupts me and asks, 'Can this be mass - produced next year? If so, I'll make samples for free and bet on your future.'

Such conversations happen all the time in Shenzhen.

Here, the supply chain is finely segmented. From frameless torque motors to coreless motors, these 'chokehold' components once dominated by foreign companies are being rapidly localized in Shenzhen's thousands of small and medium - sized factories, CNC machining centers, and PCB quick - turn factories. The reason UBTECH secured the world's largest single order (over 800 million yuan for the Walker series), and DJI maintains or even leads global iteration speeds, is fundamentally because they've built their R&D labs 'on top of' the supply chain.

This geographical advantage in engineering efficiency, combined with policy dividends, makes Shenzhen the preferred destination for new product launches. Here, validating an idea doesn't require lengthy processes; it just takes a short walk out the door to chat with a factory owner.

Dongguan: The Optimal Ground for Replicating the 'Tesla Model'

If Shenzhen solves the 'fast validation' problem, then heading north along the Guangzhou - Shenzhen Expressway, Dongguan tackles a harsher reality: 'mass production challenges'.

Elon Musk once vowed to slash the price of Optimus to $20,000. This figure looms like a Damocles' Sword, compelling all Chinese companies to confront two questions: How to scale up production? How to halve costs?

We must face the data honestly: currently, domestic leaders like UBTECH plan annual production capacities in the 100,000 - unit range, still an order of magnitude lower than BYD's single - factory capacity in the millions. In terms of manufacturing scale and standardization, we're still far from the ideal 'Tesla Model'.

But Dongguan is the best—perhaps the only—ground to bridge this gap.

Here lies a vast amount of production capacity refined by both the 'Apple supply chain' and 'automotive supply chain'. Beyond 5,000 mold factories, Dongguan has distilled a methodology for'making precision products dirt cheap'.

Companies like Silver Base Group and Foxlink Precision are experimenting with transferring automotive'stamping + die - casting' processes to robots. This 'crossover reuse' capability is crucial. As an expert from CDH Investments noted, '70% - 80% of the supply chain for embodied intelligence can be shared with new energy vehicles.' Dongguan's massive automotive parts cluster stands ready to provide low - cost structural components for humanoid robots.

In this sense, Dongguan isn't just a factory; it's a 'compressor' for BOM costs.

Planetary ball screws, six - axis force sensors—these once - prohibitive precision components are undergoing process breakthroughs in Dongguan's precision factories. Whoever secures Dongguan's production capacity will survive the future price wars. New energy vehicle startups understand this, and robot unicorns are beginning to as well.

Foshan: The 'Value Anchor' for Deflating Hype

The endpoint of the industrial chain is application. For B2B clients, robots are not just technological carriers but production assets.

We cannot ignore the current bubble in the primary market: numerous projects clustered in seed and angel rounds, with valuations front - loaded but revenues lagging; beautiful PowerPoints but insufficient commercial validation. How to deflate this bubble? The only answer is: enter factories, work, and collect payments.

Foshan serves as this deflationary 'value anchor'.

As the heartland of Chinese manufacturing, Foshan hosts world - class factories like Midea, Haier, and FAW - Volkswagen. Here, bosses don't listen to stories or watch flashy demo videos; they focus on two Excel metrics: MTBF (Mean Time Between Failures) and ROI (Return on Investment).

At Zeekr's 5G smart factory, UBTECH's Walker S2 already collaborates on assembly lines; in unmanned warehouses, VisionBot's wheeled robots attempt to replace manual labor. The selection criteria here are brutally pragmatic.

A Foshan factory director once bluntly told me, 'Don't talk to me about high tech. If this machine acts up on the production line or breaks down daily, I'll kick it out of the workshop in two days.'

The environment here is filled with dust, oil, vibrations, and strong electromagnetic interference—a nightmare for delicate electronics but mandatory training for mature industrial products. Currently, multiple robots from UBTECH, Kuka, and others are undergoing trials in Foshan factories. This'scenario - driven R&D' provides the harsh feedback necessary for China's embodied intelligence to move beyond PowerPoint financing and achieve commercial closure.

An investment manager put it bluntly: 'If you can execute orders, delivery, and payments in industrial scenarios like Foshan within two to three years, valuations will align with fundamentals.' Foshan's factories are using the toughest 'exams' to filter (select) companies with true viability.

The Bottom Line

When we zoom out and re - examine this industrial map, the so - called 'Beijing/Shanghai vs. Pearl River Delta' dynamic isn't a zero - sum game but a relay race.

This is no longer a simple geographical division of labor but a profound collaborative evolution of China's hard tech industry.

National policies point the direction; Beijing and Shanghai's top research teams break through the 'brain' and 'cerebellum' algorithm ceilings, solving the 'think like a human' problem. Meanwhile, this 50 - kilometer stretch in the Pearl River Delta takes the baton, using its robust supply chain resilience and manufacturing heritage to forge a strong, affordable, and mass - producible 'body' for these algorithms.

The future of embodied intelligence will be the fusion of the'strongest brain' and the'strongest body'.

In this tech race tied to national destiny, algorithmic gaps may be closed by open - source communities and time, but manufacturing barriers and industrial chain depth require decades of accumulation.

As the industry shifts from 'concept validation' to'scaled applications', proximity to factories and supply chains determines survival probability. On this map, the Pearl River Delta's 50 kilometers represent China's robot industry's 'critical leap' toward a trillion - dollar sector. It's not just the starting line but the finish line that decides the outcome.